Seems like everyone on Twitter (if they didn’t just disappear already) scrambled to post their 2022 returns this year, either to bury a horrific result in the New Year’s rush, or because they’re one of the few who can boast a minor loss (or even a gain!) last year. As always, especially if you’re nursing your own portfolio (& pride) after an excruciating year, you should take all of this with a grain of salt…because, alas, it’s Twitter’s job to surface the outliers & the blowhards, so #FinTwit is definitely NOT a good (or even accurate) benchmark to reference as an investor in good years, let alone bad.

But as always, I’m here with a genuine/auditable portfolio, where all changes (if any) to my disclosed holdings have been tracked here & on Twitter on a real-time basis, for over a decade now. [Seriously, if you’re a new reader, take a peep: There’s countless posts on old & current portfolio holdings, plus my entire investing philosophy & approach…some of which may even be useful & interesting today!] And this year, my main (selfless) purpose is to make you feel better about your own performance. ‘Cos yeah, you probably did much better than me…and if you didn’t, maybe you should question your investing choices!? And I want to remind you: a) it could be worse, there’s plenty of bad ‘investors’ out there who’ve been trapped in a savage bear market for two years now (since Q1-2021), and b) once again that, esp. noting the past year, nobody knows anything…

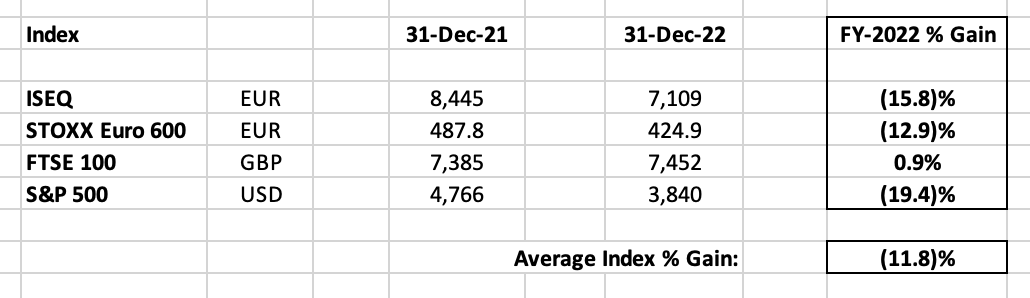

So let’s jump right in, here’s the damage in benchmark terms – my FY-2022 Benchmark Return is still* a simple average of the four main indices which best represent my portfolio, which produced a benchmark (11.8)% loss:

[*NB: As I flagged this time last year, I adopted the STOXX Euro 600 as my new European index in 2022.]

This overall (11.8)% benchmark loss is somewhat deceptive, as it was significantly offset by the value bias in the European index, and particularly in the FTSE 100 index which actually managed to squeeze out a gain for the year. [Though notably, for US investors, this was offset by the dollar’s perverse strength, so there’s still little chance of seeing them diversify away from their all-in home-bias]. It was also mitigated by the resilience of many large-cap sectors, such as consumer staples. Whereas down below, in smaller-cap/risk-on parts of the market, the carnage was much worse…the FTSE 250 was down (20)%, Russell 2000 was down (22)%, MSCI Emerging Markets USD Index was also down (20)%, while the MSCI Frontier Markets USD Index was down (26)%. The AIM All-Share Index did even worse, with a (32)% loss – for once, silencing most of the perennial #UKFinTwit winners – while the crypto market’s Total Market Cap collapsed by (64)%.

This is what happens when the Fed defies expectations, and decades of market history, to keep raising interest rates…producing a near-250 bps rise in the 10 Year UST to 3.88% as of year-end (after peaking at 4.33% in October). And nobody really saw it coming…who’d have thought Powell would actually try reimagine himself as Volcker-reincarnated?! Once again, ‘Don’t fight the Fed!’ proved the best piece of market wisdom. But that being said, I’d have to disagree with (some aspects of) the consensus. I think the whole higher interest rates/lower DCFs view of the market is far too naive (& quantitative) – while risk-free rates (& equity risk premiums) obviously move higher or lower, often for years at a time, I think it’s silly to assume some implied long-term market discount rate just marches up & down in lock-step. [And I note the same people who insisted the market shouldn’t have rallied over the years on QE-induced zero/negative interest rates, are the same people who insisted the market should & did collapse in the last year because of rising interest rates!?] In reality, human fear & greed is still the primary market driver – an unexpected Fed stance sparked confusion & fears of higher interest rates, lower market prices, slower growth & potential recession, which ignites selling, then selling begets selling, and soon price is entirely driving narrative…and this spiral continues to feed on itself, ’til we finally reach some type of capitulation. [I don’t agree with the doomers who insist the next leg of a #GFC repeat-meltdown is coming…there’s nothing like the same leverage in the banking/financial system today].

