Want to avoid breaking labor laws? Then you need to pay employees according to federal, state, or local minimum wage law. But if you have tipped employees, you might be able to pay a lower, tipped minimum wage.

Read on to learn what is a tipped minimum wage, along with the current federal tipped wage and the tipped minimum wage by state.

What is the tipped minimum wage?

The tipped minimum wage, or minimum cash wage, is the lowest amount you can pay a tipped employee per hour of work. A “tipped employee” is a worker in a service industry (e.g., restaurant) who customarily and regularly receives more than $30 per month in tips. The tipped minimum wage is lower than the regular minimum wage because employers can claim a tip credit.

The tip credit is the difference between the minimum wage and the tipped minimum wage. There is a federal tipped minimum wage. But like the regular minimum wage rate, the cash wage can vary depending on what state your business is in.

You must pay employees the higher of the:

- Federal tipped minimum wage

- State tipped minimum wage

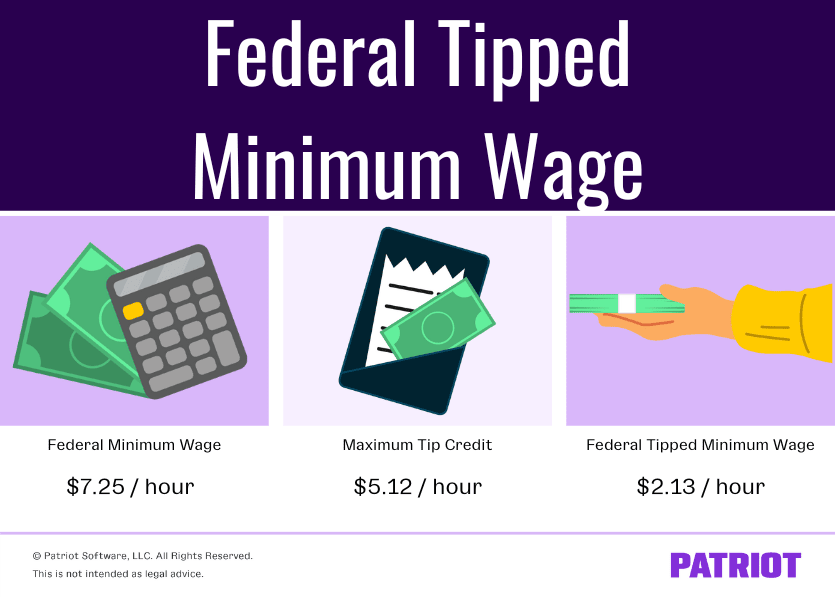

Federal minimum wage for tipped employees

The federal minimum wage for servers and other tipped employees is $2.13 per hour. You must pay your tipped employees at least $2.13 per hour.

The regular minimum wage is currently $7.25 per hour, meaning employers can claim a maximum tip credit of $5.12 per hour ($7.25 – $2.13 = $5.12).

If you want to use the FLSA tip credit and pay employees the minimum cash wage, you need to provide details. Tell employees:

- Their hourly wage (at least $2.13 per hour)

- The additional amount you’re claiming as a tip credit (maximum $5.12)

- That the tip credit you claim cannot exceed the tips your employees receive

- That your employees retain their tips (unless you have a tip pooling agreement)

- The tip credit does not apply to anyone unless you notify the employees

Failing to notify your employees about the above means you must pay them the regular minimum wage and let them keep their tips. You can let them know orally or in writing.

