Unless you’re one of the few people who knows exactly what they want to do with their life, choosing your future career can be challenging.

With a high job satisfaction rate and a healthy real estate market, more people are turning to the real estate industry.

Within the industry, it is estimated that Real Estate Investment Trusts (REITs) supported 3.2 million jobs in 2021, according to a study commissioned by the National Association of Real Estate Investment Trusts (Nareit).

The market continues to expand, creating more opportunities for career growth in various property management and development positions.

In this article, I’ll share the best-paying jobs in real estate investment trusts and related information you’ll want to know to make an informed decision about your career.

Table of Contents

- What Are Real Estate Investment Trusts?

- How Many Real Estate Investment Trusts Are There in Total?

- What Is The Job Outlook For People In Real Estate Investment Trusts?

- How Many Jobs Are Available In Real Estate Investment Trusts?

- 12 Best REIT Jobs for 2023

- 1. Chief Executive Officer (Salary: Up to $500,000)

- 3. Chief Operating Officer (Salary: Up the $325,000)

- 4. REIT Analyst (Salary: $75,000-$100,000)

- 5. Finance Manager (Salary: $55,000-$65,000)

- 6. Property Developer (Salary: $80,000-$100,000 )

- 7. Property Manager (Salary: $70,000 – $120,000)

- 8. Investment Analysts (Salary: $100,000 – $130,000)

- 9. Lawyer or Attorney (Salary: $100,000 – $150,000)

- 10. Site Acquisition Specialist (Salary: $130,000 – $160,000)

- 11. Real Estate Acquirer (Salary: $140,000 – $200,000)

- 12. Head of Marketing (Salary: $130,000 – $160,000)

- Benefits of Working for a REIT

- How Much Can You Earn Working For A REIT?

- How Do I Become A Real Estate Investment Trust Professional?

- Final Thoughts on the Best REIT Jobs

What Are Real Estate Investment Trusts?

Real estate investment trusts or REITs are pooled investment funds that own and operate income-generating properties in residential, commercial, and industrial real estate. They allow regular and accredited investors to invest in real estate without the capital requirement and complexity of owning entire properties.

When you purchase a REIT, you are not buying any single property outright – you are investing in a company that owns real estate. These companies hold the properties long-term and generate income through rent or lease payments.

For example: Suppose you want to invest in property in a certain location. You could either buy a property or purchase shares of a REIT that owns property in that market area. The REIT will then manage the property and collect rent or lease payments. They may also develop and improve the property to increase its value.

How Many Real Estate Investment Trusts Are There in Total?

Globally, thousands of REITs exist today. With a collective market capitalization of more than $1.4 trillion, they own an array of property types – from shopping malls to medical office buildings or data centers – in every state.

The Real Estate Investment Trusts industry in the US has seen average annual growth of 0.3% between 2017 and 2022, according to the IBIS World report.

More than 225 real estate investment trusts (REITs) are registered with the Securities and Exchange Commission (SEC) in the United States that trade on a major stock exchange, such as Nasdaq or the New York Stock Exchange. Most of the more than 1,100 REITs that have filed tax returns with the IRS are privately held entities.

What Is The Job Outlook For People In Real Estate Investment Trusts?

The demand for people in real estate investment trusts is high because the real estate industry continually needs more workers, and there are many opportunities for advancement.

The real estate market is expected to grow, with increasing numbers of people investing in REITs and more opportunities available for REIT employees.

The Bureau of Labor Statistics (BLS) estimates that the projected job growth for real estate and rental services will be 5% between 2021 and 2031.

Consequently, the job market for individuals in real estate investment trusts is projected to expand at a rate of 9% to 10% yearly, signifying that more top-level positions will be available in upcoming years.

Moreover, 30% of all REIT jobs require a business degree to start working at a managerial level. Although, you can locate entry-level positions to commence your career without having any prior experience or formal qualifications.

How Many Jobs Are Available In Real Estate Investment Trusts?

