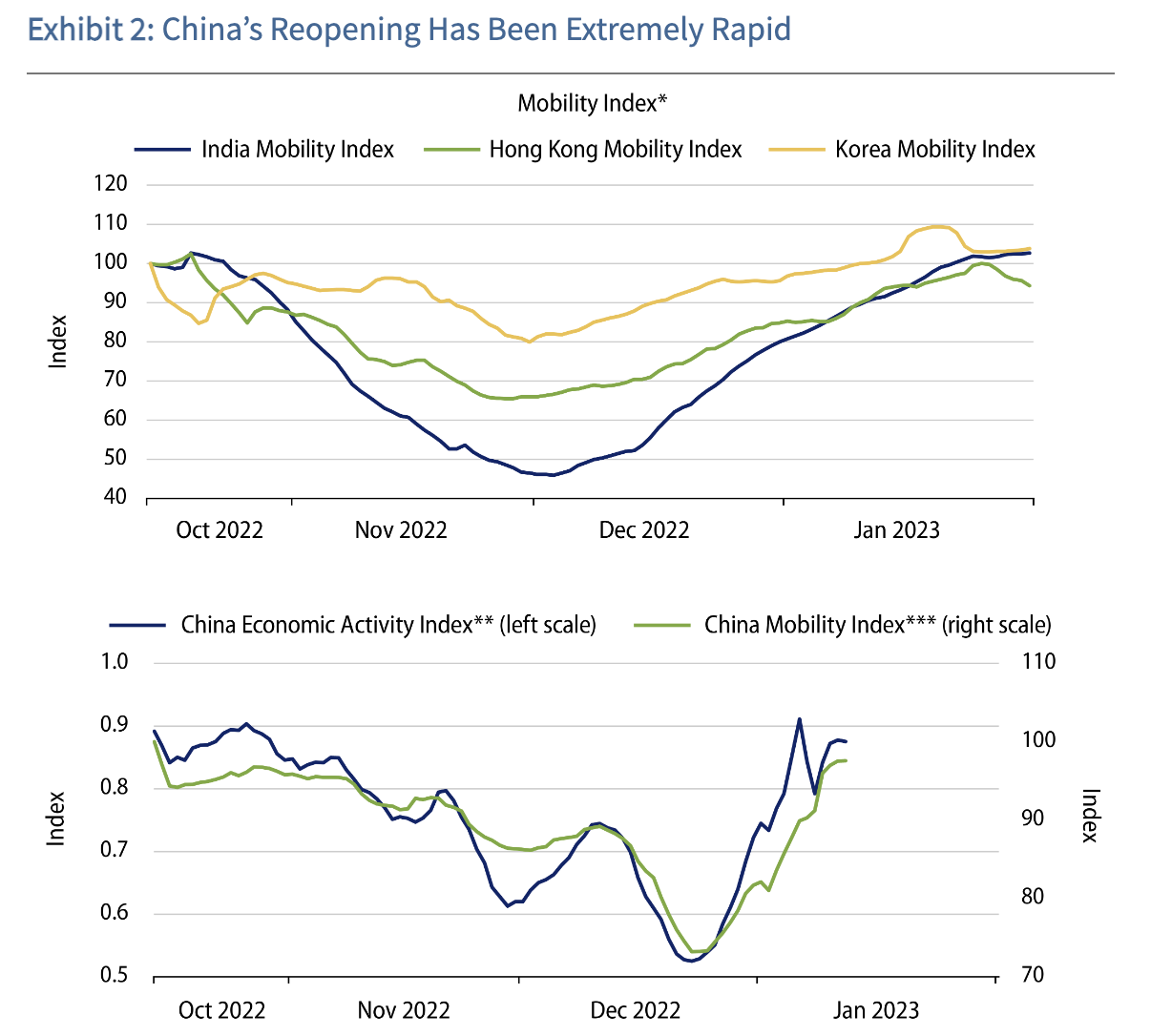

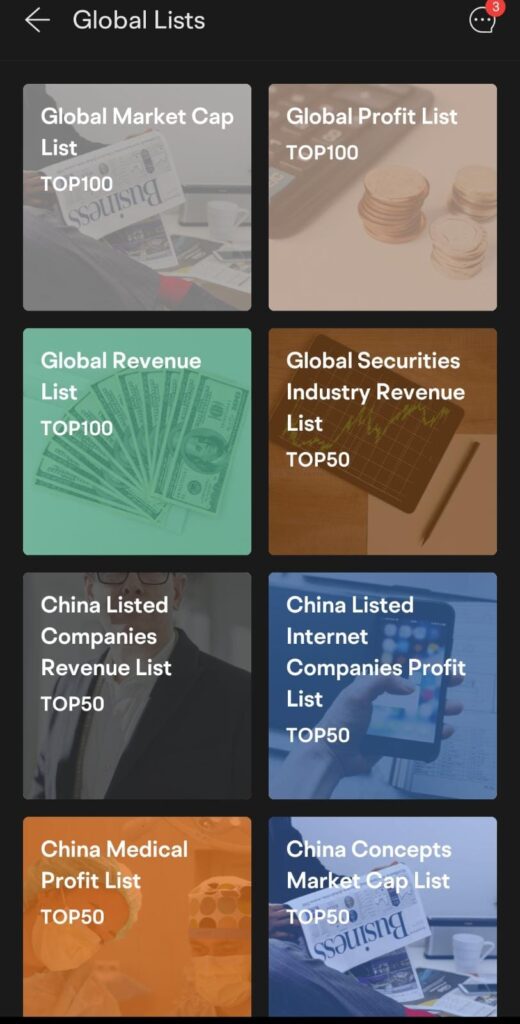

Now that China has ended its zero-COVID policies, what sectors and investments could benefit from the recovery? For investors, where should we look to find profitable investment ideas…or are we already too late?

The fact that I’m writing this article today shows that no, I don’t think we’re too late to invest in China’s recovery – provided you know where to look. As for traders, there may be more opportunity in the coming weeks as many of the Chinese recovery stocks are now experiencing volatility.

