The count of open, unfilled jobs for the overall economy declined slightly in January, falling to 10.8 million, after an 11.2 million reading in December, which was the highest level since July. The count of total job openings should fall in 2023 as the labor market softens and the unemployment rises. From an inflation perspective, ideally the count of open, unfilled positions slows to the 8 million range in the coming quarters as the Fed’s actions cool inflation. While higher interest rates are having an impact on the demand-side of the economy, the ultimate solution for the labor shortage will not be found by slowing worker demand, but by recruiting, training and retaining skilled workers.

The construction labor market saw a more significant decline for job openings in January as the housing market cools. The count of open construction jobs decreased from a revised data series high of 488,000 in December to just 248,000 in January. Not only is this a significant decline from the January 2022 reading of 396,000, but the January 2023 levels marks the lowest estimate for construction sector job openings since October 2020.

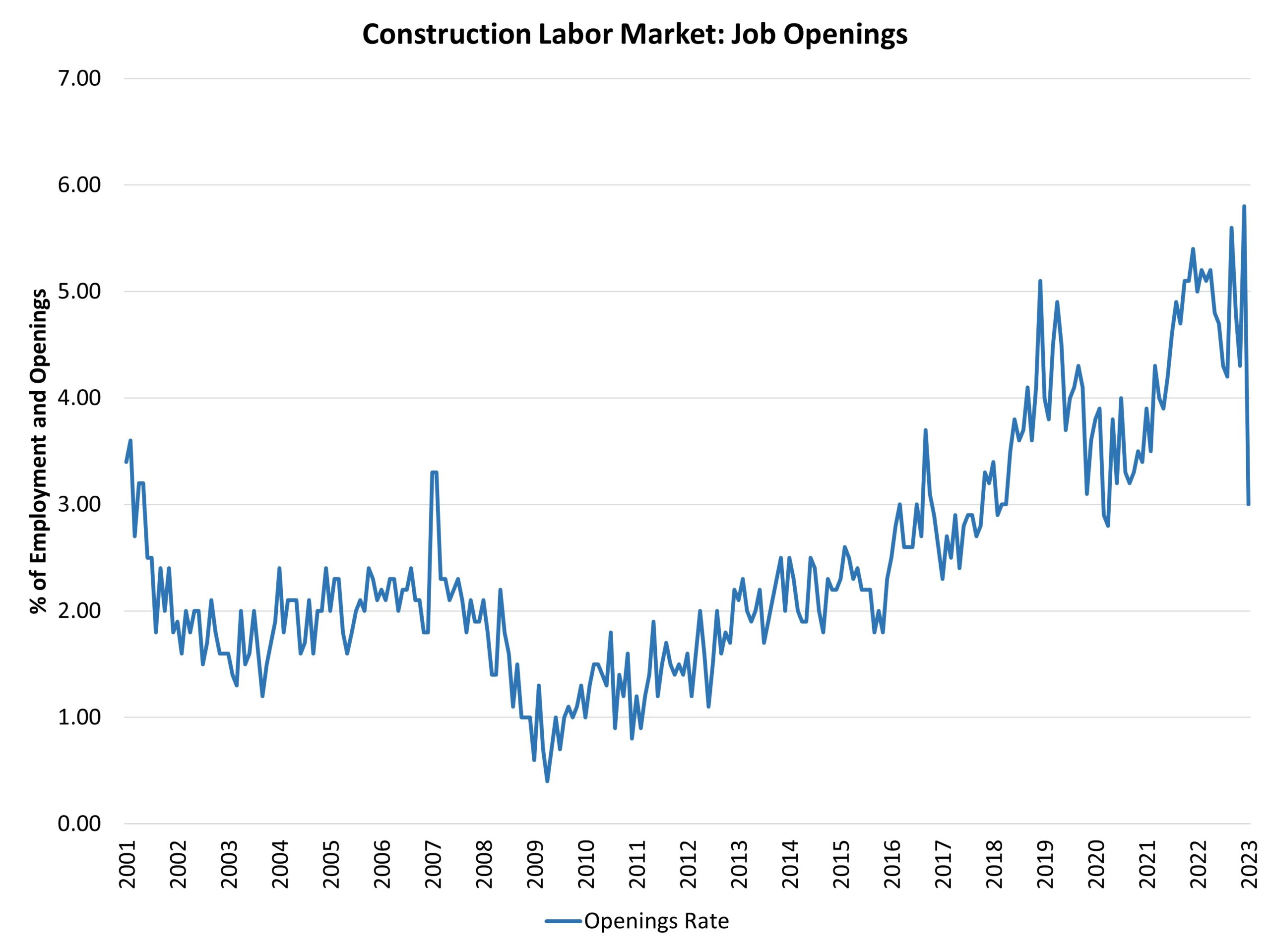

The construction job openings rate declined to 3% in January after a 5.8% data series high in December 2022. The January 2023 job openings rate was the lowest since April 2020. The combination of these estimates points to the construction labor market having peaked in 2022 and now entering a cooling stage as the housing market weakens.

Despite the weakening that will occur in 2023, the housing market remains underbuilt and requires additional labor, lots and lumber and building materials to add inventory. Hiring in the construction sector increased to a 5% rate in January. The post-virus peak rate of hiring occurred in May 2020 (10.4%) as a post-covid rebound took hold in home building and remodeling.

Construction sector layoffs ticked up to a 2.2% rate in January. In April 2020, the layoff rate was 10.8%. Since that time, the sector layoff rate has been below 3%, with the exception of February 2021 due to weather effects. Nonetheless, the layoff rate has been above 2% for four of the last five months, which is consistent with a weakening trend.

Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. While a slowing housing market will take some pressure off tight labor markets, the long-term labor challenge will persist beyond the ongoing macro slowdown.

Related