Debt relief companies, more commonly referred to as debt settlement companies, can help you avoid bankruptcy if you’ve exhausted other forms of relief and still can’t pay your debts. They negotiate with your creditors to let you settle your accounts for less than you owe.

Debt settlement can help you break out of a desperate debt situation, but the process has serious drawbacks. It’s important to understand the debt settlement process before making a decision. In many cases, bankruptcy may be a better option.

Unfortunately, there are many dishonest companies in the debt relief industry, so it’s essential that you choose a provider carefully. To help you avoid scam artists, we’ve found the five best debt relief companies in 2023.

During this period, your accounts will continue to accrue interest and late fees, your credit score will suffer significantly, and your creditors may sue you. Make sure you understand the repercussions and exhaust all less drastic solutions first, such as debt consolidation, credit counseling, and debt management plans.

Best Debt Relief Companies in 2022 Compared

Here are our favorite debt relief companies in 2023:

- National Debt Relief –

Best Overall

- Freedom Debt Relief –

Best For Credit Card Debt

- Accredited Debt Relief –

Best For Quick Results

- JG Wentworth –

Best for Customer Service

- CuraDebt –

Best for Tax Debt Relief

How We Reviewed Debt Relief Companies

Trustworthiness is the most significant factor to consider when selecting a debt relief company. Debt settlement is a multi-year process with thousands of dollars and your credits at stake. You must choose a provider you trust to have your best interest at heart.

As a result, we started our search with companies that have operated across the country for years and consistently received high customer ratings. They also have accreditations from reputable organizations like the American Fair Credit Counsel (AFCC) and the Better Business Bureau (BBB).

In addition to having a good reputation, we wanted to recommend companies that are transparent about the realities of debt settlement programs. Each of our choices offers perks like free consultations, personal debt coaches, and digital dashboards to ensure you’re well-informed.

Finally, though most debt relief companies advertise similar terms, we also considered prices, minimum debt balances, and program lengths. All of our final selections have offerings that are in line with industry standards.

BEST OVERALL

National Debt Relief

- Prices: 15% to 25% of the enrolled balance

- Minimum balance: $10,000

- Allowable debts: Unsecured accounts

- Length of program: 24 to 48 months

- Approximate savings: 46% of the enrolled balance before fees; 25% after fees

- Founded in: 2009

- BBB Rating: A+

- BBB Score: 4.59/5 stars (1,617 Reviews)

- TrustPilot Score: 4.7/5 (35,979)

- Accreditations: AFCC, BBB

BEST FOR QUICK RESULTS

Accredited Debt Relief

- Prices: 15% to 25% of the enrolled balance

- Minimum balance: $10,000

- Allowable debts: Unsecured debts

- Length of program: 12 to 48 months

- Approximate savings: 45% of enrolled balance before fees

- Founded in: 2011

- BBB Rating: A+

- BBB Score: 4.82/5 stars (240 Reviews)

- TrustPilot Score: 4.8/5 (4,382)

