While the Singapore government’s latest Budget 2023 doled out several goodies, it also came with one unexpected shocker (especially for many working mothers) when it was announced that there’ll be changes to the Working Mother’s Child Relief (WMCR) scheme from 2024 onwards.

The scheme is one of the government’s efforts to encourage married women to stay in the workforce even after they have kids. And for several years now, you could say the scheme has been relatively successful at achieving its objective, especially as being a working mother meant one could get a lot more benefits from the government vs. if one chose to quit and be a stay-home mum.

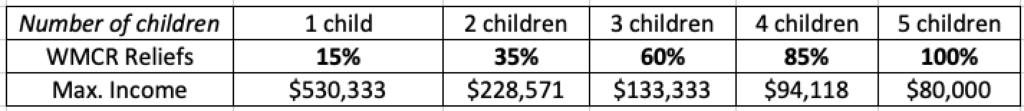

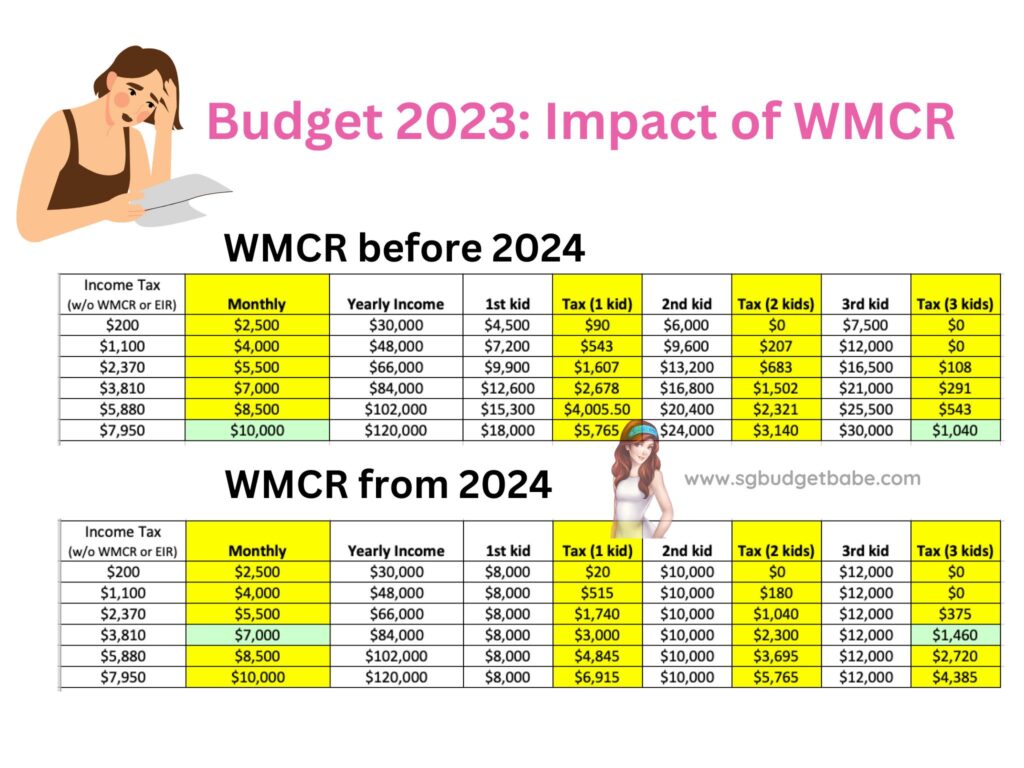

The old scheme, which allowed working mothers to claim a percentage of income tax reliefs for every child, was good in the sense that even for women who were high-flyers at their workplaces and earning a high income, could benefit if they decided to have more children and contribute to Singapore’s birth population.

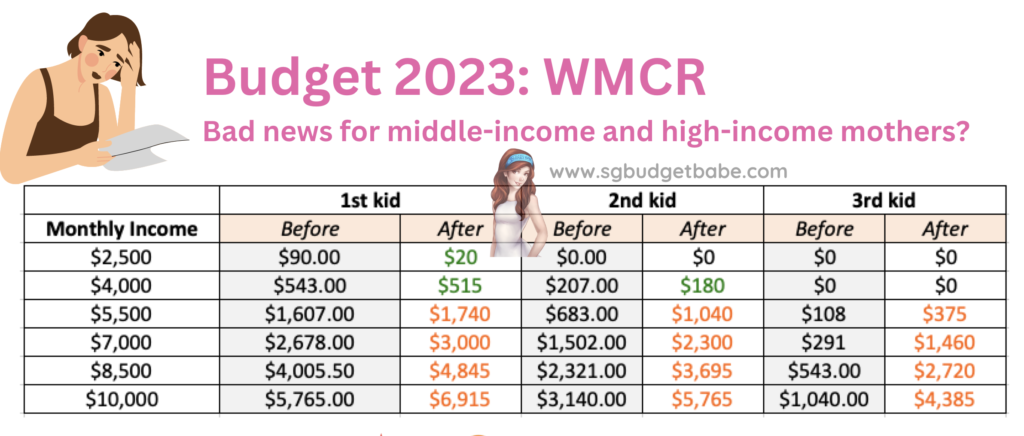

Of course, there were certain limits to ensure this wouldn’t be abused. For instance, the maximum reliefs were capped at $80,000 per mother (regardless of the number of children) and 100% of her income for those who have more kids.