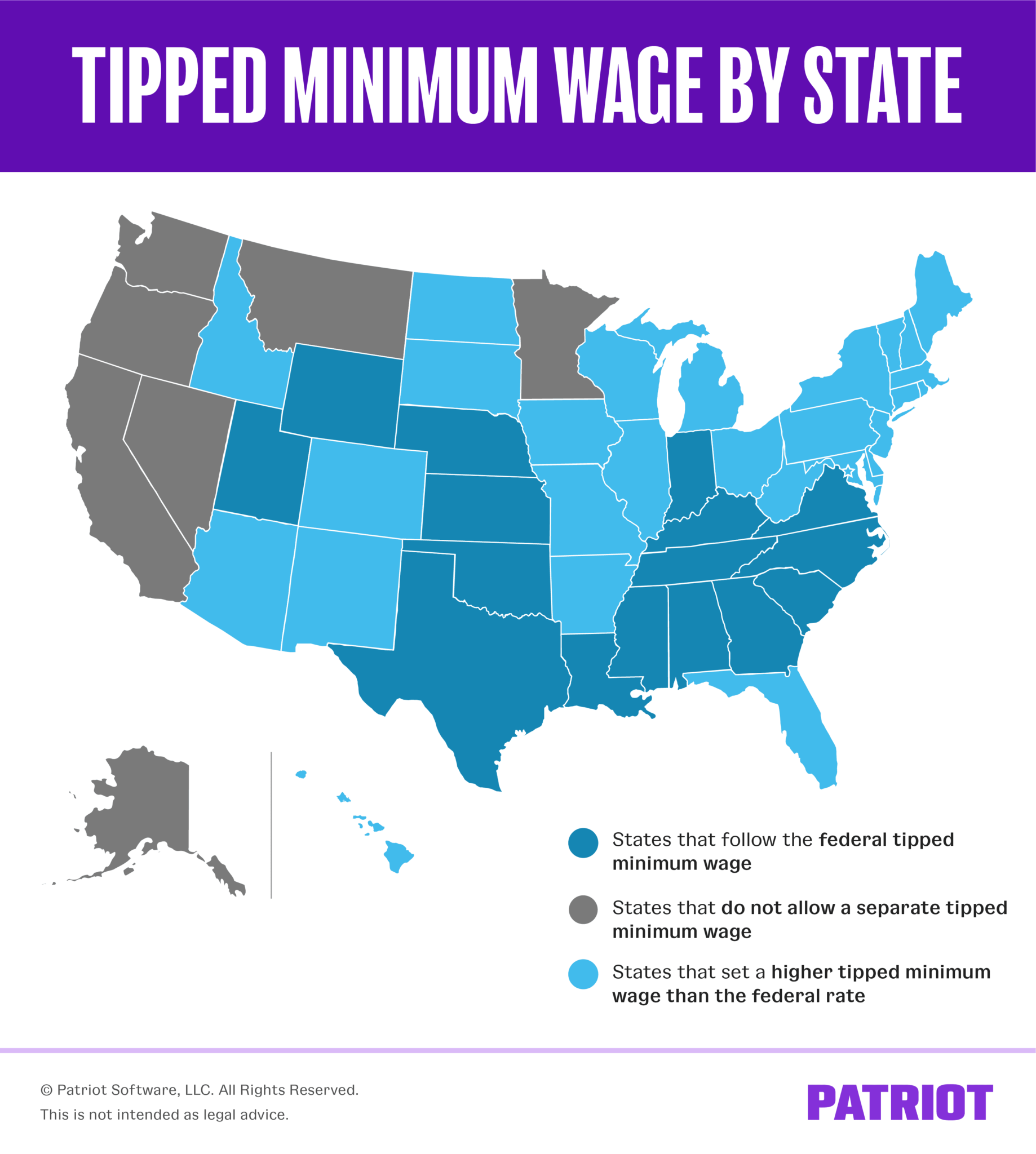

Tipped minimum wage by state

Again, the federal tipped minimum wage rate may not apply to your business. State law trumps federal if it’s more generous to employees.

- Follows the federal tipped minimum wage law

- Does not allow any tipped minimum wage

- Sets a state tipped minimum wage

Keep in mind that your state’s definition of who is considered a “tipped employee” may be different than the federal definition. For example, workers are considered tipped employees if they make more than $20—not $30—per month in Massachusetts.

So, what does your state require? Take a look below.

States that follow the federal tipped minimum wage

When it comes to the tipped wage, these states follow the federal rate of $2.13 per hour:

| Alabama | Mississippi | Texas |

| Georgia | Nebraska | Utah |

| Indiana | North Carolina | Virginia |

| Kansas | Oklahoma* | Wyoming |

| Kentucky | South Carolina | |

| Louisiana | Tennessee |

*The DOL classifies this as a state that sets a higher tipped minimum wage than the federal rate. However, Oklahoma’s current rate is $2.13, which is the same as the federal rate. For more information, contact Oklahoma’s department of labor.

Check with your state for more information on their specific rules. For example, you cannot claim the tip credit in North Carolina unless you receive a signed certification of your employees’ tips monthly or each pay period (e.g., tip reporting sheet).

States that do not allow a tipped minimum wage

Again, not all states let employers pay employees a tipped minimum wage. The following states require that employers pay employees at least the regular state minimum wage in addition to the employee’s collected tips:

| Alaska | Montana | Washington |

| California | Nevada | |

| Minnesota | Oregon |

If your business is located in one of the above states, do not try to pay employees the minimum cash wage.

