With the U.S. economy predicted by many experts to slow down in the near future, many people’s thoughts have turned to the prospect of a recession. And along with those expectations may come concerns for those still in the workforce about the possibility of layoffs, and needing to get by without income for an unknown period of time. Such periods can be fraught with anxiety, since beyond ‘just’ the fear of losing one’s livelihood is the realization that there is little way to control whether or when one is laid off. This uncertainty makes it difficult to prepare for the possibility of a layoff, since there is often little real knowledge of what to prepare for.

Financial advisors with clients who are worried about being laid off can play a role in alleviating those worries by helping the client regain a sense of control over their future. And while there are many things to consider when planning for a layoff, these considerations can be grouped into two distinct types of conversations.

First, the advisor can help the client take stock of their current situation to assess their current preparedness for a layoff. This can include inventorying the client’s ‘safety net’ (i.e., the asset and debt options they have available to use if they aren’t employed), listing their essential expenses, and using those figures to estimate how long of a layoff they could potentially sustain. Additionally, there are some actions that may be best to get done before the client loses their employee benefits, such as getting medical work done, using FSA funds, and obtaining individual life and/or disability insurance.

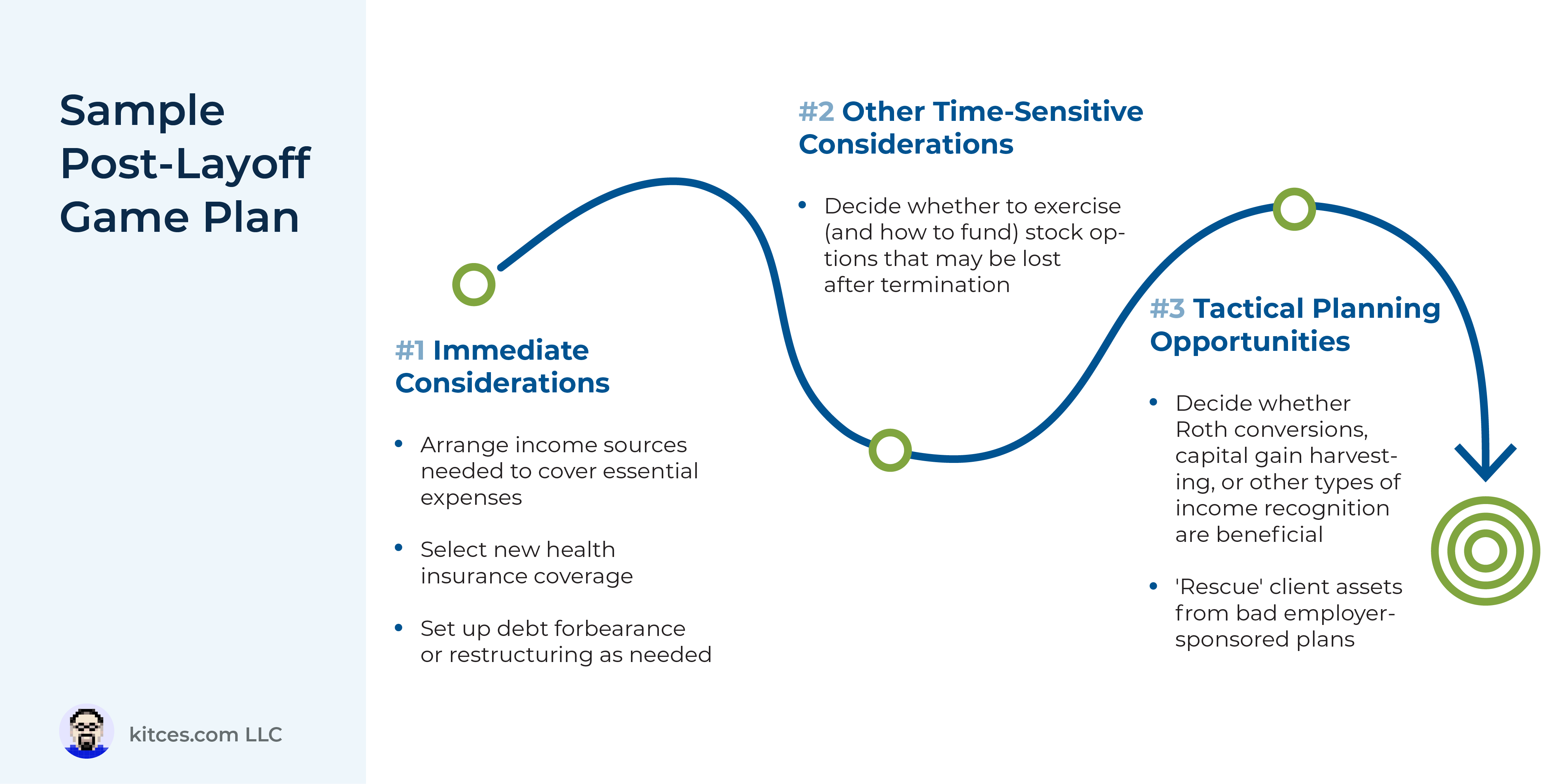

Next, the advisor and client can make a ‘game plan’ which would take effect if the client is actually laid off. These actions can go in order from most to least urgent: starting with immediate concerns (like setting up sources of liquidity, finding new health insurance, and reducing expenses), moving to less-urgent but still time-sensitive tasks (like exercising employee stock options), and finally taking advantage of potential tactical planning opportunities (like making Roth conversions to take advantage of a low-income year or rolling over assets from an undesirable 401(k) plan).

The key point is that although advisors can’t reduce the probability of a layoff themselves, they can reduce some of the feeling of stress and anxiety felt by clients who fear a layoff is coming. Because, even though the game plan for being laid off will ideally never be used because the client is never laid off to begin with, there is peace of mind in having a strategy for when things go wrong. And if the worst case does happen, having a plan already set up to ensure the client’s financial security can help ensure they can focus on finding their next opportunity!