- Accreditations: AFCC, BBB

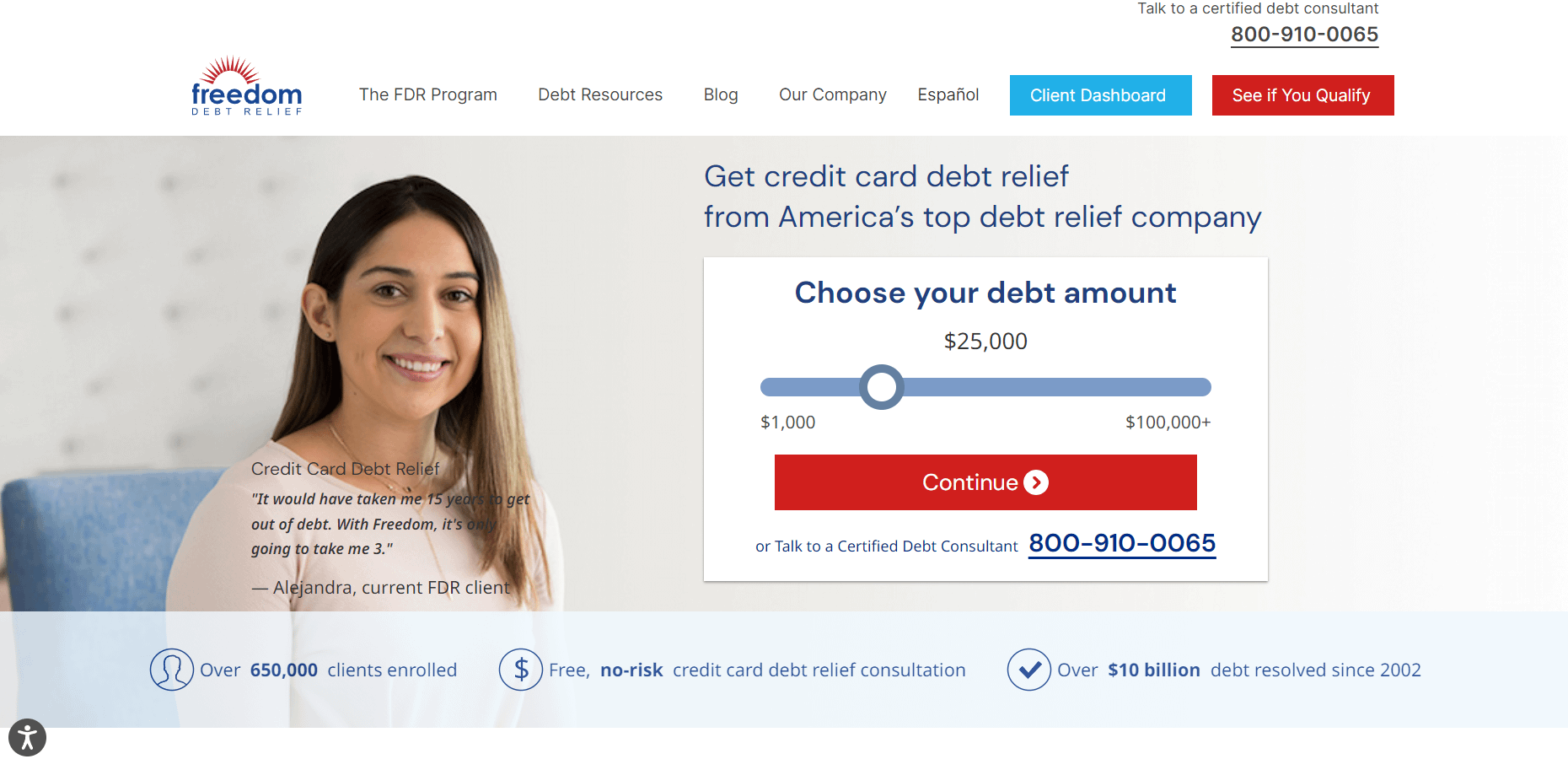

BEST FOR CUSTOMER SERVICE

JG Wentworth

- Prices: 18% to 25% of the enrolled balance

- Minimum balance: $10,000

- Debt specialty: Unsecured debts

- Length of program: 24 to 48 months

- Approximate savings: 51% of the enrolled balance before fees

- Founded in: 1991

- BBB Rating: A+

- BBB Score: 4.25/5 stars (133 reviews)

- TrustPilot Score: 4.8/5 (4,283 reviews)

- Accreditations: AFCC, BBB

BEST FOR TAX DEBTS

CuraDebt

- Prices: About 20% of the enrolled balance

- Minimum balance: $5,000

- Allowable debts: Unsecured debts; tax debts

- Length of program: 24 to 48 months

- Approximate savings: 50% of the enrolled balance before fees; 30% after fees

- Founded in: 2000

- BBB Rating: A+

- BBB Score: 4.81/5 stars (21 reviews)

- TrustPilot Score: 4.1/5 (11 reviews)

- Accreditations: AFCC, IAPDA

National Debt Relief

In addition, NDR has a highly engaged customer service team. When customers encounter issues and leave complaints on review sites, NDR reaches out to rectify the situation within a few days at most.

NDR is also transparent about its prices and track record. It shares several examples of successful programs with real customers and discloses the average customer’s savings before and after fees. Those are approximately 46% and 25%, respectively.

After applying, you undergo a free consultation with a debt expert, who will get more detail on your situation and discuss your options. Next, they’ll recommend a personalized debt settlement plan and monthly payment, subject to your approval.

If you decide to move forward, NDR aims to settle your debts in 24 to 48 months. You won’t pay anything until it settles with each of your creditors, at which point NDR charges 15% to 25% of the initial enrolled balance.

NDR works with customers across the country, but its services aren’t available in every state. Unfortunately, it doesn’t share which states it operates in, so ask about availability during your initial consultation.

Freedom Debt Relief

In addition, FDR has served over 850,000 clients since opening its doors, resolving more than $15 billion in debt. It also holds accreditations with the AFCC, the BBB, and the International Association of Professional Debt Arbitrators (IAPDA).

FDR accepts most unsecured accounts, but it specializes in credit cards. That may indicate that they have closer relationships with card issuers than other providers, which could benefit you if you’re primarily struggling with credit card debt.

FDR’s enrollment process involves filling out an online application and scheduling a consultation with one of their specialists. They’ll help determine whether a debt settlement program could save you money.