I’m also puzzled by the disconnect between the Fed’s ultra-aggressive rate hikes, and investors (& voters) shrugging their shoulders over another debt ceiling contretemps in Congress. How do you square tight monetary policy with an unprecedented & ultra-easy fiscal policy – a $1.4 trillion budget deficit last year (the fact it’s down from a $3.1T+ pandemic peak doesn’t make it any less bad), quite possibly a larger budget deficit this year, and $31.4T of government debt now outstanding (on which the run-rate cost could easily be an additional $0.5T government spending at today’s interest rates). Not to mention, a ‘tight’ monetary policy isn’t what it appears in real terms either – with inflation still at 6.5% (vs. a 3.68% 5 Yr UST today), from a 9.1% peak last June. In my opinion, we’re just looking at a different version of the usual US Presidential cycle: Year two is when you tighten – after 50+ years of deficits (& a pandemic spending frenzy), government’s totally incapable of doing that via fiscal policy. Biden was also doing really badly in the polls…for many reasons, but not-so-transitory inflation was the most obvious & palatable reason, and fighting it would also complement the whole ‘fighting for the workers, and punishing the millionaires & billionaires’ narrative. Therefore, I suspect the White House required an always-compliant Powell (who was also seeking re-appointment) to tighten via shock & awe interest rate hikes, setting the stage for falling inflation & the opportunity to again juice the economy & market in 2023 (in response to a potential recession, which hopefully the market’s already discounted anyway), and ideally a glide-path to successful Democratic elections in 2024. If I’m making Biden sound incredibly smart here, I’m really not…as with most politicians & government, most of this happens by default (& by the seat of their pants), i.e. they fix the most obvious looming problem, then fix the next looming problem that resulted from them fixing the last problem!

Frankly, I think technology innovation & deflation (actually, a very good thing!) will keep bailing us out here, especially now we stand on the cusp of the Fourth Industrial Revolution. I suspect we may look back in time on this period as just another blip on the economic/market charts, and convince ourselves we’ve actually invented a new paradigm of near-unlimited (pandemic-inspired) spending & debt, while also learning to control inflation (once again). And I’m still not convinced this is not just another leg in the greatest bubble ever…

But c’mon, why should you listen to anyone pontificate about big-picture macro, let alone me…who got blindsided by the Fed last year, and severely underperformed my benchmark index. Nobody knows anything, but we’re always fooled into thinking the macro outlook will be so much clearer once/if we can just get past the next few difficult/confusing months ahead…so all we can really do is focus on stock-picking, diversification & building up the mental resilience to be a true long-term buy & hold super-investor.

OK, that’s enough bitching, moaning & excuses – here’s the real damage – my own Wexboy FY-2022 Portfolio Performance, in terms of individual winners & losers:

[Gains based on average stake size (with TFG the only portfolio holding that marginally changed, due to its DRIP) & end-2022 vs. end-2021 share prices. All dividends & FX gains/losses are excluded!]

[*Alphabet end-2021 share price adjusted to reflect the 20-for-1 stock split in Jul-2022. **Donegal Investment Group FY-Gain adjusted to reflect 46.2% of o/s shares redeemed at €15.30/share in Feb-2022.]

And ranked by size of individual portfolio holdings:

And again, merging the two together – in terms of individual portfolio return:

And yeah, that’s a savage (44.8)% loss for the year…

And it specifically reflects a technology bear market (crypto is just early-stage tech), with my other portfolio holdings’ gains & losses actually offsetting each other – what better argument is there for more (not less) diversification? Especially when my underperformance is entirely attributable to KR1 – eliminate this holding, and my portfolio loss would actually have been limited to (13.7)% & broadly in line with my benchmark. But of course the haters who dismissed & excluded KR1 as a dumb outlier YOLO bet when it produced blockbuster returns/outperformance in my portfolio will turn up like bad pennies to rigorously insist it should obviously be included now…

More fairly though, they can query a 24.0% portfolio allocation to KR1 at the beginning of last year, which now looks inexplicable & irresponsible…what the hell kind of diversification was that?! But I’ve been very explicit about this…for readers, followers & current/potential KR1 investors, I’ve repeatedly emphasized a 3-5% KR1 holding is perfectly sufficient as a reasonable/diversified crypto allocation in almost any portfolio. But personally, my net cost base in KR1 is negligible (so right or wrong, I’m pretty much betting house-money here), it’s still a huge multi-bagger for me, it’s still so early for crypto & KR1 and both continue to offer asymmetric risk-reward potential, and in reality the downside risk here won’t ultimately impact the overall health & wealth of my portfolio…as Bill Gurley noted recently ‘you can only lose 1x’ on a holding, and it’s more important to ‘think about what could go right’! So yes, this has obviously proved to be a painful outlier decision in the short-term, but hugely rewarding in the longer-term (& still to come, I anticipate!).

