Health Savings Accounts (HSAs) feature useful tax advantages that make them a popular savings vehicle. In addition to allowing for tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses (the so-called ‘triple tax benefit’), HSA funds can be invested and allowed to grow for the long term – which has led many people to treat their HSA as a de facto retirement account by saving and investing the funds to be used for healthcare costs in retirement.

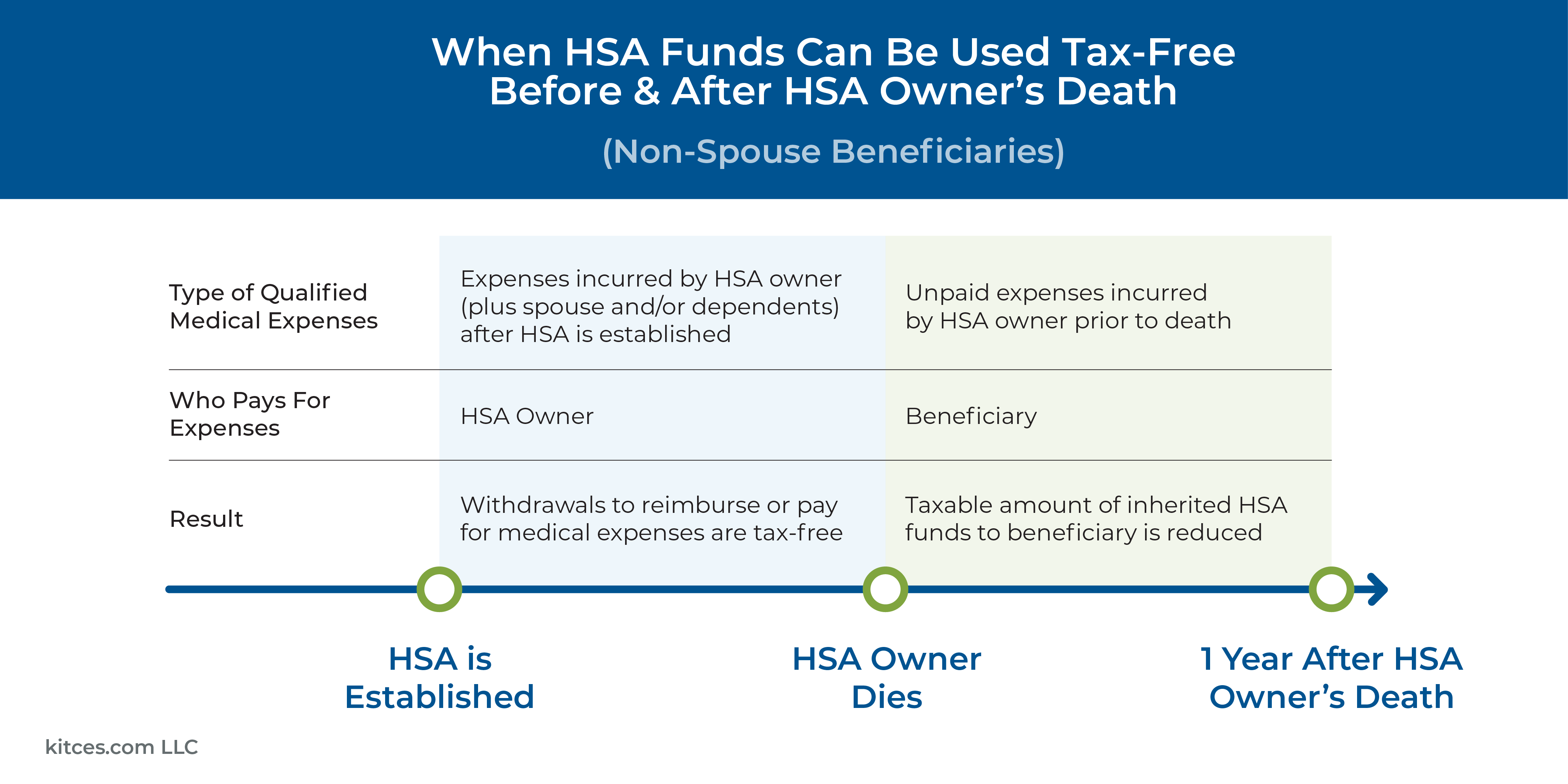

One possible outcome of ‘superfunding’ an HSA, however, is that the account owner may not actually use up all of their HSA funds over their lifetime, which can have significant tax consequences. Namely, if the HSA’s beneficiary is anyone other than the owner’s spouse, the account loses its HSA status and the entire account value becomes taxable income to the beneficiary in the year of the original owner’s death.

For advisors who recommend HSA-maximizing strategies, then, it’s important to consider the risks of the account owner being unable to use up their funds and to plan for potential ways to quickly draw down the account in the event the HSA owner will not outlive their HSA funds.

One such strategy is to advise clients to keep track of any qualified medical expenses they incur after establishing the HSA – even those that are paid for from funds outside the HSA. Because if the owner ever needs to quickly withdraw funds from the HSA, they will be able to do so tax-free to the extent that they have any previously unreimbursed medical expenses from any point after the HSA was established – which could allow the HSA owner to make a tax-free ‘deathbed drawdown’ of a large amount (or even all) of their account, which would otherwise become taxable income if inherited by the account beneficiary. It’s also important for other parties involved in the owner’s estate plan to be aware of their roles, and to ensure that any funds withdrawn from the HSA are still distributed according to the HSA owner’s wishes.

The key point is that the more that advisors (and their clients) can plan in advance for the contingency of needing to quickly withdraw HSA funds, the more likely they will actually be able to do so. Because although it (hopefully) isn’t likely that any one person will need to do a deathbed HSA drawdown, as more people establish HSAs and accumulate large balances, the odds are that the need to quickly withdraw those funds will become increasingly common – making it all the more valuable for advisors (particularly those recommending HSA maximization strategies) to have tools for doing so while still maximizing the tax advantage of the HSA!