Getting the lowest possible APR can help you lower your monthly loan payment or help you pay off your vehicle sooner. Those are important goals, so let’s take a look at the best auto loan rates available and find out how you can land them.

Best Auto Loan Rates

Not all banks and financial institutions will offer you the same rate on an auto loan. Credit requirements, vehicle requirements, and loan terms vary greatly between lenders.

To help you get started on your auto loan search, we’ve gathered a list of the best auto loan rates currently being offered. All of these financial institutions and matching services currently advertise APRs below 6%.

| Loan Method | Loan Types | Min. Credit Score | Min/Max Value | Loan Terms | Lowest APRs | |

|---|---|---|---|---|---|---|

| Alliant | Direct | Dealer, refinance, and Tesla | 630 | $4,000 $1 million |

12 – 84 months | 5.10% new 5.47% used 5.47% refi 5.19% Tesla |

| AutoPay | Matching | Dealer, private party, refinance, & lease buyout | n/a | $2,500 $100,000 |

24 – 96 months | 2.99% |

| Bank of America | Direct | Dealer, private party, refinance, & lease buyout | n/a | $7,500 + | 48 – 72 months | 4.54% new 4.64% used 5.34% buyout 5.54% refi |

| Lending Tree | Matching | Dealer, refinance, lease buyout | 300 | $250 $4 million |

12 – 84 months | 1.00% new 4.69% used 2.14% refi 1.99% buyout |

| MyAutoLoan | Matching | Dealer, refinance, lease buyout, private party | 575 | $8,000 $100,000 |

36 – 84 months | 3.69% new 3.94% used 2.49% refi 2.39% buyout 3.99% private party |

| Navy Federal | Direct | Dealer, refinance | n/a | $250 $500,000 |

36 – 96 months | 4.29% new 4.29% used 4.29% refi |

| PenFed | Direct | Dealer, refinance | 652 | $500 $150,000 |

36 – 84 months | 4.44% new 5.64% used 5.24% refi |

Next up, let’s take a look at the loan requirements and costs for each of these lenders.

1. Alliant

| Fast Facts | |

|---|---|

| Credit Score Required | 630 |

| Minimum Loan Value | $4,000 |

| Loan Terms Available | 12, 36, 48, 60, 72, 84 months |

| Lowest APR | as low as 4.60% |

| Average Loan Approval Time | 24 hours |

| Customer Satisfaction | 2.1/5 on TrustPilot and 1.1/5 on BBB |

| Credit Union Membership Fee | $5 (repaid) |

This open-to-anyone credit union offers various banking and lending services, including auto loans, refis, and special loans for Tesla vehicles.

They also have a dedicated car buying program where you can earn up to a 0.50% discount on your APR and receive discounts when you purchase your vehicle from their network of dealerships.

How Much Does it Cost?

Alliant does not charge application fees, origination fees, or early repayment penalties.

APRs on Alliant’s car loans have different starting rates depending on loan type.

- Alliant’s car buying service: 4.60% on new cars and 4.97% on used (with automatic payments discount).

- Standard: 5.10% on new and 5.47% on used (with automatic payments discount).

- Auto loan refinance: 5.47% or 5.70% for refinancing an existing Alliant auto loan.

- Tesla auto loans: 5.19 % new and 5.54% used.

Your individual APR will depend on your creditworthiness.

2. Autopay

| Fast Facts | |

|---|---|

| Credit Score Required | not disclosed |

| Minimum Loan Value | $2,500 |

| Loan Terms Available | 24 – 96 months |

| Lowest APR | as low as 2.99% |

| Average Loan Approval Time | 24-48 hours |

| Customer Satisfaction | 4.8/5 on TrustPilot and 4.5/5 on BBB |

This auto loan marketplace offers matching services for a variety of auto loans and refi options, including 3rd party sales and lease buyouts.

It is also worth noting that they are part of The Savings Group, which includes auto loan refi matching companies RateGenius and Tresl.

How Much Does it Cost?

Autopay does not charge any application fees or prepayment penalties. Since they are a matching service, your loan offer could come with lender-specific fees like origination fees or credit union membership fees.

