(And by implication, frowns on celebrity endorsements)

Happy New Year! I wish everyone a prosperous 2023. It is that time of year again when investment companies, analysts, and pundits create outlooks for the coming year. The quote attributed to Dwight D. Eisenhower that “Plans are useless, but planning is indispensable,” is applicable as there are risks to the outlook, which is the first section in this article. The second section is my outlook and strategy for 2023. The final section is the outlook from the Federal Reserve, The Conference Board, and Vanguard. Links to other outlooks are included in the Appendix.

Thanks to the notice by David Snowball, I have become a premium subscriber to The Independent Vanguard Adviser. I use the Bucket Approach with several portfolios managed by financial advisors. I also follow a personalized Vanguard approach which is a low-cost Do-It-Yourself approach compared to higher-cost management services. “Keep it Simple.“

Risks to outlooks

Most of the outlooks that I reviewed include a mild to moderate recession with short-term bonds doing well as the Federal Reserve raises the Federal Funds rate in the first quarter, with longer duration high-quality bonds performing well as interest rates plateau in the second quarter, and equities doing well in the second half of the year as the economy starts to recover from the recession. This is my base case, but what could go wrong?

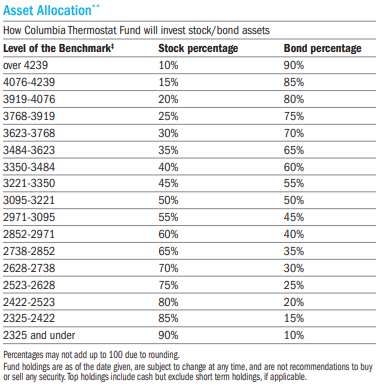

The following figure shows real (inflation-adjusted 2020 Q1=100) Corporate Profits After Taxes (blue line) are trending lower. Real Personal Income (red line) is not keeping up with inflation. Real Personal Savings (green line) has declined below the pre-pandemic level as consumers dip into savings and inflation takes a bite. Credit card delinquency (purple line) is on the rise. Risks created by the bursting of the credit bubble will not be fully realized until the recession is underway.

Figure #1: Economic Indicators

Source: Created by the Author Using the St. Louis Federal Reserve FRED Database

Lance Roberts with Real Investment Advice believes that “disinflation risk is Wall Street’s blind spot.” His reasoning is that there will be a long lag in growth as the pandemic-era stimulus is depleted. He shows that the median 2023 Target for the S&P 500 on Wall Street is 4,000, with a range of 3,675 to 4,500. Mr. Roberts shows a range of possible outcomes based on earnings and valuations, most of which fall well below the median Wall Street estimate. In “Valuation Math Suggests Difficult Markets in 2023” at Seeking Alpha, Mr. Roberts estimates that without a recession, the S&P500 may fall 12.5% below current levels, while in a “mild recession,” the S&P500 may fall 22.5%. In the case of a severe recession, the S&P500 could fall another 40% from current levels.

