True or false: As an employer, you can pay employees any amount you want. False. It’s 100% false. Why? Because of minimum wage laws.

But, what’s minimum wage? Depending on your business’s location, you may have differing federal, state, and local minimum wage rates. To ensure your business is compliant with labor laws, get to know minimum wage.

What is minimum wage?

The minimum wage is the lowest amount you can legally pay an employee per hour of work. You can pay more than the minimum wage if you’d like, but you cannot pay less than the minimum wage.

Minimum wage laws do not apply to independent contractors, so it’s crucial to make sure that you classify your employees correctly.

Who sets the minimum wage?

The federal government sets a standard minimum wage that applies to all employees in the United States. However, states and localities can set their own minimum wage rates, too.

So, which rate do you need to follow? Federal, state, or local?

Federal minimum wage vs. state vs. local

What happens if a state’s minimum wage is lower than the federal minimum wage? What about if the local minimum wage is lower than the federal?

If the state or local minimum wage is lower than the federal minimum wage, you must pay your employees at least the federal minimum wage rate.

What about if the state or local minimum wage is higher? If the state or local minimum wage is higher than the federal rate, pay your employees the state or local rate, whichever is higher.

Pro tip: When choosing between federal, state, and local minimum wage laws, always pay your employees the highest rate.

What is the federal minimum wage?

The federal minimum wage is set by the Fair Labor Standards Act (FLSA) and enforced by the U.S. Department of Labor (DOL).

Although the federal minimum wage rate is subject to change, it has not increased since 2009.

So, what is the national minimum wage? The current federal minimum wage is $7.25 per hour. However, the federal minimum wage could potentially increase in upcoming years.

Minimum wage by state

Each state can set its own minimum wage. If a state’s minimum wage is greater than the federal minimum, pay employees at least the state’s minimum wage.

For example, the minimum rate in Ohio is $10.10 per hour for 2023. If you have employees in Ohio, you must pay them at least the state’s minimum since it is greater than the federal minimum wage of $7.25.

A number of states passed legislation to increase the state’s minimum wage to $15.00 by a specific year. For example, Connecticut’s Public Act No. 19-4 requires the state’s minimum wage to increase annually over a five-year period. Because Connecticut follows this minimum wage increase schedule, the state is on track to reach a minimum wage of $15.00 in 2023.

