Now that the housing market is turning in favor of home buyers, the phrase “seller concessions” might become a lot more common.

Over the past decade, home sellers have had the upper hand, often unloading their properties above list price.

In many cases, home buyers were forced to enter bidding wars, assuming they were lucky enough to get the opportunity.

But now that mortgage rates have doubled, and home prices are on a downward trajectory, the situation is quite the opposite.

If you’re a prospective home buyer, you need to know what seller concessions are and how they work.

What Are Seller Concessions?

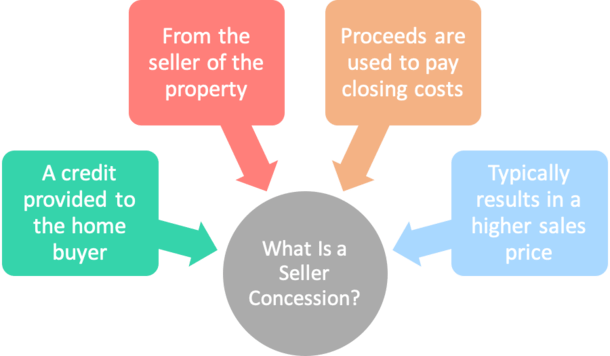

A seller concession is a financial contribution from a home seller that reduces a home buyer’s closing costs.

One of the biggest hurdles prospective home buyers face, other than DTI constraints, is having the necessary funds (assets) to close on a home purchase.

Seller concessions lessen that burden, making it easier to qualify for a home loan and acquire a property.

The funds are typically generated via a slightly higher contract price, which reduces the buyer’s out-of-pocket expenses.

However, this means the borrower will wind up with a larger loan amount, and finance those costs over time via a higher monthly mortgage payment.

For example, if a buyer offers $360,000 for a property with $10,000 in seller concessions, the seller may say, “Sure, it’s all yours for $370,000.”

You’re not really getting money for free since the purchase price rises by the amount requested. But it does reduce the amount of cash due at closing.

In a nutshell, it means you’re paying for that $10,000 via the higher sales price over time instead of at closing.

Keep in mind that the property must then appraise for that higher amount in order for the mortgage financing to work out.

And your down payment may change as a result, assuming you want to keep your loan-to-value (LTV) ratio the same.

While they weren’t popular when the housing market was red hot, seller concessions have since become a lot more common as buyers gain the upper hand.

In fact, a new report from Redfin found that a record 42% of home sales in the fourth quarter of 2022 included concessions to the buyer.

What Can Seller Concessions Be Used For?

The proceeds from seller concessions can be used for a variety of costs associated with the home purchase.

This can include lender fees, third-party lending fees, taxes, insurance, HOA dues, buydowns, repairs/improvements, and much more.

Of course, if your inspection finds that real repairs are necessary, these should reduce the sales price or be taken from the seller’s proceeds without increasing the sales price.

Lender fees

Loan origination fees

Discount points

Title insurance

Escrow fees

Appraisal fees

Attorney/recording fees

Inspection fees

Property taxes

Transfer taxes

Homeowners insurance premiums

Mortgage insurance premiums

Funding fees

Prepaid items for an impound account

Interest charges

HOA dues

Mortgage buydowns

What Can’t Seller Concessions Be Used For?

Seller concessions typically can’t be used for certain things, such as the down payment. Nor can the buyer receive cash via the seller’s contribution.

To that end, the concessions you receive can’t exceed your closings costs, so be sure you don’t ask for more than you need.

If you do wind up with an excess, you could explore paying mortgage discount points to lower your mortgage rate. Or load up a mortgage impound account.

Additionally, concessions can’t be utilized to meet reserve requirements, or minimum borrower contribution requirements.

And the amount of seller concessions must be at/below the limit set forth by the associated loan type used for financing.

Seller Concession Limits by Loan Type

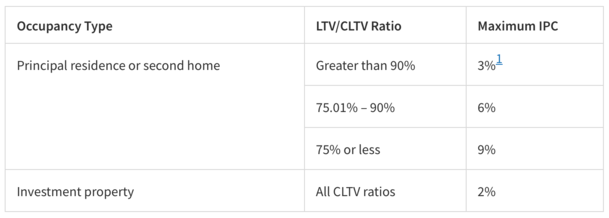

Fannie Mae and Freddie Mac refer to seller concessions as “interested party contributions,” or IPCs for short.

Fannie Mae considers IPCs to be either financing concessions (more common) or sales concessions (less common).

As to what they consider sales concessions, these “are IPCs that take the form of non-realty items,” such as cash, furniture, cars, moving expenses, along with financing concessions that exceed Fannie Mae limits.

The good news is lender credits are not considered IPCs even if the mortgage lender is considered an interested party.

So you can get lender credits to reduce your closing costs AND credits from the home seller (via concessions) to reduce your outlay.

Both Fannie and Freddie back the majority of home loans that exist, known collectively as conforming loans.

On conforming loans, seller concessions are limited to 2-9% of the sales price, as seen in the table below.

If the property is a primary residence or second home, the limit ranges from 3-9% based on your loan-to-value (LTV) ratio.

The greater the down payment, the more you can receive in concessions. To calculate seller concessions, simply multiply the proposed sales price by the percentage allowed based on the LTV.

Note that non-realty items and IPCs in excess of the limits are considered “sales concessions,” and will require the property sales price be reduced by the value of such sales concessions when calculating the LTV ratio for underwriting/eligibility purposes.

