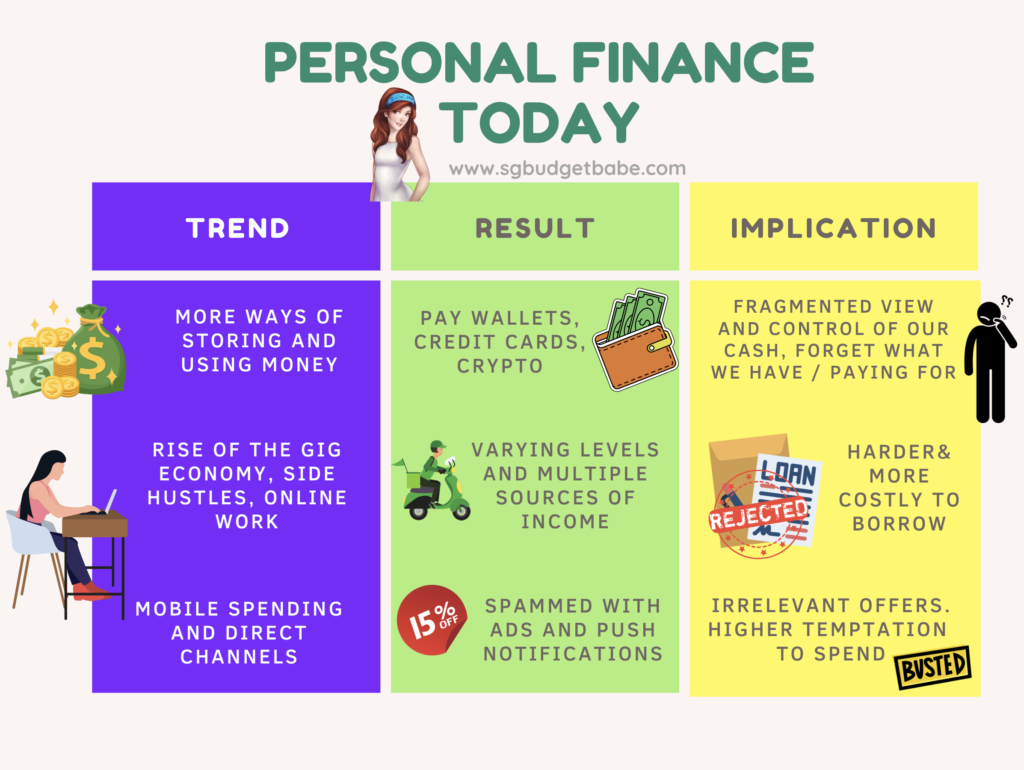

Managing one’s personal finances today looks very different from what it used to be for our parents’ generation. No wonder more people are falling behind and are unable to get a proper grasp on their finances, much less control and plan for it. By learning from Europe, a possible solution lies on the horizon, but it’ll take regulatory mandate, consumer behaviour and businesses to all come onboard for it to change. Can Open Finance be our answer?

For almost a century, the norm was a single source of income and a single bank account; today, many of us have at least one side hustle and our money parked across different banks and instruments to get the most out of it. In the past, all payments were made manually so there was control and visibility; today, automated payments mean that we often don’t realize that we might still be paying for something we’ve stopped using a long time ago.

With inflation pushing our expenses up, it becomes even more crucial that we understand where our money is going, but that’s a difficult task. Just looking at credit cards alone, most of us have multiple cards and there’s a real headache in figuring out which card we should even be using. Back in 2018, I partnered with a reader and we launched an app to address this problem, but as our resources ran out, we were no longer able to keep it going.

There’s a growing need to understand our expenses, but the problem is that there are no easy solutions now. Spreadsheets are boring and cumbersome. So then, what can we consumers do?

The limitations of SGFinDex

Europe may have the answer, where regulators are in the midst of setting up a framework for Open Finance i.e. sharing of financial data among different players. Their previous Payment Services Directive (PSD2) was the world’s first regulatory initiative to open up bank-held account data, and many countries then followed suit. Singapore’s own SGFinDex has been a great step forward, but it is still limited to only member financial institutions so there remain several challenges:

- Customers of several insurers or banks are still being left out e.g. FWD, AIG and CIMB.

- The only apps we can use to make sense of SGFinDex data right now are all owned by financial institutions (FIs), whose agenda would be to naturally push their own products and services to us.

In the last year, many of you have confided in me about your skepticism towards SGFinDex and sharing your data on one of the banks’ app, as you shared concerns about whether that will be used to promote products or services to you that aren’t always in your best interest.

Some examples would be to encourage you to take on a short-term balance transfer just because you have unused credit left on your card, or to push for more critical illness insurance because you’re perceived to be “underinsured” by LIA’s definition.

