In the light of FTX’s collapse, a lot of blame has gone towards the lack of regulation, governance controls, and the ways that its founder-CEO used its customer funds. A number of you have been asking me, could the same happen to digital stock brokerages? Are the stocks or cash holdings in your account safe?

This article explains that, and delves into the differences in controls that digital brokerages are subjected to, which FTX lacked.

At first, I thought it was pointless to compare a crypto exchange with a digital stock brokerage. After all, that’s like comparing apples to pears.

But with so many of you readers sharing the same concerns (and you’re not the only ones), it eventually led me to sit down and write this article. So for those of you who already know why both are different, then you can skip this. But for the rest of you who are still worried about whether digital stock brokerages are safe to use, this is for you.

Firstly, let me start by caveating that almost nothing in life is 100% risk-free. The same goes for platforms – be it a crypto exchange, a robo-advisory (remember Smartly?) or even bike-sharing apps.

And the one thing they all have in common is that we, as users, put our hard-earned funds on those platforms. It is only natural that we worry about getting our funds back should they collapse or disappear.

FTX vs. digital stock brokerages

Similar to FTX, digital stock brokerages like Robinhood, Tiger Brokers, moomoo Singapore (by FUTU) and WeBull are a fairly new phenomenon that cropped up only in recent years.

FTX, until its recent demise, was among the largest crypto exchanges in the world with prominent financial investors and many celebrities / popular influencers who promoted it to their audiences. But yet, within a week of events, FTX is now bankrupt and most customers will probably never get back their funds (or their crypto).

The investigations into FTX are still ongoing, but here’s what we know so far:

- The company was set up in the Bahamas, structured in a way such that customers of FTX actually have no claim on any of the tokens that they bought from FTX (because of the way the law works across borders)

- Founder-CEO Bankman-Fried is said to have used customers’ funds to make risky bets for his hedge fund

- Crypto exchanges trade unregulated financial assets

- No external audits or governance controls

I’ve highlighted the above in bold because that’s where the similarities end.

Of course, even the strictest regulations cannot 100% eliminate the possibility of a player committing fraud, but at least in the securities market, the operating regulations makes it harder for that to happen.

Aside from investor protection policies, the segregation of roles between trading venues, market makers and asset custodians are a key feature of regulated stock exchanges like the New York Stock Exchange (NYSE). Exchanges are also prohibited from owning brokerages (at most, a 20% stake). However, this is not the case for many crypto exchanges, and most certainly not FTX.

Here’s 5 reasons why you have less to worry about.

1. Your deposits and assets are insured.

Insurance for crypto assets are still new, and most customers of crypto exchanges are not protected by any insurance which would cover against their losses. But that’s not the case when it comes to the securities market. Using moomoo SG as an example,

Note: If the brokerage you’re using offers you the option to “sweep” your cash into individual FDIC-insured bank accounts, then you’ll also be entitled to $250k of USD cash protection. However, this only applies for US banks and brokerages with a US bank sweep program, so unfortunately none of our local players can provide this.