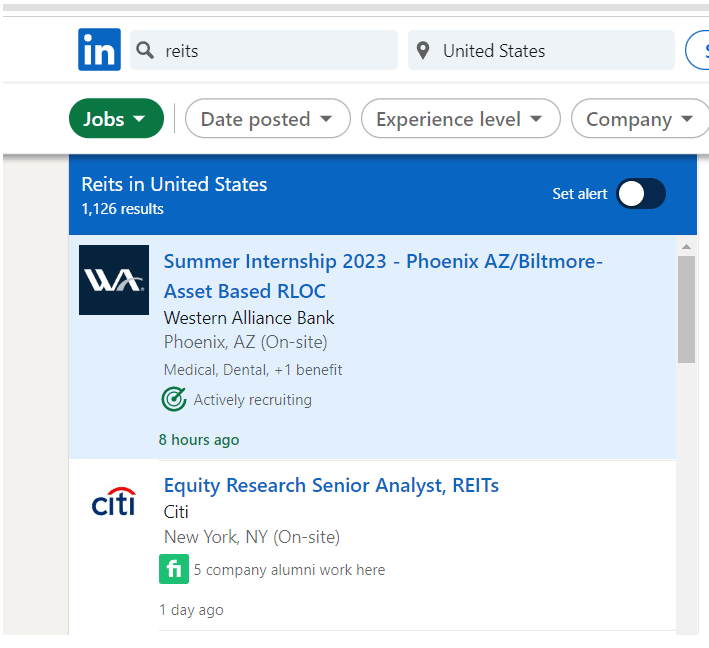

As the real estate market continues to grow and develop, the number of jobs available in REITs also increases. According to a LinkedIn job search, there are currently 1100 jobs in real estate investment trusts available.

This includes a variety of job titles, such as property managers, equity research senior analysts, real estate property appraisers, and Corporate Development managers.

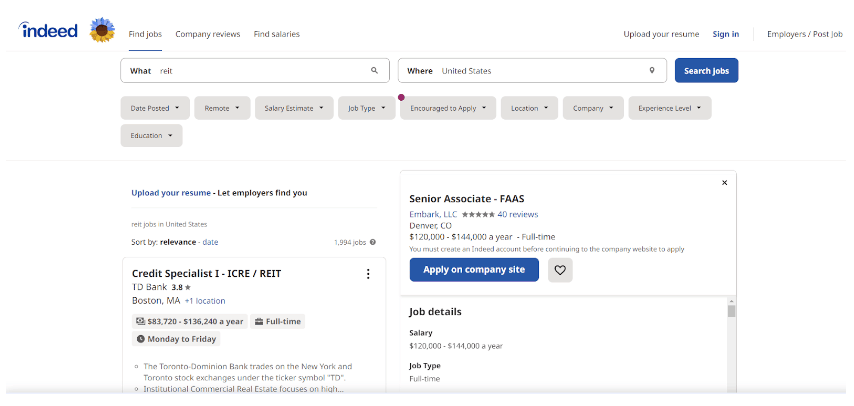

On Indeed, the number of job openings in the US is even higher, with over 1900 jobs advertised.

The real estate sector offers a wide range of job opportunities for individuals looking to enter the field. Whether you are interested in becoming a real estate investor, real estate agent, financial analyst, or corporate manager, REITs provide a comprehensive platform to begin your journey.

12 Best REIT Jobs for 2023

Since the real estate sector is expected to experience growth in the upcoming years, it can be assumed that the REIT job market will become increasingly competitive. Like most fields, the best-paid positions in REITs are managerial and executive.

Whatever your qualifications and experience level, there are still a variety of lucrative jobs available in REITs. Here is a list of the highest-paying jobs in Real Estate Investment Trusts in 2023:

1. Chief Executive Officer (Salary: Up to $500,000)

Typically, the CEO is the company’s highest-paid individual.

But what makes a CEO worth such a hefty paycheck? It’s simple – their decisions have the power to shape the entire direction of the company. As the highest-paid individual in the organization, the CEO is responsible for making strategic choices that will impact not only the company’s performance but also the performance of all of the direct reports.

It’s no easy task, and it’s not given to just anyone. CEOs in the real estate investment trusts industry are typically seasoned professionals with at least 20 years of experience. They have proven themselves, successful leaders, rising through the ranks and taking on various departmental roles.

In short, the position of CEO is one of the most demanding and rewarding jobs in the real estate investment trusts industry. It requires strong leadership skills, extensive industry knowledge, and the ability to make tough decisions. But for those who are up to the challenge, the rewards are well worth it.