And oddly enough, my Alphabet holding’s given me more heartburn…not because I ever considered bailing out of it, but because realistically I never expected to see the stock decline so much in a single year. And I don’t know whether this makes sense or not, but when $GOOGL is down (39)% & barely outperformed my overall (45)% portfolio return, KR1’s collapse doesn’t actually seem so exceptional after all. And KR1’s performance here is in the context of my disclosed portfolio, so thankfully its impact is mitigated IRL…i.e. it’s obviously a significantly smaller holding in relation to my actual overall disclosed & undisclosed portfolio. I was also blessed with two undisclosed holdings which were significant out-performers last year, in absolute & relative terms – both are (primarily) #content companies & Top 5 portfolio holdings for me today (in fact, one has surpassed Record plc to become my top holding), which is an astonishing outcome in a year where the headline content companies ($DIS, $NFLX, $WBD, $PARA) actually declined by (50)% on average!

But again, the stocks/performance that matter here are what you find in my auditable/disclosed portfolio…and as always, we can’t focus/obsess too much over a single calendar year’s return, no matter how good or bad. What really matters is what comes before (& ultimately after)…the buried lede here is my performance punchline, here’s my Wexboy FY-2020 Portfolio Performance:

And my Wexboy FY-2021 Portfolio Performance:

In an ideal world, after a +56.4% gain in 2020, followed by a further +133.8% gain in 2021, obviously you’d cash out everything at the top, doze off on a big pile of money, and wait happily & patiently for the next bear market capitulation. Alas, investing (& real life) is just not like that – except in some of those old-school investment newsletters, apparently – and if I tried to play that game, I have little faith I’d have the actual mental fortitude & sheer bloodymindedness required to hang on & rack up those kind of gains. But our minds always want us to believe we can have our cake & eat it too – and of course we just KNEW the current bear market was coming – but that’s our brains bamboozling us with hindsight, and our brains helpfully forgetting all the other (imaginary) bear markets we saw coming & all our previously botched market timing adventures. It’s a simple truth: If you ever hope to make huge long-term multi-bagger gains, you have to accept you’ll also suffer huge reversals along the way! And in the end, bearing that in mind, I can happily accept & celebrate what’s turned out to be a cumulative/net +102% gain over the last three years!

And now, since it’s been a full year – my apologies for skipping my usual mid-year review in 2022 – here’s an up-to-date look at each of my disclosed portfolio holdings:

FY-2022 (22)% Loss. Year-End 1.3% Portfolio Holding.

Saga Furs kicked off last year trading on a sub-4 P/E & looking primed for continued gains, after a pandemic bounce-back delivered its best revenue & earnings in recent years (FY-2021 auction sales of €392M & €3.63 EPS). Alas, poor auctions subsequently erased hope of a sustained recovery, and sank the stock, with investors presuming more of the same cyclicality we’ve seen over the last decade+, as Chinese producers (& buyers) came to dominate. Fortunately, a late surge in demand (Sep sale was up 100%+ at €123M) & continued rationalization produced a (positive) profit warning, with FY-2022 now marginally profitable (as confirmed late last week).

While this is good news, the FY-2022 results obviously don’t move the needle here. That’s frustrating, as my original/core investment thesis that Saga Furs was a unique auction house business in a niche luxury sector was correct…despite all the ‘but it’s fur!’ doubters. Saga sells more pelts now than a decade ago, not forgetting a Millennial generation who went gaga over fur-trimmed Canada Goose coats (with $GOOS peaking at an $8B market cap some years back)! But I didn’t anticipate the Chinese imposing a step-change in fur prices (lower), or consumers embracing lower prices for poorer quality/welfare pelts.

That means Saga remains, in the absence of a value-realization event, a micro-cap value stock…but not a value trap, as it continues to generate earnings (on average) & its strong balance sheet supports a higher dividend payout. It was on a massive 17% yield – but the new proposed dividend is insignificant – and averaged a €0.70/5.9% annual dividend over the previous 5 years. It also trades at a near-50% discount to its latest €22.82 equity/share, which I remain confident could be wound down relatively quickly for 100+ cents on the euro, if an ultimate trade/PE sale doesn’t materialize here (which seems to be the end result for its defunct Danish rival Kopenhagen Fur, with no obvious sign of a buyer for its legacy business/brand).

ii) Donegal Investment Group ($DQ7A.IR)

FY-2022 +23% Gain (exc. share redemption). Yr-End 1.3% Portfolio Holding.

