It’s Wednesday and a lot is going on. The RBA governor appeared before the Commonwealth Senate Estimates Committee today and demonstrated what a troglodyte he is, defending massive bank profits and deliberately trying to cause unemployment. Meanwhile, US data shows that inflation has peaked and is now falling. The pace of the deceleration is picking up. Meanwhile – MMTed – is active and our 4-week course began today (see details below) and we are helping a new radio show to launch next week – Radio MMT. And we cannot go a Wednesday without some great music. All in a day.

MMTed and edX MOOC – Modern Monetary Theory: Economics for the 21st Century – started today

MMTed invites you to enrol for the edX MOOC – Modern Monetary Theory: Economics for the 21st Century – which is a free, 4-week course starting today (February 15, 2023).

For those who have already completed the course there will be new material in Week 4 to cover the current inflationary period.

Overall, lots of videos, text, forum interactions, several live Q&A sessions and more to help you come to an MMT understanding of how the monetary system operates.

Further Details: https://edx.org/course/modern-monetary-theory-economics-for-the-21st-century

So enrol and be part of the fun.

Announcing Radio MMT – 3CR Melbourne

MMTed – is proud to be supporting a new venture in public radio – Radio MMT – which is an hourly program on Friday’s at 17:30 from 3CR Melbourne, which badges itself as ‘Radical Radio’.

3CR – is a long-standing alternative radio station in Melbourne which I have loved since its inception in 1976.

It is just around the corner from my office in Melbourne.

It was “Australia’s first community-owned and community-run grassroots radio station” and “gives voice to issues that would otherwise go unheard, and to people striving for political and social justice.”

You can listen to 3CR from anywhere these days – Live Stream.

They also take donations and subscriptions, which I urge people to consider.

Anyway, Kev and Anne are the hosts of RadioMMT and have reoriented their previous segment into a specific focus on MMT and social justice issues.

I am very grateful for the time they take to promote MMT to a wider audience.

I will make regular appearances on the show.

So a great development.

Onwards and upwards.

US inflation falling

The latest data from the US Bureau of Labor Statistics (BLS) – Consumer Price Index Summary (released February 14, 2023) – shows that:

The all items index increased 6.4 percent for the 12 months ending January; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.6 percent over the last 12 months, its smallest 12-month increase since December 2021.

That major contributor to the inflation in January was rental housing and food with some pressure from petrol prices.

But the June 2022 inflation rate (annual) was 9.1 per cent.

It is now 6.4 per cent and falling.

There is evidence that the rental market is softening.

Further the NFIB – Small Business Optimism Index – shows that business owners are expecting inflation to ease and fewer businesses reported higher prices.

Which should lead to no further interest rate rises in the US.

It won’t unfortunately as the Federal Reserve is locked into its NAIRU-ideology.

Meanwhile, in Australia, pavlov rules

Back in Australia, the same ideology rules.

The RBA governor appeared before the Federal Senate Estimates Committee today to answer questions about the current policy stance of the RBA and his refusal to make a public statement about the interest rate rises last week, while still finding time to give a private briefing to the traders in the banking sector.

There is no transcript available as yet.

The ABC report (February 15, 2023) – RBA boss Philip Lowe defends record bank profits as he flags further rate hikes – provides some quotes.

He claimed that the RBA would increase the rates further in the coming year.

Why?

Because allegedly wages expectations will rise.

How will the weaked unions exact higher nominal wages when they haven’t been able to keep pace with inflation for year and real wages are falling?

Answer: no answer.

Apparently we are on the cusp of an expectations-driven price spiral, except all the evidence suggests otherwise.

But this is the flimsy veil that the RBA governor is now trying to hide behind.

He also claimed that it was fine for the commercial banks to be reaping record profits while many low income workers are about to lose their houses due to mortgage default.

He claimed:

The banks are profitable, it’s true. We want resilient banks … I know it’s hard for people to accept when they’re suffering … but the country is better off having strong, resilient banks that can provide the financial services that we need.

But why do the big Australian banks need to earn returns well above the global average (see below)?

We should also note that the Australian commercial banks generate profit returns on capital that are well above the global average.

The big four commercial banks in Australia returned 10.6 per cent on capital in 2022 where as the

You can learn more about that from this RBA Bulletin article (March 16, 2017) – Returns on Equity, Cost of Equity and the Implications for Banks.

