Seasonally adjusted home prices continued to fall in December and have declined for six consecutive months due to high mortgage rates and economic uncertainty. Locally, all 20 metro areas, reported by S&P Dow Jones Indices, experienced negative home price appreciation in December.

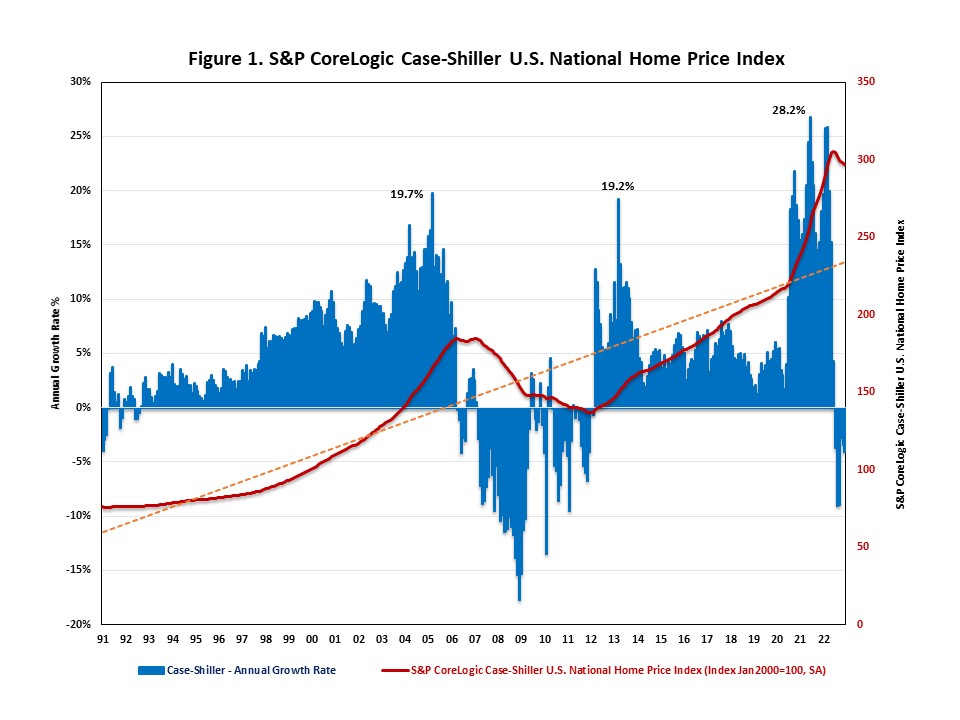

The S&P CoreLogic Case-Shiller U.S. National Home Price Index, reported by S&P Dow Jones Indices, fell at a seasonally adjusted annual growth rate of 4.1% in December, following a 3.4% decline in November and a 2.8% decrease in October. After a decade of growth, home prices started to decline in July, driven by elevated mortgage rates and weakening buyer demand. The July decrease marked the first decline since February 2012, and this month’s decline marks the sixth consecutive monthly decline. Nonetheless, national home prices are now 61% higher than their last peak during the housing boom in March 2006.

On a year-over-year basis, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index posted a 5.8% annual gain in December, down from 7.6% in November. Year-over-year home price appreciation slowed for the ninth consecutive month as the monthly growth rates have turned negative.

Meanwhile, the Home Price Index, released by the Federal Housing Finance Agency (FHFA), decreased at a seasonally adjusted annual rate of 1.2% in December, following a 1.4% decrease in November. On a year-over-year basis, the FHFA Home Price NSA Index rose by 6.6% in September, down from 8.2% in the previous month. The FHFA thus confirmed the slowdown in home price appreciation.

In addition to tracking national home price changes, S&P Dow Jones Indices reported home price indexes across 20 metro areas in December. All 20 metro areas reported negative home price appreciation. Their annual growth rates ranged from -16.5% to -1.4% in December. Las Vegas, Phoenix, and Portland experienced the most monthly declines in home prices. Las Vegas declined 16.5%, while Phoenix and Portland declined 14.8% and 14.7%, respectively.

The scatter plot below lists the 20 major U.S. metropolitan areas’ annual growth rates in November and in December 2022. The X-axis presents the annual growth rates in November; the Y-axis presents the annual growth rates in December. Compared to last month, home prices declined faster in December in the following 11 metro areas: San Diego, Denver, Washington, DC, Miami, Chicago, Detroit, Minneapolis, Las Vegas, Cleveland, Portland, and Seattle.

Related