Have you ever seen such a successful investment (a low-risk six-bagger in a decade) end up such a small position in a portfolio?! Seems like a contradiction, but attests to how effective a share cannibal Donegal’s been over the years (via share redemptions), and how bad I was at accumulating more shares to replace the ones I ‘lost’ along the way. And serves as a frustrating reminder of how easy it is to get waylaid into buying new & more exciting holdings instead, and how averaging up on a good stock (even a multi-bagger!) can be such a good investment proposition.

With the sale of Nomadic Dairy in late-2021, and another €20 million share redemption in early-2022 (at €15.30/share, for 46% of the company’s outstanding shares), we’re close to the end-game here. Sure, I’ve probably said that before, but now it’s a matter of timing with one major deal left outstanding, i.e. sale of the seed potato business. This has triggered the elimination of the head office (& its staff) last March, for €1 million pa in cost savings, with the CEO & CFO retained via non-executive consultancy agreements (while remaining on the board).

Seed potato revenue is pretty stable at €25.2 million, while current profitability’s impacted by COVID/supply-chain issues – but in normal years, its operating margin averaged in the high single-digits (& maxed out around 10%). However, Donegal’s head office, board, listed company expenses, etc. is fully absorbed by its business units, so seed potato margins have always included some/all of this significant cost-allocation. It also boasts a multi-year R&D pipeline, while its overall IP portfolio is potentially far more valuable in the hands of a larger acquirer. [Management could also acquire the seed potato unit/Donegal in a final transaction, but I rely on engaged stakeholders like Pageant Investments/Nick Furlong (with an 11%+ stake) to ensure a fair sale process/price here.] Therefore, I peg the seed potato business’ M&A value at a substantial premium to its revenue run-rate – together with €2.9M net cash, €1.3M of property/other investments & €2.4M of contingent consideration receivable in 2023 from the Nomadic sale (I suspect this reflects a 50% haircut & a max. €4.8M consideration will be received), Donegal Investment Group remains a compelling/low-risk investment trading on a €30M market cap.

iii) Tetragon Financial Group ($TFG.AS)

FY-2022 +13% Gain. Year-End 2.0% Portfolio Holding.

Tetragon Financial was another value beneficiary – inc. dividends, my actual return was +18% last year. But big picture, nothing much has changed…investor sentiment’s consistently negative – a classic example of price driving narrative – with the relentless widening of Tetragon’s discount to extraordinary levels (a 66% NAV discount today) & a high dividend yield policy over the years, less & less shareholders boast a capital gain on the stock, which escalates negative sentiment & generates new (& often false/irrelevant) reasons to sell.

In reality, investors have enjoyed +9.5%-10.5% long-term NAV/share returns, with management returning a cumulative $800 million+ via share buybacks (inc. $67M last year) – that’s $1.6 billion to shareholders, with dividends included. [Those dividends really add up…my average TFG entry price, net of dividends, is now sub-$4.75! Not to mention, I reinvest all dividends (at a huge NAV discount) via the company’s DRIP]. Of course, management could & should return capital far more aggressively…but how many management teams actually shrink their empires? And management’s (total) voting control is a bit of a red herring here – and not unlike many well-known tech/media companies, which investors don’t hesitate to buy – as with most long-term focused owner-operators (principals & employees now own 36.5% of TFG), public shareholders should accept TFG will probably strike a deal (or perhaps get sold off piecemeal) only when management (primarily Reade Griffith, who’s still in his late 50s) decides it’s the right time, price & acquirer!

So TFG’s an attractive investment for the right investor…one who takes advantage of the huge discount, focuses on long-term NAV returns (not just the share price), and recognizes it’s now a bet on Tetragon’s $37.4B AUM alternative asset management business (& the compelling tailwinds it continues to enjoy). Its market cap is now just 74% of the value of its asset management business alone (in fact, infrastructure manager Equitix accounts for 70% of TFG’s market cap alone), with an additional $1.4 billion+ investment portfolio thrown in for free! And fund management drives returns too, with an average +7.0% NAV gain in December over the last 5 years, mainly from an annual catch-up/revaluation of TFG Asset Management. Obviously, it’s been a tough year – albeit, TFG NAV’s down just (3.7)% YTD as of end-Nov – so we shouldn’t necessarily presume that kind of gain this time ’round, but I already see a +1.8% NAV gain from the $25M tender offer last month, and continue to believe TFGAM valuations are reasonable/appropriate here. We shall see…the Dec factsheet is out Jan-31st.

