Fresh episode of BAD TAKES now available on the Matt Schlapp scandal and the limits of #MeToo.

It’s debt ceiling time again.

After over a decade of writing about this, I’m bored of almost every aspect of this debate, but I did recently learn something new: there is a means through which the Treasury Department might be able to evade a catastrophic collapse of the financial system that sounds a little less silly than the platinum coin thing.

Instead of selling a $100 bond that has a low interest rate for $100 dollars, they can offer a $100 bond that has a high interest rate and see how much money people will give them for it. People would pay more than $100 for that bond, and therefore the Treasury could raise more than $100 while only issuing $100 worth of debt. It’s kind of stupid, but it’s less goofy than a platinum coin. And it is also stupid in a manner that is perfectly suitable to the underlying stupidity of the statutory debt ceiling, which purports to limit the face value of debt that the Treasury can issue separate from all the legislation that specifies how much money the Treasury has to spend.

And we really do need to do something here because this is what the new Speaker of the House was saying in October before he gave away the store to the most maniacal members of his caucus:

“You can’t just continue down the path to keep spending and adding to the debt,” McCarthy said. “And if people want to make a debt ceiling [for a longer period of time], just like anything else, there comes a point in time where, okay, we’ll provide you more money, but you got to change your current behavior. We’re not just going to keep lifting your credit card limit, right? And we should seriously sit together and [figure out] where can we eliminate some waste? Where can we make the economy grow stronger?”

This is pure, uncut nonsense. Congress controls federal spending through the Social Security Act and through annual appropriations. Congress controls federal revenue through the tax code. Debt is just the differential between what Congress has required. Saying “you have to spend X, Y, and Z” but also “sorry you can’t borrow the money” is closer to refusing to pay your credit card bill than to anything else. But also, there is no need to phrase this in terms of an analogy. The law requires the spending that it requires, and there is a legislative process for trying to change the spending laws.

McCarthy is, in fact, entirely aware of how the budget process works, and has even promised his members that he will push for a far-right budget.

That obviously won’t happen this year because Democrats control the Senate and the White House. But if Republicans want to implement their vision of balancing the budget by defunding the tax police and slashing Social Security, Medicare, and Medicaid, the way to do it is to lay out a plan like this and then win some more elections.

Instead, after declining to do a debt ceiling deal during the lame duck, we are now waiting for a crisis to arrive in the fall, with the right wing of the caucus promising to use their procedural powers to block McCarthy from being more reasonable.

Under the circumstances, it would be really good to defuse this whole dumb thing.

If you follow economic news at all, you’ve probably seen references to bond yields. Sometimes the writer explicitly invokes the phrase, other times the reference is implicit. And, if you’re anything like I was when I was early in my career, you just scan those sentences and figure you broadly get the point, even if you don’t totally understand what a “bond yield” is. Sentences like this:

-

“The yield on the 10-year Treasury bond fell over 15 basis points

on January 4” [explicit]

-

“The interest rate on the 10-year Treasury bond fell over 15 basis points on January 4” [implicit]

So what’s going on here? Well, when the Treasury Department first sells a bond, they say something like “We want to borrow $100 for 10 years — who wants to give us money?” There’s then an auction in which people can bid the interest rate they would like the government to pay them in exchange for their 10-year, $100 bond. The lowest bid wins, and that becomes the interest rate on the bond. So far so good. But then these bonds trade in secondary markets — you could buy some bonds in your Robin Hood app, for example — but because the interest rate is fixed in the initial auction, it can’t go up or down in response to future market conditions. Instead, the market price of the bond itself (which was $100 by definition in the initial auction) goes up or down. So say the bond originally paid 3.79% interest, but later there’s a ton of demand for it. People might be willing to pay $105 for that $100 bond with the 3.79% coupon.

