MBIA Inc (MBI) ($680MM market cap) is now a shadow of its former self, prior to the 2007-2009 financial crisis, MBIA was the leading financial guarantee insurer in the U.S., where MBIA would lend out its AAA rating to borrowers for an upfront fee. This business model probably never made sense, it assumed the market was consistently mispricing default risk, the fee MBIA charged had to make it economical to transform a lower rated bond to a higher rated one.

In the early-to-mid 2000s, MBIA was leveraged over 100 times, they guaranteed the timely payment of principal and interest on bonds that were 100+x that of their equity, only a small number of defaults would blow a hole into their balance sheet. When the business was first founded, MBIA focused on municipal debt through their subsidiary National Public Finance Guarantee Corp (“National”), with the thesis being that even if some municipal bonds weren’t formally backed by taxpayers, there was an implied guarantee or a government entity up the food chain that would bail out a municipal borrower. That has largely proved true (minus the recent quasi-bankruptcy in Puerto Rico), however MBIA was greedy and grew into guaranteeing securitized vehicles (via subsidiary MBIA Corp) prior to the GFC. MBIA and others (notably AIG Financial Products) got caught, finding themselves on the hook for previously AAA senior tranches of ABS CDOs and subprime-RMBS that went on to suffer material principal losses. There was no one up the chain to bail out a Cayman Islands special purpose vehicle with a P.O. box as a corporate address. A lot has happened in the 15 years since 2008, MBIA Corp stopped writing new business almost immediately, National continued to write new business on municipal issuance but stopped in 2017 after Puerto Rico went further into distress, National had significant exposure to island. The business has been in full runoff since then.

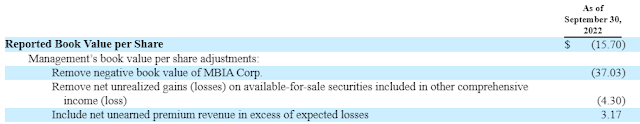

The distinction between National (municipal bonds) and MBIA Corp (asset backed securities) is important, MBIA Corp and National are legally separate entities that are non-recourse to the holding company, MBIA Inc. MBIA Corp’s equity is way out of the money, completely worthless to MBIA Inc, the entity is being run for the benefit of its former policyholders. National on the other hand has positive equity value, but when consolidated with MBIA Corp on MBIA Inc’s balance sheet, results in an overall negative book value. But again, these are two separate insurance companies that are non-recourse to the parent. The SEC slapped MBIA Inc’s wrist for reporting an adjusted book value based on the assumption that MBIA Corp’s negative book value was no longer relevant to the parent, as some compromise, MBIA Inc stopped providing the end result, but still provides the components of their adjusted book value (not sure how that’s significantly different, but whatever). Here are the adjustments for Q3:

By making these adjustments, MBI’s adjusted book value is roughly $28.80/share, today it trades for $12.50/share. The last two items in the adjusted book value bridge are more runoff-like concepts, these are the values that MBIA Inc would theoretically earn over time as the bonds mature in their investment portfolio and erase any mark-to-market losses (largely driven by rates last year) and then any unearned premiums assuming their expected losses assumptions are accurate.

I’ve kind of skipped over Puerto Rico, I’ve passively followed it over the years via Reorg’s podcasts, it is too much to go into here, but MBIA Inc’s (via National) exposure is largely remediated at this point (announcing in December that they settled with PREPA, Puerto Rico’s electric utility that was destroyed in Hurricane Maria), clearing the way to sell itself. From the Q3 earnings press release:

Bill Fallon, MBIA’s Chief Executive Officer noted, “Given the substantial restructuring of our Puerto Rico credits, we have retained Barclays as an advisor and have been working with them to explore strategic alternatives, including a possible sale of the company.”

Essentially all of the bond insurance companies have stopped writing new business, the only one of any real size remaining in the market is Assured Guaranty (AGO) ($3.7B market cap). Assured has significant overlap with National that would drive realistic synergies. Street Insider reported that AGO and another company are in advanced talks with MBIA. They’re the only true strategic buyer (maybe some of the insurers that bid on runoff operations might be interested too), AGO also trades cheap at roughly 0.75x GAAP book value. AGO would need to justify a purchase to their shareholders that would at least be on par with repurchasing their own stock (which they do constantly).

In my back of the envelope math, I’m only pulling out the negative book value associated with MBIA Corp from the adjusted book value, then slapping a 0.75x adjusted book value multiple on it. Again, the other two items in MBI’s adjusted book bridge seem more like market risks a buyer would be assuming and should be compensated for bearing the risk of eventually achieving. AGO should be able to justify paying the same multiple for MBIA Inc since it will include significant synergies. I come up with a deal target price of approximately $16/share, or 28% upside from today’s prices.

I bought some shares recently (I know, another speculative arb idea!).

Disclosure: I own shares of MBI