A broker has shared his views on the refinancing and cashback trends in the home loan market, as competition among lenders heats up.

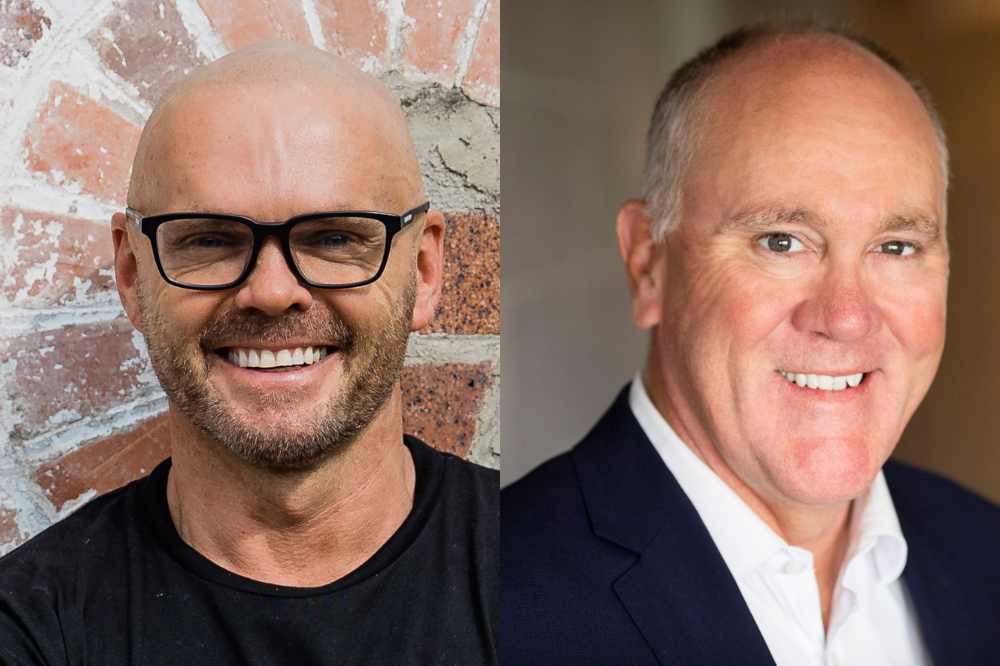

Brisbane mortgage broker Tom Uhlich (pictured above left), who owns brokerage Boss Money, said there was slight panic in the market with many wanting to refinance to “low” fixed rates that no longer existed.

“We have also seen a segment that are refinancing for cash out to hold as a buffer for the rocky road ahead (which is a strange concept), getting cash-out at higher rates to help cope with higher rates,” Uhlich said.

“Since late 2022, we contacted our clients and had them work out their repayments at 6%. Then we suggested they set up a separate account and pay in the difference between their low fixed rate and 6%, so that way they are training themselves to make repayments at the higher rate.”

Uhlich said the other conversation brokers should be having with their clients is whether they should stick with a fixed rate or move to variable.

“Given fixed rates are considerably higher than they were 12 months ago, it’s tough looking at fixing again,” he said. “However, if the variable rate goes to 8%, then fixing for five years at 6% isn’t so bad.”

The Australian recently reported that many mortgage holders that secured record-low rates during the pandemic are nearing the end of their fixed rate terms (known as the “fixed rate cliff”) and are confronting variable rates that could be double what they are currently paying. With Australian mortgages totalling approximately $500bn and home loan growth slowing, lenders are fighting harder for refinancing and new business.

Speaking to The Australian, AFG chief executive David Bailey (pictured above right), said the home loan market remained as competitive as he’d ever experienced.

“The number and volume of cashback offers is just unprecedented and it seems to be the new norm,” Bailey said.

“My view is that banks, rather than offering a cashback, should just put it into the rates to the customer. The refinance market is probably going to be the most competitive space until such time that house prices settle, bringing new customers back into the market again.”

Bailey said despite AFG having more than 70 lenders on its panel and given how much rates had increased in recent months, some fixed rate customers would no longer meet loan serviceability requirements, meaning as they moved to a variable rate they might be forced to stay with their current bank or pay mortgage insurance to switch.

“That’s inevitable unfortunately and that might temper some of that refinance activity as banks were benefitting from not passing on higher rates to savers which give them a funding advantage,” he said.

“My gut feel is there is still another six months before that (bank) funding advantage around the deposit book becomes less of an advantage. That won’t happen until such time that customers start demanding higher deposit rates and we are starting to see a little bit of that.”

Meantime, new Mortgage Choice research has found one in three mortgage holders plan on refinancing their home loan in 2023. The survey results found 44% of borrowers aged between 35 and 44 were considering refinancing, while 41% of borrowers have refinanced their loan within the past two years and 38% have used a mortgage broker before.

