Trim is a bill negotiation service that can help you save money on recurring fees and subscriptions, as well as cable, internet, and phone bills. Trim offers other features but saving money on bills is the primary attraction.

Pros

Consolidates money-saving efforts

Cons

Bills in advance of realized savings

Requires access to your bank accounts

What is Trim?

Trim is an online bill negotiation tool. It can save you money by cutting recurring expenses and canceling unwanted subscriptions. It can also help you monitor spending, pay off debts, and automate your savings.

If Trim succeeds in reducing the amount you pay, they will charge 15% of your annual savings. If you don’t save money, there’s no fee.

How Does Trim Work?

When you sign up, you will link Trim to your bank and credit card accounts. Trim uses this data to analyze your spending patterns and look for savings opportunities.

Negotiate Your Bills

Trim can negotiate better deals on your cable, internet, phone, and other utility bills. It works with multiple Internet and cable TV providers, including Comcast, Verizon, and AT&T.

All you need to do is find your supplier on the dashboard or send a picture of your last invoice.

Trim may also find the best offers and promotions, helping you choose the most cost-effective offers. The site says it can reduce your costs by 30%.

Reduce APRs and Bank Fees

Do you have exorbitant interest rates on your credit cards or monthly bank charges? Trim will negotiate with your banks or card providers to lower your APRs. You may be able to get a waiver or refund for bank charges or fees.

Cut Medical Bills

If you’re carrying medical debt, the app does the hard work on your behalf. Just share your invoice across the dashboard, and Trim will contact your medical provider to determine a better rate and payment plan for this medical debt. There is no fee for this service.

Stop Subscriptions

Trim can isolate and cancel subscriptions or memberships that you don’t want. The application will monitor your expenses and identify your frequent or recurring transactions. You will receive a notification about them asking if you want to opt out.

If you want to cancel an unwanted subscription, send a message “Cancel name of service.” Trim will do the rest.

These monthly payments may seem trivial by themselves, but they add up, and you can save money by canceling them.

Grow Your Savings

Trim also offers the Simple Savings account, which allows you to automatically shift a fixed amount from your checking account into savings. Trim is not a bank, and accounts are held at Evolve Bank, which is FDIC insured.

As with most savings accounts, there are limits on withdrawals, and per Federal Reserve regulations, you can only make six withdrawals a month.

Other Features

Once you log in, there are more potentially helpful functions. Although they don’t provide direct savings, they can help you make better financial decisions.

Spending Analysis

Trim’s spending analysis function gives you a picture of where your money is going and allows you to compare your expenses month by month, by exact date, and by category.

This makes budgeting easier, helps you track whether you’re following your budget, and lets you identify areas where you may be spending more than you realized.

Expense Monitoring

Trim can send you text notifications whenever certain transactions occur, such as a paycheck deposit, overdraft fees, or late fees. You can also set it to notify you when other parameters are met, such as a minimum checking account balance or a significant transaction.

TrimPay

This service helps you repay your credit card debt by transferring money from your current account to TrimPay and applying the transfer to your credit card bills. The idea is to get the money from your checking account as quickly as possible before you spend it on items other than debt.

TrimPay can help you save on late fees by assuring that you make your credit card payments on time.

Companies that Trim Negotiates With

Trim works with many companies, including ADT, CenturyLink, AT&T, Bright House, Charter, Comcast/Xfinity, Cox, Cricket Wireless, DirecTV, Dish Network, Energy/Utility Providers, Frontier, Mediacom, Time Warner, Optimum, RCN, Sirius XM, Spectrum, Sprint, Suddenlink, T-Mobile, and Verizon.

If you don’t see your supplier in the list, you can email Trim to see if they can help.

How to Sign Up with Trim

To signup/register, visit AskTrim.com and select one of the “Get Started” messages. This will take you to a page that allows you to sign up by email or by using your Facebook account.

After you have entered some basic information into Trim’s website, connect your Facebook Messenger account or phone so that Trim can contact you about potential savings.

You will then link your master bank account, credit card account, or both. This will enable the company to recommend savings options tailored to your needs.

Pros & Cons Of Trim

Let’s walk through some of the pros and cons.

Pros

- Trim is a well-constructed application geared toward saving you money. Those who have been using the same credit card or bank account for years can benefit from Trim’s ability to sift through data and find recurrent expenses.

- One of the essential benefits is the cost. There are no costs associated with using Trim. Though the Bill Negotiator is not technically free, it won’t cost you anything if it cannot save you money.

- The company negotiates your Internet service, cable, phone, and other recurring bills and helps you save as much as 30%.

- Trim takes data safety seriously and will only access your financial records in read-only mode. Trim uses 256-bit encryption, two-factor authentication, and other security measures.

Cons

- Although Trim offers some features in addition to its recurring load reduction feature, it is not the most in-depth financial planning application. Trim is probably unnecessary for people who already monitor their expenses closely.

- There is no mobile application.

- You will be asked to link your bank accounts, which may be uncomfortable for some individuals.

- The success fees are charged in advance following a successful negotiation, which can increase your expenses in the current month.