2. Chief Finance Officer (Salary: Up the $350,000)

The Chief Finance Officer of a real estate investment trust manages the organization’s financial health and ensures its long-term stability and growth. Their duties include overseeing the budgeting and financial planning process, analyzing financial data to identify trends and areas for improvement, and developing strategies to optimize the company’s financial performance.

Other responsibilities include managing the accounting and finance team and building relationships with key stakeholders such as investors, lenders, and regulatory bodies. They can significantly impact the organization’s success and are well compensated for their expertise.

3. Chief Operating Officer (Salary: Up the $325,000)

The Chief Operating Officer (COO) serves as the organization’s backbone, ensuring the project’s smooth running and success. From managing teams to leading senior operators and fostering junior personnel, the COO holds many responsibilities and must have excellent organizational skills.

By leveraging their expertise in operations and administration, they ensure that everything runs within budget and on time. This makes them a highly sought-after position for those who have established themselves in this field.

One of the most important skills a COO will bring to any organization is thinking strategically and creating long-term strategies for success.

4. REIT Analyst (Salary: $75,000-$100,000)

REIT Analysts play a key role in the success of a REIT. Their salaries range between $75,000 and $100,000. A bachelor’s degree in either finance or real estate is essential to qualify. The REIT Analyst must be able to effectively research, analyze and develop strategies for any new or existing real estate opportunities.

They share the results with the acquisition team, who decide whether the REIT should invest based on the data provided. REIT analysts also consider other market opportunities and evaluate their value.

5. Finance Manager (Salary: $55,000-$65,000)

If you’re looking for a high-paying, stable REIT career, consider becoming a Finance Manager. Armed with a finance degree, the Finance Manager ensures that REIT investments are well managed and projects are reported on accurately.

They forecast, create budgets, and ensure that developers aren’t overspending or stretching resources too thin. Finance Managers report directly to the Chief Financial Officer and are involved with some of the most critical projects within REITs. They are an integral part of any successful REIT team.

6. Property Developer (Salary: $80,000-$100,000 )

Property Developers are the shining stars of the REIT scene. With salaries ranging from $80,000 to $100,000, they have one of the most sought-after roles in the industry.

You may need an MBA to qualify for this role, as they must monitor complex projects from initiation through completion. This includes hiring and firing contractors, staying on budget, and ensuring that development runs smoothly. If you have previous experience, it will prove valuable.

7. Property Manager (Salary: $70,000 – $120,000)

Working as a REIT Property Manager can be financially and professionally rewarding. Though no formal qualifications are needed, having a bachelor’s degree is heavily recommended, and previous experience in the field can give you an advantage.

Depending on the type of REIT, your role as a Property Manager may involve overseeing rentals or managing multiple locations with potential for rentals.

With salaries ranging from $70,000-$120,000 depending on managerial experience and workload, this career path has great potential for financial rewards and professional advancement.

8. Investment Analysts (Salary: $100,000 – $130,000)

Investment Analysts are crucial to a REITs success. They are also among the highest paid professionals in the industry. To be an Investment Analyst, you should possess a bachelor’s degree in business, investment management, or finance.

Investment Analysts work closely with the REIT’s finance and acquisitions teams. The data and research for any new project must pass their review to determine if it is actionable. Analysts can also offer additional insight into potential investments.

9. Lawyer or Attorney (Salary: $100,000 – $150,000)

Becoming a lawyer is another option if you’re considering a career in real estate investment trusts. This is because lawyers can channel their expertise into legal proceedings, such as loan contracts, real estate documents, and other legal matters.

A real estate lawyer will take care of all the legal paperwork related to buying and running property on behalf of their employer and even represent them should any difficulties arise. So if you’re looking to grow your earnings with a lucrative job in this sector next year, pursuing a career as a lawyer is worth considering.

10. Site Acquisition Specialist (Salary: $130,000 – $160,000)

If you’re looking for a high-paying career in the REIT field, consider becoming a Site Acquisition Specialist. They handle the ins and outs of purchasing property, including the legal and contractual obligations. The role requires an in-depth knowledge of entitlements, building codes, and leasing.

11. Real Estate Acquirer (Salary: $140,000 – $200,000)

Real estate acquirers ensure that a REIT doesn’t overpay for precious land or property. They must remain calm and collected and have excellent negotiating skills.

