One of my biggest fears for renters has come true. Rents are surging due to rising home prices, increasing household formation, and not enough inventory. The main question now is: How long will rent increases last?

We shouldn’t feel bad for those who’ve been against homeownership for years. You can find plenty of them commenting in my posts:

All those against real estate have rationally saved and invested the difference in the stock market and other classes. And given most asset classes have done phenomenally well over the years, renters who invested have also done very well.

However, for those of you who wanted to buy real estate but couldn’t or want to buy real estate but can’t, this post is written mostly for you. This post should help you better figure out your future living situation.

How Much Are Rents Up Year Over Year?

According to data from Zillow, 2021 rent was up 11.5% from a year earlier, or almost $200. In other words, the median rent price in America in August 2020 was around $1,530. Today it is around $1,739.

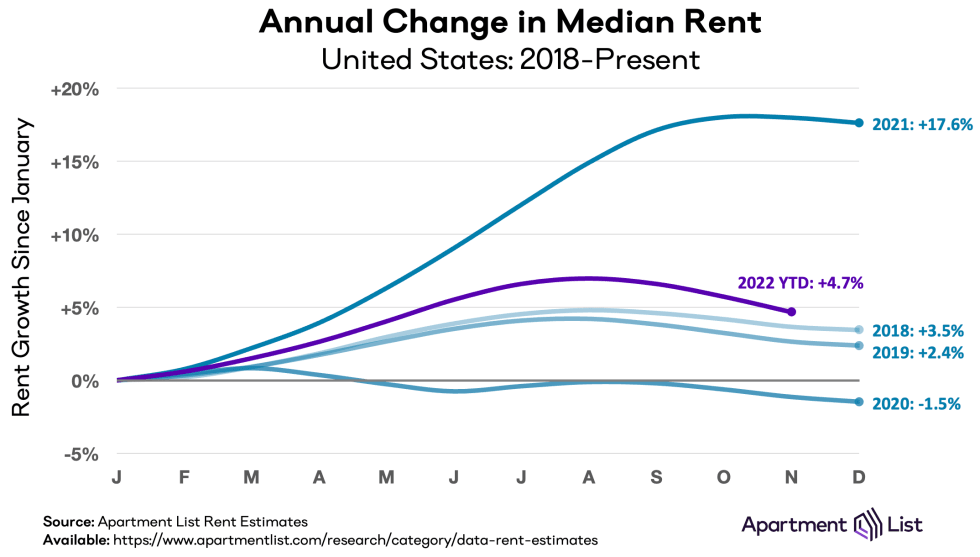

According to ApartmentList, the national median rent increased by a record-setting 17.6 percent over the course of 2021. 2021 was the highest rent growth year in decades.

In 2022, rent continued to creep higher by about 4.8% according to ApartmentList and consistent with my 2022 housing market forecast. In other words, rent increases finally slowed down in 2022 as the bear market took hold.

Here’s another chart from CoreLogic. It shows a national single-family rent index for various price points is also up dramatically year over year in 2021 as well. It shows the High Tier segment (black line) increase the most.

Rents Will Finally Slow Or Go Down In 2023

I think home prices in 2023 will finally decline by about 8%. As a result, so will rents thanks to a Fed-induced global recession. Due to aggressive rate hikes by the Federal Reserve in 2022 and a ~20% decline in the S&P 500, rents should inevitably begin to fall.

In 2023, I expect national rents to decline by 5% in 2023.

Here are some signs of lower inflation to come:

- Gas prices down 37% from June peak

- Used car prices down 19% from peak

- Global freight rates down 81% from 2021 peak

- Fertilizer prices down 45% from March peak

- Rents down in Sep, Oct, & Nov of 2022

- Home Prices down over 10% from June peak

New Tenant Repeat Rent Index

Researchers at the BLS and Cleveland Fed released a data series on December 19, 2022 called the New Tenant Repeat Rent Index. As you can see from the yellow line below, the New Tenant Repeat Rent Index has rolled over hard.

The Consumer Price Index tracks housing inflation through a large panel of housing units that are surveyed every six months. But because rental turnover is slow and CPI tracks contract rents for all units, CPI data lags current market conditions significantly.

How Long Will Rent Increases Last?

Rents cannot increase faster than wage growth indefinitely. At some point, rent increases will have to slow.

Therefore, it is my belief that rent increases will begin to moderate by 1H2023 as home price growth slows, enough people finally move out of their parents’ homes or shed roommates, and housing construction bottlenecks decrease.

The New Tenant Repeat Rent Index attempts to capture rent growth or declines in real-time. Therefore, it is highly likely CPI data for 2023 will continue to head south since rent is a large component of the Consumer Price Index.

Moderating Rent Price Growth Versus Negative Rent Price Growth

Make sure to differentiate between moderating rent price growth and negative rent price growth. Instead of driving 85 mph on the highway, a car might slow down to 65 mph. The car is still moving forward, but just not at as rapid of a pace.