States that set a state tipped minimum wage

The majority of states set their own minimum wage for tipped employees that is above the federal rate of $2.13:

| Arizona | Iowa | North Dakota |

| Arkansas | Maine | Ohio |

| Colorado | Maryland | Pennsylvania |

| Connecticut | Massachusetts | Rhode Island |

| Delaware | Michigan | South Dakota |

| D.C. | Missouri | Vermont |

| Florida | New Hampshire | Wisconsin |

| Hawaii | New Jersey | West Virginia |

| Idaho | New Mexico | |

| Illinois | New York |

If your state sets its own minimum cash wage, there may be some additional state rules to keep in mind. For example, your state might:

- Allow a tip credit if the employee’s combined hourly wage and tips is a certain amount more than the applicable minimum wage (e.g., Hawaii)

- Only apply the state law to employers with a certain number of employees (e.g., West Virginia)

- Only apply the law to employees over a certain age (e.g., Wisconsin)

Minimum wage for tipped employees 2023: Chart

Want to know how much you must pay tipped employees? Use the chart below to find out.

States with an * by their name do not allow a separate minimum wage for tipped employees. The amount listed is the same minimum wage you must provide to your non-tipped employees.

| State | Tipped Minimum Wage |

|---|---|

| Alabama | $2.13 |

| Alaska* | $10.85 |

| Arizona | $10.85 |

| Arkansas | $2.63 |

| California* | $15.50 |

| Colorado | $10.63 |

| Connecticut | $8.23 (Bartenders who customarily receive tips) $6.38 (Employees who work in a hotel or restaurant) |

| D.C. | $5.35 |

| Delaware | $2.23 |

| Florida | $7.98 |

| Georgia | $2.13 |

| Hawaii | $11.00 |

| Idaho | $3.35 |

| Illinois | $7.80 |

| Indiana | $2.13 |

| Iowa | $4.35 |

| Kansas | $2.13 |

| Kentucky | $2.13 |

| Louisiana | $2.13 |

| Maine | $6.90 |

| Maryland | $3.63 |

| Massachusetts | $6.75 |

| Michigan | $3.85 |

| Minnesota* | $10.59 (Businesses with gross revenue of $500,000 or more) $8.63 (Businesses with gross revenue of less than $500,000) |

| Mississippi | $2.13 |

| Missouri | $6.00 |

| Montana* | $9.95 (Businesses with gross annual sales over $110,000) $4.00 (Businesses with gross annual sales of $110,000 or less that are not covered by the FLSA) |

| Nebraska | $2.13 |

| Nevada* | $9.75 until July 1, 2023, when it increases to $10.50 (Employees who do not receive health insurance from employer) $8.75 until July 1, 2023, when it increases to $9.50 (Employees who receive health insurance from employer) |

| New Hampshire | $3.26 |

| New Jersey | $5.27 |

| New Mexico | $3.00 |

| New York | $12.50 (Tipped service employees in New York City, Long Island, and Westchester) $10.00 (Tipped food service workers in New York City, Long Island, and Westchester) $11.85 (Tipped service employees in greater New York state) $9.45 (Tipped food service workers in greater New York state) |

| North Carolina | $2.13 |

| North Dakota | $4.86 |

| Ohio | $4.65 (Employers with annual gross receipts of $305,000 or more) |

| Oklahoma | $2.13 |

| Oregon* | $13.50 (Employers in standard areas) $14.75 (Employers in Portland metro area) $12.50 (Employers in nonurban counties) |

| Pennsylvania | $2.83 |

| Rhode Island | $3.89 |

| South Carolina | $2.13 |

| South Dakota | $5.40 |

| Tennessee | $2.13 |

| Texas | $2.13 |

| Utah | $2.13 |

| Vermont | $6.59 (Hotel, motel, tourism, or restaurant employees who receive more than $120 per month in tips) |

| Virginia | $2.13 |

| Washington* | $1574 |

| West Virginia | $2.62 |

| Wisconsin | $2.33 |

| Wyoming | $2.13 |

Again, check with your state on specific guidelines regarding the tipped minimum wage.

Your employees don’t earn enough tips. Now what?

The point of a tip credit is for employees’ combined minimum cash wage and tips to be more than the regular minimum wage.

If an employee’s tipped minimum wage and tips are not enough to reach the minimum wage, you must make up the difference.

Need an easier way to run payroll for tipped employees, non-tipped employees, or both? With Patriot’s payroll, you can add tips to each employee’s paycheck and withhold taxes with ease. Start your free trial now!

This article has been updated from its original publication date of September 4, 2019.

This is not intended as legal advice; for more information, please click here.