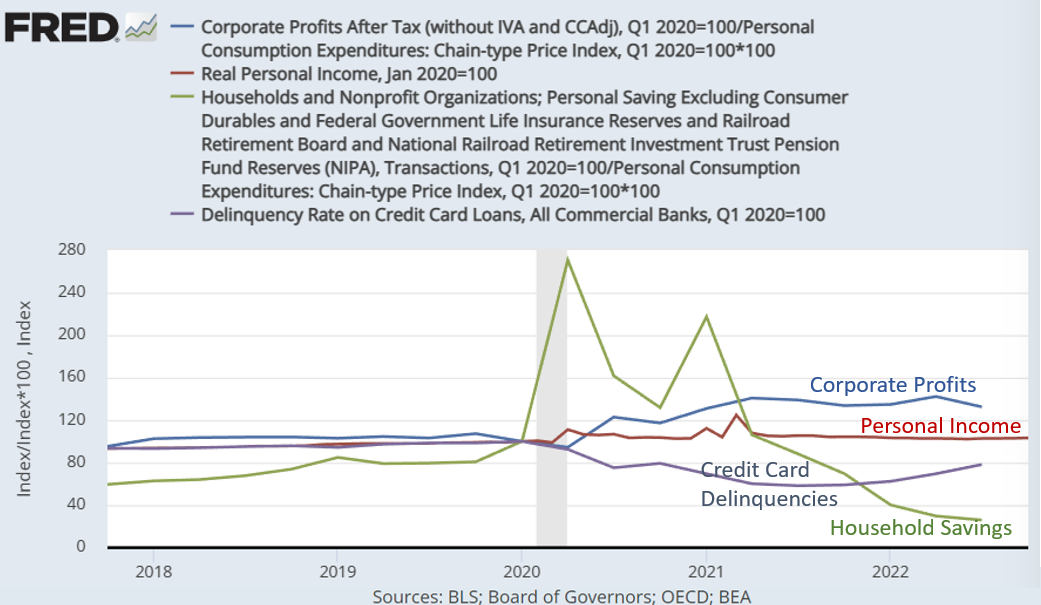

To put this into perspective, the following figure compares the current bear market to the bursting of the Technology Bubble. The 2001 recession was “predicted” seven months in advance by Mr. Market, which continued to fall for sixteen months after the recession ended as valuations normalized. Bear markets can be more severe than the associated recession.

Figure #2: Comparison of 2000 and 2021 Bear Markets

Source: Created by the Author Using the St. Louis Federal Reserve FRED Database

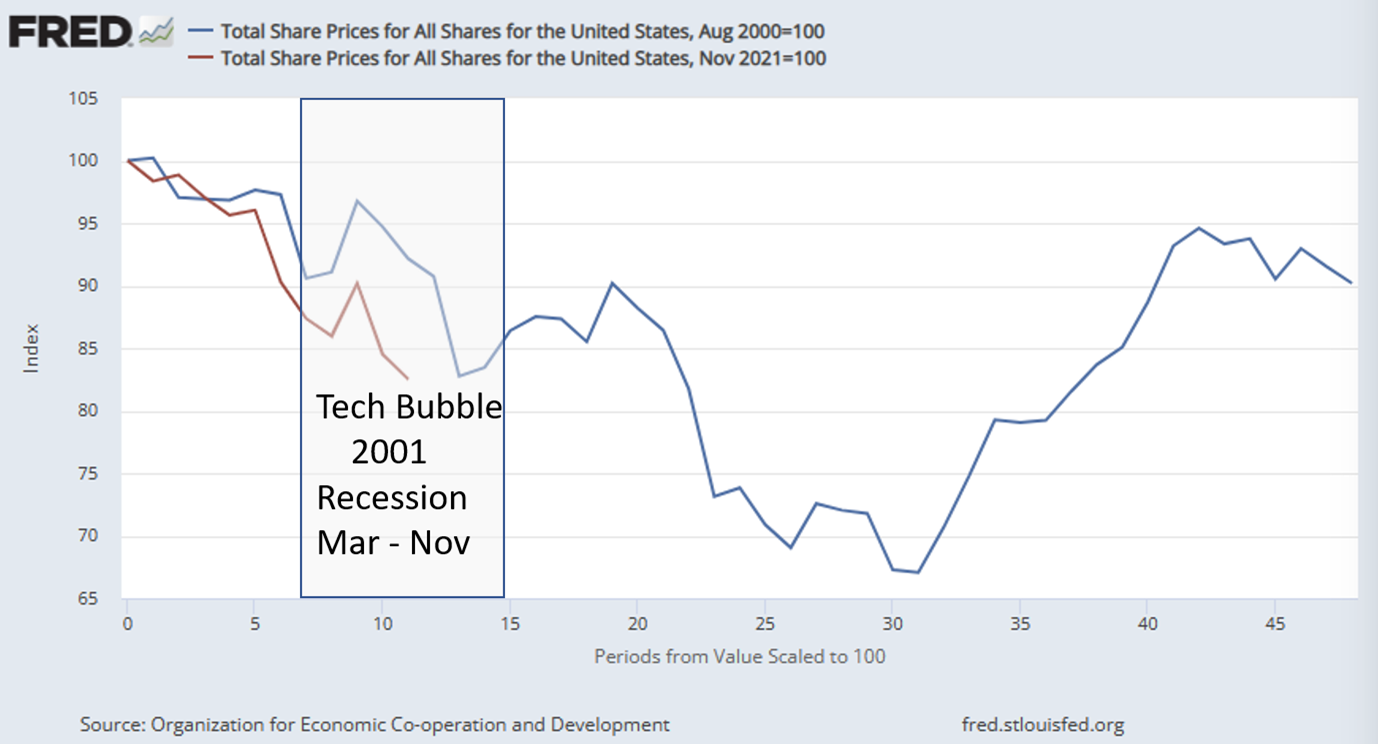

Starting valuations are one of the determining factors of the severity of the bear market. Below is my composite of six valuation techniques where minus one is very unfavorable and positive one is very favorable. The bear market of 2022 brought equity valuations down, but they are still elevated for the current landscape. Valuations at the start of 2023 are no bargain.