The article noted that:

Australian banks have consistently generated ROE that are much higher than banks in most other countries. For the major banks, ROE averaged around 17½ per cent for the 15 years prior to the global financial crisis and moderated only slightly (to 15 per cent) over the past five years …

While the ROE is now a little lower, it remains well above the global average.

There was also a news story today (February 15, 2023) – Commercial banks enjoy $14 billion windfall as RBA faces grilling – which is finally reporting what I noted many months ago.

I wrote about this in this blog post – Champagne socialists in the banking sector reaping millions from public money (November 23, 2022).

Basically, as a result of the RBA’s bond-buying program in the early stages of the pandemic, commercial bank reserve accounts boomed.

These are the accounts (called Exchange Settlement Accounts in Australia) that allow the commercial banks to reconcile the daily transactions and are normally at very low levels.

The balances in total have gone from $A20 billion in February 2020 to $A469 billion now.

The RBA pays a return to the banks (3.25 per cent currently) on these balances (sequestering around 5 per cent with no interest paid).

So as the cash rate target has risen with the RBA rate hikes, so has the return the RBA is paying on these balances.

The article estimates that 40 per cent of total bank profits are now coming from these payments (around $A14.4 billion per year).

What the article doesn’t explain (and I doubt the journalist understands the point) is that if the RBA didn’t pay that support rate, the overnight cash rate would fall towards zero as a result of the attempts by the banks to shed the excess reserves they are holding.

This would compromise the RBA’s pursuit of a non-zero cash rate target.

The alternative would be to issue ‘government debt’ in exchange for the excess reserves (a sort of reverse QE), which would just be a conventional open-market operation.

But the point is that the interest rate rises are unjustified and the RBA should have followed the lead of the Bank of Japan and held rates low, which means it could easily just cut the support rate on excess reserves to zero and not be seen as transferring public money to bank shareholder profits, while at the same time, driving around a million lower-income households in Australia to the point of losing their homes through mortgage default and rising unemployment.

So both the rising mortgage rates has increased bank profits especially as the banks have not passed the higher rates onto deposit rates (proportionately).

But profits are also booming because of the RBA support payments.

The Governor also claimed that:

… unemployment would need to rise before there were any major changes” in the inflation rate.

The old NAIRU mindlessness.

The reality is that inflation is already falling because the supply-side drivers are abating.

These drivers are not responding to the interest rate rises but to easing in the supply chain.

The RBA is locked into a defunct paradigm.

That message is even getting through to the mainstream economics journalists.

For example, earlier this week (February 12, 2023), Ross Gittins (who is a mainstream economics commentator) wrote – Interest rates: Lowe’s not the problem, the system is rotten (it is behind a paywall).

The essence of the article was:

1. “It’s a pity you have to be as ancient as me to know there’s nothing God-ordained about the notion that central banks must have primary responsibility for stabilising the economy, with the elected government’s “fiscal policy” (the manipulation of government spending and taxes) playing a subsidiary role, and the central bankers being independent of the elected government.”

2. “As a tool for limiting demand, monetary policy turns out to be primitive, blunt and unfair.”

3. “This arrangement became the conventional wisdom only in the mid-1980s, after many decades of relying mainly on using the budget, with monetary policy’s job being to keep interest rates permanently low.”

4. “But after 40 years, the limitations of monetary policy have become apparent. For one thing, we learnt from the weak growth in the decade following the global financial crisis that monetary policy is not effective in stimulating growth when interest rates are already very low and households already loaded with debt.”

5. “Now we have high inflation caused primarily by problems on the supply (production) side of the economy. Can monetary policy do anything to fix supply problems? No. All it can do is keep raising interest rates until the demand for goods and services falls back to fit with inadequate supply.”

6. “But as a tool for limiting demand, monetary policy turns out to be primitive, blunt and unfair. Its manipulation of interest rates has little effect on borrowing for business investment, and little direct effect on all consumer spending except spending on mortgaged or rented housing.”

7. “See how round-about monetary policy is in achieving its objective? It hits some people hard, but others not at all … Why does stabilising the economy have to be done in such a round-about and inequitable manner?”

There was more in the article but the fact that these views are now being offered as part of the mainstream commentary indicates a change is occurring in the way we see our policy makers and the instruments they wield.

Some progress.

