In today’s economic climate, leveraging data is a good way for banks to increase efficiency and save costs, positively impacting their bottom line. By leveraging their data, banks gain valuable insights and can align business objectives and strategy, leading to new growth opportunities.

The data market in the United States is already significant, and expected to grow even more over the next decade. The AI market is also growing rapidly and is expected to continue that growth. According to industry analysts, the global AI market was valued at ~$17 billion in 2020 and is expected to reach $354.5 billion by 2027, growing at a compound annual growth rate (CAGR) of 49.7%.

The automation market is another fast-growing segment, expected to reach $365 billion this year. The exact increase will vary depending on a number of factors such as technological advancements, increased adoption of AI and automation, and global economic conditions. To analyze current market trends, we will take a look back at 2022 and anticipate what you can expect in 2023.

Trend #1: Focus on Cloud Tech Stacks

Q1 2023 is shaping up to be highly competitive and fast-paced. In the business intelligence sector, companies are investing in developing their cloud tech stacks. This trend is surfaced in earnings calls and client interactions.

Larger companies typically lean towards Microsoft Azure, while smaller companies and startups prefer Google and Amazon. The optimal choice of cloud platform depends on factors such as the specific needs and requirements of the company, the industry it operates in, their geographic location and the corresponding data rules, and existing infrastructure.

While true that Microsoft Azure is widely adopted by large enterprises, there are also smaller companies and startups using Azure to capitalize on its range of services and ability to integrate with existing Microsoft technology. On the other hand, AWS and Google Cloud are popular due to their scalability, innovation, and cost-effectiveness.

Ultimately, the choice of cloud platform should be based on a thorough evaluation of the company’s specific needs and requirements, and not solely on the company’s size or type.

Trend #2: Rising Demand for Analytics

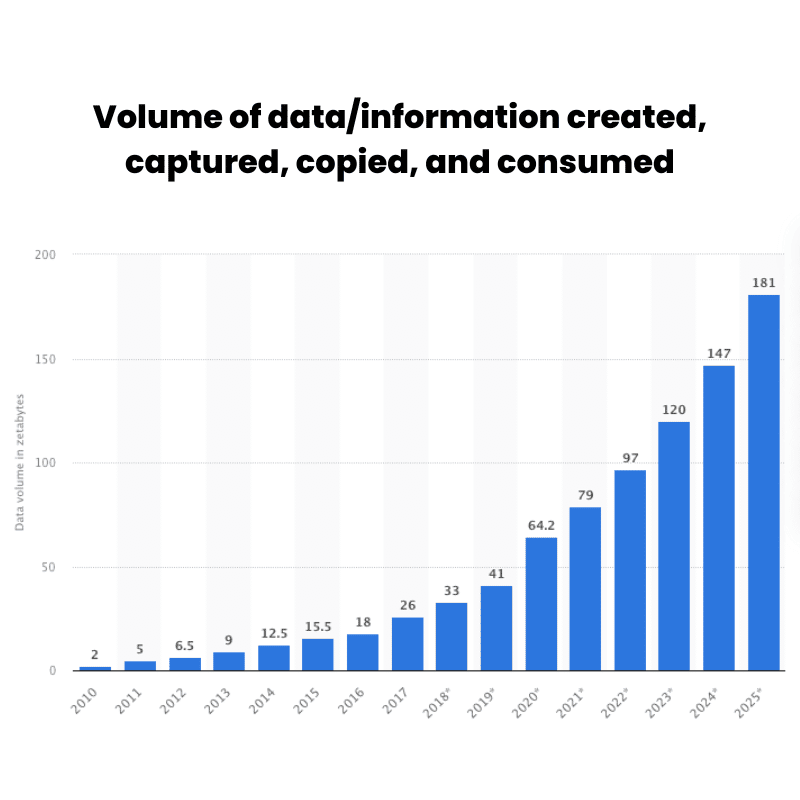

The Big Data sector has created growing demand for analytics engineers in recent years, particularly in the US. As companies collect and generate more data, they require staff who can build and manage big data platforms, and also analyze and interpret data in a meaningful and actionable way. However, finding staff with both strong technical skills and business acumen is challenging, as the skills are not commonly found in one person. This is making the analytics engineering job market highly competitive.

Trend #3: Hybrid Model

The pandemic brought about widespread remote work. But with the easing of restrictions, many companies are calling for in-person support. Feelings of isolation and decreased productivity is powering a shift back to in-person work. This is especially true for traditional businesses like banks, auto dealers, and lenders that place a high value on face-to-face relationships. Many smaller organizations are continuing a mostly digital retail model due to cost savings and a focus on digital transformation.

Economic experts predict that the United States will experience a mild recession, but growth of the data market is not expected to slow. In fact, it is expected to expand, particularly in FinTech where automation and AI are projected to increase this year. Many companies, including some over a hundred years old, are now entering the analytics space. This supports the thesis that the value of data is only increasing.

While some executives, unaccustomed to making data-driven decisions, are skeptical, a consultative approach changes minds. This is an opportune time for companies interested in data-driven insights or with a need to reduce headcount and focus on automation, to explore their options.

The use of data and technology to streamline processes and free up employee time can lead to cost savings. Artificial intelligence tools assist this effort. “Time is money” and companies that embrace these advancements will ultimately save money.

To hear more on this topic, join us at the BI Panel at the upcoming Bank Automation Summit on Friday, March 3 at 1:30.

BIO

With more than 15 years’ experience in the financial services industry, including tenures at Santander Consumer USA and Visa, Jessica Gonzalez is the Director of Lending Strategies at Informed.IQ.

-Jessica Gonzalez, Director of Lending Strategies at Informed.IQ