Millions of homeowners are poised to face higher mortgage rates when their fixed-term loans expire this year – known as the “fixed rate cliff”.

The fixed rate cliff refers to the expiration of fixed-rate terms on mortgages and their subsequent re-pricing at much higher rates, with a new report by CoreLogic head of research Eliza Owen (pictured above) calling it “one of the biggest potential risks to housing market values and overall stability in 2023”.

The fixed rate cliff – how did we get here?

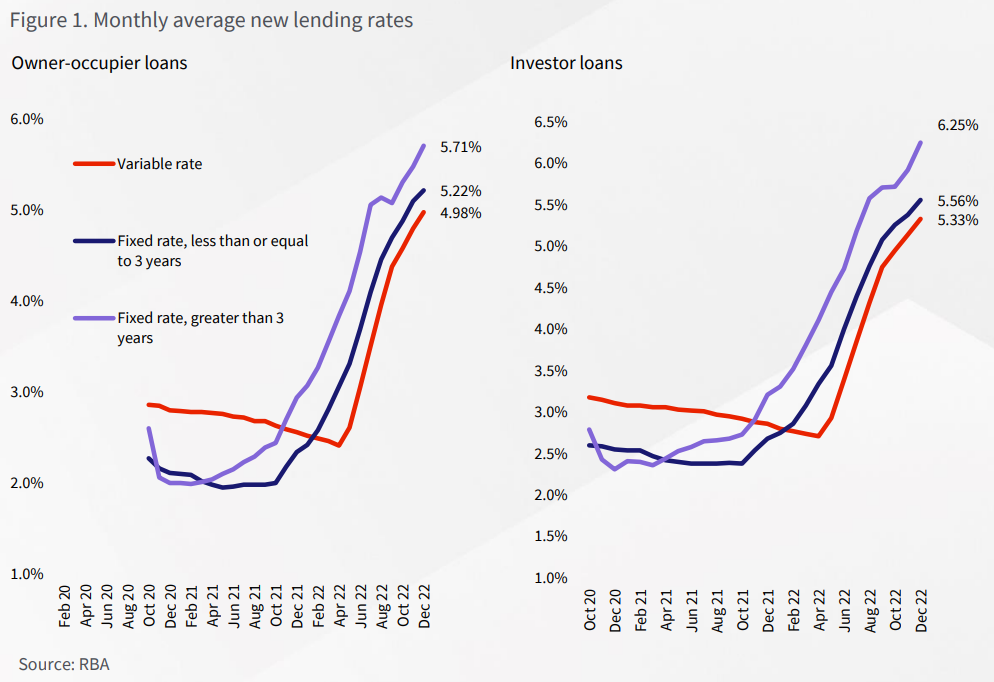

Mortgage rates fell significantly during the pandemic, with short-term fixed rates averaging as low as 1.95% in May 2021 for owner-occupiers. As a result, fixed-term home lending rose to 46% of new mortgage commitments in July and August 2021, up from its historical average of 15%.

In its October Financial Stability Review, the RBA noted that about 35% of outstanding housing credit was on fixed terms, and roughly two-thirds of this debt is set to expire in 2023.

With the fixed rate period coming to an end this year, around 23% of all outstanding fixed mortgage debt will be repriced at a much higher rate, posing a risk to many borrowers.

Factoring in another 50 basis points of rate hikes over March and April, average variable rates could be around 5.7% for owner occupiers and over 6.0% for investors, Owen warned.

What comes next?

The fixed rate cliff will be felt most acutely from April 2023, according to Owen, as the change in rates will be significant due to more rate rises, and average loan sizes have grown considerably since April 2021 during the housing boom.

The initial repricing from an average two-year fixed term rate during the pandemic to a variable rate two years later will be significant and will likely pose “some challenge to serviceability,” Owen said, especially as interest rates have risen beyond the 3% minimum serviceability buffer recommended by APRA.

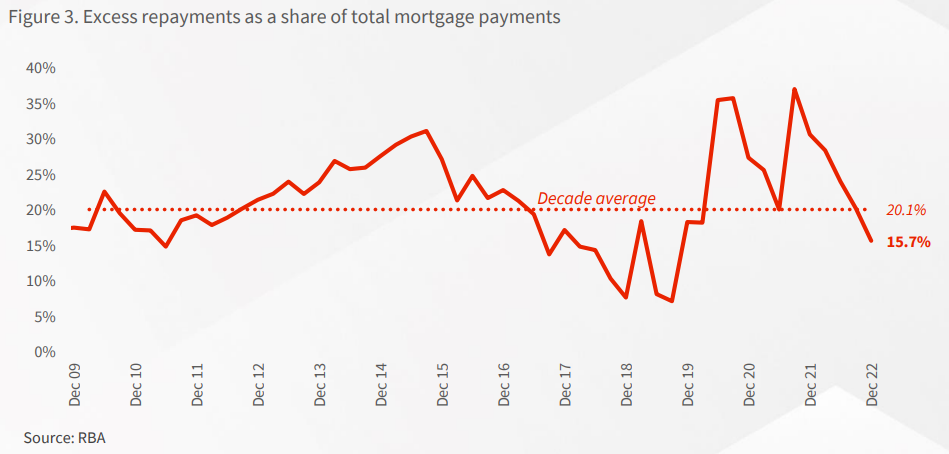

Using the average $538,936 loan taken out in April 2021 as a reference point, a fixed rate of 1.98% will surge to a variable rate of 5.48% in April 2023. This translates to an added $1,066.63 in monthly repayments, going from $1,986.63 under a fixed term to $3,053.26 under a variable rate.