Figure #3: Author’s Valuation Indicator

Source: Created by the Author

Doug Noland provides a detailed and comprehensive summary of immediate market conditions and risks in his Weekly Commentary on Seeking Alpha. In this Commentary, Mr. Noland covers global risks, including inflation, monetary tightening, hawkish shift by the Bank of Japan, cryptocurrency collapse, Russian war on Ukraine, deglobalization, military buildups, and Covid. He describes domestic risks, including high private debt levels, rising borrowing costs, earnings shocks, labor strikes, layoffs, lower bonuses, falling residential sales, and high outflows from equity and higher-risk credit.

To get a sense of what can go very wrong, read Megathreats by Nouriel Roubini, who describes ten interconnected threats: Debt Crises; Public and Private Failures; Demographic Time Bomb, Credit Boom-Bust Cycle; Stagflation; Currency Meltdowns and Financial Instability; New Cold War and the end of Globalization; Artificial Intelligence Technology Revolution; and Climate Change. He is well known for predicting the severity of the 2007 housing crisis and the ensuing financial crisis. Mr. Roubini is a professor at New York University’s Stern School of Business and served from 1998 to 2000 in the White House and in the US Treasury.

Prudent Investors should “maintain a margin of safety” and “beware of false prophets.”

My outlook and strategy for 2023

My starting 2023 outlook and strategy are as follows:

- The Federal Funds rate will rise close to 5% by the end of the first quarter of 2023. I plan to match Treasuries with anticipated spending and withdrawal needs for the next several years. Two advantages of owning Treasuries directly are that they are low risk and not callable when rates fall.

- The 10-year Treasury will rise toward 4% but will end 2023 near 3.5% as bond investors anticipate rates to fall. I plan on increasing duration with Total Bond Funds, Investment Grade funds, and inflation-protected bond funds during the second and third quarters.

- As short-term Treasuries and CDs mature, I expect to increase my allocation to equities in the second half of the year with a tilt toward value and internationally developed equities.

- I tentatively plan a Roth Conversion and combining a small, conservative savings plan with a more aggressive Roth IRA in the second or third quarter of 2023 with the effect of increasing allocations to equities.

- I expect to end 2023 overweight in bonds because of locking in higher yields and expected lower long-term returns in equities. Deferring Social Security until age seventy results in my allocations to equity increasing over time as savings are used to cover some expenses.