If you agree to a program, FDR will try to settle your outstanding accounts in 24 to 48 months. As with NDR, you’ll only pay when FDR reaches an agreement with your creditors, and the fees range from 15% to 25% of the original enrolled balance.

FDR’s services are available in most states but not all of them, so you’ll have to double-check whether you’re eligible during your consultation.

Accredited Debt Relief

It’s received significantly fewer ratings than National and Freedom Debt Relief, but there are still thousands of reviews in total. In addition, ADR holds accreditations with the AFCC and the BBB.

ADR’s customer service team is also proactive about addressing problems its customers encounter. They consistently respond to what few complaints customers leave on their crowdsourced review pages within days.

Finally, ADR is transparent about the average customer’s approximate savings based on your initial debt amount – approximately 45%. However, it doesn’t disclose what you can expect to save after the company’s fees.

However, unlike most of its competitors, ADR advertises that its programs can be as short as 12 months. If you want to get out of debt as fast as possible, it may be a better option than most, though there’s no guarantee you’ll see such quick results.

If you meet ADR’s requirements, you can apply online and schedule a free consultation with one of its debt specialists. They’ll review your finances and explore your debt relief options with you.

That includes the ADR program and its fee structure, which should sound familiar. In accordance with federal law, ADR won’t charge you until they reach a settlement with your creditor. At that point, its fees range from 15% to 25% of the enrolled balance.

ADR is another national debt relief company that doesn’t publicly disclose which states it operates in, so you’ll have to inquire about eligibility when you have your initial consultation.

JG Wentworth

Founded in 1991, it’s maintained a reputation for top-tier customer service for over three decades. It receives five-star ratings from thousands of people, replies to all negative reviews, and has accreditations with the BBB and the AFCC.

Many reviews praise JG Wentworth for going above and beyond to make customers feel safe and respected. You can keep the same representative throughout your journey and even communicate with them via text message.

JG Wentworth is also transparent about the realities of debt relief. It informs prospects immediately that creditors aren’t required to negotiate and that settlement is a last-ditch effort to avoid bankruptcy.

In addition, JG Wentworth shares that the average client saves 51% of their total debt balance through its program. However, that doesn’t include the company’s fees.

If you have $10,000 in unsecured accounts, you can fill out an online application, and a representative will contact you for a free consultation. They’ll assess your eligibility and propose a debt relief program.

Should you accept, you’ll start making monthly payments into a dedicated account, and JG Wentworth will negotiate on your behalf. You can monitor your progress through an online portal and receive updates from your representative. Programs last 24 to 48 months, and fees are 15% to 25% of the initial enrolled balance, due upon settlement.

JG Wentworth’s services are unavailable in CT, GA, HI, IL, KA, ME, NH, NJ, OH, RI, SC, and VT. However, JG Wentworth will refer prospects from those states to law firms that provide debt relief services in their area.

CuraDebt

CuraDebt has a nearly perfect rating on its BBB and TrustPilot review pages. It also holds accreditations with the AFCC and the IAPDA. It’s not accredited with the BBB, but the platform gives it an A+ rating.

CuraDebt isn’t as well-established as the other entries on this list, but it’s one of the only debt settlement companies to allow tax-related debts. If you want help navigating the unique challenges of settling with the Internal Revenue Service or your state tax department, CuraDebt may be your best option.

That makes CuraDebt more accessible than most of its competitors. However, if your debts are that low, you can probably use a less extreme method to meet your needs.

If you meet the requirements, you can schedule an initial consultation online. During the discussion, you’ll explore your financial situation and debt relief options with a counselor.

If debt settlement is your best option, they’ll create a program proposal for you. CuraDebt’s programs last between 24 and 48 months, save you roughly 50% before fees, and cost about 20% of your initial enrolled balance.

CuraDebt’s unsecured debt relief services are unavailable in CT, HI, ID, KS, LA, ME, MT, NH, NV, OR, SC, TN, UT, VT, and WV. Tax debt relief is unavailable in PA and PR.

Pros and Cons of Debt Relief Companies

If you’re drowning in debt payments that you can’t hope to afford, debt relief companies can sound like a much-needed lifeline. However, they have significant drawbacks that you must consider before you hire one.

Let’s explore the most notable pros and cons of debt relief companies to help you decide whether or not you should consider using one.

Pros of Debt Relief Companies

The only tangible benefit of hiring a debt relief company is that they’ll negotiate with your creditors for you. Theoretically, you can try to reach a settlement agreement with your creditors personally, but it’s often stressful, time-consuming, and challenging.

Outsourcing the work can save you time, energy, and mental stress. In addition, debt settlement companies have more experience in negotiation than you, and the best ones have good relationships with creditors. They might be able to reach an agreement faster than you could and achieve more favorable terms.