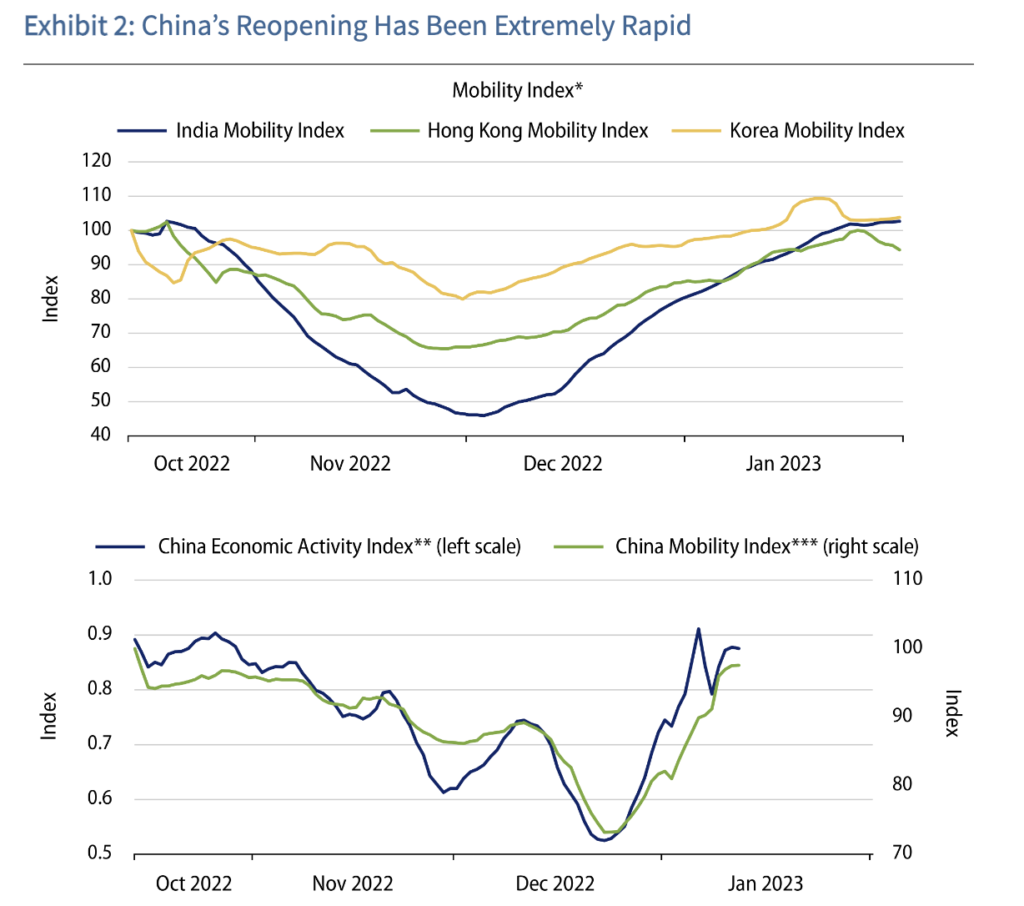

Many Chinese stocks have already rebounded 50% – 100% from their October lows, which is why the big question on everyone’s mind right now is whether we’ve missed the boat, or is there still any opportunity left?

But aside from the more obvious names (i.e. companies that benefit directly from the reopening because people are out and about), there are also other stocks that can benefit from the “revenge spending” phenomenon that we’ve observed in other countries that lifted their border controls earlier.

Source: moomoo (24 Feb 2023)

Experts originally warned that the Chinese New Year travel rush would lead to a surge of COVID-19 cases in China, but that has not happened. Barring another new virus variant, I guess it can be safe to assume that things will be better moving forward.

And when you adopt a long-term view on China’s future, many structural trends start to become clear.

Here are 5 investment ideas that you can start digging into:

Important Disclaimer: None of these ideas are meant to be personalized financial advice. They are only meant to provide a starting point for you to think about and research further to find stocks that would fit your investment objectives and portfolio. Please do your own due diligence.

1. F&B Operators

With more people out and about, companies like Yum China and Starbucks could benefit from higher consumer traffic and spending. Kweichou Moutai may well see higher sales as business events return in full scale.

2. Discretionary consumer spending / Luxury

Chinese tourists are well-known for their luxury purchases while travelling abroad, and many expect this trend to come back now that travel restrictions have been lifted. French luxury goods company Kering SA, which owns brands like Gucci, Bottega Veneta and Balenciaga could benefit if this plays out.

3. Pharmaceuticals

We will avoid the obvious vaccination plays here, but another area to consider is how the reopening, which has caused fears of another outbreak, has led many consumers to stockpile and hoard medicines at home. The biggest player, Sinopharm Group, has already tripled its production of key drugs to meet the demand for its medications treating fever and cough symptoms.

4. Technology

Technology is expected to pave the way for China’s next stage of growth, which includes advancements in artificial intelligence, 5G, future mobility, robotics and automation. With the reopening, many Chinese technology stocks have already started to regain momentum.

But if the volatility scares you, or if picking individual stocks isn’t your cup of tea, you can also get exposure via ETFs like our local Lion-OCBC Securities Hang Seng Tech ETF or the iShares Hang Seng Tech ETF to ride on the tech recovery.

5. Environment and renewable energy

China has set ambitious targets to curb its CO2 emissions before 2030 and achieve carbon neutrality before 2060. Among these, its electric vehicle industry is also years ahead of the US, be it in terms of sales, charging infrastructure, cost or even policy support.

