The balance of consumer credit outstanding grew 6.5% in the fourth quarter of 2022 (seasonal adjusted annual rate) after climbing 6.7% (SAAR) in the third quarter according to the Federal Reserve’s latest G.19 Consumer Credit report. Revolving debt—which consists primarily of credit card debt—increased at a 12.0% rate, as the level of nonrevolving debt (excluding real estate) grew 4.8% (SAAR).

Total outstanding consumer credit currently stands at $4.78 trillion, an increase of $79 billion over the third quarter. Nonrevolving credit outstanding increased $191 billion, year-over-year, while the level of revolving debt rose $154 billion. Revolving debt accounted for 25.0% of total consumer debt outstanding, up from 23.5% in Q4 2021.

The average interest rate of a 60-month auto loan increased by more than a full percentage point over the quarter, from 5.50% to 6.55%. Over the past three quarters, the rate has climbed 2.03 ppts and is at its highest level since 2009.

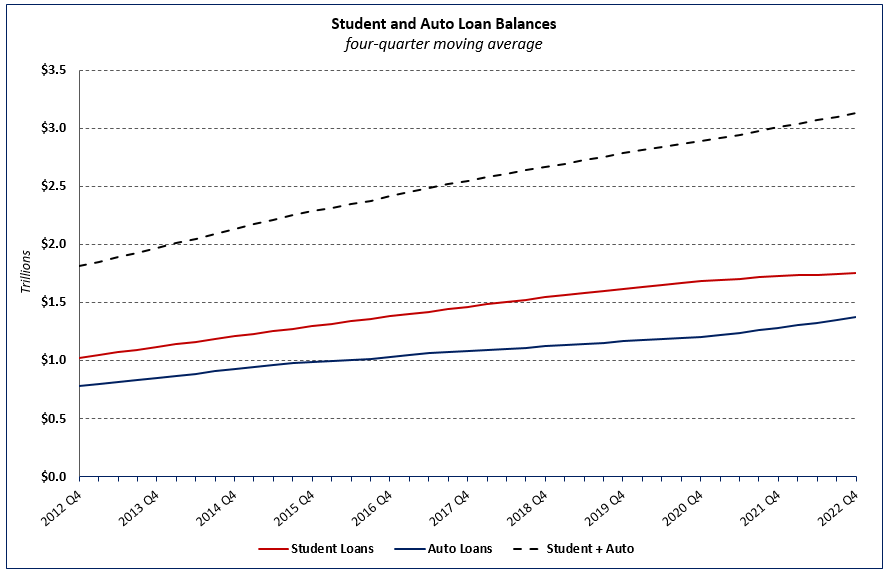

With every quarterly G.19 report, the Federal Reserve releases a memo item covering student and motor vehicle loans’ outstanding levels on a non-seasonally adjusted (NSA) basis. The most recent release shows that the balance of student loans was $1.8 trillion at the end of the third quarter while the amount of auto loan debt outstanding stood at $1.4 trillion.

Together, these loans made up 88.6% of nonrevolving credit balances (NSA)—1.3 percentage points lower than the share in Q4 2021 and 4.4 ppts below the series high reached in 2010.

Related