Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!

Background:

After looking at Hannover Re and Munich Re a few days ago, I decided to include also Swiss Re and Scor in my analysis. Unfortunately, for both of these players, the CAGRs for profit etc. are meaningless as they were making losses in 2022. However, especially for SCOR I found a few numbers very interesting

Score still has a relatively conservative equity ratio, similar to Hannover Re, and is also relying less in financial income and has a decent long term ROE of 8%. Swiss Re in contrast is indeed a “class of its own” with really bad comps in all categories.

What I really found interesting however is the fact that SCOR seems to trade at an enormous discount to its peers, both in terms of Price to Book value as well as in expected 2023 P/E. That’s why I decided to have a deeper look into SCOR.

SCOR as a company

SCOR is a French Reinsurance company that is supposed to be the number 5 global reinsurer based on total premium. Just before the financial crisis in 2007, Scor merged with Swiss based Converium (itself a spin-off from Zurich Insurance). In their investor deck, they do have a good chart of how they are positioned globally:

At the time of writing, Scor has a marked cap of ~4,2 bn EUR with aroun 178 mn shares outstanding.

Fundamental Tailwind (1): Reinsurance cycle

2022 was from a claims perspective not a great year for reisurance. However, 2023 looks much better. One specialty of reinsurance is that the industry basically adjusts pricing only once a year at year end. Already in November, it was relatively clear that prices will increase.

Just a few days ago, the FT finally reported that Reinsurance prices increased significantly, in some areas, premiums increased by up to 200%.

https://www.ft.com/content/f5f9d450-c539-47a7-bc5c-44a8db57e74e

The war in Ukraine and extreme weather events have driven up the cost of reinsurance by as much as 200 per cent in crucial January renewals, according to a new report, threatening to raise premiums and reduce what insurers are willing to cover.

Clearly not all business lines will profit that much, but overall it seems that reinsurers were able to get “decent prices” which should tranfer in “better than average margins” (before NatCat).

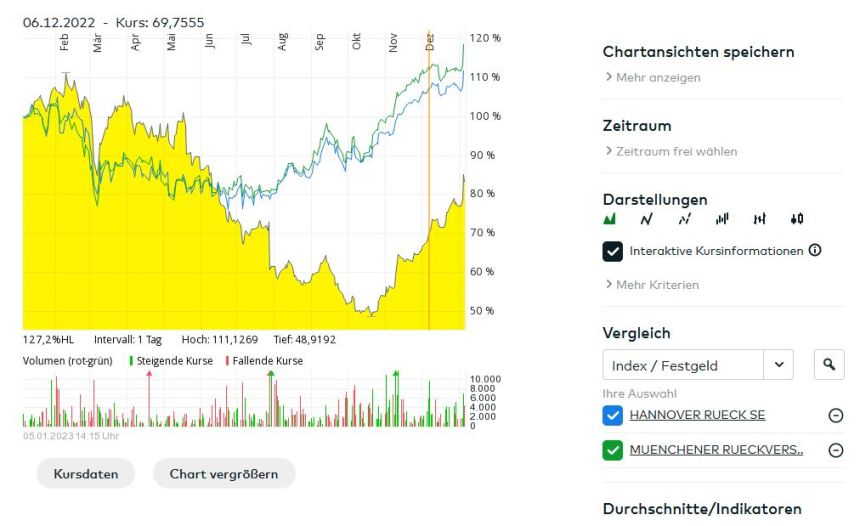

Part of this is clearly reflected in the share prices of Reinsurers that have recovered significantly since last summer:

Why has SCOR’s stock performed so bad in the second half of 2022 ?

It is always difficult to interpret why a stock does soemthing. In SCOR’s case, I think 2 factors could have scared investors in 2022 especially in Q3: A relatively large exposure to French storms and a ~500 mn “reserve strenghtening” in Q3. This is the slide form the IR presentation:

Fundamental Tailwind (2): Interest rates

Another tailwind are interest rates. With increased interest rates, the yield on newly invested money clearly goes up. However there is one caveat: Long running fixed income securities are “under water”, so in order to prevent losses, Insures have to wait until the old paper matures.

Scor has a decent investor presentation from November. With regard to their investment income, I found this slide really helpful:

Scor’s portolio duration is really short. The 3,3 years compare with ~6,5 year for Munich Re (including Ergo, 5 years excluding Ergo) and 5 years for Hannover Re.

This has two main effects:

- The interest rate sensitivity of the IFRS Equity was lower than for its peers

- The higher yield envrionement will result in a quicker and larger increase in investment income compared to their peers, both because of the shorter duration as well as the lower starting yield-

A back of the envelope calculation looks as follows:

Scor has around 20 bn in ifxed incoem assets that yield currently around 2% or 400 mn in investment income. Next year, they will be able to reinvest 30% of the 20 bn at 5% instead of 2%. This has the following effect:

=0,3*20bn*(5%-2%) ~180 mn EUR more net investment income in 2023 compared to 2022.

Assuming that interest rates remain where there are, this effect will continue for the next two years as well, until the whole portfolio yields 5% (assuming that yield stay where they are).

Valuation / Model

I came up with a simplified model base case which looks as follows:

The base case assumption are as follows:

- Every maturing asset (~30% of the existing assets) and any new investments (5% growth of the float p.a.) can invested at 5% (current reinvestment rate) in 2023 and roughly 4,5% in 2024 and 4% in 2025.

