Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!!!

Summary:

In my relentless effort to create the most boring and unremarkable stock portfolio imaginable, I think I identified an ideal candidate with SFS Group from Switzerland. Despite having a market cap of ~4 bn CHF, this majority family-owned company is not very well known and its products and B2B business model look similarily unremarkable.

The company doesn’t have an easily identifiable moat, doesn’t pay high dividends or buys back stock, is not super cheap and also not super profitable, doesn’t grow like crazy and doesn’t have sexy products that one can see in the supermarket.

Nevertheless I do think it is an great addtion to my portfolio as it is attractively priced and both, the business as well as the management are of high (Swiss) quality. Based on my own estimates, the stock trades at a PE of ~12x for 2023, despite having delivered EPS growth in EUR of around 15% p.a. since its IPO in 2014 and maintaing double digit EBIT margins across the cycle.

As the post has become quite long, here an overview of the chapters:

- Background

- Company History

- Business Model

- Why did I become interested ?

- Where does the growth and margin increase come from ?

- Moat and competivie advantages

- The Hoffmann Group acquisition

- Management

- Shareholders

- Valuation

- Risks

- Other stuff

- Pro’s and Con’s

- Summary & Return expectations

- Game plan

1. Background:

SFS Group has been on my watchlist since 2021 when I encountered them in my “All Swiss shares” series. Back then, the stock looked too expensive despite showing some attractive characteristics (EBIT margins, ROC etc.). In the meantime, they have made a significant M&A transaction and the share price came down by-25%.

2. Company history:

Despite being a 95 year old company, SFS Group only IPOed in 2014 at a share price of 64 CHF. According to the very detailed company history, they went international in 1971 and added new business and business lines along the way on an opportunistic basis. Looking at SFS Group’s Website, it is not so easy to understand what they are actually doing. Therefore let’s jump into the business first:

3. Business model

Effectively, they are active in 3 different segments that I try to describe in my own words:

a) Manufacturing of a diverse range of very small but “Mission critical” high precision parts for a variety of customers. SFS components can be found in cars, mobile phones and even Airplanes

b) Manufacturing of fastening and riveting solutions that are used in the construction and industrial sector

c) Distribution of tools to manufacturing businesses. Initially only in Switzerland but since 2022 also via an acquisition internationally.

What these segments have in common, that they are all focused on B2B business models catering to larger corperates. Within these 3 segments, SFS operates 8 different divisions that seem to be more or less independent:

To get a a first overview on their wide variety of products, their own product site is a good starting point.

One of their slogans is “local for local”, so they manufacture locally in around 100 sites in 26 countries around the world. The HQ mainly coordinates and helps if extra know-how is required, for instance to develop new special machines.

4. Why did I become interested ?

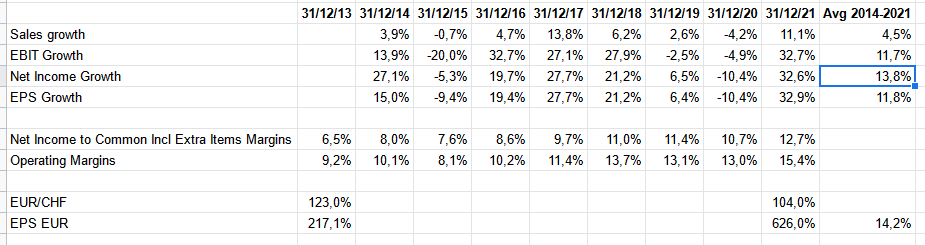

Since its IPO in 2014, SFS Group has delivered very solid results despite having faced at last 2 crisis and a very strong CHF. This is how margins and earnings developed from 2014 to 2021:

Despite increasing sales only by 4,5% (in CHF), SFS managed to improve Net income by ~14% p.a. and EPS in almost 12% by annum since its IPO. This was mainly achieved by improving margins signifcantly. EBIT margins improved from 9-10% to 15% and net income margins almost doubled.

