In 1942, Rhode Island was the first state to offer Temporary Disability Insurance (TDI) benefits to employees. Following the success of this program, Rhode Island created the Temporary Caregiver Insurance (TCI) program in 2013. Rhode Island TCI offers qualifying employees paid leave to care for their loved ones in certain situations.

Read on to find the answer to your Rhode Island TCI questions.

What is Rhode Island TCI?

Rhode Island’s Temporary Caregiver Insurance (TCI) is the state’s paid family leave program.

TCI is paid entirely through employee contributions.

TCI gives qualifying Rhode Island employees up to six weeks of paid leave to:

- Care for a seriously ill child, spouse, domestic partner, parent, or grandparent

- Bond with a newborn, adopted child, or foster child (available only during the first 12 months of parenting)

Rhode Island’s TCI program is part of the state’s Temporary Disability Insurance (TDI) program.

What are my responsibilities as an employer?

All Rhode Island employers must provide Rhode Island family leave to eligible employees.

If you are a Rhode Island employer, you must:

- Display the required posters informing employees about the state program

- Deduct TDI tax (which includes TCI) from employee wages and remit that money to the Employer Tax Unit quarterly

- Provide employee wage and employment reports when requested by TDI

- Protect employee jobs while an employee is on qualified leave

When an employee files for TCI, the state will ask you to verify your employee’s last day of work.

Who’s eligible for TCI?

Most individuals who work in Rhode Island (including those who commute from out of state) are eligible for Rhode Island TCI.

Notable exceptions include:

- Federal, state, and municipal employees

- Partners of an LLC or a corporation

- Non-incorporated self-employed workers

Rhode Island employees must also meet certain earning requirements to be eligible.

What are the earning requirements for TCI eligibility?

To be eligible for Rhode Island paid leave, employees must have:

- Earned wages in Rhode Island and paid into the TDI/TCI fund

- Received at least $11,520 during their base period

If employees haven’t earned at least $11,520 during their base period, they may still be eligible if:

- They earned at least $1,920 in one of their base period quarters

- Their total base period taxable wages are at least one and one-half times their highest quarter of earnings

- Their base period taxable wages are at least $3,840

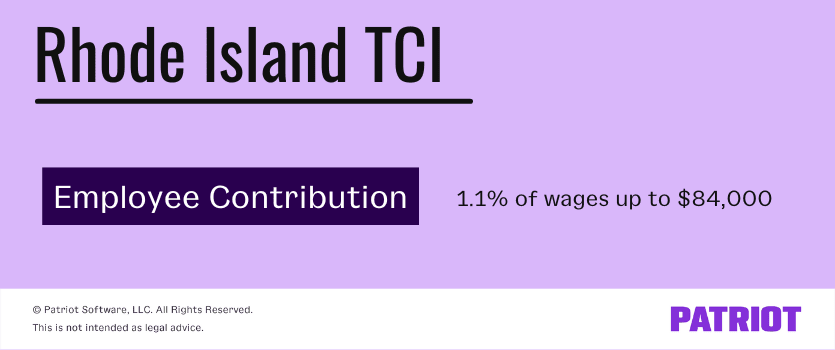

What’s the contribution rate for Rhode Island TCI?

The contribution rate for Rhode Island Temporary Disability Insurance (TDI) is 1.1%. Withhold employee wages for Rhode Island TDI, which also funds the TCI program.

Let’s say you pay an employee $2,000 biweekly. You would deduct $22 from their paycheck (0.011 X $2,000) and send it to Rhode Island’s Employer Tax Unit.

The taxable wage base for the TDI program is $84,000. Do not withhold any TDI contributions from employee wages over $84,000.

How much does an employee receive?

Employees receive 4.62% of their weekly wages in the highest quarter of their base period. The minimum benefit rate is $121, and the maximum is $1,007 per week.

If your employee has a dependent child younger than 18 years old, they may qualify for an additional dependency allowance. The dependency allowance can cover five dependents and is equal to whichever is greater: $10 or 7% of an employee’s weekly TCI benefit rate.

Does Rhode Island TCI protect employee jobs?

Yes, Rhode Island TCI protects employee jobs.

As an employer, you must:

- Hold an employee’s position until they return from TCI leave OR

- Offer a comparable position to employees once they return from their leave. Comparable positions must include equivalent seniority, status, employment benefits, pay, and fringe benefits

Is TCI the same as paid sick or vacation time?

No. Unlike paid sick or vacation time, you do not pay employees TCI benefits—the state does.

If an employee is collecting TCI benefits, do not pay them their regular salary, sick pay, or vacation pay while on leave.

Can employees work part-time and still collect TCI?

No. Employees receiving TCI benefits can’t return to work part-time and continue to collect TCI benefits.

Can an employee get additional weeks of TCI?

No. Employee claims are processed based on the number of weeks and the dates requested on their initial application.

If an employee hasn’t reached the maximum allowance of six weeks (within the same year), they may file another claim.

Are TCI benefits taxable?

Yes, TCI benefits are subject to federal and state income taxes.

Employees will receive a Form 1099-G, Certain Government Payments, in the mail at the end of their claim year. Employees who don’t receive a Form 1099-G in the mail can access it online.

It’s not your responsibility to mail a 1099-G form to your employees (this will come from the state).

What are employee responsibilities?

Before applying for Rhode Island medical leave, employees must:

- Notify you in writing at least 30 days before taking their leave (unless there are unforeseeable circumstances, such as a medical emergency)

- Apply for TCI benefits during the first 30 days after the first day of leave

If an employee is already receiving TDI benefits, a doctor must release them as “fully recuperated” before they submit an application to TCI for bonding or caregiving payments.

How do employees make a claim?

Your employees may ask you how they can make a TCI claim. You can advise them to file their claims online.

When filing a claim, employees must provide their:

- Full name, address, and telephone number

- Social Security number

- Date when they were first unable to work

How do employees receive payments?

Employees can receive payments in two ways—either through direct deposit or an electronic payment card.

To receive payments, employees must complete the Electronic Payment Card Request and Direct Deposit Authorization/Cancellation form and mail it to:

Temporary Disability Insurance

P.O. Box 20100

Cranston, RI 02920

If an employee chooses direct deposit, they must include a voided check or their bank routing and account numbers.

Remember, the state (not you!) pays the employees for Rhode Island paid family leave. Employees usually receive their TCI benefits within 48 hours after the Department of Labor and Training approves their claim.

Rhode Island TCI fast facts

There are several things to keep track of when it comes to Rhode Island’s paid family leave program. To make things easier, here are some fast facts to remember:

- Rhode Island TCI is an employee-only contribution

- Employers must withhold 1.1% of Rhode Island employees’ wages

- Qualified employees can use TCI to care for seriously ill family members and bond with a new child

- Leave can last up to six weeks

- The minimum benefit rate is $121, and the maximum is $1,007 per week

- Employers must submit withheld TCI to the Employer Tax Unit Quarterly

Calculating paid family leave doesn’t have to be difficult. Patriot’s payroll software can calculate and deduct paid family leave contributions from your employees’ pay. And if you sign up for our Full Service Payroll, we’ll deposit and file TDI taxes for you. Try a free trial today and see how easy it can be!

This is not intended as legal advice; for more information, please click here.