- Trim bills you 15% of the yearly amount he saves for you, but you would have to pay these fees upfront, in a lump sum, before the savings are realized over time. This was upsetting for some users.

- Trim will only work if your bank or credit union links to Plaid.

Is Trim Safe?

Trim requires you to provide access to a large amount of sensitive personal financial information. Whenever you do business with a company that uses your personal information, there is some risk. Trim uses some of the best security to keep your data safe.

Every piece of information the app has access to is protected by 256-bit SSL encryption, which is the industry standard for retail banking. In addition, Trim uses a company called Plaid to receive information from more than 10,000 financial institutions to which it is directly linked.

Plaid will forward all authentication data you provide to Trim to financial institutions for approval. Trim will have read-only access to your data. The company will never receive the credentials themselves, which is why the Plaid system is much safer.

Customer Reviews

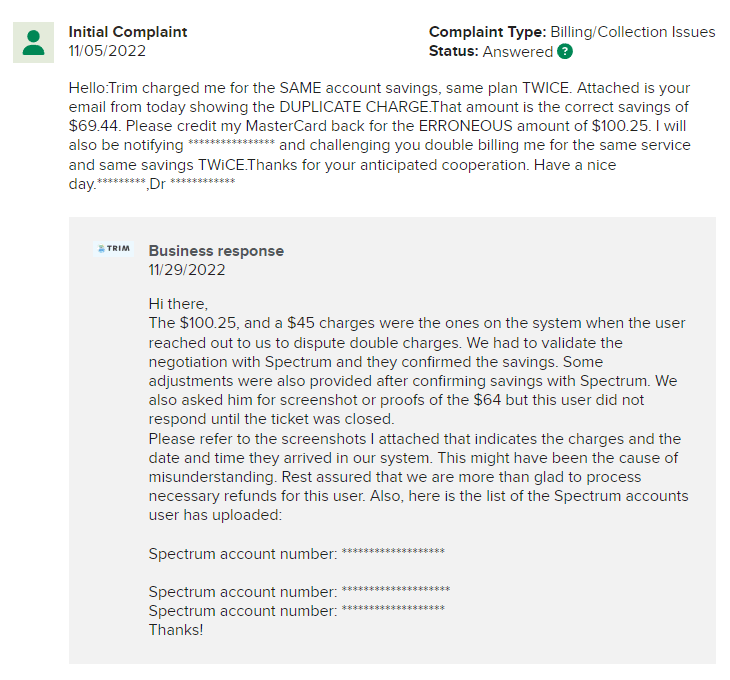

Trim gets 3.94 stars out of a possible 5 from 96 customer reviews on the Better Business Bureau (BBB) page. The company is BBB accredited and gets a B+ rating, indicating a good degree of responsiveness to customer complaints.

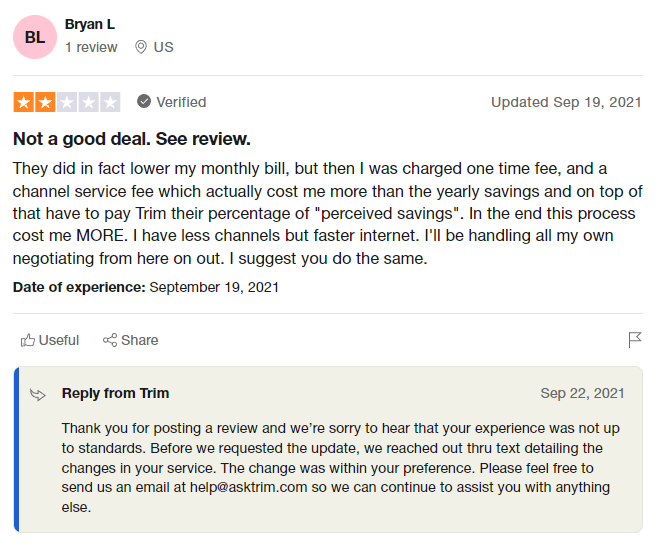

Trim gets better reviews on Trustpilot, with 4.2 of 5 stars from 1,474 reviews. 69% of the reviews are five-star.

The difference may be partly because the BBB tends to be a place where dissatisfied users go to complain. The number of reviews on the BBB site is relatively small, which in itself could be taken as a positive sign!