Stocks like BYD (Tesla’s rival) or JinkoSolar (manufacturer of solar panels) could benefit from this structural trend, but if you find individual stocks too risky, then the NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF (SGX:EVD) could be a way to diversify.

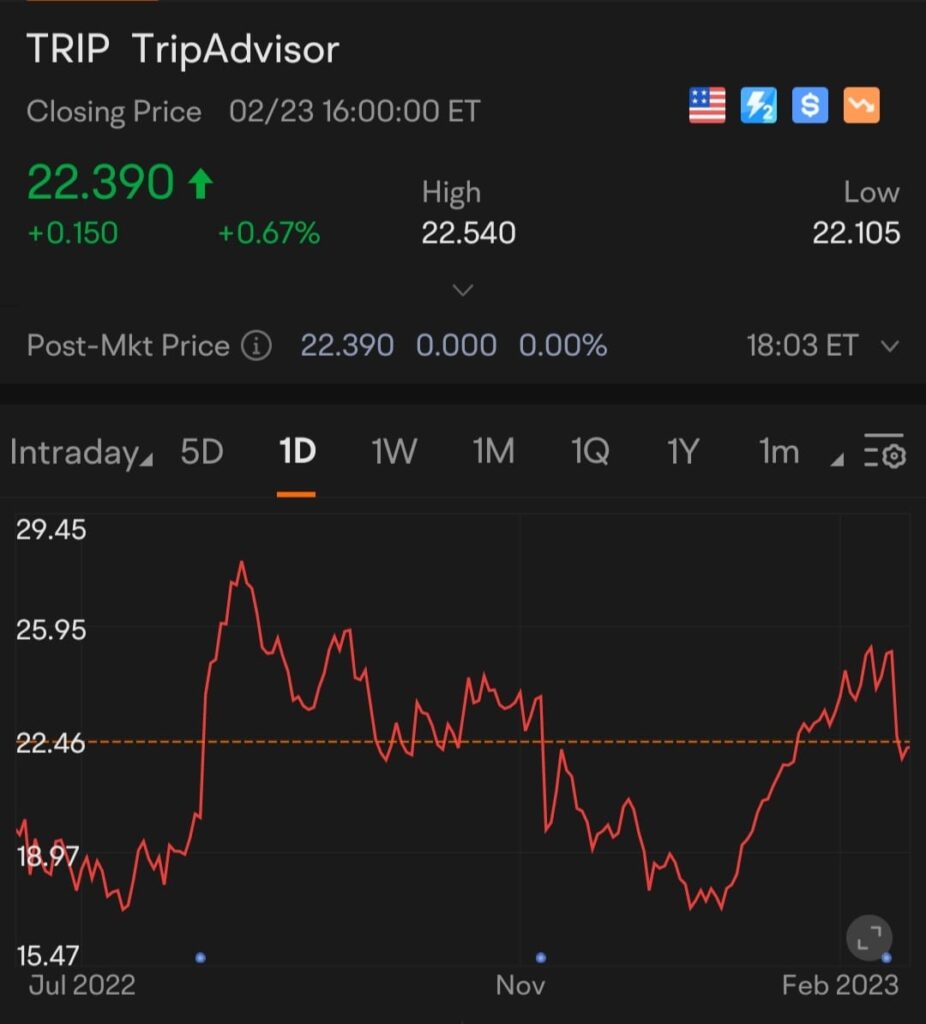

Otherwise, broader ETFs like the Global X China Clean Energy ETF or KraneShares MSCI China Clean Technology Index ETF are another way to ride this theme in your portfolio. To find more ETF ideas, tap on the “Market” tab –> “Explore” –> “Global List”.

Of course, if you’re neither keen on individual stocks nor thematic ETFs to ride China’s reopening and recovery, then another alternative could be to look at broader index funds that track the wider Chinese equities market.

Some of such ETFs you can look at include:

- iShares MSCI China, which tracks the index and owns a broad range of large- and mid-cap stocks, but note that Alibaba and Tencent Holdings represent about one-third of the fund’s assets.