The lowest APR that Autopay advertises on their loans is 2.99%. The APR you qualify for may be higher depending on the loan terms you are looking for and your overall creditworthiness.

3. Bank of America

| Fast Facts | |

|---|---|

| Credit Score Required | not disclosed |

| Minimum Loan Value | $7,500 ($8,000 in Minnesota) |

| Loan Terms Available | 48, 60, or 72 months |

| Lowest APR | starting at 4.69% (with preferred rewards discount) |

| Average Loan Approval Time | 1 minute |

| Customer Satisfaction | 1.4/5 on TrustPilot and 1.1/5 on BBB |

One of the largest banks in the U.S., Bank of America offers a wide variety of banking and lending services, including auto loans, auto loan refis, and lease buyouts.

Unfortunately, they do not offer a prequalification process, so your loan application will result in an immediate hard inquiry.

How Much Does it Cost?

Bank of America does not charge loan origination fees, but they can pass along governmental fees (i.e., title fees).

Their current advertised starting APRs are

- 5.04% new

- 5.14% used

- 5.84% lease buyout

- 6.04% refinance

If you are a preferred rewards member, you can earn a rate discount of 0.25% up to 0.50%, so the lowest possible rate for a new car would be 4.69%.

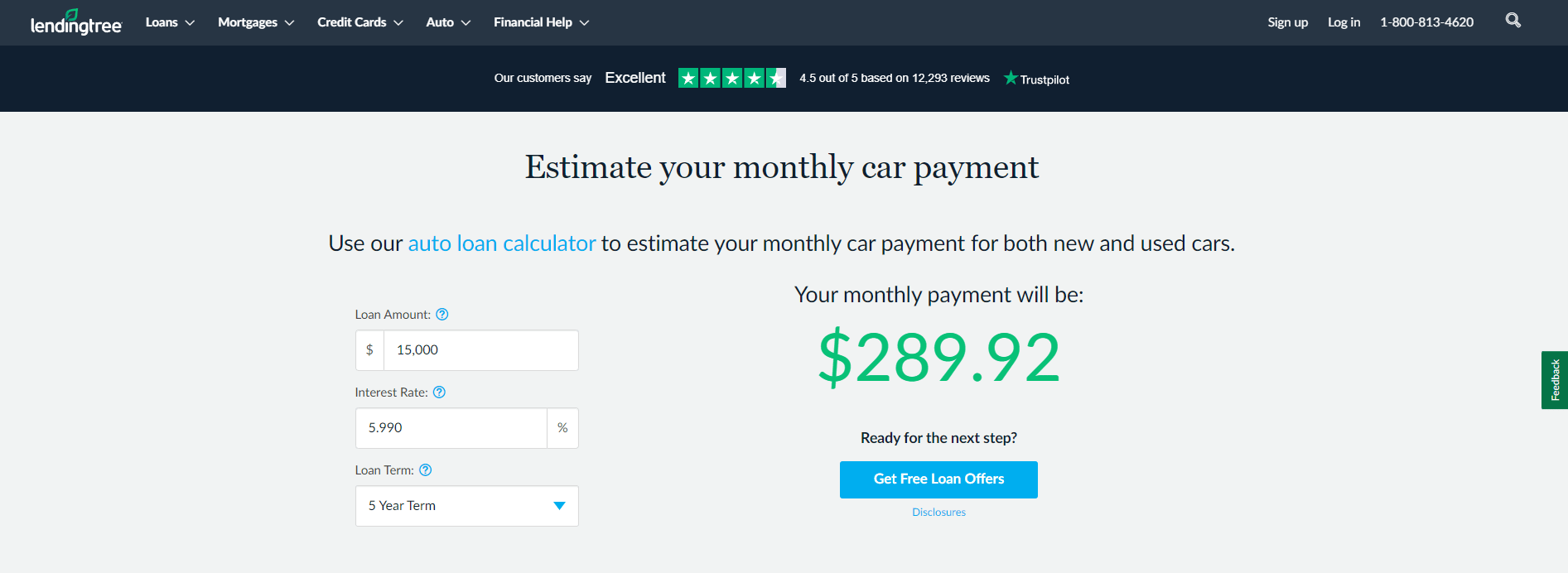

4. Lending Tree

| Fast Facts | |

|---|---|

| Credit Score Required | as low as 300 (depending on the lender) |

| Minimum Loan Value | $250 |

| Finance Terms Available | 12 – 84 months |

| Lowest APR | 1.00% new & 4.69% used |

| Average Loan Approval Time | 1 – 60 minutes |

| Customer Satisfaction | 4.5/5 on TrustPilot and 1.4/5 on BBB |

This loan matching service offers a variety of loans, including auto loans and auto loan refinancing. When you fill out your loan application, they’ll match you with up to 5 lenders from their network of over 500 lenders.