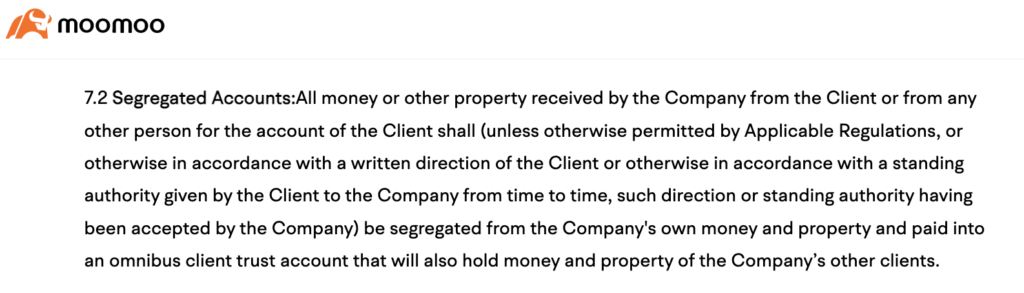

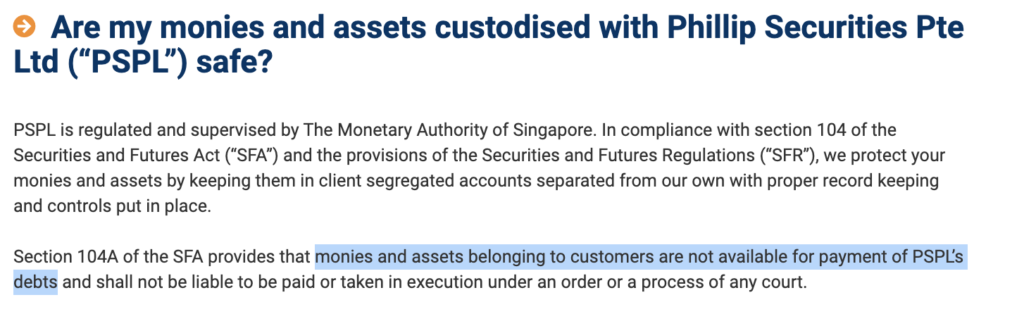

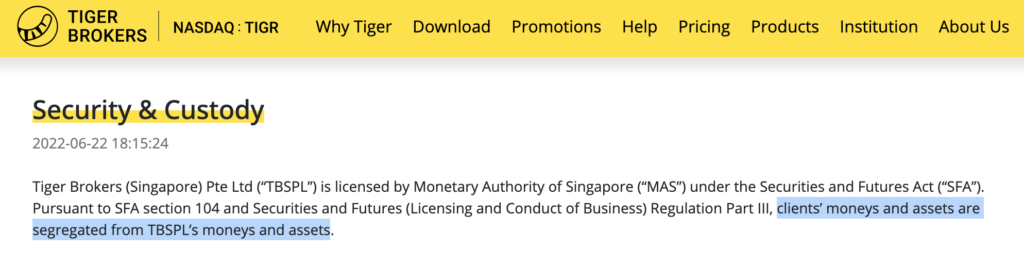

2. Your funds are segregated and kept separate from the brokerage’s own funds

Most crypto exchanges hold your assets on-chain, on their own hot wallets. These leave them susceptible to being potentially drained by the company’s staff (those who hold the wallet keys), or hacked by outsiders anytime.

But on the contrary, all digital stock brokerages that operate in Singapore are required by law to be kept separate from the company’s own funds. Your brokerage is not allowed to use your funds for their own business activities, nor can your funds be ordered (not even by law) to pay off the company’s debts or loans.

If you recall, that’s completely opposite of what allegedly happened with FTX, who is being

3. Your assets are not held by the broker.

Contrary to what some people believe, not all your shares are under your legal title or rights, even though you paid for those shares. In most cases, the reason why we can buy and sell shares electronically (within seconds) is because we only hold and transfer our beneficial interest in the securities, rather than our legal title or rights to .

Of course, this isn’t the case for Singapore citizens, where you legally own the SGX stocks held in your Central Depository (CDP) (but not when you buy through custody brokers such as Standard Chartered). This is also why some folks are willing to pay higher brokerage commissions just so that they can legally own it in their CDP accounts.

As for your US shares, the SEC has made it such that your shares are not owned by the broker, but rather, held in custody by the Depository Trust Company (DTCC) – the only domestic depository with over 800 custodial banks and brokers. Whether or not you buy your US shares through moomoo or Robinhood, your assets are still custodised by the DTCC.

