Today we’ll discuss the key differences between a mortgage co-borrower and a mortgage co-signer.

While the two phrases sound pretty similar, and are sometimes used interchangeably, there are important distinctions that you should be aware of it considering either.

In either case, the presence of an additional borrower or co-signer is likely there to help you more easily qualify for a home loan.

Instead of relying on your income, assets, and credit alone, you can enlist help from your spouse or a family member.

This may allow you to qualify for a larger loan amount, snag a lower interest rate, or even win a bidding war via a stronger offer.

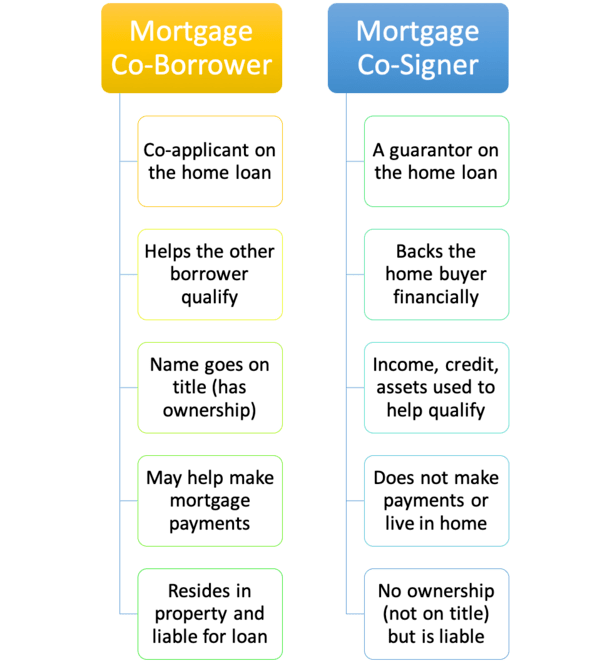

What Is a Mortgage Co-Borrower?

A mortgage co-borrower is an individual who applies for a home loan alongside the main borrower.

Typically, this would be a spouse that will also be living in the subject property. To that end, they share financial responsibility and ownership, and are both listed on title.

For example, a married couple may decide to purchase a home. They apply together as co-borrowers.

Doing so allows them to pool together their income, assets, and credit history. Ideally, it makes them collectively stronger in the eyes of the lender and the home seller.

This could mean the difference between an approved or rejected loa application, and even a winning vs. losing bid on a property.

Just imagine a home seller who is deciding between two competing bids with their real estate agent.

Do they go with the borrower just scraping by financially, or the married couple with two good jobs, two steady incomes, solid pooled assets, deep credit history, etc.

Speaking of that income, two incomes could allow you afford more home.

What Is a Mortgage Co-Signer?

A mortgage co-signer is an individual who acts as a guarantor on a home loan and takes responsibility for paying it back should the borrower fail to do so.

In that sense, the co-signer acts as a sort of safety net, and not an active participant.

This means they don’t make monthly payments, nor do they reside in the subject property.

Perhaps more importantly, they do not have ownership interest in the property. However, they share liability along with the borrower(s).

To be blunt, they get all the potential bad without any of the good, i.e. ownership.

But the whole point of a co-signer is to help someone else, so it’s not about them. A common example is a parent co-signing for a child to help them buy a home.

Both their income and credit history can come into play to help their child get approved for a mortgage.

For the record, someone with ownership interest in the property can’t be a co-signer. This includes the home seller, a real estate agent, or home builder. That would be a conflict of interest.

Mortgage Co-Borrower vs. Mortgage Co-Signer

What Is the Credit Score Impact for Co-Borrowers and Co-Signers?

As a co-signer, you are responsible for the loan for the entire term, or until it is paid off via refinance or sale.

This means it’ll be on your credit report and any negative activity (late payments, foreclosure) related to the mortgage will carry over to you.

There are also credit inquiries, though these usually have a minimal impact.

However, it’s possible the on-time mortgage payments can help you credit over time, per Experian.

The other issue is it may limit your borrowing capacity if you’re on the hook for the loan, even if you don’t pay it.

Its presence could make it more difficult to secure your own new lines of credit or loans, including your own mortgage, if wanted, due to DTI constraints.

If you’re a co-borrower on a mortgage, credit impact will be the same as if you were a solo borrower. There will be credit inquiries when applying for a mortgage.

And the loan will go on your credit report if/when approved, and payment history will be reported over time.

On-time payments can increase your score, while missed payments can sink your score.

What About a Non-Occupant Co-Borrower?

You may also come across the term “non-occupant co-borrower,” which as the name implies is an individual on the loan who does not occupy the property.