As an Euro investor, one should also take into account, that over this period, the CHF increased significantly against the EUR from 1,23 to 1,04. So in Euro, EPS would have increased even 14,2% p.a. vs. the 11,8% in CHF.

Now comes the interesting part: This increase in margins and earnings went along with a continuous decrease in valuation as we can see in the next table:

Maybe the valuaion at the IPO was priced too rich, but for a “Swiss quality” company, SFS does not look expensive these days. As we can see in the stock chart, IPO investors might not be too happy, as SFS has even underperformed the SMI since the IPO:

To me, a company with steadily increasing margins is worth looking at anyway and combined with a declining valuation even more so.

5. Where does the growth and margin increase come form ?

Looking one level below the Group to the segments, we can see a very interesting, diverging development:

The three segments diverge quite widely. The smallest segment, the Swiss focused Distribution segment has more or less stagnated, both in top line and operating profit. The largest segment, Engineered Components, has performed very soldily. However the star segment was clearly the Fastening systems segment that almost doubled sales and improved operating profit by 5x. This segment is clearly the main driver at the moment and seems to have done very well in 2022 as well.

6. Moat & Competitive advantages

In my understanding, SFS doesn’t have a “hard Moat”. However, they seem to have some competitive advantages. Especially in the Engineered division, the competivie advantage seems to be the detailed know-how in certain production technologies, including the design of specific machines, that allow them to produce high precision components in locations around the world.

Many products that they produce are only a small portion of the final product in absolute value, but quite important for the functionality which is often a good position to have as a supplier. They seem to be very client centric and try to become a development partner rather than an exchangeable supplier for their clients.

On a more strategic level, the fact that SFS is still a family owned company. seems to give them access to certain M&A transactions where the seller doesn’t want to maximise the price but wants to make sure that the company remains a relatively independently run enterprise. As far as I understand, the Hoffmann Deal was an example but also possible because hey are still family owned.

So overall, no hard moats but a combination of competitive advantages that allow them to earn decent margins and returns while growing at a satisfactory speed.

7. The Hoffmann Group Acquisition

In late 2021, SFS announced that they will take over the German Hoffmann Group, a privately owned, 1 bn EUR sales tool distribution and manufacturer. For SFS , this is clearly the largest transaction in its history and as such clearly a risk. SFS has paid ~1 bn for Hoffmann, I haven’t seen any explicit EBIT/profit numbers for Hoffmann yet.

A few factors might mitigate the risks:

- SFS and Hoffmann collaborate since more than 20 years and according to Breu have similar values and culture

- Hoffmann will run as an independent division

- The Hoffmann CEO will join the executive board

- A certain part of the purchase price has been financed with on balance sheet cash and shares, the remaining leverage is not critical. (<1,5 Net debt/EBITDA)

In one of the interviews, the CEO mentioned that with this acquisition they plan to open up a third platform on top of the manufacturing and Fastening sector, as distribution so far was only a local Swiss business. They also seem to intend to grow this platform internationally. In addition, some of SFS products might be sold via Hoffmann (Fastening).

The Acquistion was consumated as of May 1st 2022. This results in an interesting effect that the 2022 results will only include 8/12 of the earnings impact, whereas debt and addtional shares are already fully accounted as of year end. so EV/EBIT and EV/EBITDA at year end 2022 are not fully represetative.

Just the effect of fully including Hoffmann in 2023 will increase sales by another ~12,4% vs. 2022 (all other things equal).

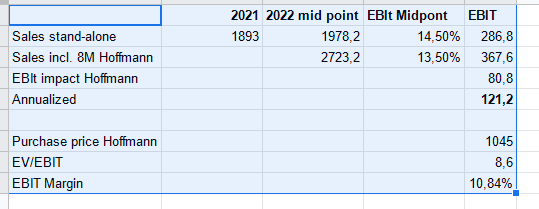

So far, SFS has not directly mentioned how profitable the acquired business is. However, management has dropped some hints, especially in their second investor day with this slide:

With this information, one can estimate the anualized 2022 EBIT of Hoffmann as well as the EBIT margin and the implied multiple that SFS paid which I did in this table using mid points for all estimated ranges:

So overall, the Hoffmann acquisition seems to have been done at a quite reasonable multiple. Although the EBIT margin is lower than the average EBITT margin of the SFS Group, a double digit EBIT margin is still good and acquiring this for an EV/EBIT of around 8,6 is clearly not overpaying.