[NB: On a look-through/control basis, TFG actually owns about 91% of its current $37.4B of AUM vs. a $1.2B balance sheet value – back of the envelope, that’s a 3.6% of AUM valuation. Cheaper than you might expect, due to real estate/bank loan AUM – but accounting for that, overall it looks sensible in alt. asset management terms].

iv) VinaCapital Vietnam Opportunity Fund ($VOF.L)

FY-2022 (13)% Loss. Year-End 5.6% Portfolio Holding.

As you’d expect, last year’s bear market was punishing for a small frontier market like Vietnam – and exacerbated by tighter liquidity & an anti-corruption campaign in the real estate sector – the VN Index ended the year down (33)%. This would have been compounded by a weak VND, which finally succumbed (after years of stability) to the strong dollar last summer, only for a remarkable late-year recovery that left the dong just (3.7)% weaker in 2022. Fortunately for investors, diversification saved the day, via: i) portfolio out-performance due to a substantial allocation (43% in aggregate) to unlisted/quasi-private equity/private equity investments, and ii) sterling weakness, which was another substantial tailwind despite a weaker VND. Some narrowing of the NAV discount also helped…and inc. dividends, this limited my loss to (11)%, about a third of the local index decline!

Which sets us up nicely for 2023: GDP growth was close to +9% (& accelerating) at the end of Q3, with FDI, export growth, retail & infrastructure spending all running at +13%-20% levels, whereas inflation still remains well under control at just over 4%. The market’s now trading around an 8.5 P/E, a 40% discount to regional peers & with continued 15-20% earnings growth. We may some slowdown in exports to the West this year, but that looks like it’s already been aggressively discounted, and likely to be offset by continued post-COVID tourism growth & the stimulus of a China re-opening. The latter, of course, is a reminder of my big picture thesis…that Vietnam’s perfectly positioned as a nation & an economy to be the #NewChina. Not only can it replace Chinese production in world trade (& duplicate the economic/investment trajectory of China in earlier decades), it can also outsource Chinese manufacturing & be a potential (indirect) conduit for US-China trade, if political & trade relations continue to suffer. VOF now trades on a 13% NAV discount, and breaking the critical 1,200 level on the VN Index (we’re now just over 1,100, after recently bottoming sub-1,000) is again a key indicator for a potential multi-year bull market ahead.

FY-2022 (39)% Loss. Year-End 8.3% Portfolio Holding.

I still find it hard to believe Alphabet’s 2022 decline was double the S&P’s!? But this is primarily a tech bear market…in fact, for many tech sub-sectors & investors, the bear market’s almost two years old now (since Q1-2021). Fed rate hikes have eviscerated ‘jam tomorrow’ DCF valuations…and while clearly that’s an obvious trigger, I think it’s ultimately a bit of a cop-out (per above). In reality, it’s a bear market…so after a certain point, bad stocks infect good stocks & even #BigTech, selling begets selling & price literally drives narrative. [With negative sentiment re Facebook & Zuck’s all-in metaverse bet AND positive ChatGPT sentiment both impacting Alphabet negatively]. Perhaps the bigger challenge for investors – which arguably we’ve handled quite badly – has been the struggle to handicap/value the pandemic surge in digital/technology revenues & profits, and the inevitable post-pandemic slowdown since (we see this also in e-commerce stocks, which have collapsed in response). Personally, with current & potential holdings, I’ve forced myself to focus just as much on 2019/pre-pandemic financials when evaluating their progress, prospects & valuations as of today.

And looking at Alphabet, it’s obvious revenue growth slowed significantly last year. However, the strong dollar had an inevitable impact, so it’s important to also focus on cc revenue growth which slowed from +26% in Q1 to +11% in Q3, still a compelling growth rate. But that growth (& slowdown) comes on top of +41% revenue growth in 2021 (to surpass $0.25 trillion in annual revenue!). And in the wake of +13% revenue growth in 2020. That’s an incredible revenue/business trajectory…and to butcher Buffett, I’m perfectly happy to accept that kind of lumpy revenue growth in any long-term holding! And the continued progress (& dominance) in Alphabet’s business is just as incredible. The $5.4B acquisition of Mandiant will continue to enhance its cyber-security reputation & opportunity. Alphabet now offers nine products with 1B+ users, six of which boast 2B+ users. [All of which are basically free for users…worth remembering every time US/EU regulators (& jealous corporate peers) demonize Alphabet for its ‘abusive monopoly power’!] YouTube has now carved out a 9% share of total viewing hours (in the US), as it continues to steal market share from TV, cable & other streaming services, and assert itself as the dominant free & subscription streaming (& music streaming!) service in the world. DeepMind is now transitioning to a commercial business…in 2020 it tripled revenue in a year, and in 2021 it quintupled revenue to $1.7 billion in just two years! [Yes, it’s internal revenue from the rest of Alphabet, but I’m confident: i) it’s billed on (basically) arms-length terms, and ii) DeepMind could just as easily have opted to grow its business externally from day one, and just as spectacularly!] Now picture its revenue in 2024, and what DeepMind’s implied valuation might be if we apply the same 29 P/S multiple OpenAI’s apparently commanding in its new funding round (on a projected $1B revenue in 2024, vs. zero today!).

