California was the first state to create a paid family leave (PFL) program in 2002 (benefits became available in 2004). Since then, 11 other states have created paid family leave programs (plus Washington D.C.). If you’re an employer in California, you must withhold PFL contributions from employees’ wages while running payroll. Read on to learn more about your California paid family leave responsibilities. But first, a quick recap on paid family leave.

What is paid family leave?

Paid family leave is a state-mandated law that provides employees with paid family and medical leave for qualifying events. Qualifying events can include the birth of a new child or caring for a seriously ill family member. Depending on the state and paid family leave program, employees can receive up to six to 30 weeks of qualifying leave.

Paid family leave is different from paid sick leave, which employees can use for short-term injuries or illnesses.

You may have also heard of the Family and Medical Leave Act (FMLA). FMLA is a federal law that protects employee jobs while employees are on leave for qualifying events. But unlike paid family leave, the FMLA doesn’t provide employees with paid time off.

California paid family leave FAQs

California paid family leave requires that employers provide their employees with paid leave for qualifying events. Read on for FAQs on paid family leave in California.

What does California PFL cover?

California paid family leave provides employees up to eight weeks of paid time off for qualifying events.

Qualifying events include:

- Caring for a seriously ill family member

- Bonding with a new child

- Participating in an event related to a family member’s military deployment

Is California PFL part of the State Disability Program?

Yes, California’s PFL program is part of the State Disability Insurance (SDI) program. The California SDI program is a partial wage-replacement insurance plan for workers in the state.

SDI is a payroll tax that covers disability insurance and paid family leave.

You must deduct SDI contributions from employee wages. Generally, the deduction appears as “CASDI” on employee pay stubs.

Do all employers have to participate in California’s PFL program?

Yes, all employers must participate.* However, the program is 100% employee-funded. As a California employer, you are responsible for withholding PFL contributions from employee paychecks.

*You or a majority of your employees can apply to the California Employment Development Department (EDD) to provide a Voluntary Plan (VP) instead of SDI and PFL coverage. The VP plan must:

- Offer the same employee benefits as the SDI

- Provide at least one additional benefit that is better than the SDI

- Not cost more than the SDI

- Update to match any increases in benefits to the SDI

When are employees eligible for PFL?

For employees to be eligible for PFL benefits, they must:

- Be unable to do their regular work

- Have lost wages because they need to:

- Care for a family member that is seriously ill

- Bond with a new child

- Participate in a qualifying event related to a family member’s military deployment to a foreign country

- Be employed when their family leave begins

- Have contributed at least $300 to State Disability Insurance during their base period

- Submit a completed claim no earlier than the first day their family leave begins and no later than 41 days afterward their leave begins

- Provide supporting documentation which may include:

- Medical certificate of a seriously ill family member

- Proof of relationship to a child for bonding claims

- Proof of qualifying event for the military deployment of a family member

Once an employee submits a claim, you will be notified by California’s Employment Development Department.

What do employers have to do?

Employers must:

- Inform employees of laws and regulations concerning employment, benefits, and working conditions

- Withhold and send PFL contributions to the California Employment Development Department

- Respond to the EDD for employee claims

If you are an employer with employees who work in San Francisco, you may need to supplement employee wages if they receive PFL benefits for bonding with a new child. For more information, see the Paid Parental Leave Ordinance with San Francisco’s Office of Labor Standards Enforcement.

Can employees opt out?

While the PFL is a mandatory requirement for California employees, some employees can apply to opt out.

An employee can opt out of the paid family leave program if:

- You or a majority of employees in your company apply for a Voluntary Plan in place of SDI coverage.

- The employee adheres to a religious sect, denomination, or organization dependent on prayer for healing. To request an exemption along these grounds, your employee must complete and mail the Religious Exemption Certificate (DE 5067) to the address on the form. If an employee becomes exempt, they will not be eligible to receive SDI benefits.