If median rent price growth is 4.8% YoY for the entire 2022, I suspect median rent price growth will slow to about just 2-3% by the end of 2022.

Before the Fed started aggressively hiking rates, I expected national median rent price growth to revert to the mean by increasing 2% – 3%. However, the Fed seems determined to cause another recession in 2023. As a result, I expect rents to decline by 5% in 2023.

2023 should turn out to be a better time to be a renter as rent prices fade. However, there should be a good opportunity to buy property in mid-2023. This is especially true if returns for equities and bonds dramatically decline over the next 10 years as well.

Post pandemic, the intrinsic value of a home has permanently increased. We are all spending more time at home, and therefore, we all appreciate our homes more.

There is no going back to the way things were. The most likely scenario is a hybrid model where workers work from home part-time and work in the office part-time.

Therefore, I’m an investor in single-family and multifamily homes to take advantage of this long-term trend. In 20 years, I’m pretty sure our children will marvel at how cheap rents were today.

Advice For Renters Looking To Control Living Expenses

As a landlord since 2005, generating positive returns was important so I could escape work earlier. Today, generating positive returns is important so I can better take care of my family of four. Real estate income accounts for about 50% of our current passive income portfolio.

At the same time, as a personal finance writer since 2009, I also have a goal of helping as many people achieve financial freedom as possible. This goal is why I’ve encouraged readers to buy real estate as young as they possibly can for so long. Inflation is too powerful of a force to combat.

Whether you believe me or not is neither here nor there. If you are a renter, what matters is what you do and how you think about the current situation going forward. Therefore, here is some advice for renters as a landlord and as an ex-renter myself.

1) Eliminate misinformation, understand the latest market conditions

Although seeing rents and home prices increase can be frustrating, there’s a positive for renters. Most landlords are incapable of increasing rents as fast as the market. The reasons are due to kindness, ineptitude, laws, and laziness.

Therefore, even if the national median rent or local market rent increased by 11% from a year earlier, your rent has most likely not increased by the same magnitude.

In a rising market, the difference between current market rent and the rent you are paying is your “profit” and a landlord’s “loss.” Your profit is what you save by not having to pay market rent. A landlord’s loss is the opportunity cost of not earning market rents. The longer you rent a place, usually the larger your profit grows and vice versa for the landlord.

Understand Rental Conditions

If a renter does not understand the latest rental market conditions, s/he might get erroneously upset at not getting their way.

For example, one tenant recently asked for a rent decrease when neighborhood rents are up between 10% – 15% ($400 – $615). Since 2H2020, there’s been a huge flood of people migrating to the western side of San Francisco due to better value, more space, better air, more parks, and less density. I knew demand was up because I rented out a house in September 2020 and experienced more demand than ever before.

When I declined my tenant’s request and just kept the rent unchanged, he was unhappy. But if he understood the latest market conditions, he would have felt more at peace.

Asking for a rent decrease when the rental market is up 15% is like asking for a raise during a bear market. It could happen if you’ve developed an amazing relationship with your landlord. But what’s more likely to happen is your manager adding you to the RIF list for being so disconnected from reality.

Do not make the second biggest financial mistake if you want to achieve financial freedom.

2) Know that your landlord has rising expenses too

For those who have never owned property before, it’s understandable to not know all the costs associated with owning real estate. Landlords often have the following costs: insurance, maintenance, mortgage, property taxes, special assessments, property management.

In other words, the increased rent never 100% goes to the landlord’s bottom line. For example, even if I have no mortgage, I still pay about $23,000 a year in property taxes for one rental property. This property tax goes up 2% a year, usually forever.

The more a renter understands a landlord’s costs, the more a renter won’t feel as bad about paying higher rents. The same goes for voting on legislation to raise more money for some cause. If the money raised is coming from paying more property taxes, then rents will inevitability increase. Therefore, voters of such legislation should be fine with paying higher rents.

If you’re lucky to not have any rent increase in a rising-rent environment, your landlord’s cashflow is declining. Therefore, as a renter, you might gain comfort knowing your landlord is making less.

3) Keep things harmonious and don’t get personal

If you have a good landlord who is attentive, takes care of issues, and communicates with you in a professional manner, cherish the relationship. A landlord who finds good tenants will certainly do the same.

At the end of the day, a harmonious relationship is better than a contentious one, especially if you know your landlord and see him/her every so often. If your landlord is a faceless corporation, then it’s easier to be more aggressive or combative. But even still, it’s usually worth keeping things cool with the property manager.

If you get too personal, you run the risk of offending either party. If you offend the landlord by bringing up some personal issue, he might decide to raise the rent to the legal maximum. Worse, he might give you notice, which would be bad if you don’t want to move out.

At the same time, if a landlord offends a renter, the renter might damage the place, delay paying rent, or not pay at all. Therefore, when it comes to the lease agreement and negotiating future terms, keep things strictly business. Please don’t bring personal issues and judgement calls into a negotiation.