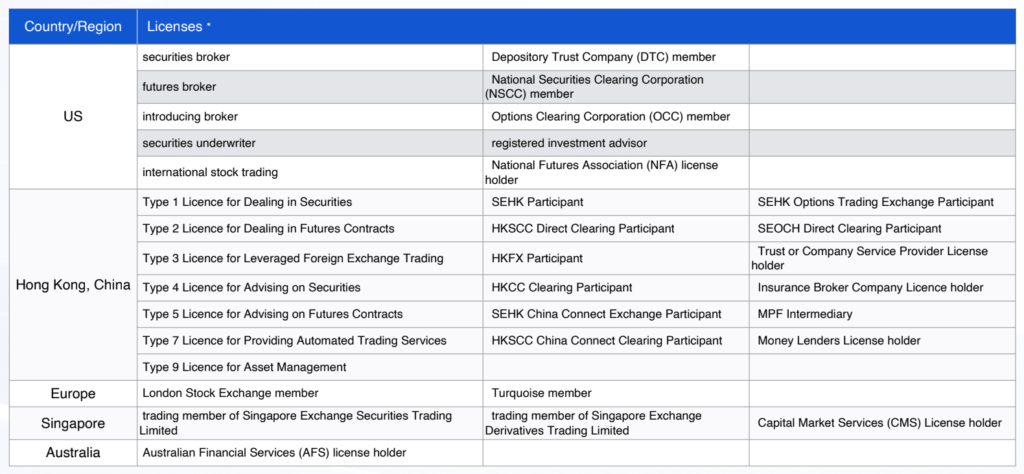

4. Strict controls for regulatory licenses and memberships.

Needless to say, it is much harder to set up and operate a digital securities exchange than to set up a crypto exchange. There are stricter controls and a whole multitude of regulatory licenses that you need to get approvals for. And when it comes to the US markets, as a result of the financial mayhem that caused the Great Depression, statutes were implemented to restore investor confidence by providing clear rules of honest dealing. Today, the Securities and Exchange Commission (“SEC”) enforcement mandate covers all securities brokers, transfer agents and clearing agencies, including the National Association of Securities Dealers, which operates the NASDAQ system.

Similar regulations exist in other countries, where you can only get licenses to operate after clearing the relevant rules.

Here’s a look at what Futu Holdings has:

5. Positive revenue and profits

When placing your money with a broker, you’d want to make sure your brokerage is financially stable to withstand even large market drawdowns. Most brokerage firms are also required to meet minimum net capital requirements, so as to reduce the odds of insolvency.

You’d also want a brokerage which is profitable, so that they are less inclined to commit fraud.

Here’s a quick look at Futu Holdings Limited financials (they are the parent company of moomoo SG)a company which has had positive earnings since its listing:

| $ in US dollar | 2020 | 2021 | 2022 First 3Q |

| Non-GAAP adjusted net income | $175 million | $374 million | $269.8 million |

We cannot rule out all possibility of bad actors, but at least this helps to minimize the risk.

What happens if a brokerage goes bust?

Never say never. Big brokerages went bust in 2008, so we cannot rule out the possibility of it happening again, although newer controls and regulations have been put in place since to prevent the same. All the regulations and laws in the world, though, cannot prevent fraud.

But in most cases, should a brokerage firm cease to operate, the multiple layers of protection step in to safeguard customers’ assets:

- The brokerage cannot run away with your funds, since it is held in segregated trust accounts

- SIPC insurance kicks in for US securities

- Your SGX securities are safe in your CDP (provided you used a CDP account)

As for your US assets, the SIPC oversees the liquidation of failed US broker-dealers, with the primary function of returning money to customers as quickly as possible.

Conclusion: how can investors protect themselves?

If you invest with a digital securities broker, your assets are much safer vs. those held in a crypto exchange, so I hope this article helps you to understand why you can feel a little more reassured.

Having said that, I would never rule out any possibility, so as an investor, here are some tips for the super kiasu and kiasi:

Tip 1: Check the regulatory licenses and memberships.

If the brokerage you’re using is not showing up as a registered member or licensed operator (or worse, shows up on the MAS Investor Watchlist), then you should rightfully be concerned.

But if the broker has managed to clear the regulatory controls and receive the licenses, then there’s less to worry about.

Tip 2: Limit your assets to the protected limits

Just like how some Singaporeans choose to put no more than S$75k in each bank (due to SDIC limits), in the US, some investors choose to hold no more than US$500k of cash and securities in a single broker, and US$250k of cash per bank.

It is entirely up to you if you find it safer to split your assets across multiple platforms so that in the worst case scenario, you’re protected by the maximum insured limits.

Tip 3: Diversify across different brokers

It may not be a bad idea to have a secondary account, especially if it’ll make you feel psychologically better about your assets.

And should you be looking for a low-cost and regulated broker to open an account with, check out moomoo – I use them too.

Message from our Sponsor: New User Promotion: • Get up to 1 free Apple Stock* + S$20 cashback* when you deposit > S$2,700! *Terms and conditions apply. Stack that with an Exclusive Promotion (Dec 1, 2022 – Jan 31, 2023): • Commission-Free* Options Trading Valid for 30 days • Reduced Margin Requirement - Up to 100% reduction for trading specific options strategies • Exclusive offer via this link: 3-month free depth quote for US options

All views expressed in this article are my own independent opinions and research notes based on publicly available information put out by each of the regulators and brokerages. Protection measures may change over time and this article will not be updated moving forward, so please use this simply as a reference and you are to do your own due diligence you rely on prevailing retail investor protection measures as a key factor in your investment decisions.

The information in this article/video is purely for informational purposes and should not be relied upon as financial advice.

Disclosure: This post is brought to you in collaboration with moomoo SG. All opinions are that of my own, based on my trading experience with moomoo. Please feel free to click on my affiliate links if you’ll like to sign up for an account!

This advertisement has not been reviewed by the Monetary Authority of Singapore.