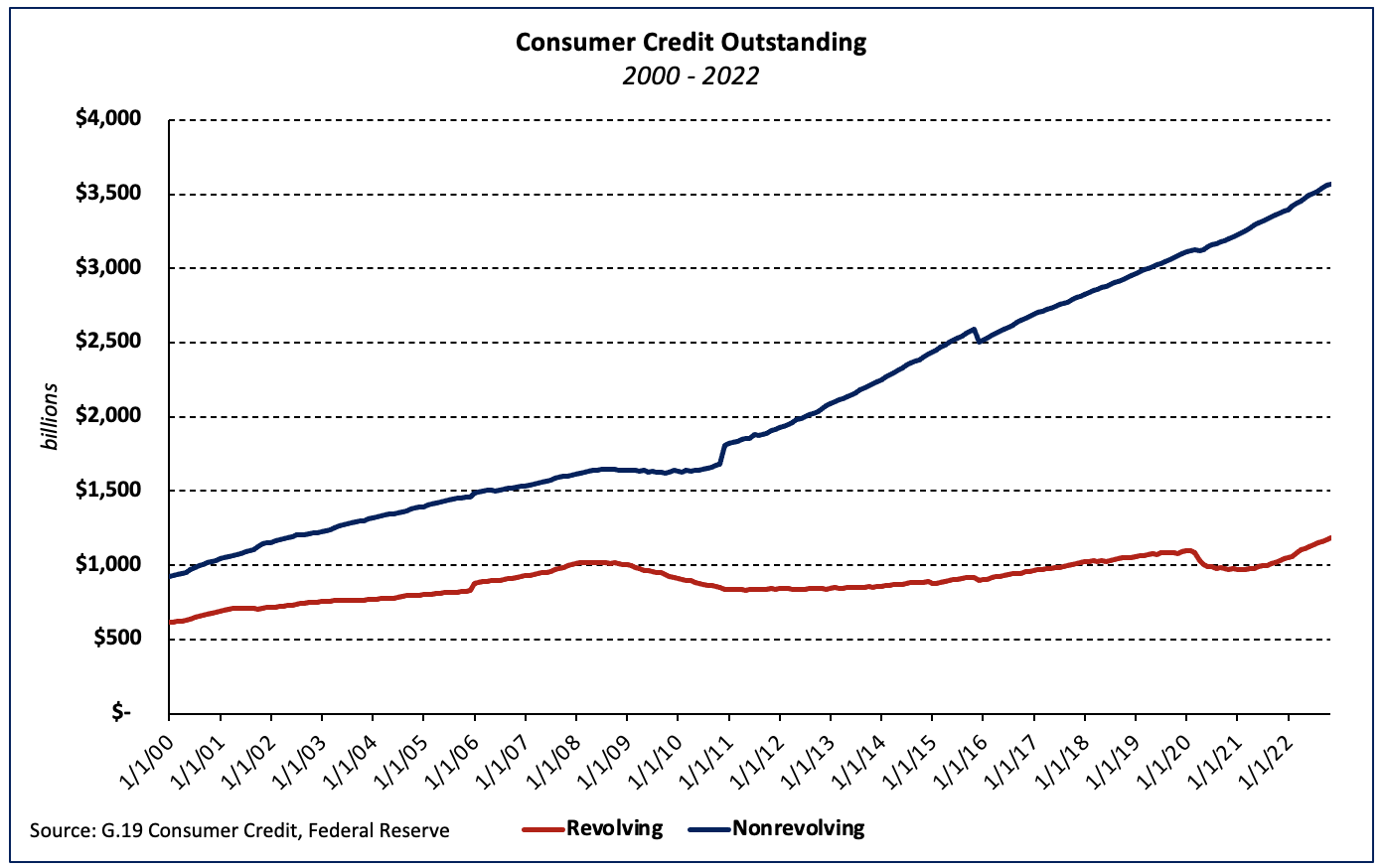

The balance of consumer credit outstanding grew 7.1% in November 2022 (seasonal adjusted annual rate) after climbing 7.4% (SAAR) in October according to the Federal Reserve’s latest G.19 Consumer Credit report. Revolving debt—which consists primarily of credit card debt—increased at a 16.9% rate, more than four times the growth of nonrevolving debt (excluding real estate) which grew 3.9% (SAAR).

Credit card interest rates climbed 1.97 percentage points—or 197 basis points—to 20.4% between August and November 2022, following a 178 basis point increase between May and August (credit card terms are only released in February, May, August, and November).

Prior to August 2022, the largest three-month increase in the series—which dates back to 1994—was a 98 basis point increase in May 1995.

Total consumer credit currently stands at $4.76 trillion, an increase of $28 billion over the month and $349 billion, year-over-year. Nonevolving credit outstanding increased $11.5 billion while the level of revolving debt rose $16.5 billion over the month.

Revolving and nonrevolving debt accounted for 25.0% and 75.0% of total consumer debt, respectively. Between November 2021 and November 2022, revolving consumer credit outstanding as a share of the total increased 1.6 percentage points after reaching its most recent low of 22.9% in May 2021.

Related