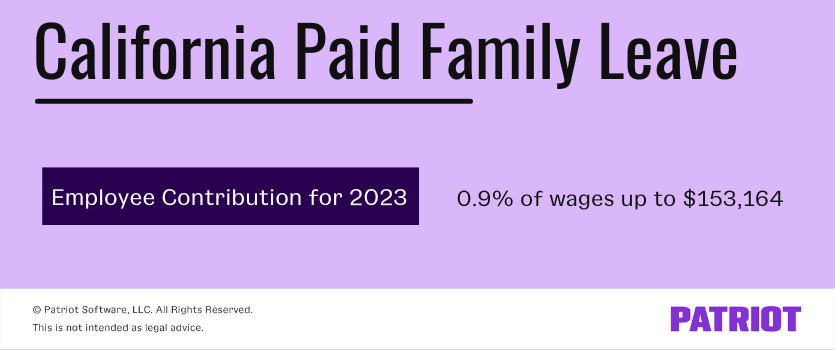

What is the California SDI withholding rate for 2023?

The SDI withholding rate for 2023 is 0.9%. The taxable wage limit is $153,164. And the maximum amount you can withhold from each employee is $1,378.48 (.009 X 153,164).

The SDI withholding rate is the same for all employees. The rate is based on the balance in the SDI fund and the disbursements and wages paid.

Does California PFL protect employee jobs?

No, PFL doesn’t protect employee jobs but does provide paid benefits. Employees may qualify for job protection through other state and federal laws taken at the same time as their PFL.

For more information, direct employees to the following programs:

Can I protest the SDI withholding rate?

No. While you can protest unemployment insurance rates and benefit charges, you cannot protest the SDI withholding rate.

How do I inform my employees about California Paid Family Leave?

You must provide your employees with information about California State Disability Insurance by:

Where do I send my employee contributions?

To send employee contributions to California’s SDI program, you must enroll in California’s e-Services for business.

Once you have an account, you can send your employee contributions to the EDD electronically.

Do I have to respond to employee claims?

Yes, the EDD will notify you of an employee’s claim by sending you a Notice of Paid Family Leave (PFL) Claim Filed (DE 2503F). You must complete and return Form DE 2503F to the EDD within two working days.

How do employees apply for PFL?

The fastest way for employees to apply for PFL is by making a claim through SDI Online. SDI Online allows employees to upload additional documents and manage and update personal information. SDI Online is available 24 hours a day.

Employees can also file by mail by completing and submitting a Claim for Paid Family Leave (PFL) Benefits (DE 2501F). Direct employees to the Employment Development Department’s website for more information about filing by mail.

Do I need to provide claim forms to my employees?

No, employers aren’t required to provide PFL insurance claim forms to employees.

Do I need to make contributions on the wages of independent contractors?

No. If you work with independent contractors, you do not have to withhold contributions to the EDD from their wages. Independent contractors can apply for Disability Insurance Elective Coverage (DIEC).

How can I be covered by paid family leave if I don’t pay into State Disability Insurance?

If you are a small business owner, entrepreneur, independent contractor, or self-employed, you can apply for Disability Insurance Elective Coverage. You must pay into the program before you apply for paid leave.

To qualify for DIEC, you must:

- Own your own business, be self-employed, or work as an independent contractor

- Have a minimum annual net profit of $4,600

- Have a valid license if your occupation requires one

- Perform your normal duties on a full-time basis when you submit your application

- Earn the majority of your income from your trade, business, or job as an independent contractor

- Have a business that isn’t seasonal

- Stay in the program for two complete calendar years as long as your business is in operation in California

For more information on DIEC coverage, contact the DIEC Unit.

Calculating California paid family leave doesn’t have to be difficult. Patriot’s payroll software can calculate and withhold paid family leave contributions for your employees. Try a free trial today and see how easy it can be!

This is not intended as legal advice; for more information, please click here.