PEXA found the volume of mortgage refinancing increased 0.4% in the first week of December 2022, as borrowers try to find a better deal following consecutive interest rate increases. This was in response to the Reserve Bank’s decision on December 6 to lift the official cash rate 0.25% to 3.10%, the eighth straight month of OCR increases.

According To RateCity, there are currently 34 lenders offering cash back in the mortgage market, which is almost a record level. This compares to about 29 lenders in July last year.

Cashback offers on RateCity.com.au January 11

|

Lender

|

Cashback

|

Who For?

|

Conditions

|

|---|---|---|---|

|

AMP

|

Up to $4,000

|

Refinancers,

new borrowers

|

Loan size of $750K+ for $4K. Select loans only

|

|

|

$2,000-$4,000

|

Refinancers

|

LVR of 80% or lower for $4k

|

|

Bank of China

|

$3,000

|

Refinancers

|

|

|

Bank of Melbourne

|

$4,000

|

Refinancers

|

|

|

|

$3,000

|

Refinancers

|

|

|

BankSA

|

$4,000

|

Refinancers

|

|

|

BankVic

|

$1,500

|

Refinancers

|

Owner-occupiers only

|

|

|

$2,000

|

Refinancers

|

|

|

bcu

|

$3,000

|

Refinancers

|

|

|

|

$2,000

|

Refinancers

|

|

|

Citi (via a broker only)

|

$3,000-$5,000

|

Refinancers

|

Cashback on $500K loan is $3K

|

|

Credit Union SA

|

$2,500

|

Refinancers

|

Not available on lowest rate loan

|

|

Defence Bank

|

$4,000

|

Refinancers

|

|

|

Geelong Bank

|

$2,000

|

Refinancers

|

Owner-occupiers only

|

|

Great Southern Bank

|

$3,000

|

Refinancers

|

|

|

Greater Bank

|

$3,000-$4,000

|

Refinancers

|

Cashback on $500K loan is $4k

|

|

Heritage Bank

|

$3,000

|

Refinancers,

new borrowers

|

|

|

HSBC

|

$3,288

|

Refinancers

|

|

|

IMB Bank

|

$2,000

|

Refinancers

|

|

|

ING

|

$3,000

|

Refinancers

|

|

|

|

$2,000-$4,000

|

Refinancers

|

LVR of less than 60% for $4K. LVRs between 60% – 80% receive $2K

|

|

MyState Bank

|

$2,000-$3,000

|

Refinancers

|

Cashback on $500K loan is $3K

|

|

|

$2,000

|

Refinancers

|

|

|

Newcastle Permanent

|

$2,000-$3,000

|

Refinancers

|

Cashback on $500K loan is $3K

|

|

People’s Choice

|

$4,000

|

Refinancers

|

|

|

Queensland Country Bank

|

$3,000

|

Refinancers

|

Investors only

|

|

RAMS

|

$4,000

|

Refinancers

|

|

|

Reduce Home Loans

|

$2,000-$10,000

|

Refinancers,

new borrowers

|

Cashback on $500K loan is $3K. Not available on lowest rate loan

|

|

Regional Australia Bank

|

$2,000

|

Refinancers

|

|

|

St.George Bank

|

$4,000

|

Refinancers

|

|

|

Summerland Credit Union

|

$2,000-$3,000

|

Refinancers

|

Cashback on $500K loan is $3K

|

|

|

$3,000-$4,000

|

Refinancers

|

Cashback on $500K loan is $3K

|

|

|

$4,000-$5,000

|

Refinancers,

new borrowers

|

Cashback on $500K loan is $4K

|

|

|

$2,000

|

Refinancers

|

|

Source: RateCity.com.au

Lowest fixed rates for owner-occupiers paying principal and interest, January 11

|

Loan Type

|

Lender

|

Advertised Rate

|

|

1-year fixed

|

Bank Australia

|

4.64%

|

|

2-year fixed

|

RACQ

|

5.19%

|

|

3-year fixed

|

Police Bank

|

5.19%

|

|

4-year fixed

|

Bendigo Bank/Macquarie Bank/ING

|

5.49%

|

|

5-year fixed

|

RACQ

|

5.39%

|

Note: rates are for owner-occupiers paying principal and interest. LVR requirements apply.

Source: RateCity.com.au

Lowest variable rates for owner-occupiers paying principal and interest, January 11

|

Lowest Rate

|

Advertised Rate

|

|

Hume Bank

|

3.99% for 2 years then 4.49%

|

|

Bank First

|

4.44%

|

|

|

4.46%

|

|

Bendigo Bank

|

4.47%

|

|

Qudos Bank

|

4.49%

|

(Excludes lenders that have not announced their Dec RBA changes)

Source: RateCity.com.au

What do you think about the refinance boom? Share your thoughts in the comments section below.