- Another more balanced option could be the iShares China Large-Cap, which follows the FTSE 50 China index.

- Franklin FTSE China ETF tracks the performance of the FTSE China Capped Index, a market cap-weighted index comprising Chinese large and mid-cap equities. The fund’s sector allocation skews toward the consumer discretionary (29.1%), communication services (18.5%), and financials (15.6%) sectors, which accounted for a combined 63.2% of the total portfolio.

- Invesco Golden Dragon China ETF tracks the performance of the NASDAQ Golden Dragon China Index, which comprises US exchange-listed equities of companies headquartered or incorporated in China (i.e. US ADRs). As such, its holdings lean towards consumer discretionary and communication technologies, which make up over 75% of its portfolio.

| Name | Index Tracked | Expense Ratio | Management Fee |

| iShares MSCI China | MSCI China Index | 0.58% | |

| iShares China Large-Cap | FTSE 50 China index | 0.74% | |

| Franklin FTSE China ETF | FTSE China Capped Index | 0.19% | |

| Invesco Golden Dragon China ETF |

NASDAQ Golden Dragon China Index | 0.7% | 0.5% |

Of course, we cannot afford to ignore the Chinese government’s influence over businesses in China, which has been a real risk (and often cost) to investors in the affected sectors. The private education sector, for instance, enjoyed spectacular stock price increases over the years but plummeted ever since the 2021 crackdown, sending many investors into the red.

Still, China as a long-term investment could be a worthy trade-off. It is already the world’s largest economy (20% bigger than the US), and its growth is still not stopping. Despite threats from the U.S., China is too big for the world, much less America, to do without.

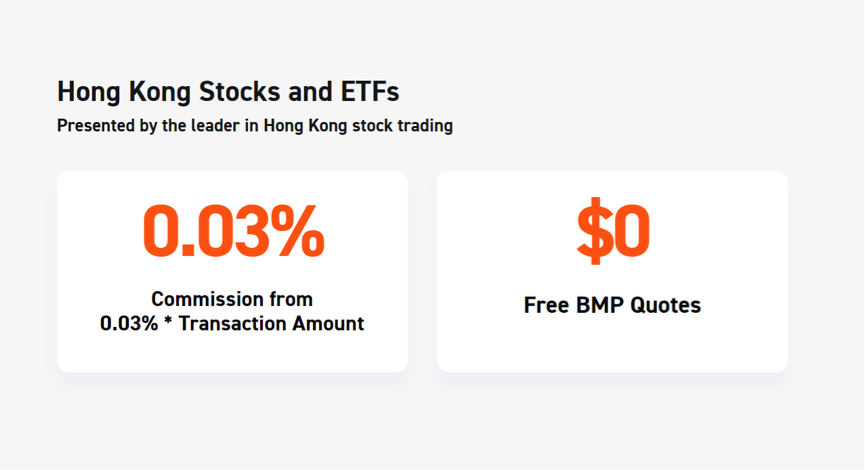

Sponsored Message Get exposure to the China stock market by investing via the moomoo app, which offers one of the lowest fees in the industry for Hong Kong and China stocks.

The moomoo app is an award-winning trading platform offered by Moomoo Technologies Inc., a subsidiary of Futu Holdings Limited (NASDAQ:FUTU) and backed by Tencent. moomoo SG is regulated by the Monetary Authority of Singapore and is the first online brokerage to have received all 5 memberships from SGX Group for Securities and Derivatives Market.

Disclosure: This post is brought to you in conjunction with moomoo SG. All opinions are that of my own, and none of the stocks or ETFs mentioned constitute a buy or sell recommendation. You are encouraged to do further research and due diligence if any of the above names pique your interest.

All views expressed in this article are the independent opinions of SG Budget Babe. Neither moomoo Singapore or its affiliates shall be liable for the content of the information provided. T

his advertisement has not been reviewed by the Monetary Authority of Singapore.