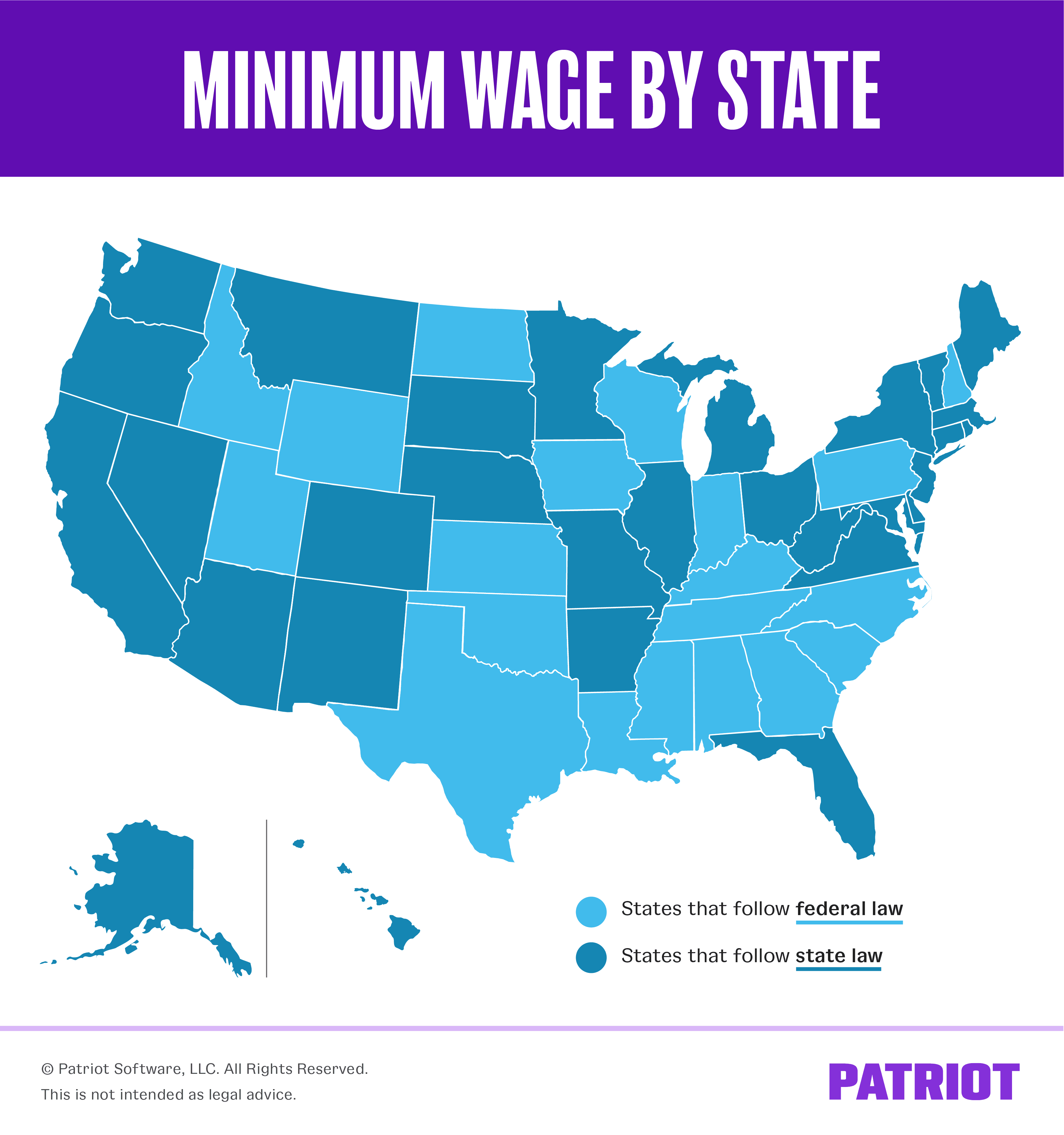

Use the map below to see which states follow the federal minimum wage rate and which set their own minimum.

You might be wondering how much minimum wage is in your state. Check out our state-by-state minimum wage rate chart below to find out. Keep in mind that the states with $7.25 follow the federal minimum wage base.

[State minimum wages as of January 1, 2023]

*These states do not have a state-mandated minimum wage. Instead, most employers must pay the federal minimum wage.

**These states have a minimum wage of $5.15 for any employers who are not covered by the Fair Labor Standards Act. Most employers are covered by the FLSA and must pay the federal minimum wage of $7.25.

Heads up! State minimum wage laws are ever changing. Stay up-to-date with your state’s minimum wage requirements by periodically checking your state’s website.

Local minimum wage

Some cities and counties create a local minimum wage that differs from state or federal rates. Local wages are most common in bigger cities. Employers must pay the higher of the two rates if the local minimum wage is different from the state minimum wage.

For example, the minimum wage in San Francisco is $16.32 per hour. Employers in San Francisco must pay employees at least the local base wage because it is greater than both the state and federal minimums.

Use the chart below to get started. However, check your city’s laws, as this may not be an all-inclusive list.

[Local minimum wages as of January 1, 2023]

| City / State | Local Minimum Wage |

|---|---|

| Alameda, California | $15.75 |

| Albuquerque, New Mexico | $12.00 |

| Belmont, California | $16.75 |

| Berkeley, California | $16.99 |

| Bernalillo County, New Mexico | $9.45 (use the state minimum wage of $12.00) |

| Burlingame, California | $16.47 |

| Chicago, Illinois | $14.50 (employers with 4 to 20 workers) $15.40 (employers with 21 or more workers) |

| Cook County, Illinois | $13.35 (some municipalities opt out of the county minimum wage) |

| Cupertino, California | $17.20 |

| Daly City, California | $16.07 |

| El Cerrito, California | $17.35 |

| Emeryville, California | $17.68 |

| Flagstaff, Arizona | $16.80 |

| Fremont, California | $16.00 |

| Las Cruces, New Mexico | $12.00 |

| Los Altos, California | $17.20 |

| Los Angeles, California | $16.04 |

| Malibu, California | $15.96 |

| Menlo Park, California | $16.20 |

| Milpitas, California | $16.40 |

| Minneapolis, Minnesota | $13.50 (employers with 100 or fewer employees) $15.00 (employers with more than 100 employees) *Rates change on July 1, 2023 |