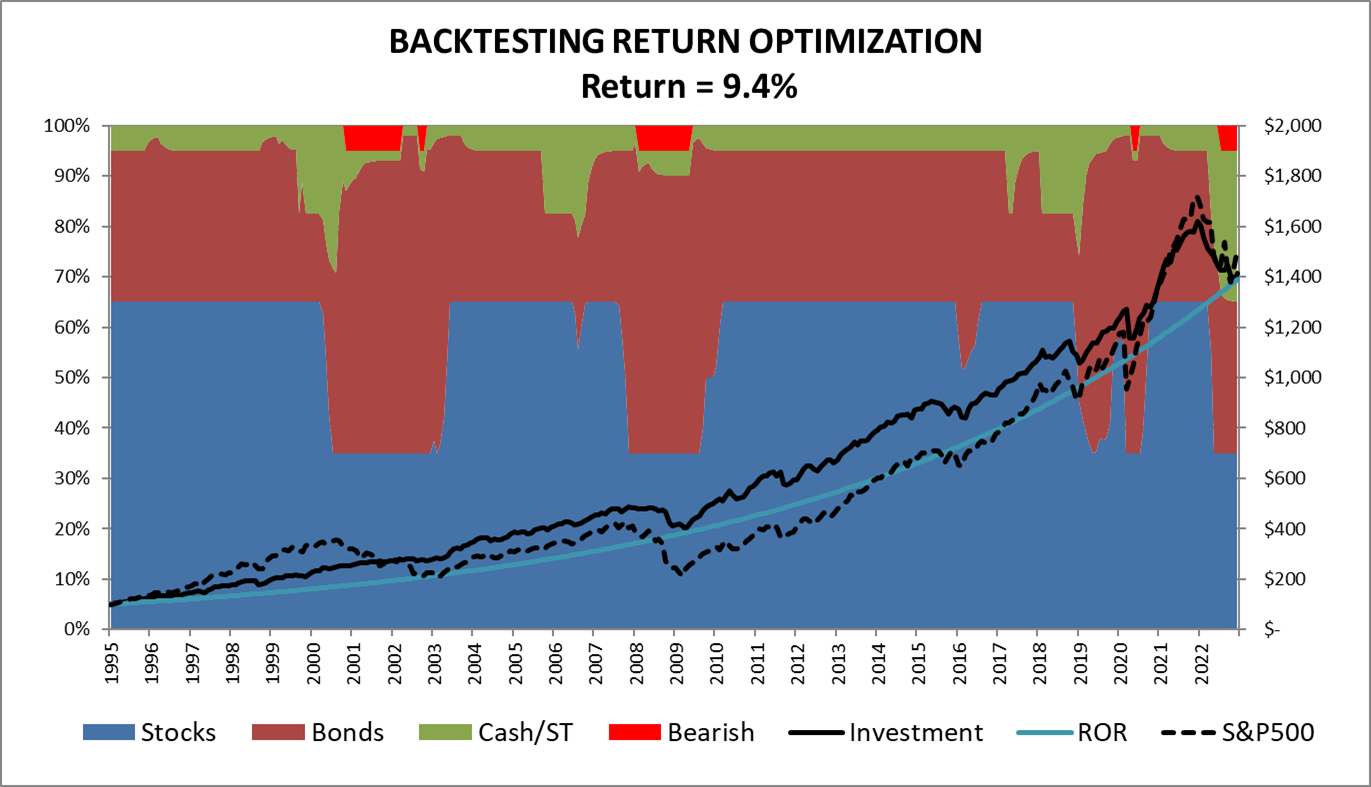

I updated my Investment Model below with a few new indicators and techniques. My target allocation to risk assets (blue-shaded area) ranges between 35% and 65% and is currently 35% because of slowing growth, risks, and higher bond yields. Allocations to cash and short-term fixed income are at the maximum of 35% (green-shaded area) because interest rates have been rising and bond values falling. My approach has been influenced by or reflects the philosophies of The Intelligent Investor by Benjamin Graham; Mastering the Market Cycle by Mark Howards; Nowcasting The Business Cycle by James Picerno, Conquering the Divide by James B. Cornehlsen and Michael J. Carr, and Vanguard’s Time-Varying Asset Allocation Model [TVAA], among others.