But because it’s annoying to talk about the price of bonds fluctuating, instead we often take the price of the market bond ($105) and its interest rate (3.79% on $100) and use those numbers to calculate a yield, which in this case is 3.6%:

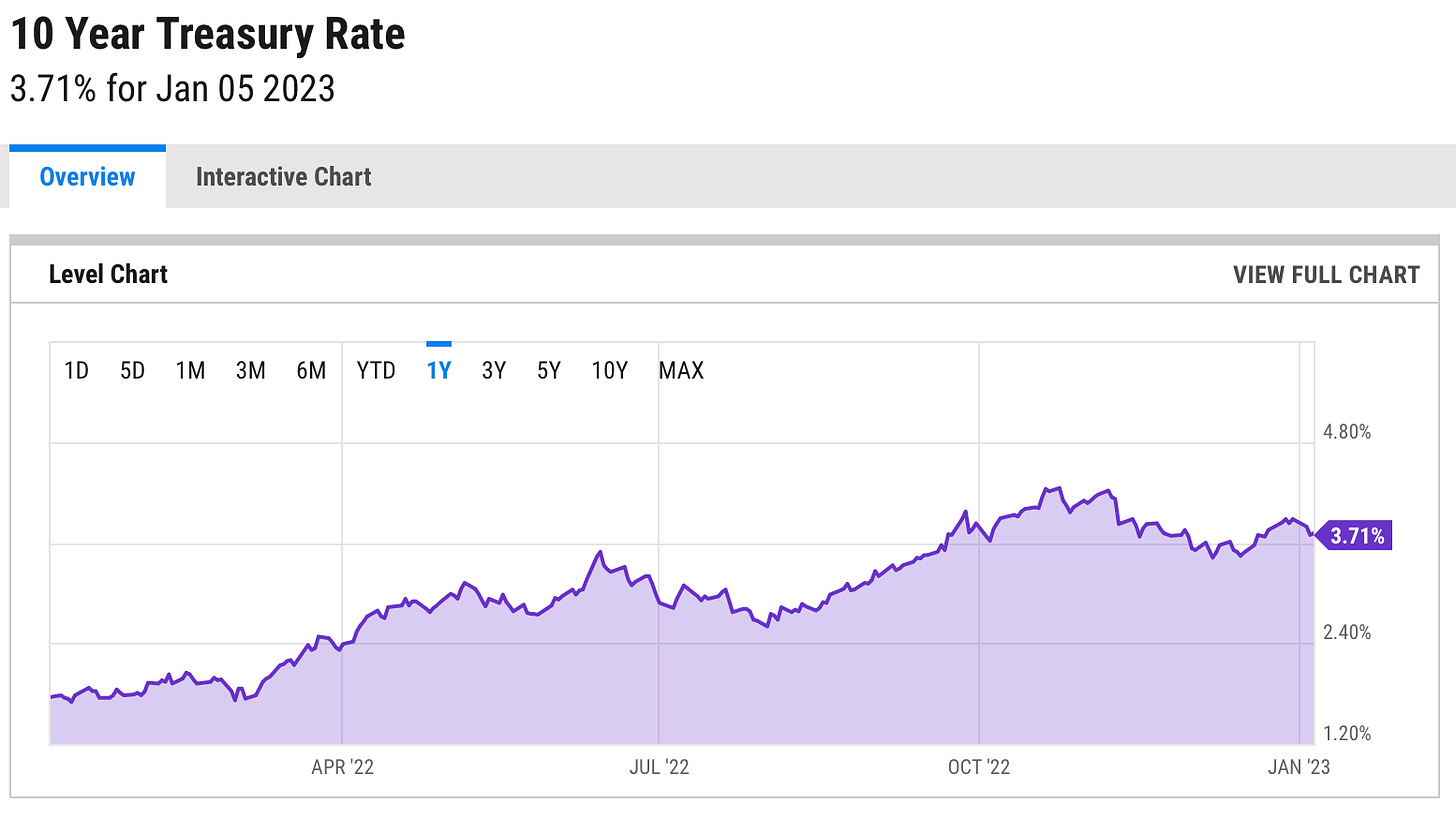

Yield = (Face Value * Interest Rate) / Market PriceThis lets you make charts showing the evolution of bond yields over time, like this one of the 10-year treasury bond:

In summary, a bond starts its life with a face value, then its interest rate is determined at the initial auction, and the price of the bond floats over time. But we normally discuss the yield rather than the price of the bond, which lets us talk about fluctuations in interest rates rather than in prices.

But this is all a conventional way of doing things, not a law of nature.

And since the debt ceiling caps the face value of the debt, it suggests that the Treasury should continue to meet the nation’s financial obligations by changing the way it sells bonds to prevent the face value of the debt from growing too high.

