On January 11, 2023, Matthews Asia launched Matthews Emerging Markets ex China Active ETF (MEMX). It is an actively managed ETF that might invest in every country in the world except China, the United States, Australia, Canada, Hong Kong, Israel, Japan, New Zealand, Singapore, and most of the countries in Western Europe.

Our January issue originally, and mistakenly, suggested that the fund had launched on 12/31/2022. That was corrected as soon as Matthew’s representatives let us know of the error. Our regrets!

The fund will be managed by John Paul Lech, the lead manager, and Alex Zarechnak. Mr. Lech joined Matthews in 2018 after a decade as an EM manager for Oppenheimer Funds. Mr. Zarechnak joined Matthews in 2020 after a 15-year stint with Wellington Management, primarily as an analyst in the EM equity group. He has shorter stays with Capital Group and Templeton Funds. Together they also manage Matthews EM Equity Fund (MEGMX) and Matthews EM Equity Active ETF (MEM).

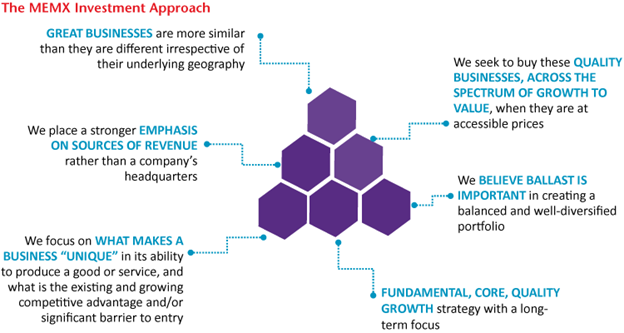

The ETF will follow the same strategy that the managers embody in Matthews Emerging Markets Equity Active ETF. They describe the new fund as “a subset or an extension of the Matthews Emerging Markets Equity Active ETF (MEM). We’ve kept the approach simple. Aside from excluding China, the investment approach is the same as the MEM. MEMX employs a bottom-up stock-picking strategy focused on companies rather than themes and geographical markets … We seek out high-growth, high-quality companies across emerging markets and across the market capitalization spectrum. And by employing an all-cap approach, we believe small companies may offer attractive potential for generating alpha and that incumbency can be an advantage that compounds over time.”

The team’s picture of the pieces of the portfolio puzzle for the benefit of visual learners:

There are three arguments for considering MEMX

1. Dictatorships make for bad investments

Making a good long-term investment starts with the simple faith that a firm’s managers will make their decisions based on their assessment of the firm’s long-term financial interests. If you take that as your starting point, then managers (or index designers) try to identify the managers, companies, and industries which embody the best economic prospects.

Investing in a dictatorship plays hobs with that first principle. In a dictatorship, decisions are made based on the dictator’s vision of where they want to take the entire country; individual companies – whether state-owned enterprises or not – are simply along for the ride. Managers do what the government directs and are forced to live with the consequences of the government’s choices.

Under such circumstances, neither dissent nor independent thought is much tolerated, a lesson embodied by the former Russian oligarchs – Wikipedia actively tracks the deaths of Russian oligarchs, about 30 of whom have died since January 2022 – and former Chinese billionaires – with Forbes wryly commenting on China’s “disappearing” billionaires. That deteriorating rule of law has made such countries “uninvestable” in the judgment of some professional investors.

2. Existing EM – ex China options are pretty limited

The average EM fund invests about 32% of its portfolio in China.