“Stretched serviceability could be compounded by an increase in the unemployment rate this year along with higher than budgeted household costs due to high inflation,” Owen said.

“A rise in distressed sales could also put added downward pressure on property values. If people are forced to sell their home in a declining market, there is the added risk of being unable to recover mortgage debt from the sale of a home.”

Amid this looming risk, Owen noted only 4.9% of lending went out on fixed terms in December 2022, meaning that most outstanding housing debt will be exposed to fluctuations in interest rates by the end of 2023, as many fixed-term loans will have expired.

“On one hand, this increases the risk of reduced serviceability as interest rates rise,” she said. “On the other hand, borrowers may be better positioned to seek a lower interest rate as the cash rate passes a peak, which some believe could be as soon as late 2023.”

Owen pointed to a recent report from CBA highlighting that the RBA may need to start reducing rates by the fourth quarter of 2023 in order to avoid a recession.

“This means while increased variable rates could create tough conditions for households in the short term, the steep hike in interest repayments will not be for the entire life of the loan,” she said. “With external refinancing hovering around record highs, banks will also be more incentivised to reduce their mortgage rate offerings to stay competitive.”

Owen’s analysis also reveals that equity remains high in most markets despite the recent decline in home values in Australia.

While the decline in Australia’s housing markets from respective peaks is highly varied, CoreLogic has estimated that only 2.9% of suburbs across the country have seen home values fall more than 20% from their recent peak.

“Large deposits also help to strengthen the equity position of mortgage holders,” Owen said. “RBA assistant governor Brad Jones recently noted that around 0.5% of home loans were in negative equity amid current price falls. If home values were to fall a further 10%, the RBA estimates the rate of loans in negative equity would only rise to around 1%.”

What is the extent of the impact?

Overall, Owen said there is currently no data to indicate any significant impact on the housing market, and it may take some time for the effects to become apparent.

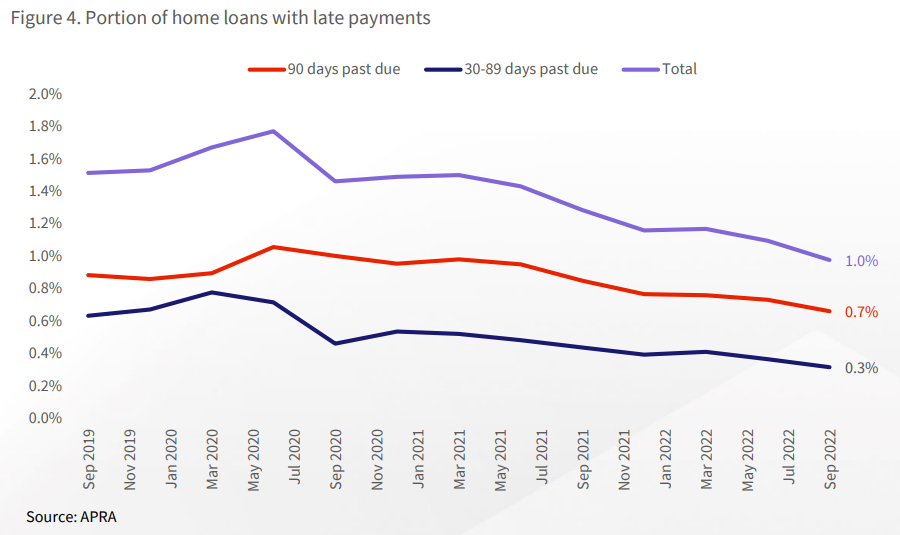

She referred to APRA’s latest available data on non-performing loans from September 2022, which indicated that only 1.0% of home loans were at least 30 days past due. This number has also been falling, but the available data has only captured around two-thirds of the interest rate increases that have been seen so far.

Understanding the impact of rising rates on households can be difficult because different income cohorts and support networks will respond differently to higher interest costs, Owen said.

For example, some people may be able to move in with their parents and rent out their home to supplement mortgage payments, while others on higher incomes can generally afford to allocate a higher portion of their income to housing.

Institutions such as banks will also be working proactively to avoid mass loan defaults in the housing market, and may implement temporary forbearance measures such as extending the loan term, temporarily reverting to interest-only repayments, or reducing monthly repayments.

The implementation of mortgage repayment holidays at the onset of the pandemic had similarly seen “the rise of a ‘cliff’ narrative” as the deadline approached, Owen said, but banks extended the deadline and there seemed to be no significant impact on the property market when the deferrals ended. Still, she acknowledged that “the economic and housing value context was starkly different then, to what it is now.”

“Looking ahead, there’s no escaping that Australians with fixed-rate loans are about to see a painful adjustment,” Owen added. “This is partly the intention of rising rates, as households have to curb spending in response to higher interest costs. So far, listings data and arrears data suggest there is minimal impact on the housing market from defaults. However, the true test of the market will be over the next ten months.”