You might have heard of the Golden Rule in life: Treat others as you want to be treated. But, did you know that there’s also a golden rule for accounting? In fact, there are three golden rules of accounting. And no … one of them is not treating your accounts the way you want to be treated.

If you want to keep your books up-to-date and accurate, follow the three basic rules of accounting.

3 Golden rules of accounting

The world of accounting is run by credits and debits. Debits and credits make a book’s world go ‘round.

Before we dive into the golden principles of accounting, you need to brush up on all things debit and credit.

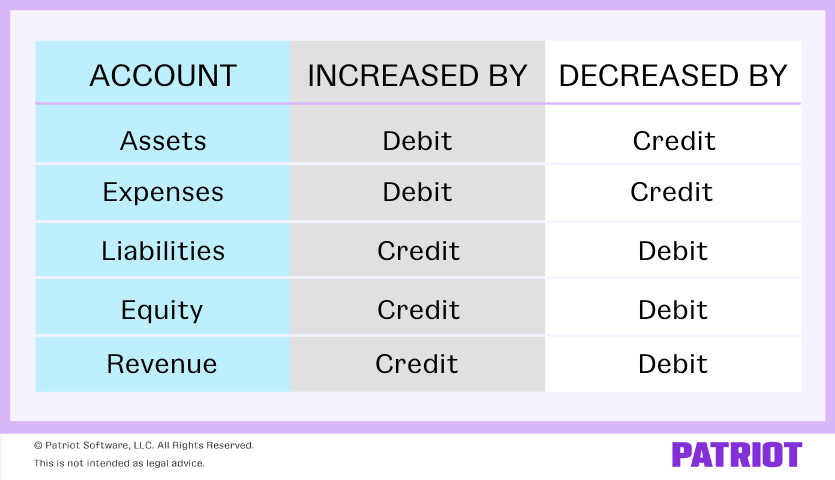

Debits and credits are equal but opposite entries in your accounting books. Credits and debits affect the five core types of accounts:

- Assets: Resources owned by a business that have economic value you can convert into cash (e.g., land, equipment, cash, vehicles)

- Expenses: Costs that occur during business operations (e.g., wages, supplies)

- Liabilities: Amounts owed to another person or business (e.g., accounts payable)

- Equity: Your assets minus your liabilities

- Income and revenue: Cash earned from sales

A debit is an entry made on the left side of an account. Debits increase an asset or expense account and decrease equity, liability, or revenue accounts.

A credit is an entry made on the right side of an account. Credits increase equity, liability, and revenue accounts and decrease asset and expense accounts.

You must record credits and debits for each transaction.

The golden rules of accounting also revolve around debits and credits. Take a look at the three main rules of accounting:

- Debit the receiver and credit the giver

- Debit what comes in and credit what goes out

- Debit expenses and losses, credit income and gains

1. Debit the receiver and credit the giver

The rule of debiting the receiver and crediting the giver comes into play with personal accounts. A personal account is a general ledger account pertaining to individuals or organizations.

If you receive something, debit the account. If you give something, credit the account.

Check out a couple of examples of this first golden rule below.

Example 1

Say you purchase $1,000 worth of goods from Company ABC. In your books, you need to debit your Purchase account and credit Company ABC. Because the giver, Company ABC, is providing goods, you need to credit Company ABC. Then, you need to debit the receiver, your Purchase account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Purchase | 1,000 | |

| Accounts Payable | 1,000 |

Example 2

Say you paid $500 cash to Company ABC for office supplies. You need to debit the receiver and credit your (the giver’s) Cash account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Supplies | 500 | |

| Cash | 500 |

2. Debit what comes in and credit what goes out

For real accounts, use the second golden rule. Real accounts are also referred to as permanent accounts. Real accounts don’t close at year-end. Instead, their balances are carried over to the next accounting period.

A real account can be an asset account, a liability account, or an equity account. Real accounts also include contra assets, liability, and equity accounts.

With a real account, when something comes into your business (e.g., an asset), debit the account. Credit the account when something goes out of your business.

Example

Let’s say you purchased furniture for $2,500 in cash. Debit your Furniture account (what comes in) and credit your Cash account (what goes out).

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Furniture | 2,500 | |

| Cash | 2,500 |

3. Debit expenses and losses, credit income and gains

The final golden rule of accounting deals with nominal accounts. A nominal account is an account that you close at the end of each accounting period. Nominal accounts are also called temporary accounts. Temporary or nominal accounts include revenue, expense, and gain and loss accounts.

With nominal accounts, debit the account if your business has an expense or loss. Credit the account if your business needs to record income or gain.

Example: Expense or loss

Say you purchase $3,000 of goods from Company XYZ. To record the transaction, you must debit the expense ($3,000 purchase) and credit the income.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Purchase | 3,000 | |

| Cash | 3,000 |

Example: Income or gain

Say you sell $1,700 worth of goods to Company XYZ. You must credit the income in your Sales account and debit the expense.

| Date | Account | Debit | Credit |

| XX/XX/XXXX | Cash | 1,700 | |

| Sales | 1,700 |

On the hunt for a simple way to track your account balances? Patriot’s accounting software has you covered. Easily record income and expenses and get back to your business. Try it for free today!

This article has been updated from its original publication date of March 10, 2020.

This is not intended as legal advice; for more information, please click here.