US investors who would like to have vibrant emerging markets exposure have few attractive options. Including MEMX, we identified 10 funds that promised emerging markets but foreswore China.

| 2022 | ||

| WisdomTree Emerging Markets ex-China Fund (XC) | n/a | It did not launch until 9/22/2022 |

| Strive Emerging Markets Ex-China ETF (STXE) | n/a | Launched 1/30/2023 |

| abrdn Emerging Markets Ex-China Fund | n/a | Launched in August 2000 as Aberdeen Global Equity, but did not become an EM ex China fund until Feb 28, 2022 |

| GMO Emerging Markets Ex-China Fund III | -32.9 | Institutional fund, minimums range from $5M – $750M |

| KraneShares MSCI EM ex China ETF | -19.3 | Tracks a mid- to large-cap index holding 282 stocks |

| iShares MSCI Emerging Markets ex China ETF (EMXC) | -19.3 | Tracks a mid- and large-cap index, excludes state-owned enterprises |

| Columbia EM Core ex-China ETF XCEM | -17.6 | Index fund holding 256 mid- to large-cap stocks with about 60% in Taiwan, India & Korea |

| DFA EM ex China Core Equity | -15.8 | With 3800 stocks, this is more like EM-all-equity than EM-core-equity. Like most DFA products, it has size and value tilts and is advisor-sold only |

| Freedom 100 Emerging Markets ETF (FRDM) | -14.4 | A freedom- and liquidity-weighted index of 100 stocks from “countries with higher human and economic freedom scores” |

| Benchmarks and comparisons | ||

| MSCI ex China index | -19.3 | |

| MSCI EM index | -18.5 | |

| Matthews EM | -20.9 | Not explicitly ex-China but carries one-third the China weight of its peers, about 10% |

| Seafarer Overseas Growth & Income | -11.8% | Not explicitly ex China but carries just an 11% weighting there |

Of the 10 funds, two are unavailable to independent retail investors (GMO, DFA), four have a track record of under one year, and three track the same or similar mid- to large-cap indexes.

Two stand out. The Freedom 100 Emerging Markets ETF seems to take “ex-China” to another level by investing “ex-any-stinkin’-dictatorship.” It tracks a specialized index that weights emerging markets by their degree of freedom, then invests in the 10 most liquid, not-state-owned corporations in their top markets. It’s managed by a former Fidelity adviser.

3. Matthews has a solid track record

The other standout is Matthews Emerging Markets ex-China Active ETF. While the fund is new, it uses the same team and follows the same investment discipline embodied in an active mutual fund and ETF. The fund is not quite three years old but has performed quite solidly.

Matthews EM Equity Fund, Lifetime Performance (Since May 2020)

| APR | MAXDD | STDEV | DSDEV | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio |

|

| Matthews EM Equity | 9.50 | -35.41 | 19.77 | 12.10 | 16.64 | 0.44 | 0.72 | 0.52 |

| EM Equity peers | 3.8 | -36.5 | 20.3 | 13.2 | 16.5 | 0.22 | 0.39 | 0.38 |

The translation: since inception, the fund has returned an annualized 9.5%, two-and-a-half times the return of its average peer. Its volatility – measured by drawdown, standard deviation, and downside deviation – has been comparable to, or a bit better than, its peers. That leaves it with stronger risk-adjusted returns, measured variously by the Sharpe, Sortino, and Martin ratios.

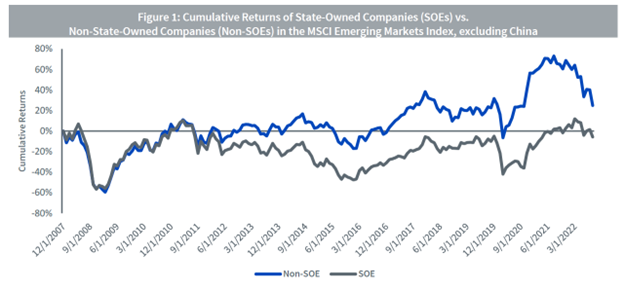

The best short exposition of the “emerging markets without China” argument was made by WisdomTree in “The Case for Emerging Markets ex-China Fund” (2022), which holds that state-owned enterprises are underperformers and, on the whole, low-quality enterprises.

For those seeking an apolitical analysis, it’s well worth reading. Goldman Sachs makes the case at greater length (EM ex-China as a separate equity asset class, 2021), though it too soft-pedals any geopolitical judgments.

Likewise, Matthews offers an extended discussion of the MEMX strategy and prospects on their website.