How Much Does it Cost?

Lending Tree will not charge you anything, but individual lenders may charge you origination fees or other fees.

Lending Tree advertises the lowest possible APR as 1.00% from Southwest Financial Credit Union (SFCU). You’ll need a credit score of 750 and a loan term of 12 months to qualify for this rate. You’ll also need to become a member of the credit union.

The 1.00% APR is available on new and used vehicles. The lowest APR available for refi loans is 2.14%.

5. My Auto Loan

| Fast Facts | |

|---|---|

| Credit Score Required | 575 |

| Minimum Loan Value | $8000 |

| Loan Terms Available | 36, 60, 72, 84 months |

| Lowest APR | 2.39% and up |

| Average Loan Approval Time | as little as 30 seconds |

| Customer Satisfaction | 4.2/5 on TrustPilot and 1/5 on BBB |

This loan matching service specializes in auto loans and auto refi loans. You can compare up to 4 offers simultaneously without negatively affecting your credit. MyAutoLoan offers loans for new cars, used cars, private party sales, refis, and lease buyouts.

MyAutoLoan is not currently available to residents of Alaska or Hawaii.

How Much Does it Cost?

MyAutoLoan is a matching service, and filling out their application is 100% free.

The lowest APR MyAutoLoan offers is 2.39% for a lease buyout loan. APRs for other types of loans start at

- 2.49% Refi

- 3.69% new

- 3.94% used

- 3.99% private party sale

The lowest available rate varies based on loan term length and creditworthiness.

6. Navy Federal

One of the largest credit unions in the nation, Navy Federal offers a variety of lending and banking services, including auto loans and auto refi loans.

However, loans are only available to members, and membership at Navy Federal is limited to the military, their families, and government workers.

| Fast Facts | |

|---|---|

| Credit Score Required | not disclosed |

| Minimum Loan Value | $250 ($5000 for refi and $30,000 for 96-month financing) |

| Loan Terms Available | 36, 60, 72, 84, 96 months |

| Lowest APR | as low as 4.29% with an active duty discount |

| Average Loan Approval Time | 5 minutes |

| Customer Satisfaction | 4.6/5 on TrustPilot and 1.4/5 on BBB |

How Much Does it Cost?

Navy Federal does not charge an application fee.

The interest rates they offer depend on the loan type. Their starting APRs are

- 4.54% for new vehicles

- 4.54% for used vehicles only 1 or 2 years old

- 5.44% for used vehicles over 2 years old

If you are an active duty service member, you can receive a rate discount of 0.25% making your lowest potential APR 4.29%.

7. PenFed

| Fast Facts | |

|---|---|

| Credit Score Required | 652 |

| Minimum Loan Value | $500 |

| Loan Terms Available | 36, 48, 60, 72, 84 months |

| Lowest APR | as low as 4.44% |

| Average Loan Approval Time | 1 minute or less |

| Customer Satisfaction | 4.5/5 on TrustPilot and 1.2/5 on BBB |

| Membership Fee | $25 minimum account deposit |

This national credit union with open membership (anyone can join), offers various banking and lending services, including auto and auto refi loans.

PenFed also offers a car buying program where you can score lower interest rates and cashback incentives from select manufacturers. You must be a PenFed member for at least 60 days before applying for an auto loan through their car-buying program.

How Much Does it Cost?

There are no application fees or origination fees.

PenFed offers its best interest rates through its car buying program. Starting APRs are as follows:

- 4.44% – New vehicles purchased through their car buying program

- 5.24% – New vehicles

- 5.64% – Used vehicles purchased through their car buying program

- 6.04% – Used vehicles

- 5.24% – New vehicle refinance (2 years or newer)

- 6.04% – Used vehicle refinance

Your APR offer will depend on the specific terms of the loan and your creditworthiness.