Instead, $GOOGL bear market capitulants greeted the emergence of ChatGPT with horror…with price driving narrative again, prompting Twitter claims that Google Search is now dead! Which is a bit silly – not to denigrate its spectacular output/progress, but ChatGPT also reminds me of the typical journalist, i.e. that weird mix of copy & paste confidence & cluelessness. In reality, Google Search has been/is the best AI in daily use on the planet – and has been specifically designed & refined to satisfy the respective needs & wants of users, advertisers & Google – in our daily lives, we mostly want simple facts & figures backed up by original source links, whereas ChatGPT (much like journalists) serves up paragraphs & no links!? But if that’s what users now want & demand, I don’t doubt Google/DeepMind can deliver – in fact, I was already betting on a digital AI assistant subscription to come, harnessing & amalgamating Google Search, Voice, Cloud, YouTube, DeepMind, etc. Don’t be fooled by an approach that’s more tempered & responsible – as Yann LeCun recently noted, ‘If Google & Meta haven’t released ChatGPT-like things, it’s not because they can’t. It’s because they won’t!’. I liken it to Waymo vs. Tesla – while Tesla FSD’s demonized in the media, and other companies pull back on their autonomous driving investment, Waymo keeps its head down, continues to build & is now the only company with rider-only service (& no human driver) in multiple cities.

In the short-term, we face (as always!?) an uncertain outlook & a potential recession – but in that scenario, I believe Google & digital advertising are still poised to win an even greater share of ad spend (from old media). Not to mention valuation, $GOOGL trades here on a sub-19 P/E & a 4.1 P/S multiple – vs. 30% unadjusted operating margins – cheaper than most consumer staples multiples! It also presents much lower regulatory/user risk than $META (for the same P/E), and Other Bets spending/losses remains under control & should still be treated as (asymmetric risk-reward) venture-capital investment by investors. In the end, AI’s obviously an incredible opportunity – as well as a potential threat – so long-term, I continue to bet on what I believe is the best AI company in the world.

FY-2022 (75)% Loss. Year-End 8.4% Portfolio Holding.

What an abominable year it’s been for crypto…and for KR1. It really doesn’t matter whether it was actually prepared for a potential crypto winter & boasted a fortress balance sheet accordingly…in a bear market turbo-charged by deleveraging & fraud, investors were always going to throw KR1 out with the bathwater. The incredible long-term alpha the team has delivered & will continue to generate for shareholders is irrelevant in the eye of the storm, because all that matters in the short-term is the unavoidable beta of a crypto collapse. Again, that’s why my last write-up was titled ‘KR1 plc…the #Crypto #Alpha Bet’ – I continue to recommend KR1 as the best listed crypto alpha generator on the planet, but this recommendation only makes sense if/when you personally accept & own the beta of the underlying crypto market, i.e. have developed your own conviction in blockchain as a foundational technology, and have the actual sang-froid (& gut) to live with the inevitable downside volatility of crypto. Of course, most investors will claim that up-front…but alas, most never get to enjoy the huge multi-baggers, as fear & greed inevitably shakes them out far too early, at best with a profit that looks tiny in hindsight, at worst they bail out at the worst possible time & price (remember, all the best long-term performers correct 50%-90% along the way).

But anyway, despite the crypto winter, it’s business as usual for the KR1 team. They continue to check more items off the laundry list – appointing a new auditor (PKF Littlejohn), adding a new website FAQs to address outstanding issues/concerns, adding another impressive NED (Aeron Buchanan, who’s worked alongside Gavin Wood on Ethereal, Polkadot & the Web3 Foundation), etc. They also settled KR1’s outstanding 2020 & 2021 performance fee liabilities, per the new executive services agreement (which locks the team up exclusively with KR1), i.e. via the issuance of new shares at the appropriate NAV/share price. [For example, a £30.1 million 2021 performance fee was settled via issuance of 24.6M new KR1 shares last July at 122.7p a share (vs. a market price of 26.5p at the time)]. This means the team’s now earned (in aggregate) a 25%+ stake in KR1…and finally has the skin in the game to reflect the owner-operator approach they’ve taken from day-one (back when KR1 launched, the team did NOT grant themselves a free promote, unlike most other crypto management teams out there). And most of this stake’s only been transferred to the team in the last 13 months, in the midst of a crypto winter, so it’s only now we can hope to see new incentives start to drive new behaviour, e.g. better Investor Relations to come, and ideally an up-listing ultimately to the LSE (or AIM) to broaden the potential pool of KR1 investors.