Many landlords have a love-hate relationship with real estate. The older and wealthier a landlord gets, the less they want to deal with tenant and maintenance issues. As a result, the more a tenant can be self-sufficient, the less likely the rent will increase.

4) Practice Stealth Wealth

Before I had kids, one of the reasons why I enjoyed driving a Honda Fit was because my tenants wouldn’t judge me when I came over to address an issue. Driving a cheaper car than my tenants not only felt good, it helped diminish envy.

Strategically, to minimize the chances of a rent increase, it’s also best for renters to practice Stealth Wealth. If the landlord sees you rolling in a new car, fancy watch, $10,000 home theater system, or whatever luxury item, he may logically think you can afford to pay more rent.

When in doubt, it’s better to be more low key with everything you do.

5) A renter really does have to save and invest the difference

Anti-homeownership advocates always argue that renting is better because it’s cheaper, less hassle, and you can invest the difference in better performing assets. Yes, these are great reasons for renting in the short term or medium term.

However, just like how you wouldn’t short the S&P 500 over the long term, you wouldn’t short the real estate market by renting long term either. Instead, it’s better to invest in the S&P 500 and at least own your primary residence to get neutral real estate.

If you rent, you must actually save and invest the difference. If you don’t, you will likely fall financially behind your peers who do own. The main reason is homeowners have a forced savings account every time they pay their amortizing mortgage. The other reason is that real estate tends to inflate with inflation over time.

If a homeowner owns a $500,000 house that appreciates by 8% one year, a renter with a $80,000 income needs a 50% pay raise just to stay even. Or, a renter with a $100,000 stock portfolio needs to see a 40% return to stay even. Both are unlikely.

The average net worth for a homeowner is 40X or so greater than the average net worth of a renter. There are all sorts of reasons for this massive discrepancy. But one reason is the lack of discipline in saving and investing the difference over the long term.

6) Always be looking for buying opportunities

One of the great benefits of renting is trying out a neighborhood in a lower-cost way before buying. After about a year, you should have a great idea if you want to live in the neighborhood long-term. And if you don’t, you should spend time at least once a month exploring new neighborhoods.

Thankfully, it’s easier than ever to explore new homes online. You can even track rent increases in addition to property prices. I recommend setting up e-mail alerts with homes that meet your filters. It’s just like signing up for my e-mail list that automatically e-mails you whenever I publish a new post. This way, you’ll never miss a thing.

If you can afford to buy a home using my 30/30/3 rule, I would buy. Just make sure to leave in your home for at least five years to ride out the cycles.

There are great buying opportunities that pop up all the time. You might find a stale-fish listing that was priced too high. You might stumble across a great listing during the middle of a snow storm when nobody is looking. A couple might be getting a divorce and just wants a quick sale.

Gems are waiting to be snagged every day. You just have to spend time looking.

Rents Are An Economic Signal

Finally, another good way to look at rising rents is to view them as a positive signal for a healthy local economy. Rising rents usually mean positive demographic changes, rising wages, and more job opportunities. Conversely, declining rents general means a weakening economy.

If your rent is rising by 5% – 10%, but you can get an equal or greater raise, you’re winning! If rents are flat or declining, it will likely be harder to get that raise and promotion. Which situation would you rather be in? If I was working, I’d much rather be in the former.

If rents are rising quickly, it might be a positive signal to invest in local companies. After interviewing many prospective tenants who worked at Google and finding out their mind-boggling salaries, I decided to invest in Google stock 10 years ago.

There’s always a silver lining to every suboptimal situation. Even sitting in horrendous traffic everyday could be a positive signal for you to invest more.

Renting is absolutely fine during the short or medium term. Even in a rising-rent environment, renters can prosper by buying Treasury bonds and other fixed income investments. However, over the long run, I encourage everyone to own their primary residence, invest in real estate, and invest in stocks and other risk assets.

Your net worth and your descendants will thank you.

Real Estate Suggestion

To invest in rising rents, take a look at Fundrise, one of the largest real estate crowdfunding platforms today. Fundrise primary invests in residential rental properties across the country. You can invest in a Fundrise eREIT for as little as $10. Fundrise manages over $3.2 billion in assets under management for over 310,000 investors.

There’s no need to wait until you have a down payment to invest in property. Nor is there a need to be a landlord anymore to take advantage of the residential real estate boom.

Read The Best Personal Finance Book Today

If you want to read the best book on achieving financial freedom sooner, check out Buy This, Not That: How to Spend Your Way To Wealth And Freedom. BTNT is jam-packed with all my insights after spending 30 years working in, studying, and writing about personal finance.

Building wealth is only a part of the equation. Consistently making optimal decisions on some of life’s biggest dilemmas is the other. My book helps you minimize regret and live a more purposeful life.

It’ll be the best personal finance book you will ever read. You can buy a copy of my WSJ bestseller on Amazon today. The richest people in the world are always reading and always learning new things.

For more nuanced personal finance content, join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail.

Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. How Long Will Rent Increases Last is a Financial Samurai original post.