This article has been updated to include 2023 information.

Let’s face it: Health insurance is expensive. The average employer health insurance premium contribution—per employee—is nearly $6,000 (single) and nearly $15,000 (family) annually.

It’s natural to weigh your options, but skipping the benefit altogether? Nearly 90% of employees value health insurance. And with 69% of private industry workers having access to medical benefits, you could stand out—and not in a good way.

If you don’t want to foot the high bill for traditional health insurance premiums or miss out on talent, you might opt for an alternative … like reimbursements. Can employers reimburse employees for health insurance?

Can employers reimburse employees for health insurance?

So you’ve decided to pay employees back for their medical expenses. But, can you reimburse employees for health insurance? Is it a faux pas? Is it OK’d by the IRS and Affordable Care Act (ACA)?

Turns out, you can reimburse employees for insurance, depending on the type of plan you choose. In fact, there are a number of small business health insurance options that use a reimbursement system.

Great! But can an employer reimburse an employee for health insurance premiums, or is it just for medical-related expenses? Again, the answer to this depends on the type of plan you go with.

And the type of plan you can go with may depend on employer size. Here’s a rundown of:

- Why employer size matters

- Insurance reimbursement options

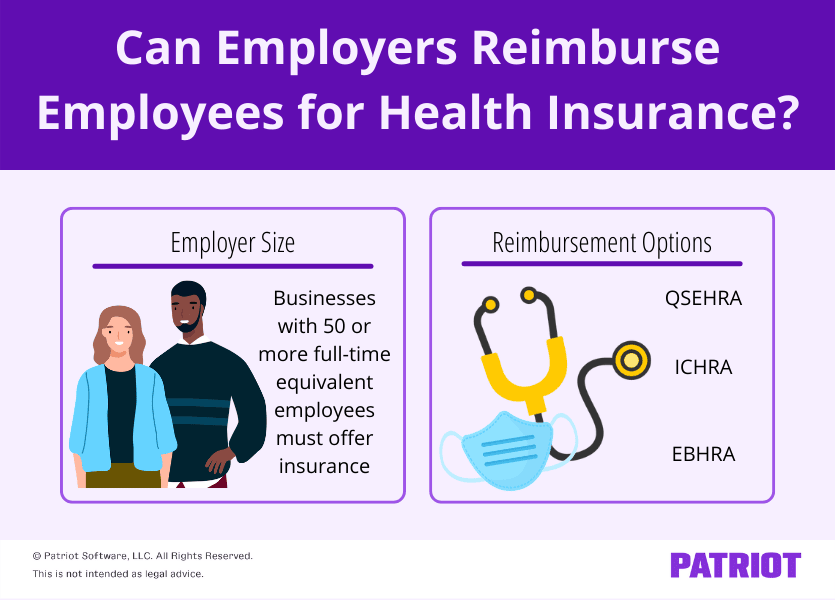

Employer size

The Affordable Care Act requires that employers of a certain size offer employees health insurance. The size?

Businesses with 50 or more full-time equivalent (FTE) employees must offer health insurance. However, you do not need to cover the cost of the full premium.

To determine if you have 50 or more FTEs, count up the number of employees you have who work at least 30 hours per week or 130 hours per month. These are your full-time employees under the ACA. Then, divide the total number of hours your part-time employees worked by the number of part-time employees to find your FTE part-time employees. Add together your full-time employees and FTE part-time employees to get your total full-time equivalent employee number.

If you have 50 or more full-time equivalent employees, you are known as an applicable large employer (ALE). There are limits to which type of health insurance reimbursement programs applicable large employers can offer.

Insurance reimbursement options

Under a traditional health insurance plan, employers choose an insurance plan and collect premiums from employees who enroll.

If employees do not receive health insurance through their work, they must independently obtain insurance through the individual health insurance marketplace.

Employers can then reimburse employees for the costs of these plans through a health reimbursement arrangement (HRA). There are three types of reimbursement options to choose from.

Why consider reimbursing employees for health insurance? According to Dan Bailey, President of WikiLawn:

HRAs are a great investment for small businesses. When the group plans you can afford aren’t the best, HRAs allow you to offer competitive benefits to attract the best candidates. They also provide more comprehensive coverage to keep your employees healthy.”

Interested in HRA plans? Read on to learn:

- The basics of each reimbursement program

- Which employers can set it up

- If the reimbursement arrangement is a standalone plan

- Whether reimbursements can go toward premiums

QSEHRA

What is it?

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a reimbursement option for eligible employers. It has a maximum reimbursement limit of $5,850 (single) or $11,800 (family) in 2023.

If you reimburse employees through a QSEHRA, report the amount on the W-2 form in box 12 using code FF.

There are a number of benefits of setting up a QSEHRA, as Henry O’Loughlin, Director Of Operations, of Nectafy, highlights:

Nectafy has offered QSEHRA to its employees for the last few years. We have just six full-time employees, so grouping together and providing health insurance doesn’t provide enough of a benefit. The QSEHRA reimbursement allows us to pay most or all of the health insurance for our employees but allows them to choose a plan that fits. It’s a good setup for small companies.”

Who can set it up?

Only employers with fewer than 50 full-time equivalent employees can set up a QSEHRA plan. Applicable large employers cannot take advantage of QSEHRAs.

Is it a standalone plan?

Yes, a QSEHRA is a standalone plan.

Can reimbursements go toward premiums?

You can use a QSEHRA to reimburse employees for individually-obtained premiums as well as qualifying medical expenses (e.g., medication).

ICHRA

What is it?

An Individual Coverage Health Reimbursement Arrangement (ICHRA) is a plan that allows employers to reimburse employees without contribution limits.

Who can set it up?

Any employer can set up an ICHRA. However, ALEs (aka employers with 50 or more employees) are responsible for ensuring the plan is affordable. The ACA considers a plan affordable if the monthly premium for the lowest-cost Silver Health Plan for self coverage in the employee’s area (minus the monthly ICHRA reimbursement amount) is less than 9.83% of one-twelfth of the employee’s household income.

Is it a standalone plan?

Yes. You cannot offer an employee both an ICHRA and a traditional group health insurance plan.

Can reimbursements go toward premiums?

Yes, ICHRA payments go toward premiums. Employees select their own insurance plan and receive a reimbursement for part of their costs.

EBHRA

What is it?

An Excepted Benefit Health Reimbursement Arrangement (EBHRA) is a type of HRA that employers can offer. Under an EBHRA, you can reimburse employees up to $1,950 for 2023.

Who can set it up?

Employers of any size can set up EBHRAs.

Is it a standalone plan?

If you set up an EBHRA, you must also have a traditional health insurance plan in place. You cannot offer an EBHRA in place of traditional health insurance.

Can reimbursements go toward premiums?

No, reimbursements cannot go toward typical health insurance premiums. Reimbursements can cover premiums not included in a group plan (e.g., vision insurance), copays, and deductibles.

Want to reimburse employees for health insurance? Remember to distribute written notices. You can upload electronic notices with Patriot’s online HR Software add-on. Share important documents with your team, organize employee records, and more. Plus, it integrates with our online payroll. Try both for free today!

This is not intended as legal advice; for more information, please click here.