CORRECTION: As several people pointed out to me the math in the original version of this was wrong; I was trying to make the numbers simpler for myself (and ideally the audience) but the simple math only works if you assume the government is selling perpetual bonds, which the US government doesn’t actually do. With real bonds, the details of the math depend on the duration of the bond and the calculations are more complicated. I apologize for the error — I don’t think the details here are material to the political calculus but obviously were you to actually do the bond sales you would need to get the numbers right. The good news is that both the people at the Bureau of the Fiscal Service and also actual bond traders are good at these details.

The Treasury Department could basically flip the terms of the auction. Instead of saying “We want to sell a $100 perpetual bond, how much interest will you demand to give us the money?” they could say “I have this nice juicy $100 bond for sale that pays a 27% interest rate, how much are you willing to pay for it?”

If the current yield on a hypothetical perpetual bond is 3.79%, then we would expect our new bond to sell for a market price that causes convergence with that yield. So we do a little algebra:

0.0379 = ($100 * 0.27) / Market Price

Market Price * .0379 = $27

Market Price = $712And it turns out the $100 bond sale raises $712 for the government by the magic of fixing the interest rate before the auction rather than at the auction.

The first thing this would do is let the Treasury finance the ongoing operations of the government while dramatically slowing the pace at which the face value of the outstanding debt accumulates. I picked numbers at random, but there’s no reason it has to be a $100 bond with a 27% interest rate. Treasury could just as easily sell a $1 bond with a 2,700% interest rate and raise the $712 that way. This is the magic of the trick. Just as the government can sell high face-value bonds at low interest rates to raise a large sum of money, they can also sell tiny face-value bonds at high interest rates to raise the exact same sum of money.

In addition to the 10-year bond that’s often discussed in policy terms, the government sells a lot of short-term debt — 1-month, 2-month, 3-month, 4-month, and 6-month bonds — so there are always some fresh bonds coming due. By swapping out old bonds with high face values and low interest rates for equivalent-yielding bonds with low face values and high interest rates, the Treasury can not only slow the pace at which the face value of debt accumulates, it can start to reduce the face value of that debt. This should not only get around the debt ceiling issue — it should make it entirely irrelevant over time.

From the standpoint of the smooth functioning of financial markets, this would not be an ideal situation. Republicans are committed to the debt ceiling fight precisely because they, for a mix of reasons, actively want a huge destructive blowup. So they’re not going to respond to this by just saying “well played Secretary Yellen, you’ve foiled us this time.”

They’re going to scream and yell and posture and complain and sue and possibly do other things.

In practice, confidence in the full faith and credit of the United States will be somewhat diminished if the Treasury resorts to this tactic, and federal borrowing costs will rise. Since the federal government is also the guarantor of the bonds issued by Fannie Mae and Freddie Mac, the yield on their debt will also rise.

That’s going to raise the rate charged on mortgages, making it more expensive for new buyers to buy homes and depressing the equity value of homeowners’ existing dwellings. Higher interest rates also depress stock market values. What’s more, because U.S. government debt is always going to be safer than other kinds of dollar-denominated debt, if a crisis raises yields on treasuries, borrowing costs for every business in America will go up. It will also mean higher borrowing costs for every school district or municipal water system that wants to sell bonds to facilitate some repairs. It’s definitely bad, and the best thing would be for Republicans to not shoot the country in the foot out of spite for having lost the 2020 election.

That said, if yields go up a lot because people are afraid the Treasury Department would lose this case in court, I’d happily swoop in and buy some bonds. Because I have a very high degree of confidence that they would win.

The biggest practical problem is that troublemakers only need to find one insane district court judge somewhere in the country to order a national injunction and create at least a temporary crisis. In the end, Biden will prevail in court because the GOP appointees to the federal courts are mostly not insane. But there is a non-zero level of insanity out there, and the “one district judge issues a nationwide injunction” trend has unfortunately become a tricky issue for basically all policymaking.

As you get to a higher level, though, I think the legal argument in favor of doing it is unimpeachable. It’s not clear who would even have standing to sue as the allegedly injured party. But beyond that, in the event of a debt ceiling breach, the executive branch has to do something, and issuing high-yield bonds is a way to avoid doing something flagrantly illegal.

It’s gotten boring writing this over and over again for more than a decade, but the basic problem with the debt ceiling is this:

-

Congress wrote laws, years ago, governing how Social Security works and who is entitled to benefits and how much they are entitled to and when the benefits should be paid. Joe Biden and Janet Yellen do not have the legal authority to blow off the law and not pay those benefits.