What Is a Good Interest Rate for a Car Loan?

Your credit score has a huge impact on the interest rate you’re offered. The higher your credit score, the lower the rates you will be offered. When you take this into consideration, a good interest rate for a car loan will be the one that allows you to finance a car with manageable monthly payments for your budget.

In the table below, you can see the most recent average interest rates for both new and used cars by credit score.

Average auto loan rates for Q2 (April – June) 2022

| Category | Score Range | New car average interest rate |

Used car average interest rate |

|---|---|---|---|

| Deep subprime | 300-500 | 12.93% | 19.81% |

| Subprime | 501-600 | 10.11% | 15.86% |

| Near prime | 601-660 | 7.25% | 9.81% |

| Prime | 661-780 | 4.90% | 5.47% |

| Super prime | 781-850 | 3.84% | 3.69% |

*Actual interest rates are based on many factors such as state, down payment, income, and others.

How to Get the Best Auto Loan Rates

The above banks, credit unions, and matching services are the lowest rates that we could find offered to the general public. But you can still find as good or better APR offers by doing a more personalized search.

Let’s take a look at some great ways you can land the best APR on your next car loan.

Use a Loan Broker

A loan matching service, or “loan broker,” lets you find the best rate and loan terms by working with a network of lenders. You fill out one application, and it is forwarded to all lenders. This often results in competitive offers, even for those with poor credit.

Plus, the matching process is usually a prequalification step, so there won’t be a hard credit pull.

Just remember the offers you receive through a loan broker are not guaranteed. Loan terms can change up until the final approval stage.

Check With Local Banks and Credit Unions

Another good resource for finding auto loans with great terms and rates is to check with your local bank or credit union, especially if you already have a relationship with that financial institution.

Big banks often offer great rates, especially to those with good credit, but they don’t publish these rates. For example, I received a 2.83% APR on my last used vehicle purchase through Capital One, but I only learned about this low rate once I applied.

Credit unions are also a good choice as they are known for offering low interest rates and longer repayment terms thanks to their not-for-profit model.

Explore Dealer Financing

Many dealers offer 0% APR offers on new vehicles and low APR loans (under 3%) for certified pre-owned vehicles. But you’ll likely need excellent credit to qualify for these offers.

Just be aware that these financing offers often disqualify you from receiving any manufacturer rebates or promotions.

Buy from Online Dealers

No haggling with a dealer and explore vehicles virtually and buy on your own time. Online-only dealers such as Carvana and Vroom have pioneered this buy-from-your-couch car-buying process.

In addition to helping you find a car, they can finance it for you. Carvana, for instance, has an in-house financing program. The lowest advertised rate is 6.85%, but many customers have reported getting much lower rates, sometimes under 4%.

Improve Your Credit

If your credit is poor, then the best way to score a good APR is to improve your credit. Even a boost of a few points can move you from fair credit to good credit and save you a decent chunk of change with a lower APR.

If you financed $28,000 for a new car at 6.57%, you would pay $4,926.20 in interest over the 60-month life of the loan. If you financed the same amount at an interest rate of 4.03%, you would only pay $2,962.40 in interest. That is almost $2,000 in savings.

Refinance Your Loan

If you had to purchase a vehicle when your credit wasn’t the best or got duped by a bank or dealer that stuck you with a high APR, you could still save money by refinancing.

Many lenders offer low rates for refis. You can check with loan matching companies such as RateGenius and LendingClub to help you find the lowest refi rates.

Just make sure you refi early on in the loan, or you could end up overpaying in interest charges.

Bottom Line

When shopping around for an auto loan, finding the best rate possible can save you a significant chunk of change over the life of the loan. Unfortunately, loan rates change frequently, so the bank with the best rate today might not have the best rate tomorrow.

The good news is that most banks offer a prequalification process that doesn’t require a hard inquiry, so you can shop around to find the best auto loan rates and terms without damaging your credit.

We hope you can use this list of the best auto loan rates to save money on your next vehicle purchase.