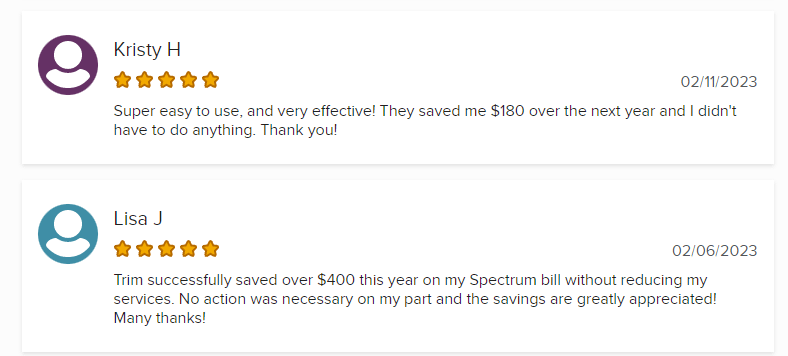

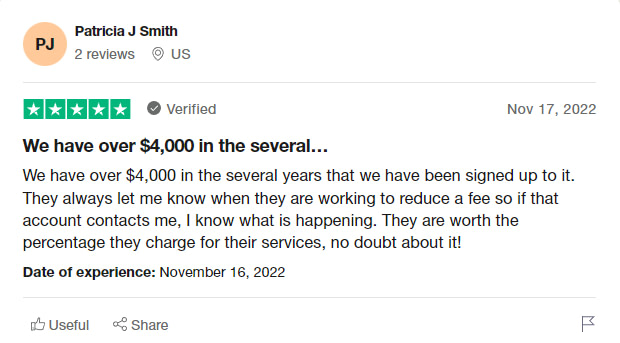

Positive reviews consistently state that the service works as advertised and has saved the reviewer a significant amount of money.

Some negative reviews complain that users were charged twice for the same savings or that they were charged for savings they didn’t see. The company responds to all complaints, and the responses generally seem reasonable and credible.

Trim Alternatives

There are many other bill negotiation services. This table summarizes the services and costs of some of Trim’s major competitors.

| Company | Types of Bills Negotiated | Fees | Fee & Savings Example* | Offers Payment Plans | Additional Features |

|---|---|---|---|---|---|

| Trim | Phone, internet, cable, and wireless, credit card APR, medical | 15% of 1 year | Fee: $72 – $144 Savings: $576 – $648 |

No | Medical bill and APR negotiations not available in AK, AR, CT, DC, MA, RI & VT |

| Billshark | Internet, phone, tv, mobile, home security | 40% for 2 years | Fee: $192 Savings: $528 |

Yes ($9) | Subscription cancellation ($9) |

| Rocket Money | Cable, cell phone, home security | 30% – 60% of 1 year | Fee: $36 Savings: $684 |

No (unless you have a high total) | Subscription management, credit score tracking, budget tools |

| BillCutterz | Cell phone, TV, internet, phone, home security, satellite radio, electricity (TX only) | 50% | Fee: $360($324 if you pay upfront) Savings: $360 (or $396) |

Yes | Shopping insurance rates |

| BillTrim | Cable, internet, home security, electricity, insurance | 25% | Fee: $180 Savings: $540 |

No | 24hr turnaround time |

| BillFixers | Cell phone, internet, phone, TV, radio, home security, subscriptions | 50% of 1 year | Fee: $120 Savings: $600 |

Yes | Separate business services |

| Bill Advisor | Cell phone, internet, TV, phone, insurance, utilities (limited), home security, subscriptions | 50% or $12.99/month | Fee: $360 or $155.88/year membership Savings: $360 |

No | Subscription model offers unlimited bill negotiations |

| Bill Saver | Cell phone, internet, radio, TV | 35% | Fee: $252 Savings: $468 |

No | Cancel services (tv, internet, etc.) for $50 each |

| Mint | Internet, phone, tv, mobile, home security | 40% for 2 years | Fee: $192 Savings: $528 |

Yes ($9) | Credit monitoring, budget tools, fee credit scores |

| CoPatient | Medical bills | 35% or custom | **Fee: $1400 Savings: $2600 |

Undisclosed | Parnters with employers |

| Resolve Medical Bills | Medical bills | $99 + 25%, $499 + 10%, or custom charge | **Fee: $1099 Savings: $2901 |

Undisclosed | Partnership with non-profits |

As with any financial service, it pays to learn more about the best bill negotiating services before making a decision.

Is Trim Worth It?

Trim saves you money if you have recurring charges, unwanted subscriptions, or cable bills that are out of control. You don’t have to make those calls yourself.

Trim can lower your bills by negotiating down your credit card interest rates (APRs). Trim is legit and secure.

It is also easy to use because it communicates with you through SMS or Facebook Messenger chats. (SMS will be billed to your phone bill if you don’t have an unlimited number of SMS.)

Trim charges a percentage of what they save, so there’s no real risk involved. If they don’t save you money you lose nothing. That model also gives them an incentive to find all the savings they can.

Verdict

Given the low risk and low cost, Trim is worth trying. Just make sure you are not paying for things you already do. It is designed for those who don’t keep up with all the small expenses that add up. It is most useful for finding and canceling unwanted subscriptions and renegotiating bills.

FAQs

Trim can cut your energy, phone, internet, and other utility bills. Just upload a copy of your invoice and let the app do the job. You will receive a text message once negotiations end.

There’s no cost to open an account. Certain services on the platform are free of charge. Other services, such as negotiating bills, saving, and paying down debt, come with a relatively small monthly payment (between $2 and $10). Trim will take 15% off your entire annual savings. These charges will only apply once the company has successfully negotiated your bills.

Your savings will depend on the number of savings opportunities Trim detects. If you have a simple financial life with few recurring costs, the savings may be small. If you have many bills and subscriptions, you could save hundreds of dollars a month.

Trim finds savings opportunities by analyzing your spending patterns, especially your recurring expenses. It can’t do this without access to your bank and credit card records.