-

Congress wrote laws, years ago, governing how Medicare works and which providers are entitled to payments for services rendered and how much they are entitled to and when the payments should be paid. Joe Biden and Janet Yellen and Xavier Becerra do not have the legal authority to blow off the law and not pay those benefits.

-

Congress wrote laws, years ago, governing how Medicaid works and which providers are entitled to payments for services rendered and how much they are entitled to and when the payments should be paid. Joe Biden and Janet Yellen and Xavier Becerra do not have the legal authority to blow off the law and not pay those benefits.

-

Congress also wrote laws just last year governing how much is appropriated for every federal agency that operates on the annual appropriations cycle. These laws say the Department of Justice should spend such-and-such amount of money, and even more specifically how much money should go to the FBI vs. the DEA vs. the U.S. Attorneys’ offices vs. the Bureau of Justice Statistics. Joe Biden and his cabinet secretaries do not have the legal authority to blow off the law and not spend what Congress has told them to spend.

There’s no wiggle room here. People sometimes talk about whether Treasury has the capacity, logistically, to “prioritize” payments and ensure that bond holders get what they are owed while stiffing retirees or their doctors and hospitals instead. The official line from Treasury is they can’t do this. But whether that’s true or not, it’s definitely not legal for them to do it. They have an obligation to pay what they owe according to the laws that exist. Blowing off the debt limit does not give the executive branch any new powers that it currently lacks, but attempting to conform to the debt limit in a way that lets the Treasury Department decide which legally mandatory payments do and do not get made would have that effect.

High-yield bonds are a little bit silly, but the alternative of default or payment prioritization would destroy the constitutional order. And one of the worst legacies of the Obama years is that we even need to talk about this.

Before John Wick, there was “Speed,” which had a classic bit about how you can foil a hostage taker by shooting the hostage to eliminate the hostage-taker’s leverage. This is what needs to be done so that the country can put this whole unfortunate debt ceiling issue behind us.

It’s been a little bit lost to the sands of time, but Democrats considered doing a debt ceiling increase during the 2010-2011 lame duck session. They ultimately didn’t go for it in part because the Obama administration thought a cross-party negotiation over this might be good for the country. At the time they sincerely wanted to make a bipartisan Grand Bargain on long-term deficit reduction, so when Republicans started demanding a big deficit reduction package as the price of a debt ceiling increased, there was a certain thought that this was a constructive development. Of course what Republicans wanted was an all-cuts package, and that was unacceptable to Obama. He proposed instead a “balanced” package that was evenly split between tax increases and spending cuts.

The hope was to reach some kind of deal along those lines and across various iterations — the Simpson-Bowles Commission, the Supercommitee — and the White House was very serious about doing this. They put ideas like raising the Medicare eligibility age on the table if that’s what it took to get a fair deal.

It didn’t work. Republicans were so opposed to raising taxes that they instead settled on an all-cuts package that disproportionately impacted the military, which Obama hoped would prove so painful to the GOP that they’d eventually come back to the bargaining table. They did return, but the form that took was a series of bargains under both Obama and Trump to raise both defense and non-defense spending above the agreed-upon levels. The whole drive for a Grand Bargain failed.

Like many things that didn’t work out, you can see why Obama’s team thought this was a good idea at the time. At the end of the day, GOP intransigence on the tax issue didn’t even stop taxes from going up, which happened during the 2012-2013 fiscal cliff episode, so their attitude toward this was totally irrational. That said, it didn’t work. And the legacy it left in its wake was the idea that willingness to threaten to blow up the country with the debt ceiling is a key indicator of how hardcore you are as a partisan. We need to get out of this whole dynamic. And the way to do that is for Biden to articulate two points:

-

It is better for the country to raise the debt ceiling than to not raise it.

-

Whether or not the debt ceiling is raised, the U.S. government will one way or another make all the payments that it is legally required to make — the president is not a criminal.

He needs to try to take this issue off the table. Meanwhile, ideally we should separate the debate over the debt ceiling from the debate over fiscal policy. I always thought Obama’s quest for a Grand Bargain was a misread of the objective economic situation in which he found himself. But given the economic circumstances of 2023, a reasonable deficit reduction package would be a good idea. Biden should do a big speech calling for a bipartisan commission on deficit reduction! But then he should have the Treasury start working on some high-yield bonds, because there is no sense in negotiating with hostage takers.