| Montgomery County, Maryland | $14.50 (employers with 10 or fewer employees) $15.00 (employers with 11 – 50 employees) $15.65 (employers with 51 or more employees) *Rates change July 1, 2023 |

| Mountain View, California | $18.15 |

| Nassau County, New York | $15.73 (if the employer does offer health benefits) $18.26 (if the employer does not offer health benefits) |

| New York City, New York | $15.00 |

| Oakland, California | $15.06 |

| Palo Alto, California | $17.25 |

| Pasadena, California | $16.11 |

| Portland, Maine | $14.00 |

| Prince George’s County, Maryland | $15.00 (increases to $15.60 on June 30, 2023) |

| Redwood City, California | $17.00 |

| Richmond, California | $16.17 |

| Rockland, Maine | $14.00 |

| Saint Paul, Minnesota | $15.19 |

| San Carlos, California | $16.32 |

| San Diego, California | $16.30 |

| San Francisco, California | $16.99 |

| San Jose, California | $17.00 |

| San Leandro, California | $15.00 |

| San Mateo, California | $16.75 |

| Santa Clara, California | $17.20 |

| Santa Fe City, New Mexico | $12.95 |

| Santa Fe County, New Mexico | $12.95 |

| Santa Monica, California | $15.96 |

| SeaTac, Washington | $19.06 (for employees in hospitality and transportation industries) |

| Seattle, Washington | $16.50 (employers with 500 or fewer employees who pay $2.19 per hour toward medical benefits and/or employees earn $2.19 per hour in tips) $18.69 (employers with 500 or fewer employees who do not pay $2.19 per hour toward medical benefits and/or employees earn $2.19 per hour in tips) $18.69 (employers with 501 or more employees) |

| Sonoma, California | $16.00 (employers with 25 or fewer employees) $17.00 (employers with 26 or more employees) |

| South San Francisco, California | $16.70 |

| Suffolk County (Long Island), New York | $15.00 |

| Sunnyvale, California | $17.95 |

| Tucson, Arizona | $13.85 |

| West Hollywood, California | $18.35 (hotel employees) $17.00 (employers with fewer than 50 employees) $17.50 (employers with 50 or more employees) |

| Westchester County, New York | $15.00 |

Like state minimum wage rates, local rates are subject to change. Check with your local government for more information.

Exceptions to minimum wage

There are some exceptions to paying your employees minimum wage. Minimum wage varies for:

Minimum wage for tipped employees

The FLSA currently permits a tip credit, which reduces the federal minimum wage for tipped employees. Tipped employees can have a lower base wage because their tips should make up the rest of their wages.

The federal tipped minimum wage is currently $2.13. This applies to employees who earn more than $30 in tips per month.

Individual states can also have minimum wage laws for tipped employees. Check your state’s tipped minimum wage laws to learn more.

Youth minimum wage

The FLSA also permits a special youth minimum wage. You can pay employees under age 20 a wage of $4.25 for the first 90 days of employment. After 90 consecutive days of employment or the employee reaches 20 years of age (whichever comes first), the employee must receive the minimum wage.

Some states have a youth minimum that is greater than the federal youth minimum wage. For more information, check out the U.S. Department of Labor’s website.

Living wage vs. minimum wage

When looking through state and local minimum wage laws, you may see the term “living wage.” For example, Nassau County, NY uses living wage in place of minimum wage. So, what is a living wage?

A living wage is a state or local minimum wage that’s higher than the federal or state minimum wage. Lawmakers may set these wages to meet or exceed federal poverty guidelines for a family of four. Or, they may choose the living wage to accommodate the cost of living in a specific geographic region. The goal of living wage laws is to decrease poverty through increased earnings.

Some living wage laws may also mandate paid time off, health insurance coverage, or other benefits for employees.

Minimum wage and living wage laws may overlap. Or, living wage laws may be enacted in place of efforts to increase minimum wage rates.

This article has been updated from its original publication date of March 22, 2012.

This is not intended as legal advice; for more information, please click here.