On top of that, this person may or may not have ownership interest in the subject property, per Fannie Mae.

This differs from a co-signer, who does not have ownership interest as indicated on title.

But both must sign the mortgage or deed of trust, and will have joint liability along with the borrower.

On FHA loans, a non-occupying co-borrower is permitted as long as they are a family member with a principal residence in the United States.

If not a family member, or for 2-4 unit properties, a 25% down payment is required (max 75% LTV).

Either way, the non-occupant co-borrower takes title to the property, unlike a co-signer who does not.

Note that co-signers or non-occupant co-borrowers are not permitted on USDA loans.

And for VA loans, a co-signer must be a spouse or active duty/veteran who resides in the property.

Most lenders do not allow non-occupying co-borrowers on VA loans, though a “joint loan” may be an option.

When Not to Use a Co-Borrower for a Mortgage

Believe it or not, there are times when using a co-borrower could do more harm than good.

The most common example is when the prospective co-borrower has poor credit, or even marginal credit.

Because mortgage lenders typically consider all borrowers’ credit scores and then take the lower of the two mid-scores, you won’t want to add someone with questionable credit (unless you absolutely have to).

For example, say you have a 780 FICO score and your spouse has a 680 FICO score. You plan to apply jointly because they’re your spouse.

But then you find out that the mortgage lender will qualify you at the 680 score. That pushes your mortgage rate way up.

In this case, you may not want to use the co-borrower unless you need them for income purposes.

They can still be on title and get ownership in the property without being on the loan.

How a Co-Borrower’s Higher Credit Score Can Make You Eligible for a Mortgage

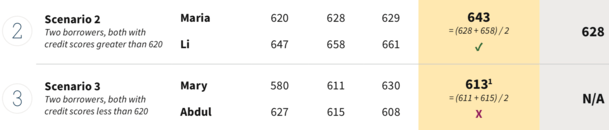

Recently, Fannie Mae instituted a new method for determining eligibility when there’s a co-borrower.

They take the median score of each borrower and combine them, then divide by two (the average).

For example, imagine borrower 1 has scores of 600, 616, and 635. They’d typically use the 616 score and tell the borrower it’s not good enough for financing.

Now suppose there is a co-borrower (borrower 2) with FICO scores of 760, 770, and 780.

Fannie Mae will now combine the two median scores (770+616) and divide by two. That would result in an average median credit score of 693.

This allows borrower 1 to comply with Fannie/Freddie’s minimum 620 credit score requirement (for conforming loans).

Note that this is just for qualifying, and only if there’s a co-borrower. And it doesn’t apply to RefiNow loans or manually underwritten loans.

Additionally, pricing (and mortgage insurance if applicable) is still determined by the representative credit score (616).

So together you qualify, but the mortgage rate might be steep based on the lower credit score used for pricing.

Note that not all lenders may allow a borrower to have a sub-620 credit score, regardless of these guidelines (lender overlays).

How to Remove a Mortgage Co-Borrower or Co-Signer

While it can be nice to have a mortgage co-borrower or co-signer early on, they may want out at some point.

There are a variety of reasons why, possibly a divorce, possibly to free up their own credit.

Fortunately, it can be done relatively easily via a traditional mortgage refinance.

The caveat is that you’d need to qualify for the new home loan without them. Additionally, you’d want mortgage rates to be favorable at that time as well.

After all, you won’t want to trade in a low-rate mortgage for a high-rate mortgage simply to remove a borrower or co-signer.

A common scenario might be a young home buyer who needed financial assistance early on, but is now flying solo.

They could refinance and alleviate the possible stress/financial burden of the co-signer and finally stand on their own.

Alternatives to Using a Co-Borrower/Co-Signer

If you’re unable to find a willing co-borrower or co-signer to go on the loan with you, there might be alternatives.

First, determine what the issue is, whether it’s a low credit score, limited income, or a lack of assets.

Those with low credit scores may want to consider improving their scores before applying. Aside from making it easier to get approved, you could qualify for a much lower interest rate.

Those lacking income/assets can look into options that require little to no down payment.

For example, both VA loans and USDA loans don’t require a down payment.

There is also Fannie Mae HomeReady and Freddie Mac Home Possible, both of which require just 3% down and allow boarder income (roommate) to qualify.

Or inquire about grants and down payment assistance via a local lender or state housing agency.

There are many mortgages that require very little down and next to nothing in terms of assets/reserves.

You may also consider lowering your maximum purchase price if these issues persist.

Another option is using gift funds to lower your LTV ratio and loan amount, thereby making it easier to qualify for a mortgage.