Meanwhile, like true decentra-heads, the team’s avoided the fraud, leverage & custody risk of centralized exchanges (like FTX) & continued to focus on new investments, their (parachain auction-focused) staking returns have been incredible with £21.0M income from digital assets in 2021 & another £16.6M in H1-2022, and the 8,000%+ share price & 9,500%+ NAV/share returns they’ve delivered (since 2016) are both spectacular & incomparable (vs. other crypto stocks, all of which have produced negligible/catastrophic returns for investors). And with so many crypto stocks still heading for zero, I now call KR1 the ZERO investment thesis…it has zero hardware, zero energy-use, zero debt, (essentially) zero options outstanding, zero dilution (last placing was in 2018!), zero liquidity issues (plenty of fiat/ETH/USDC liquidity on hand & $100s of millions of daily liquidity in its top portfolio holdings), zero capital required (it funds its modest 2% expense ratio & generates profits/free cash flow from its staking operation), zero performance fees (’til NAV exceeds £215M again), and zero taxes (KR1 is Isle-of-Man resident).

For investors, KR1 was/is the only crypto stock that can survive any crypto winter (no matter how long & severe), and continue to deliver multi-bagger returns in the next crypto summer to come, and still trades on an absurdly cheap valuation (vs. the 100%+ NAV CAGRs it’s actually delivered)…the fact that KR1’s share price has basically DOUBLED since year-end attests to how compelling that pitch can be (when sentiment finally improves). As always, I recommend a 3-5% KR1 holding as a reasonable crypto allocation for virtually any portfolio.

FY-2022 +10% Gain. Year-End 10.9% Portfolio Holding.

Under CEO Leslie Hill’s, Record went from strength to strength last year. While long-term compounding of its underlying AUME remains a secular tailwind, Record can be vulnerable to market reversals too…however this tends to be mitigated by the fact that FX hedging mandates often target a core portfolio percentage/amount (& are therefore relatively immune to market losses), by new fund inflows & by some clients actually increasing hedge ratios due to market volatility. Nonetheless, last year’s savage bear market (for the typical 60:40 portfolio) was quite the headwind, but with the help/scaling up of a new $8 billion passive hedging mandate, Record’s $ AUME actually hit new all-time-highs (as of end-Dec). This success was compounded by sterling weakness – a majority of Record’s AUME is in CHF, EUR & USD, which has served as a great post-Brexit sterling hedge for investors – with £ AUME up 13%+ yoy. The plan to respond more to client needs, exploit long-standing relationships, and diversify into higher-margin/non-currency products also progressed well, with the new (frontier market) Sustainable Finance Fund reaching $1B+ in AUM, along with the launch of a new Liquid Municipal Fund for German institutional investors (and with more/similar product launches to come). Management’s even added a little crypto pixie-dust, as planned – great timing, and eye-catching for investors, if we’re actually emerging from this crypto winter – via some small seed/early-stage investments in the space to ‘get a seat at the table’ & explore potential future product opportunities.

The P&L progression is equally impressive. For FY-2022 (to end-Mar), revenue was up +38%, operating margin expanded from 24% to 31%, and both EPS & the total dividend were up 60%+. [Inc. dividends, my total return last year was actually +16%]. This momentum continued in the FY-2023 interims, with revenue up +35%, operating margin at 34%, and EPS up +57%. The real kicker is in the performance fees: In the last couple of years, management’s focused on renegotiating (& winning) passive/dynamic hedging mandates to include greater performance fee potential, where Record actually adds value via the tenor of its client hedging (i.e. via active management of FX forward hedging duration & arbitrage opportunities). With the increasing post-QE normalization of interest & FX markets (i.e. greater volatility & dislocation!), Record can expect to earn such fees far more consistently…accordingly, it’s now earned performance fees for the last 4 consecutive quarters, including £5.8M in the current FY-2023! The company now looks set to repeat its interim performance, implying a 6.3p+ FY EPS, yet another earnings surprise. [Analyst estimates have not anticipated AUME growth, margin expansion, or performance fees]. Of course, this is all per the CEO’s medium-term goal to reach £60M in revenue (from £35M in FY-2022) & a 40% operating margin by FY-2025 – as explained in management’s recent Investor Meet presentations & in the upcoming CMD. This would imply continued 25%+ EPS growth in FY-2024 & FY-2025 to reach 10p EPS in the next 2.5 years…that’s an incredible earnings trajectory, esp. when you compare it to Record’s prospective/ex-cash (it now boasts 11p/share of net cash & investments) sub-14 P/E as of today, for a true owner-operator business (the CEO & Chairman still own a 38% stake).