It needs to be mentioned however that Hoffmann didn’t grew that much for a couple of years. This is from a 2021 presentation and might explain the relatively cheap price:

Another interesting aspect is that ~25% of Hoffmann’s sales seem to be their own tool brands.

8. Management

The CEO Jens Breu (since 2016) has an interesting background. He is not from the founding family and also not a “MBA/McK clone” but started as an industrial apprentice and worked his way up after joining SFS in 1995. I have watched a couple of videos with him and I am honestly super impressed with his down-to-earth approach.

At the age of 50 years, he clearly has some years to go, but combined already with a lot of experience. He is also member of the Supervisory board of Daetwyler, another, 3,5 bn market cap “Hidden Swiss Champion”. Overall it seems that SFS Group mostly develops Management from within instead of hiring “Mercenaries”, an approach I like a lot.

The supervisory board contains members of the founding famlies Huber and Stadler. The long term CEO and Supervisory board head Heinrich Spoerry retired (due to age) in 2021 and was replaced by the former CEO of Schindler, Thomas Oetterli. Oetterli himself was part of the Supervisory board since 2011, so continuity seems to be ensured. The Supervisory board is very Swiss, as a coicidence, one of the members (Urs Kaufmann) heads the Supervisor board at Schaffner Group, another o my Swiss holdings.

Interestingly, one member of the founding family, Claude Stadler is Executive Director and HEad of Corporate services, owning around 400K shares (or 40 mn CHF) but he seems to move out by the end of 2024 in order to focus on the family office.

Compensation for the total executive board was ~7 mn CHF in 2021, with 1,6 mn CHF for the CEO which I think is quite low. Jens Breu owns ~28k shares and gets around 2500 shares per year as part of his compensation package.

9. Shareholders

Even after the capital increase to finance the Hoffmann transaction, the founding families Huber and Stader own more than 50%, joined now by the heirs of the Hoffmann Group with 4%. There are no other “famous” or noteworthy investors according to TIKR.

10. Valuation

Using SFS’s forecasts from above, the midpoint estimated EBIT for 2022 would by 370 mn CHF. Assuming ~10 mn of interest expenses and 20% in taxes, this would result in 7,55 CHF per share in Earning for 2022 or, at a share price of 105 CHF a trailing p/E of ~13,9. For a high quality company like SFS this is not super cheap but quite cheaup.

However, looking into 2023, things looks even more interesting. Assuming a 4,5% growth rate in earnings plus the effect of the full year for Hoffmann, I expect around 433 mn EBIT and ~8,70 CHF EPS. This would mean a P/E of only 12x and an EV/EBIT of ~11x for 2023.

Looking at some other “Swiss quality manufacurers”, we can see that this looks really cheap, although players like VAT and LEM are clearly more profitable:

Daetwyler however, would be clearly a peer to SFS and they trade at around 2x the valuation of SFS Group.

What I found interesting is, that sell side analysts who cover SFS have significantly lower estimates wich in my opinion do not reflect the Hoffmann acquisition:

The Bloomberg consensus is only 6,72 EPS GAAP for 2022 and 7,00 for 2023 which is significantly even below the low end of managment estimates. For some reasons, the sell side seems to ignore this acquistion.