COVID statistics update – Australia

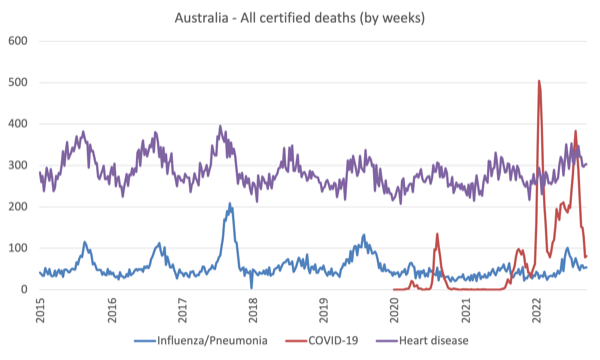

The most recent Australian Bureau of Statistics (ABS) data – Provisional Mortality Statistics – which covers the period from January 2022 to September 2022, came out on December 22, 2022. The next data comes out on February 24, 2023.

The results show that between January and September 2022:

1. There were “8,160 deaths due to COVID-19 that were certified by a doctor.”

2. “There have been 274 doctor certified deaths due to influenza”.

Think about that juxtaposition in relation to those who have tried to argue that COVID-19 is no worse than influenza.

The following graph is taken from the latest ABS data.

The years 2020 and most of 2021 were the ‘lockdown’ period in Australia (of varying severity across the states).

It is unambiguously true that the restrictions reduced the death toll from COVID-19 while there is no apparent increase in other death causes.

The restrictions were dismantled as a result of pressure from the corporate sector, the conservative mainstream media, and the whacky Right (‘cookers’), which exploited our pandemic weariness.

Out politicians failed to care about the health outcomes of their decisions as there were major elections looming and the pollies shifted from a concern about our health to a concern about retaining power.

The results were predictable and shocking.

The following Table shows the proportions of specific death causes in the total doctor certified deaths in Australia between 2020 and 2022.

Now COVID-19 is the third largest cause of death in Australia and is slowly wiping out the populations in aged care homes in addition to other deaths throughout the population.

| Cause of Death | 2020 % | 2021 % | 2022 (to September) % | ||||||||

| COVID-19 | 0.59 | 0.82 | 6.49 | ||||||||

| Influenza/Pneumonia | 1.39 | 1.29 | 1.56 | ||||||||

| Cancer | 33.90 | 32.86 | 29.60 | ||||||||

| Dementia | 10.34 | 10.45 | 10.17 | Diabetes | 3.52 | 3.35 | 3.34 | Cerebrovascular Disease | 6.38 | 6.14 | 5.59 |

| Heart Disease | 9.60 | 9.33 | 8.95 |

I read a The UK Guardian article (Source) by Larry Elliot, who I normally have a lot of time for, where he was trying to argue that the anti-lockdown movement has renewed credibility.

I disagreed with his analysis.

The problem with the lockdowns was not the lockdowns but the fact that the governments did not provide enough income support and health care protection to the low income groups.

The lockdowns were essential to reduce the death rates.

In that vein, I thought this analysis by Left commentator Richard Seymor – Interregnum – on the lockdown ‘sceptics’ – against the hysterical response to Covid by some self-styled Leftists was spot on.

Music – Peter Tosh Bush Doctor

This is what I have been listening to this morning while I have been travelling to the airport. as part of the growing violence associated with the political divisions and drug gangs in Jamaica during the 1970s and 1980s, one of the original Wailers – Peter Tosh – was gunned down on September 11, 1987 during an extortion attempt.

Several other people were killed and injured by the gang and only one was brought to justice in 1995.

This Jamaica Observer article (April 22, 2012) – The night Peter Tosh was killed – tells the story in detail.

Peter Tosh was the most radical of the old Wailers in terms of demanding equal rights and the overthrow of the political elites that took over the mantle from the Colonial oppression.

This track – Bush Doctor – is taken from the his third album – Bush Doctor – which was released in 1978.

The backing band is comprised of the whos who of Jamaican recording – Robbie Shakespeare on bass, Sly Dunbar on drums, Mickey Chung on guitar and synths, Robert Lyn on piano, Keith Sterling on other keyboards, Luther Luther François on soprano sax, Donald Kinsey on guitar, Larry McDonald and Uziah “Sticky” Thompson on percussion.

A fabulous album.