And now, to finish up, I want to return to an analysis I last shared in the grim heart of the pandemic. We all talk on FinTwit about high quality growth stocks, and what that actually means in quantitative (e.g. ROIC) & qualitative terms (e.g. moats). And while I know what I like in practice – high margin/asset-light companies which boast strong balance sheets & free cash flow – I often find the discussion itself quite frustrating. Qualitative evaluations can get very subjective very fast, while there’s no definitive quantitative screen for high quality compounders – except perhaps long-term stock performance, as good a filter as any, ‘cos winners really do tend to keep on winning! – and you can quickly end up going ’round in circles anyway. For example: High ROIC companies generally trade on high multiples, low ROIC companies generally trade on low multiples…so RoI can easily end up being a somewhat meaningless filter for identifying true relative value.

And I can’t help thinking of what Buffett said: ‘Investing is not a game where the guy with 160 IQ beats the guy with 130 IQ’. The implied/unspoken part here is that what really matters, given a reasonable minimum IQ level, is an investor’s EQ. i.e. Do they have the emotional intelligence to make consistently rational & unemotional decisions, regardless of personal & market sentiment (or turmoil), and to recognize in their gut (& not just their brain!) that having/cultivating the patience & sang-froid to simply buy & hold is what ultimately produces the best long-term returns? As Jesse Livermore put it so famously, ‘It never was my thinking that made the big money for me. It always was my sitting’. And for me, this means IQ is for buying, and EQ is for holding…which boils down to two key business attributes that give me all the comfort I need to hold a high quality compounder through thick & thin:

High insider ownership & strong balance sheets.

Owner-operators are management, founders & founding families who focus primarily on long-term investment & profitable revenue growth, strong free cash flow conversion, organic-led growth vs. acquisitions, and a strong employee & customer-centric culture…and invariably on a strong balance sheet, so you know they can & will survive & thrive through the worst of times (& avoid going bust, or diluting shareholders into oblivion). And best of all, they have real skin in the game – unlike regular corporate management, their (substantial) stake in the business is far more valuable than their annual compensation package – so they eat their own cooking, they experience the same elation & disappointment as you do over the share price, and every day they sweat & every night they get to lay awake worrying on your behalf, as you sleep soundly knowing they’ll continue to compound your & their wealth as they have in the past.

I recommend you go back to my original/more detailed commentary in 2020, so here I’ll just provide two snapshots (& brief comments) on how I’ve assembled my overall disclosed/undisclosed portfolio…first, by insider ownership:

By default, most listed companies (esp. mid/large-cap) are not owner-operators – management/founders own less than 5%, or even less than 0.5%, of the company – and investing in such companies, to some degree, is obviously unavoidable. There’s also (much rarer) companies, whose owner-operators control a dominant 50%+ stake – these require a higher investment hurdle, and a critical filter is how management’s actually treated minority shareholders in the past. But outside those two extremes, there’s an ideal ownership range of 5%-50% – and in particular, a sweet spot where insider ownership is between 20%-40% – it’s taken years of work & patience, but 65% of my current portfolio is co-invested alongside such owner-operators.

And by balance sheet strength:

Granted, 13% of my portfolio’s invested in holdings with 1.0+ Net Debt/EBITDA multiples….a part of the market where (US) FinTwit seems to spend most of its time?! And another 18% is invested in 0.0-1.0 Net Debt/EBITDA companies, and/or sub-25% (on average) Net Debt/Equity companies, which seems a reasonable level of risk to take. But that leaves 69% of my portfolio invested in companies that enjoy (significant) levels of balance sheet net cash & investments (vs. current market caps) – a critical financial attribute that’s invariably under-priced & under-appreciated – with close to 50% of my portfolio actually invested in companies that boast 7.5%-30% of their market cap in net cash & investments!

Those are some nice treasure chests, guarded by motivated owner-operators, and hopefully surrounded by decent moats! Hopefully they inspire you to appreciate these specific attributes, and/or find other criteria that make sense/help you to actually buy & hold high quality compounders. And I’ll say it again: If you ever hope to make huge long-term multi-bagger gains, you have to accept you’ll also suffer huge reversals along the way! Having/cultivating the patience & emotional intelligence to live with that dichotomy is essential…for me, it’s been the real key to the multi-baggers I’ve enjoyed in my portfolio, to my +102% net return in the last three years, and (despite the obvious reversal since) to my +26% pa decade-long investment track record I celebrated just over a year ago.

Here’s to a great 2023…