In May of last year, Eye on Housing reported on historically widespread shortages of building materials. Since then, most of the shortages have eased; the major exceptions being shortages of HVAC equipment and certain categories of ceramic materials (ceramic tiles, clay bricks and cement-based building materials), which have gotten slightly worse.

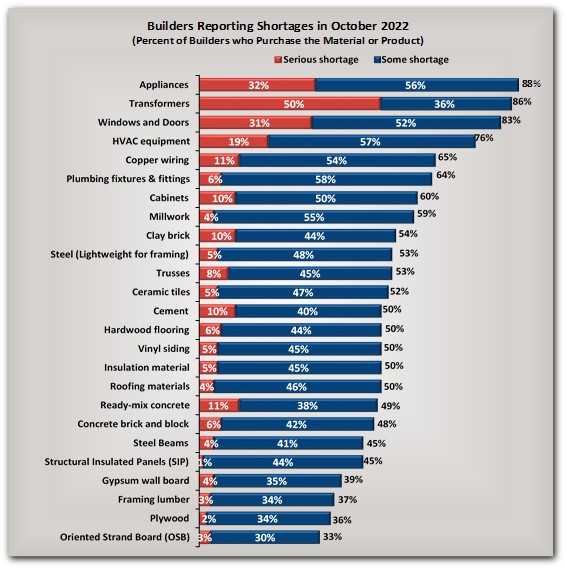

NAHB has been tracking shortages of building materials and products since the 1990s through special questions on the survey for the NAHB/Wells Fargo Housing Market Index (HMI), most recently in October of 2022. At that time, over 80 percent of single-family builders reported either a serious or some shortage of three categories of building products: appliances (88 percent), transformers (86 percent) and windows & doors (83 percent).

Appliances and transformers are relatively new to the HMI survey, added in response to anecdotal comments fielded by NAHB over the past two years. Shortages of HVAC equipment were also relatively widespread in October, reported by 76 percent of single-family builders. Overall, half or more of all builders reported shortages of 17 of the 25 building products listed in the October 2022 survey.

Although these shortages may seem severe and broad-based, they are generally not as severe as they were the last time NAHB collected similar information in May 2021. Between then and October of 2022, the incidence of the shortage fell for 18 of the 24 listed products and materials (transformers were not covered in the 2021 survey). The decline in the share of builders reporting a shortage ranged from 3 percentage points (from 63 to 60 percent) for cabinets, to a massive 59 points (from 92 to 33 percent) for OSB.

The HMI survey in general shows the availability lumber products improving markedly since May of 2021, which is consistent with the concurrent declines in lumber prices. As reported in the December 9 post, as of November the seasonally adjusted Producer Price Index for softwood lumber had declined in seven of the previous eight months.

As indicated in the title, shortages of a handful of building products actually became slightly worse between May 2021 and October 2022. The share of builders reporting a shortage of HVAC equipment increased by 8 percentage points (from 68 to 76 percent) over that period, and the shares reporting shortages of cement and ready-mix concrete each increased by 6 percentage points. This is consistent with the rapid increase in the price of read-mix concrete, also reported in the December 9 post.

Related