For investment properties, IPCs are capped at 2%, regardless of LTV. So if the purchase price were $300,000, you’d be capped at $6,000.

If it’s a HomePath property, the max IPC is 6% of the purchase price, even if above 90% LTV.

The maximum seller concessions on an FHA loan is 6% of the lesser of the property’s sales price or the appraised value, regardless of LTV. (section 4155.1 2.A.4.a)

The maximum seller concessions on a USDA loan is 6% as well, though some say loan amount and others say sales price (source)

Either way, most borrowers who take out USDA loans put nothing down, so it’s likely moot.

The maximum seller concessions on a VA loan is 4% of the appraised value/sales price (source).

However, “normal discount points and payment of the buyer’s closing costs” don’t need to be included in that hard limit. In other words, it might be possible to get more than 4%.

Max seller concessions on jumbo loans will vary because they aren’t subject to one set of guidelines like the loan types above. But there’s a good chance the limits will be similar.

Be sure your real estate agent, loan officer (or mortgage broker), and seller are all aware of these limits.

As to why there are seller concession limits in the first place, it’s to ensure home prices aren’t artificially inflated, and to ensure borrowers are properly qualified.

Seller Concession Example

| Concession Amount | $0 | $10,000 |

| Sales Price | $360,000 | $370,000 |

| 20% Down Payment | $72,000 | $74,000 |

| Loan Amount | $288,000 | $296,000 |

| Monthly Payment | $1,680.69 | $1,727.38 |

| Payment Difference | +$46.69 | |

| Closing Costs | $15,000 | $15,000 |

| Out-of-Pocket Expenses | $15,000 (plus down payment) | $5,000 (plus down payment) |

Let’s look at an example of seller concession in action. Imagine you find a house you like and offer $360,000, but need $10,000 in closing cost assistance.

The seller says no problem, we can sell for $370,000 and give you a $10,000 credit to cover your costs.

You’re putting 20% down, so the down payment increases $2,000 to account for the slightly higher sales price.

The seller concessions do not change the interest rate you qualify for, which is 5.75% in either situation.

What does change, aside from the down payment is the loan amount, which increases from $288,000 to $296,000.

As a result, the monthly payment also rises from $1,680.69 to $1,727.38, a $46.69 difference.

Sure, it’s nearly $50, but you might not notice it. You’ll certainly notice $10,000 less in out-of-pocket expenses at closing though.

And that extra cash might come in handy when it comes to making your first mortgage payment, or furnishing your new digs.

Seller Concessions vs. Lower Price (or Price Reduction)

Now you might be thinking, why not just take a lower price instead of the concessions. That way you’ll need a smaller down payment and you’ll have a lower mortgage payment too.

The problem, as evidenced in the example above, is that a slightly lower sales price does little to move the needle.

An extra $50 a month is negligible for most home buyers purchasing a near-$400,000 property.

But getting $10,000 to reduce your actual out-of-pocket expenses is huge. After all, most Americans have very little socked away in savings.

So having to give up $10,000 on top of other home buying related expenses could deplete your bank account.

Instead, you elect to pay a slightly higher mortgage payment and keep your savings intact, hopefully.

This is a similar argument to taking a lender credit instead of paying mortgage points, as more is kept in your pocket.

The only real downside to the concessions, other than the higher payment, is a higher tax basis on the higher sales price. But again, it’s not going to be a major difference.

Are Seller Concessions a Good Deal?

From the home buyer’s perspective, seller concessions can lessen the financial burden at closing, but increase the purchase price.

So it’s basically a case of paying less today, but more in the future via a larger loan amount. Still, it can keep things affordable and more liquid.

After all, you’ll likely need extra cash on hand after buying a home to account for mortgage payments, moving costs, new furnishings, and so on.

If possible, it might be better to ask for repair credits instead, in which case the purchase price doesn’t increase as a result. This is why a quality home inspection is so important.

It might also be possible to get the best of both worlds if you offer a slightly lower offer and ask for concessions. This might be a better way to negotiate seller concessions.

Using our example above, you offer $350,000 with $10,000 in concessions, bringing the sales price to the original $360,000.

You get your $10k in closing cost assistance without the sales price being inflated.

Be strategic and make sure your real estate agent gets it.

For the home seller, offering concessions may be a relative no-brainer if the purchase price is adjusted as a result, especially in a down market.

You’re basically expanding the pool of eligible buyers without giving away too much on your end.

Of course, it could adjust the real estate agent’s commission very slightly based on the difference in sales price.

But if the seller concessions get you to the finish line, they could be well worth it. Not only in more easily finding a willing/able buyer, but also one who has an easier time qualifying for a mortgage.

Pros and Cons of Seller Concessions

The Good

- Reduces out-of-pocket expenses if cash is hard to come by

- Might be easier to qualify for a home loan (asset-wise)

- Can keep you liquid after an expensive home purchase

- May only bump up your monthly mortgage payment slightly

- Allows for the purchase of other items after closing like furnishing, moving, etc.

- Can attract more home buyers (if you’re the home seller)

The Maybe Not

- Will likely increase the sales price of the property (by the amount conceded)

- Your monthly mortgage payment will be higher (larger loan amount)

- Closing costs are paid over time instead of upfront (increased interest expense)

- Higher property taxes if sales price is higher