- The strong Reinsurance cycle will allow for a 98% Combined ratio in 2023, going back up to 100% until 2025

No one could adjust this assumptions in any way (lower/higher reinvestment yields, Higher growth of float, higher/lower CR etc.), but I think these asumptions are reasonable base case assumptions.

Based on these assumptions, I would expext EPS of 3,92 for 2023 and based on a P/E of 9 this would mean a target price of 35 EUR per share. This would mean a 50% upside plus an expected 1,80 EUR dvidend. Ticker tells me that sell side analysts are expecting 3,77/4,16/4,93 as EPS for 2023 to 2025, so pretty close and equally realistic.

SCOR is clealry not exactly a long term compounder, however it looks like a potnetially very interesting “value trade” with a decent upside.

Risks:

I see three major risks in this case:

1. High Nat Cat losses (again) in 2023

There is absolutely no guarantee that 2023 will be better for NatCat than 2022, it cold be even worse. However the siginficant hieghr premium level and SCOR’s reduced exposure clearly lower the probability of a really bad year

2. Interest rate development

The biggest dirver of higher eanrings is clearly the reinvestment yield. SCOR will reinvest most of its portfolio over the next 3 years. So a sudden and permanent drop in interest rates will lower the expected increase in the investment income. According to my experience, the current yield is always the best proxy for future yields. Using the yield curves (i.e. the implied frwards) would lead to a lower expected reinvestment yield.

3. Further reserve strenghtening required

Shareholder clearly got spooked by the reserve strengthening in Q3 and there is no guarantee that this will be the last one. Their competitors did not need to do this in Q3. It looks like that SCOR’s reserves seemed to have been more “optimistic” than the competitors with one driver being inflation.

IFRS 9 / IFRS 17 changes in 2023

I don’t want to bore out anyone with accounting details, but in 2023 two major accounting changes will kick in for Insurance and Reinsurance businesses that report under IFRS:

IFRS 9 targets the accounting of investments. The main topic here is that especially for equity investments, one has to chose between either fully running them through P&L or to only show the dividend income in the P&L. This is an issue for insurers with significant exposure to equity (for instance Munich Re) but not for SCOR as they have no equity inevstments. Many market participants assume that the investment income of many insuers will become much more volatile. In addition, Insurers will not be able to steer overall P&L via realizing unrealized gains.

IFRS 17 targets the insurance side. SCOR has some charts on that in their investor presentation. Overall, especially for P&C, net premium will be lower but combined ratios will look better. They also mention that IFRS Equity will be higher due to reserve discounting, something that has been possible under US GAAP already. As price-to-book is still an important metric for valuing insurers, this could be an overall positivee development for Insurers with IFRS accounts

Overall, there is some uncertainty around these changes and I expect that some shareholders might be surprised by the increasing volatility of GAAP earnings for some Insurers and Reinsurers. again, for SCOR I think this is less o an issue due to their very conservative imvestment portfolio.

Management/Shareholders etc.

With reagrd to Managment and startegic shareholders, there is not a lot to report here. Most notable are a total 3,5% of share ownership of employees and a 3,6% position from Tweedy Brown, an old school value investing firm.

However, as this is a more short term relative value trade, these factors don’t play such an important role as for long term investments.

Pro’s/Con’s

As always, thes is now a good time to look at some pro’s and con’s regarding this investment case:

+ Tailwind 1: Strong Reinsurance cycle, high premium increases

+ Tailwind 2: Short duration of portfolio to benefit from higher interest rates

+ Low risk investment strategy

+ Very attractive relative valuation

+ relative better via IFRS 9 / IFRS 17 (higher equity, better CR)

+/- Average management, avarage ROE, Margins etc.

+/- Reinsurance claims are unpredictable and can be volatile (NatCat)

– below average P&C profitability, losses in 2022

– risk of futher reserve strengthening

– overall uncertainty about IFRS 9 / IFRS 17

– lower reinvestment rates

Game plan:

As mentioned above, for me SCOR is not a long term investment but rather a “value trade”, i.e. a relatively undervalued security that has a good chance to catch up to its peers over the next 12-18 months. My price target would be around 35 EUR plus dividend.

Some “soft catalysts” could be the the result presentation in early February where they might, among other topics, show the IFRS 17 impact on equity and give a hopefully optimistic forecast for 2023.

Operationally, normally only after Q3 (US Hurricane season) reinsurers can say if it wil be a good year or not, nevertheless, one should see the ffect of higher interest rates quarter by quarter.

If they announce another large “reserve strengthening”, then I will seriously reconsider the postion.,

Summary:

Overall, I do think that SCOR SE repdrsents an interesting “relatice value trade” opportunity. At an estimated P/E of 6 for 2023, the stock looks too cheap compared to its main competitors who trade at 10-12x P/E. The underlying business is supported by two strong fundamntal talwinds: A strong Reinsurance cycle and increasing interest rates, wher SCOR via its short portfolio duration benefits even more than the competitors.

Therefore I have allocated ~4% of the portfolio into SCOR at a price of 23,60 EUR. I financed this thorugh a sale of the GTT position as well as some profit taking at Meier & Tobler.

My base case expected return is +50% (including dividend) over a period of 12-18 months.

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!