Figure #4: Author’s Investment Model Allocation

Source: Created by the Author

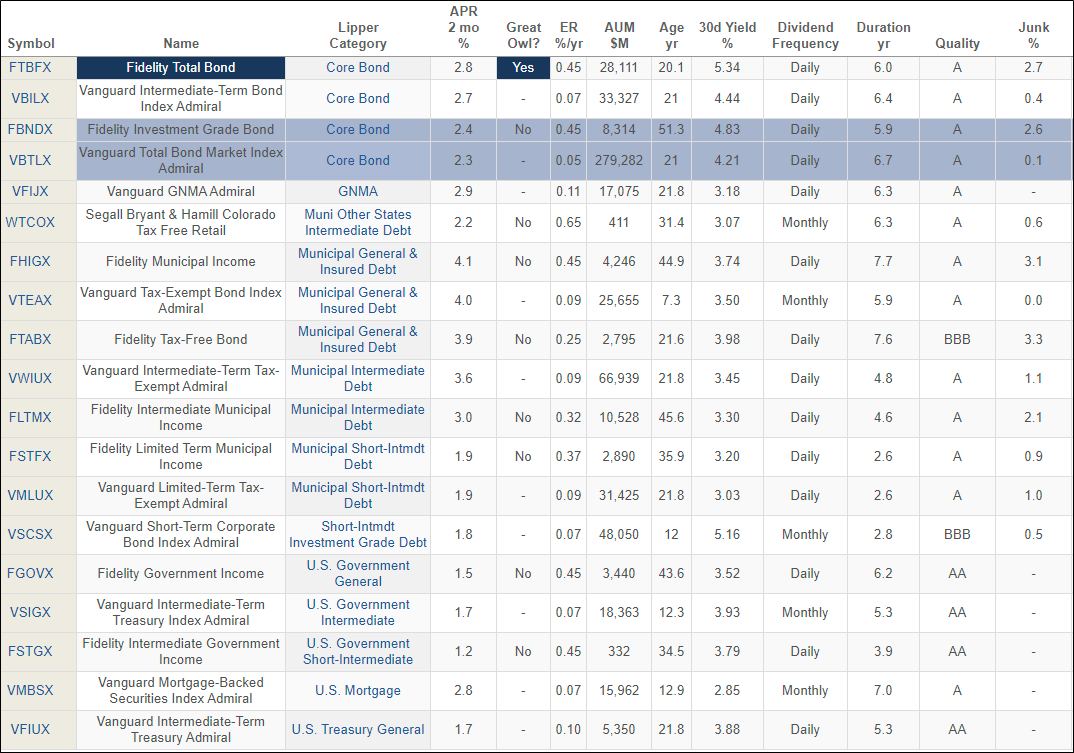

The following table contains my short list of mostly Fidelity and Vanguard intermediate bond funds that have low investments in junk-rated bonds (high yield). Yields are attractive. I have invested small amounts into Fidelity Investment Grade Bonds (FBNDX) and Vanguard Total Bond Market (VBTLX) and anticipate increasing allocations during the second quarter of 2023, as well to municipal bond funds for the tax benefits.

Table #1: Author’s Select List of Bond Funds for 2023

Source: Created by the Author Using Mutual Fund Observer MultiSearch

I favor actively managed global mixed asset funds, which have a tilt toward foreign-developed economies where valuations are lower. I like the more conservative Vanguard Global Wellesley Income Fund (VGYAX) starting in 2023 and increasing allocations to the more moderate Vanguard Global Wellington Fund (VGWLX) as the recession progresses.

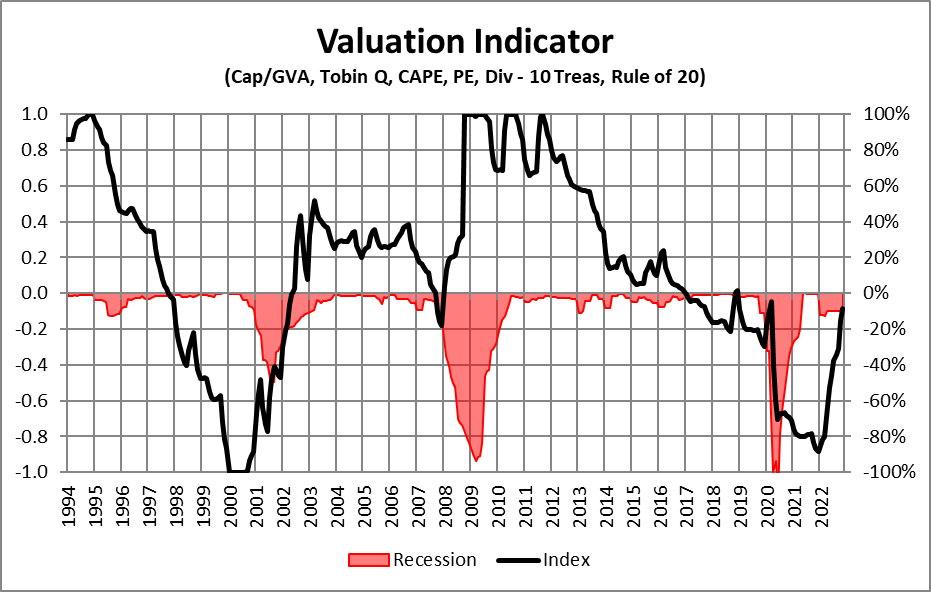

I maintain allocations to the Columbia Thermostat Fund (Morningstar links: CTFAX / COTZX). As of November, it had an allocation to stocks of about 20%. Its current strategy to allocate between stocks and bonds is shown in the following table. If the S&P500 ends 2023 between 3,500 and 4,000, the fund will have between 20% and 35% allocated to stocks. In the event of a severe bear market, Threadneedle may allocate more than 75% to equities.