Withholding information about offers can also be a problem – today, most discounts are given to incentivize further spend, instead of helping consumers save more on existing spend. Your bank can now see you tend to spend more on dining out, but are they using that to recommend that you switch from your current credit card (2.5%) to another card of theirs that can give you higher rewards (5%) on the same spend? Or, if the best credit card for dining is in fact from another bank, what’s in it for them to tell you that?

Sharing data in exchange for financial benefits

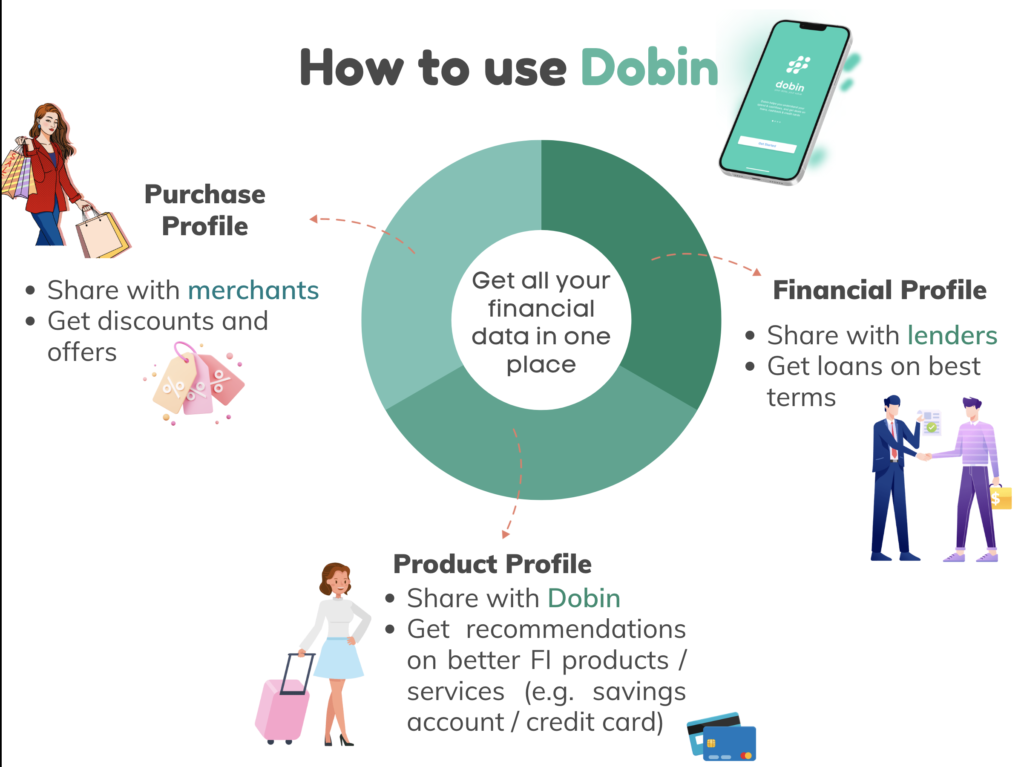

In an ideal world, I’d like to be able to use an independent, third-party app with SGFinDex instead so that they can consolidate relevant offers (across different FIs and merchants) and match them to me. I’d also prefer not to have a single FI have 100% visibility of my data, meaning I’d rather segment my data sharing into the following:

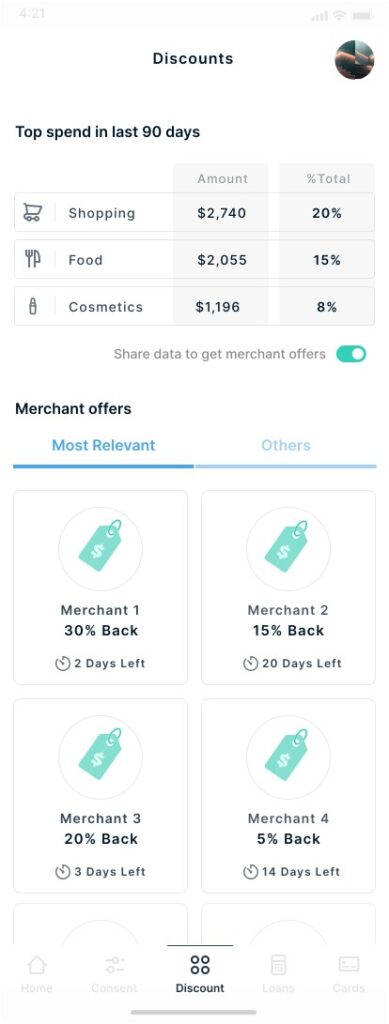

- “Shopper Profile” – let my current spending habits be shared with merchants so I can be presented with discounts

- “FI Profile” – let my data be shared with FIs in exchange for tailored recommendations on suitable credit cards, saving accounts or other FI-services

