If you’re an employer in Seattle, Washington, you may need to know about the JumpStart tax. The tax helps fund services for Seattle’s low-income population. Read on to learn more about Seattle’s JumpStart tax.

What is the Seattle JumpStart tax?

On July 6, 2020, Seattle’s city council approved a new payroll expense tax for certain businesses operating in Seattle. The JumpStart Seattle tax took effect on January 1, 2021 and currently has an end date of December 31, 2040.

Again, the JumpStart payroll expense tax provides services to Seattle’s low-income population. The tax also helps replenish Seattle’s Emergency Management Fund and Revenue Stabilization Fund (which was used up in response to COVID-19).

Who is responsible for the Seattle payroll expense tax?

The Seattle JumpStart tax is an employer-funded tax. Employers cannot make deductions from employees’ compensation for this tax.

Employers with more than $8,135,746 in annual payroll expenses are subject to the new Seattle payroll tax. Additionally, the amount of the tax is based on the cumulative compensation of highly paid employees making $174,337 or more annually.

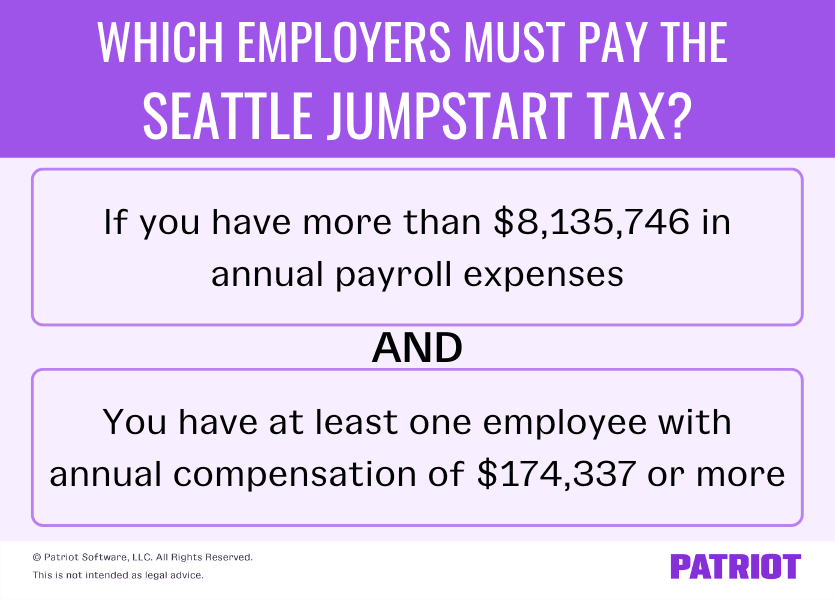

So, which employers must pay the tax? You need to pay the tax on employee wages if you have:

- More than $8,135,746 in annual payroll expenses AND

- At least one employee with annual compensation of $174,337 or more

If you have more than $8,135,746 in annual payroll expenses, pay the tax on each employee’s wages over $174,337.

The 2023 payroll tax rates range from 0.7% to 2.4% and are subject to change annually. The highest tax only applies to companies with $1,162,249,382 or more in payroll expenses and only on employee earnings of $464,900 or more.

Take a look at a breakdown of the new Seattle payroll tax:

| Business Annual Payroll expenses | Annual Employee Compensation Between $0 – $174,337 | Annual Employee Compensation Between $174,337 – $464,900 | Annual Employee Compensation of $464,900 or more |

|---|---|---|---|

| Under $116,224,938 | N/A | 0.7% | 1.7% |

| $116,224,938 – $1,162,249,382 | N/A | 0.7% | 1.9% |

| $1,162,249,382 or more | N/A | 1.4% | 2.4% |

Who is exempt from the JumpStart Seattle tax?

There are a number of businesses exempt from this new tax. The following do not have to pay into the JumpStart tax:

- Businesses with annual compensation of less than $8,135,746 in the previous year

- An independent contractor who performs services for the purposes of the Seattle business license tax and whose compensation is included in payroll expense of another business subject to the JumpStart tax

- Any business engaged in business in Seattle as a grocery business

- Businesses that are preempted from taxation by cities pursuant to federal or state statutes or regulations such as:

- Insurance businesses and their agents as defined by RCW 48.01.050 and RCW 48.17.010 and whose total revenue is exempt from the Seattle business license tax

- Businesses that only sell, manufacture, or distribute motor vehicle fuel as defined in RCW 82.38.020 and exempted under RCW 82.38.080

- Businesses that only distribute or sell liquor as defined in RCW 66.04.010 and exempted in RCW 66.08.120

- Federal and state government agencies and any local governmental entity

Also, nonprofit healthcare organizations are exempt for compensation expenses between $150,000 – $400,000 for the first three years.

For more information about whether you must pay the new tax, contact Seattle and review the legislation details.

When is the JumpStart payroll tax due?

Employers must pay the tax on a quarterly basis. However, some businesses may be eligible for an annual reporting period instead.

Calculating payroll taxes can be tricky. With Patriot’s online payroll software, you don’t have to worry about computing payroll taxes yourself. And, we offer free, USA-based support. Get your free trial today!

This is not intended as legal advice; for more information, please click here.