Table #2: Columbia Thermostat Allocation Schedule

Selected investment community outlooks

Federal Reserve:

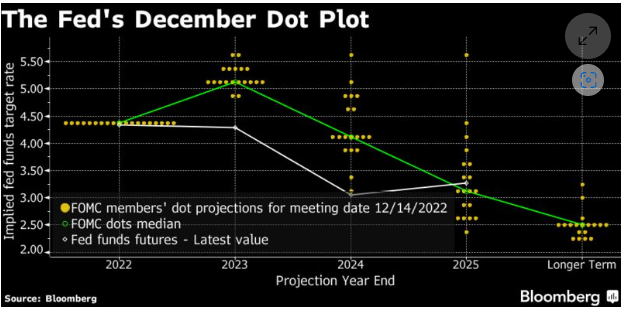

From Chris Anstey, “Still Hawkish, Still Battling Markets: New Economic Daily” at Bloomberg, the following chart shows the Federal Reserve’s December Dot Plot Median (green line) where the Federal Funds rate rises over 5% next year and falling to 4% in 2024 which is still higher than the market anticipates (gray line). Bond market investors underestimate the Fed’s resolve to contain inflation. Since the Fed’s announcement on December 14th, long-term interest rates have risen. I expect this trend to continue as the Fed raises the Fed Funds rate. I currently favor the middle of the yield curve.

Figure #5: The Fed’s December Dot Plot

Source: Chris Anstey, “Still Hawkish, Still Battling Markets: New Economic Daily,” Bloomberg, December 15, 2022

The Conference Board:

- We expect the US economy to go into recession as we enter 2023…

- We expect inflation to remain above pre-pandemic trends for several years, if not longer…

- We do not expect interest rates to fall until 2024 or later…

- Following our expectation of near-zero growth in 2023, we expect US real GDP growth to recover in 2024. However, over the next decade, growth will be somewhat muted relative to pre-pandemic trends.

- Disruptions brought about by the pandemic will have lasting effects on the drivers of US growth ahead, and there will be smaller contributions from labor, reflecting an aging demographic…

(Research Report, “Navigating the Economic Storm,” The Conference Board, November 22, 2022)

Vanguard:

Vanguard expects GDP growth of around o.25% over the course of 2023, inflation won’t reach 2% until 2024 or 2025, the Federal Funds rate to rise to 4.5% and remain there for the next twelve months before falling, and the 10-year yield to peak around recent highs of 4% to 4.3%. They suggest a tilt toward fixed income, value over growth, and Global ex-US equities. Vanguard advocates a balanced approach to investing, and one uses a time-varying asset allocation [TVAA] model described below.

TVAA methodology is appropriate for investors who are willing to take on active risk in the form of “model forecast risk.” For investors whose objectives and risk tolerances make it prudent to consider adjusting their asset allocations when market conditions materially change, the VAAM [Vanguard Asset Allocation Model], combined with time-varying VCMM [Vanguard Capital Markets Model] asset returns, provides a consistent and holistic way to analyze the trade-offs in time-varying portfolio solutions.

…In short, the TVAA [time-varying asset allocation] portfolio is inclined toward reducing equity risk because of the compressed equity risk premium and reallocating it toward fixed income with a credit tilt.

(Vanguard Research, “Vanguard Economic and Market Outlook For 2023: Beating Back Inflation”, Vanguard)

Closing

Caution is warranted for Prudent Investors entering 2023. My expectation is for a moderate recession, but I have a more pessimistic view of the stock market. “Hope for the best, but prepare for the worst.” It is worth remembering the adage, “Don’t fight the Fed!” My approach is to have Treasury and CD ladders mature regularly and to make small decisions as the year progresses, and “never catch a falling knife!”

Best Wishes for a prosperous 2023.

Appendix: Investment community outlooks

Allianz Global Investors: “2023 Outlook: Ready for Reset”, Allianz Global Investors, November 16, 2022.

Bank of America: “BofA Global Research Offers Economic and Market Outlook for 2023, Calling for Markets to Turn “Risk-On” Mid-Year,” Cision PR Newswire, December 12, 2022.

Blackrock: BlackRock Investment Institute, “2023 Global Outlook”, BlackRock

Charles Schwab: Schwab Center for Financial Research, “2023 Market Outlook: Cross Currents”, Charles Schwab, December 12, 2022.

Columbia Threadneedle Investments: William Davies, “2023 Chief Investment Officer Outlook”, Seeking Alpha, December 21, 2022.

Goldman Sachs: Economic Research, “2023 US Economic Outlook: Approaching a Soft Landing”, Goldman Sachs, November 18, 2022.

Morgan Stanley: Morgan Stanley Research, “2023 Global Investment Outlook: A Year for Yield”, Morgan Stanley, November 22, 2022.

Morningstar: Dave Sekera (CFA), “Where to Invest in Bonds in 2023”, Morningstar, December 14, 2022.

Nuveen: Global Investment Committee, “2023 GIC Outlook: Peaks and Valleys”, Nuveen, December 7, 2022.