But come 1 January 2024, mothers who give birth after this date will now have their reliefs pegged at a fixed dollar rather than a percentage of their income.

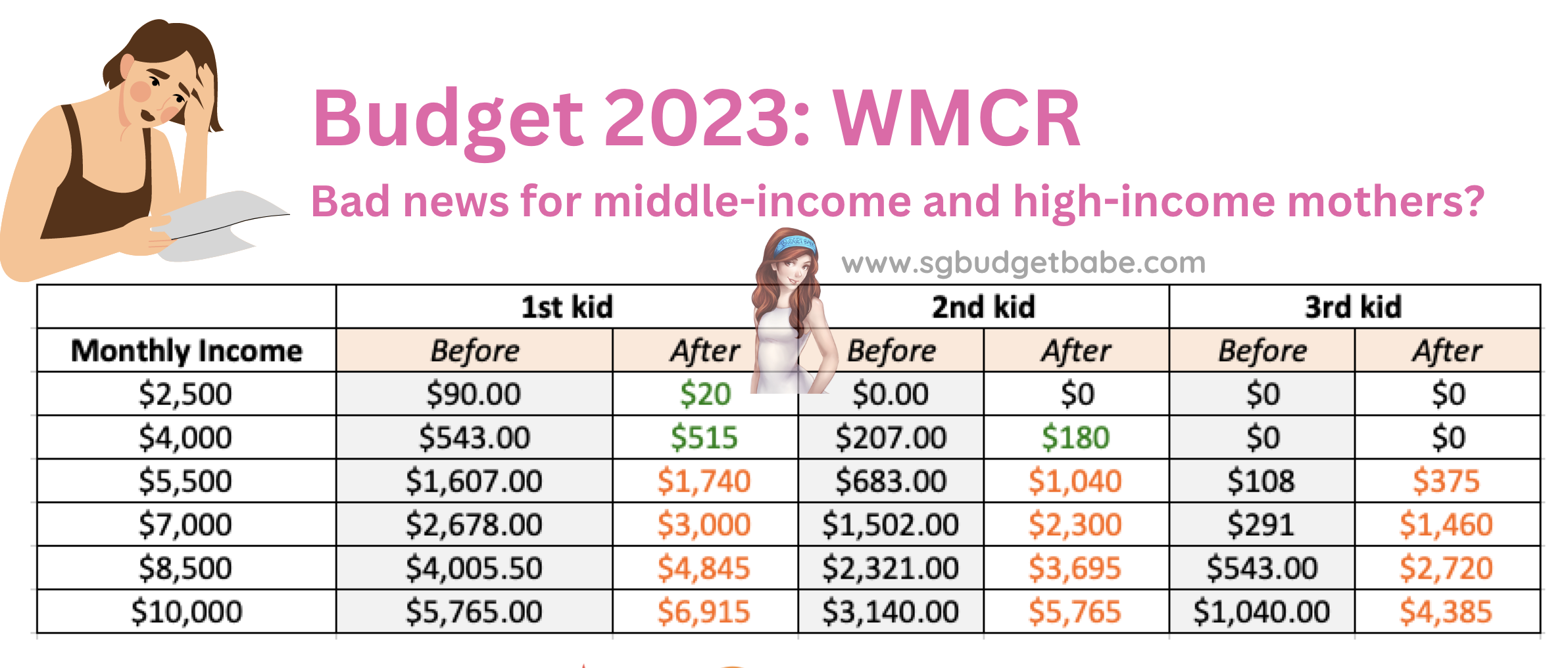

This move has been said to be a form of wealth tax, where the higher income are taxed disproportionately more than the poor. However, based on my calculations, it looks like the middle-income will also bear a significant brunt from now:

I’ve calculated the various income scenarios, and found that for working mothers who earn $4,200 or more and have children next year onwards, the new WMCR changes will hit them the hardest.

And if you look at the fields I’ve highlighted in green, you might be shocked to see how a mother of 3 earning $7k will now have to pay more taxes ($1,460) vs. her older peer who earns $10k ($1,040), despite doing what the government wants and producing the same number of kids (3).

On social media, the sentiments are mixed. Most people aren’t too happy about the change, but more importantly, while it does help the lower income mothers more, you can see from the table above that the dollar impact really isn’t that much. On the other hand, a lot more taxes is now being collected from both the middle-income AND higher-income mothers, adding further to the stress that successful career women already face as it is.

With inflation and rising costs, it is already difficult to justify raising 3 children even if a female earns $7,000 a month ($84k a year). While I get that there are many other factors that ultimately leads a couple to deciding how many children they want to have, the government removing this does not bode well, in my opinion.

And when we consider how having kids is becoming increasingly expensive, this may make higher-income women think twice about whether to have more children, so it is possible that we might see the birth rate drop among this group.

Essentially, any smart or capable woman earning more than $4,200 will now be affected. Considering how the median income for fresh university graduates is already at $4,200, this will have significant impact on the females.

Giving a bigger Baby Bonus ($3k more) doesn’t really cut it when you consider how that’s a one-time payout, whereas paying income taxes is across many years, typically 20 – 40 years for most mothers.

I’m all for paying taxes, especially wealth taxes, but I’m not sure I like how the government has chosen to take more of it from a group who’s already stressed out enough as it is – working mothers who are struggling to do well at their job and climb the corporate ladder WHILE concurrently being a good and present parent as well.

What do you think of the newest policy changes?

Share your thoughts with me in the comments below!