Looking to 2024 and further, I think it is realistic to assume a solid mid-single digit growth rate

11. Risks

So far we have focused on whats good and interesting. But there are clearly risks. Among them are:

- the business is geared towards the manufacturing and construction industry. A major and prolongued slowdown in this sectors will also hit SFS

- An M&A transaction in that size is always a risk

- The Hoffmann transaction increases the weight towards Europe, specifically Germany

- The company has exposure to China especially in the very profitable Fastening division

Structurally, the biggest bet one is making with SFS is that European manufacturing will not die. Reading the press these days, once again many people think that Europe will become a historic theme park for rich Asian tourists. This would be clearly not optimal for SFS. Personally however; I do believe that high quality manufacturing has actually a pretty good future in Europe. The recent crisis has shown that suply chains shouldn’t be too long and that the outsourcing of manufacturing is not a good idea.

In addition, the coming Energy transition requires a lot of manufacturing and as it looks like, the US and Europe will not make the same mistake again and outsource everything to China. My feeling is that high value manufacturing could have a pretty decent future.

12. Other topics (Reporting, Capital allocation, Cashflow generation etc.)

What I do like about SFS that they have very good reporting. One very specific item that I like is how the present returns on capital. The show Return on invested capital (ROIC) as well as ROCE.

Under Siwss GAAP, they are allowed to deduct Goodwill directly from Equity when they make an acquisition. Therefore the ROIC (based on Equity and net debt) would look quite good but they are showing and are tracking the “real” numbers:

In addition, they always show clearly which part of the growth is organic and which is because of M&A. Many companies don’t do this.

Overall, capital allocation in my opinion is good. They seem to be disciplined in M&A, have a clear dividend target and are occassionally buying back some stock although they used the existing treasury stocks for the Hoffmann acquistion. One should not expect large or even debt financed share buy backs from SHS. Following the Hoffmann acquisition, they have clearly communicated that they prioritize reducing debt and that they even target a net cash positive position. I can live with this.

The business as such is generating decent cashflow. Clearly with Hoffmann, the dynamics might change a little bit as distribution is a little bit different to an industial.

My impression is that SFS is run very conservatively. They seem to own most of heir real estate, slaary levels for Managment are adequate and guidance is always conservative. SFS is “built to last”.

One other topic I found very interesting is that SFS has been ranked as the number 8 of all Companies active in Switzerland with regard to Digital Transformation. Within the Manufacturing industry they were rated number 1. Although one should always be cautious with such rankings, this is clearly an interesting aspect and a further poece of the puzzle.

Finally, I also like the fact that SFS doesn’t do quarterly reports. For a long term investment, this saves my at least 2 times a year where I don’t need to read or analyse reports.

13. Pros and Cons

Before moving to a conclusion, as always I’ll try to summarize whats good and what is not so good:

Pro:

- family owned, long term orientation

- a very good business (low value but mission critical high precision consumable parts)

- a decent valuation (especially compared to Swiss peers)

- good managment

- Solid finances, conservatively run

- decentralized structure

- resilient business (energy, input material)

Cons:

- very large acquisition closed in 2022

- unsexy and hard to explain products

- not super cheap

- no clear moat

- Exposure to manufacturing / China

14. Summary & return expectations

SFS Group is neither an “excellent wide moat” company nor a super cheap opportunity. However it is a very good business/company at a very decent valuation. Getting very good companies at decent valuations is actually my sweet spot, especially when I am convinced that the company is run with a view to the long term which I think is here the case.

I also like the fact that the company is not very sexy from the outside. It doesn’t attract a lot of attention which is another big plus for me.

At the current valuation, I would expect a return of around 10% p.a. without taking into account any multiple expansion. That is based on a 2023 FCF yield of 4-5% and a long term growth rate of also 5-6% that I think is realistic and even conservative, considering the track record. So my base case would be to double my money in 7 years plus dividends..

I therefore decided to allocate ~4% of the protfolio into SHS at an average price of around 104 CHF/per share during January.

15. Game plan

Although the release of the earnings on March 3rd could maybe trigger a certain revaluaton if EPS comes in as I expect, my plan is to hold this positon long term. If my EPS expectations turn out to be correct and depending on their guidance and the share price reaction, I might increase the position by another 1% or 2%.

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!!!

Appendix: Some bonus material.

https://www.moneycab.com/person/jens-breu/