Cons of Debt Relief Companies

Unfortunately, there are many more downsides to hiring a debt relief company than advantages. The most significant ones include the following:

- Credit score damage: Debt settlement companies force you to stop making payments toward your debt, potentially for years at a time. Since payment history is 35% of your score, your credit will drop significantly. Settling an account for less than the outstanding balance also hurts your score.

- Exposure to lawsuits: When you default on a debt, there’s a chance your creditor or their debt collection agency could sue you to collect on the funds. Your debt relief company won’t be able to provide much assistance.

- Forgiven debts may be taxable: When you settle a debt for less than you owe, the absolved portion is taxable income. However, you don’t have to pay if your assets are less than your liabilities at the time. To figure out the tax repercussions of debt settlement, you may need to speak to a tax expert.

- Savings aren’t guaranteed: Debt relief companies won’t always reach a settlement agreement with your creditors. Even if they do, you might not save much money. Penalties and interest will continue to accrue on your debts, and relief companies charge you 15% to 25% of your enrolled balance.

Don’t let debt relief companies trick you into thinking that signing up for a debt settlement program is a magic bullet for getting out of debt. In reality, it’s expensive and high-risk, and you should only consider it as an alternative to filing bankruptcy.

Alternatives to Debt Relief Companies

Before you hire a debt settlement company or attempt to negotiate a settlement yourself, make sure you’ve exhausted all your other options. Of course, the best way to resolve your debt issues is to increase your net cash flow and pay them off in full.

Assuming you can’t solve your problems by tightening your budget or earning extra income, consider the following forms of debt relief next:

- Ask your creditors for help: Contact your creditors and ask them to help you pay them back. Reaching out, especially early, is a sign of good faith. They may have a hardship program that lowers your monthly payments or gives you more time to pay.

- Sign up for credit counseling: Credit counseling agencies are typically non-profit organizations that work with you to improve your finances. They also offer debt management plans, which involve your counselor negotiating with your creditors for better terms. However, they don’t have you stop making payments or settle your account for less than you owe, so they’re better for your credit.

- Execute a debt consolidation: Debt consolidation involves using a new credit account to pay off your existing debts. With a good credit score, you can consolidate your debts into a loan or credit card with more favorable terms.

- Consider bankruptcy. If you qualify for a Chapter 7 bankruptcy with no exposed assets, it can be a better option. The process can be over in six months, as opposed to two to four years for debt settlement. You can also discharge debts completely, instead of reducing them by 25% to 30%.

Each of the above options is more affordable than hiring a debt settlement company and does significantly less damage to your credit. Make sure you try to resolve your debt issues with them before resorting to a debt settlement company.

Are Debt Relief Companies Worth It?

Debt relief companies negotiate with your creditors on your behalf to settle your unsecured debts for less than you owe. Assuming you hire one that’s trustworthy, they can save you time, stress, and money.

However, the process damages your credit score significantly, and there’s no guarantee it’ll result in debt freedom. In addition, hiring a debt relief company to manage the process for you is expensive, and you may not save much money after paying their fees. Ultimately, you should only ever consider it as an alternative to bankruptcy.

FAQs

Debt relief companies offer debt settlement programs to those experiencing financial hardship. They have you stop making payments toward your debts and make monthly contributions to a separate bank account they open for you instead.

Once you accumulate enough capital in the account, debt relief companies reach out to your creditors and try to get them to settle your account for less than you owe. If they can come to an agreement, you use the funds to pay the lower amount and eliminate your debts.

If possible, it’s better to pay off your debts than to settle them. Attempting to reach a settlement usually requires that you miss multiple monthly payments and default on your account, damaging your credit score and exposing you to creditor lawsuits.

In addition, there’s no guarantee that you’ll be able to reach a settlement at the end of the process. And even if you do, your credit report will show that the account was settled for less than the full balance, further damaging your score.

Debt relief companies typically charge between 15% and 25% of your initial enrolled balance. For example, say you have $10,000 in credit card debt that your provider eventually settles for $5,500. On top of that amount, you’d have to pay your debt settlement company $1,500 to $2,500.

In addition, you may incur a monthly fee to maintain the bank account where you make your monthly deposits during the program. For example, Freedom Debt Relief charges $9.95 to open the dedicated account and $9.95 monthly to maintain it.

The most common way consumers fall prey to debt relief scams is by paying a company upfront. Federal law prohibits debt settlement companies from charging you anything until they actually settle your accounts.

Other indicators that a company may not be trustworthy include having a relatively weak online presence and making grandiose promises that sound too good to be true. For example, it’s a red flag for companies to guarantee they’ll succeed in lowering your debts.