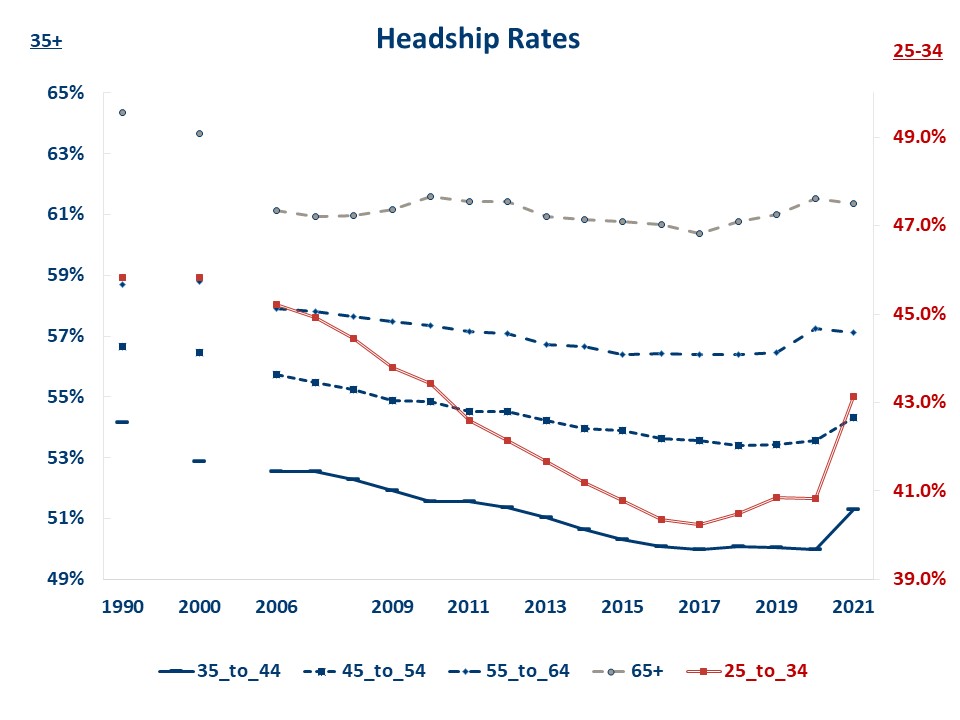

NAHB’s analysis of headship rates from the latest 2021 American Community Survey (ACS) reveals that the Covid-19 pandemic unlocked some pent-up housing demand, especially among young adults ages 25 to 34. The pandemic-heightened desire for more spacious and independent living, as well as “excess” savings accumulated early in the lockdown stages of the pandemic, propelled headship rates of young adults by two percentage point to 43.1%, the highest level since 2010. Nevertheless, constrained by a persistent structural housing shortage and the inability of builders to ramp the production up to meet the surge in pent-up demand, headship rates did not reach the historic norms of 1990-2000s.

Headship rates – share of people who are household heads – tell us how many households are formed for a given population. The higher the headship rate, the more households are formed, and the more housing units are needed to be built. For decades, U.S. headship rates of young adults have been declining, suggesting the U.S. housing market has been missing millions of new young adult households. Close to 46% of adults ages 25 to 34 were household heads in 1990 and 2000. Since that time, headship rates for this age group have been declining relentlessly and hit a bottom reading of 40.2% in 2017.

Reflecting improving housing affordability, headship rates for young adults started to rise in 2018 before the pandemic rocked the housing market, but the gains were modest at that time. Nevertheless, it was a hopeful indicator that the troublesome trend of rising shares of young adults living with parents, relatives or sharing house with roommates finally reversed.

It took the pandemic to move hundreds of thousands of young adults out of their home sharing arrangements with parents, other relatives and roommates. Between 2019 and 2021, the share of young adults living with parents declined 1.5 percentage points from 21.2% to 19.7%, the share living with other relatives dropped from 5.1% to 4.8% and the share of those sharing housing with roommates decreased 1.4 percentage points from 7.2% to 5.8%.

The pandemic-expedited formation of independent households by young adults is succinctly reflected in a 2.3 percentage point jump in headship rates. 40.3% adults ages 25 to 34 were household heads in 2019. Two years of the pandemic brought this share to 43.1%. The share of unmarried partners co-leading independent households also registered substantial gains over the pandemic, rising 1.1 percentage points from 6.2% to 7.3% over the course of 2 years. The share of married partners remained at a record low 17.1% reflecting a persistent demographic trend of declining marriage rates that remained largely unaffected by the pandemic.

Despite these significant gains, headship rates remain low by historic standards of 1990-2000s when close to 46% of young adults were leading independent households. It has been suggested that young adults merely postponed the decision to lead their own households, and what was the typical household-forming behavior in their late 20s a decade or two ago now happens in their late 30s. As of 2021, there is limited evidence to support this hypothesis. While household formation rates for the 35-44 year old group improved during the pandemic, they nevertheless remain historically low. In fact, headship rates across all age groups did not reach their historic norms despite substantial gains registered during the two years of the Covid-19 pandemic.

This suggests that while the pandemic was able to unlock some pent-up housing demand, especially among young adults, it was not released completely. Home builders could not ramp production up fast enough to meet the surge in pent-up demand. Instead, the unmet portion of the demand drove vacancy rates to record low levels. NAHB Economics compared the 2021 abnormally low vacancy rates to historic norms and estimated that 1.5 million units, almost equally split between rental and for sale units, were required to close the gap and bring vacancy rates to long-run equilibrium levels.

Related