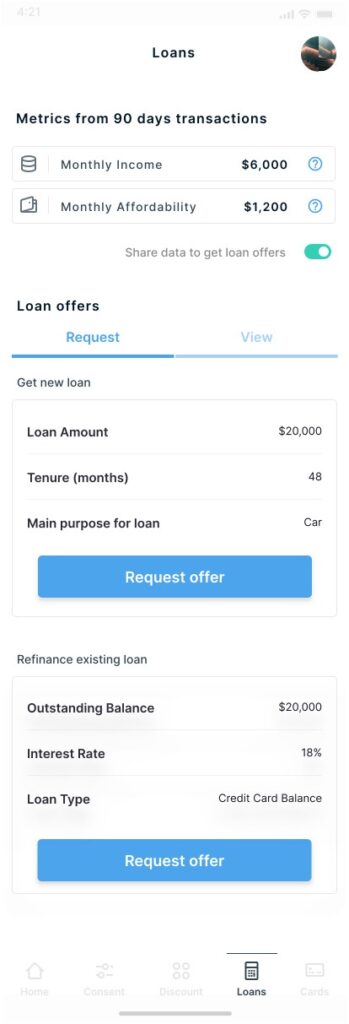

- “Borrower Profile” – let my income and assets be shared with lenders so I can access credit and reduce my cost of borrowing, whenever I want a new loan / refinance an existing credit facility.

So imagine my excitement when a reader emailed me to ask if I’ve heard of Dobin, which is an app that helps individuals track your money and share your data in exchange for the financial benefits that YOU want.

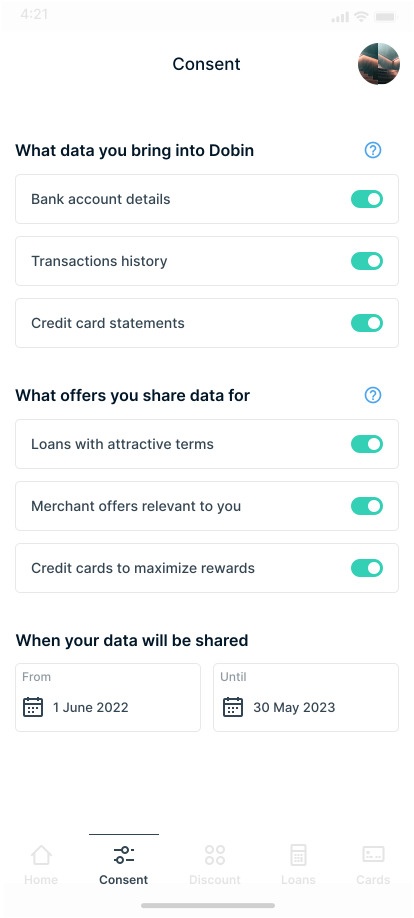

As it is a consumer-led value exchange proposition, the user is the one who controls the sharing process and parameters. Should we choose to share our data (or even parts of it), in exchange, we can get meaningful discounts, the best credit cards and loans with best terms tailored for us.

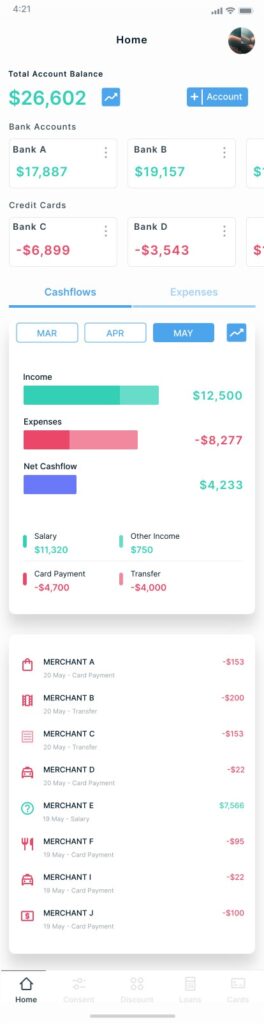

Upfront, you can use it to automatically aggregate your financial data (balances, expenses, income) across all your bank accounts and credit cards so that you can view and track your consolidated balance, cashflows and expenses. You can sync transactions in real-time whenever you want, unlike SGFinDex which is done once a month.

It lies in Open Finance, specifically, where you exchange your data for the financial benefits that YOU want.

As you can see, there are huge similarities with the ideals I had in mind (albeit executed differently at Dobin). This alone was intriguing enough for me to reach out and ask for early beta access. Although my request was turned down, I did get to meet the Dobin team in person and experimented with the beta version of the app, so I could share more details with you guys.

Sponsored Message Dobin believes in the power of data working for the consumers, and partners with financial institutions and merchants that can help them build this.