You may need a bachelor’s degree in finance, but don’t let that stop you. Being an acquirer can be incredibly rewarding, with potential salaries ranging from $140,000 to $200,000. But it’s a demanding role, requiring technical knowledge and interpersonal skills for negotiations and data assessment.

12. Head of Marketing (Salary: $130,000 – $160,000)

In the competitive real estate market of 2023, a Marketing Head role in a REIT (Real Estate Investment Trust) is one of the most attractive positions for those with a bachelor’s degree in marketing, public relations, or related fields.

With Salaries ranging from $130,000 – $160,000, the Marketing Head is critical to attracting investors and tenants to new commercial properties.

Marketing Heads need to be creative and savvy when developing campaigns targeting businesses and consumers.

Benefits of Working for a REIT

Working for a Real Estate Investment Trust (REIT) can be a great way to gain experience in the real estate industry. Here are some of the advantages of working for a REIT:

Flexibility

Many REIT businesses offer flexible work schedules and allow employees to arrange their hours according to their personal needs and preferences, something that’s hard to find in many other industries.

Career Advancement

With REITs, you can work your way up quickly as you gain experience and knowledge in the industry. There will be many opportunities for promotion or lateral movement into other business areas.

Financial Opportunities

You can earn a high salary working for a REIT and be eligible for generous bonuses or stock options as you progress.

Diversity of Businesses

REITs support diverse businesses catering to different industries. You could find yourself doing anything from managing retail stores to investing large amounts of money in real estate portfolios – each day is unique and comes with its own set of challenges.

Stability & Security

One significant advantage of working at a REIT is job security; unlike many other industries, the real estate sector doesn’t fluctuate wildly, and jobs are stable.

How Much Can You Earn Working For A REIT?

Working for a REIT (Real Estate Investment Trust) can be a rewarding career choice. While I’ve covered the highest-paying REIT jobs in this article, $75,000 is the average base salary for the industry. That’s significantly higher than median salaries in other industries. Smaller companies with lower profit margins tend to offer the lowest-paid jobs, while larger organizations with more complex job tasks typically pay more.

How Do I Become A Real Estate Investment Trust Professional?

Here’s a quick guide to getting started as a Real Estate Investment Trust professional:

Step 1: Get Educated on the Topic: Take courses and programs to learn what you need to know about real estate investing.

Step 2: Build Your Network: Connect with professionals in the industry and find mentors who can help guide you.

Step 3: Research Companies: Do the research and find the right company.

Step 4: Prepare for Success: Make sure you’re ready for the challenge of working in REITs by preparing yourself for success. For example, preparing commercial real estate property analysis and learning how to structure commercial real estate deals.

Final Thoughts on the Best REIT Jobs

As you can see, a career in the REIT industry can be very rewarding. The positions I’ve highlighted are some of the best-paying jobs available and offer stability and growth potential, but they also require specialized skills and plenty of experience. If a career in real estate doesn’t interest you, there are other ways to make money as an investor. For more information, here’s an article that shows you how to invest in real estate.

Cited Research Articles

1. Nareit. (n.d.) Economic contribution of REITs in the United States. Retrieved from https://www.reit.com/data-research/research/sponsored-research/economic-contribution-reits-united-states

2. IBISWorld. (2022, September 23). Real Estate Investment Trusts in the US. Retrieved from https://www.ibisworld.com/industry-statistics/market-size/real-estate-investment-trusts-united-states/

3. Nasdaq. (n.d.) Retrieved from https://www.nasdaq.com/.

4. New York Stock Exchange (NYSE). (n.d.). Retrieved from https://www.nyse.com/index

5. US Bureau of Labor Statistics. (n.d.) Occupational Outlook Handbook. Retrieved from https://www.bls.gov/ooh/sales/real-estate-brokers-and-sales-agents.htm

6. LinkedIn. (n.d.) Job Search. Retrieved from https://www.linkedin.com/jobs/s/?currentJobId=3421710019

7. Payscale.com. (n.d.) Salary for Industry: Real Estate Investment Trust. Retrieved from https://www.payscale.com/research/US/Industry=Real_Estate_Investment_Trust_(REIT)/Salary