Here’s what I liked:

The first thing that stood out to me is how consolidating our data on Dobin does NOT mean it gets shared with them nor all of their partners automatically. Instead, we get to choose and control what we want to share, and for how long. There’s a clear value exchange here which is up to the consumer to dictate.

Even if you don’t want to share your data, the biggest and immediate benefit is to finally be able to see our assets and expenses in a single place.

This will make it easier to get a sense of your personal finances, and even better, you might just be able to uncover hidden fees and cut unnecessary spend when you review the data regularly.

But if you want to get more out of the app, I would think sharing your data is the way to go.

What’s even better is that you can revoke access to your data anytime.

I really dislike the worthless discounts and spammy offers that I keep receiving. Now, you can share your anonymised data (Purchase Profile) and in turn, receive discounts and save more on your usual spend. For instance, Dobin can recognize that you’ve been buying stuff from Lazada, and thus present you with a Lazada voucher that you haven’t been using.

Of course, this is where I also think Dobin can do better by onboarding more merchants, so that there can be more value for each user who decides to share their Purchase Profile. This will take time, but I know the Dobin team is already working on it, so I’m hopeful.

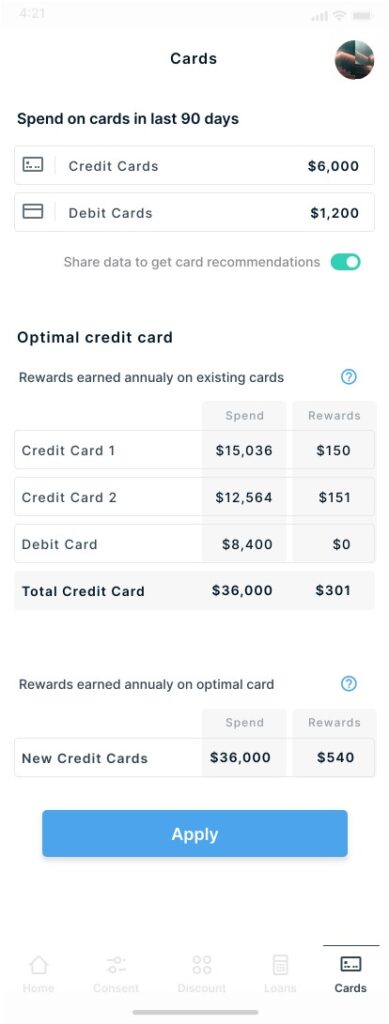

A savvy consumer would make sure they’re getting rewarded for their spend. But how much rewards did you really get from swiping your credit card last month? Well, as it turns out, not as much as you thought.

And when you share that data (Product Profile) with Dobin, the app can recommend which might be a better credit card for you.

You can then use this information as a starting point to help you narrow down which cards might suit you better and do more research before you make a switch.

I find this a super powerful feature, and one that no one else in Singapore currently offers. Because the information we share is limited on third-party comparison websites, yet existing apps primarily recommend their own bank cards to us, only a player like Dobin can solve this problem.

What about when it comes to refinancing for lower interest rates, or getting a loan for your short-term needs? Dobin can help too.

A private hire driver, for instance, does not fall within traditional borrowing guidelines when it comes to preferred customer profiles, but could in fact be earning $6,000 a month and has great credit history.

With Dobin, when you choose to share your data (Financial Profile) at times when you’re looking to refinance or get a new loan, they can show the lender that you’re a worthy borrower, and get you loan offers on best terms to compare between.

Excited? So am I.

How to access Dobin

The Dobin team is still toying with the idea of whether it’ll be a paid or free app for now, but to be frank, I’ll willingly pay $50 a year if that’s what it’ll cost to get this kind of access.

Unfortunately, we’ll only be able to use the app to study our data for real when Dobin launches in end-March, but only to a small beta group due to resources. If you didn’t join their waitlist prior to end-February, you may or may not be within this group.

But guess what? I’ve got you covered.

I know a lot of you are like me (and that’s why you’re reading this blog, right?) so the good news is, I’ve secured 100 spots for SGBB readers to try out the app before anyone else. And should the team decide to make it a paid app, then you’ll get to enjoy it free for at least the first year.

Click here to claim yours now!

Sidenote: If you’re reading this at a later date and the link above no longer works, then it means all 100 spots have been taken up. Sorry! I won’t be able to ask for any more.

Change is coming

An independent third party – like Dobin – who understands the need to balance the consumer’s wishes vs. commercial objectives would be best placed to solve this issue.

It is a reflection of our times that an app like Dobin can finally come to fruition (marrying Open Finance and advanced data analytics, which only came into being in recent years), and I’m tremendously excited about what’s ahead.

Click here to reserve your spot now.

Disclosure: This article was inspired after I got to try out the app (ahead of time), and has been fact-checked by Dobin for accuracy on their features and technical processes. All opinions are that of my own.