HDFC AMC Ltd. – The Most Trusted Brand

HDFC Asset Management Company Limited (HDFC AMC) is Investment Manager to HDFC Mutual Fund, one of the largest mutual funds in the country. It was incorporated under the Companies Act, 1956, on 10th December 1999 and was approved to act as an Asset Management Company for HDFC Mutual Fund by SEBI on 3rd July 2000. It has other SEBI licenses viz. PMS/AIF.

The company currently has over 75k empanelled distributors which includes MF (Mutual Fund) distributors, National Distributors and Banks. They serve customers and distribution partners in over 200 cities through their network of 228 branches and 1274 employees. HDFC AMC has been in a consistent position as one of India’s leading asset management companies driven by their comprehensive investment philosophy, process, and risk management.

Products & Services:

The company offers a large suite of savings and investment products across asset classes where mutual fund schemes are their main product. It includes 24 equity-oriented schemes, 68 debt-oriented schemes, 2 liquid-oriented schemes and 7 other schemes. The company also provides Portfolio Management & separately managed account services to HNIs, family offices, domestic corporates, trusts, provident funds, and domestic and global institutions.

Subsidiaries: As on March 31, 2022, the company does not have any subsidiary. In FY23, the company has opened its wholly-owned subsidiary named HDFC AMC International (IFSC) Limited in GIFT City.

Key Rationale:

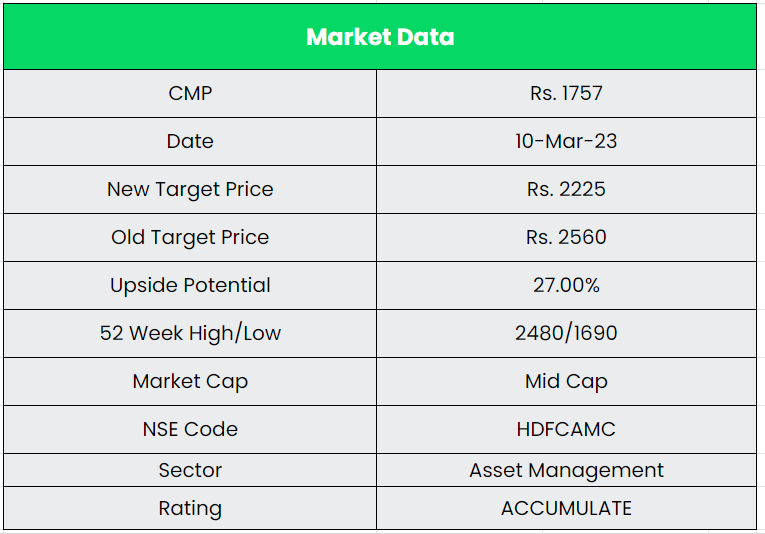

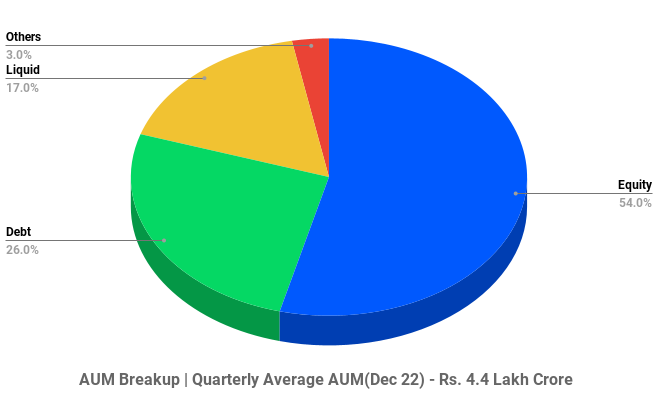

- Market Leader – HDFC AMC is one among the India’s largest mutual fund managers with a Quarterly Average AUM (QAAUM) of ~Rs.4.4 lakh crore (QAAUM market share of 11%) as on December 31, 2022. QAAUM in actively managed equity-oriented funds i.e., equity-oriented QAAUM excluding index funds stood at Rs.2.2 lakh crore as on December 31, 2022 with a market share of 11.7%. Amongst the most preferred choices of individual investors, with a market share of 12.8% of the individual monthly average AUM as of December 2022.

- Q3FY23 – Q3FY23 revenue from operations grew 2% YoY to Rs.560 crs, as closing AUM surged to Rs.4.48 lakh crore (3% YoY), aided by increase in equity AUM while yields were steady QoQ to 0.50%. HDFC AMC reported better than industry trend with sequential improvement of 6.1% in AUM at Rs.4.48 lakh crore. The company’s closing equity AUM at Rs.2.3 lakh crore, grew 7.7% QoQ and 18% YoY, higher than industry trend. Debt segment particularly witnessed a degrowth in AUM of 23% YoY (on a QoQ basis was flat) vs. 17% YoY degrowth at industry level while liquid segment was largely steady QoQ.

- Updates – During the Q3FY23, HDFC AMC launched a thematic fund named HDFC Business Cycle Fund. The fund saw healthy interest both from distribution partners and investors. It got over 110,000 applications and the AUM of Rs.23.4 billion during the NFO. They have also launched multiple Debt index funds in Q3FY23. For its wholly-owned subsidiary that is HDFC AMC International (IFSC) Limited in GIFT City, the company has on-boarded two experienced and eminent Independent Director.

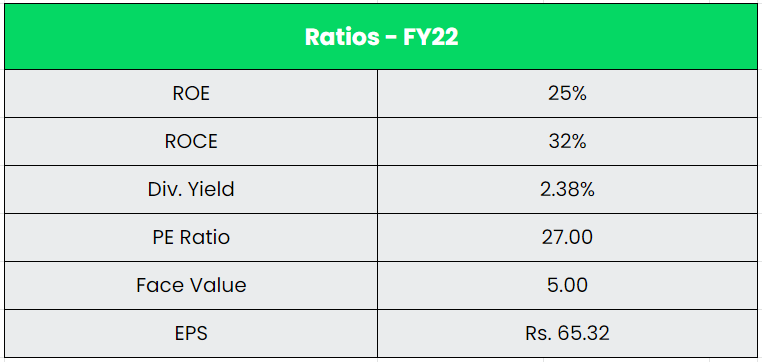

- Financial Performance – The company is financially strong with zero debt. It has a good return on equity (ROE) track record with 5 Years avg. ROE of ~30%+. The company’s closing AUM grew at a CAGR of 12% with Rs.2.30 lakh crore in FY17 to Rs.4.07 lakh crore in FY22. The Revenue and PAT CAGR were 9% and 20% for the same period. The company also paying a healthy dividend for the investors consistently with a Dividend Yield of 2.38%.

Industry:

Indian Mutual Fund Industry’s Average Assets Under Management (AAUM) stood at Rs.40.80 Lakh Crore (Rs.40.80 trillion) for the month of January 2023. The AUM of the Indian MF Industry has grown from Rs.8.26 trillion as on January 31, 2013 to Rs.39.62 trillion as on January 31, 2023 around 5-fold increase in a span of 10 years. The MF Industry’s AUM has grown from Rs.22.41 trillion as on January 31, 2018 to Rs.39.62 trillion as on January 31, 2023, around 2-fold increase in a span of 5 years. The Indian Mutual Fund Industry is Highly Under-penetrated and has the potential to grow exponentially. The mutual fund industry added Rs.2.2 lakh crore to its asset base in 2022, driven by consistent monthly increase in SIP (Systematic Investment Plan) flows. While, the growth of 42-player mutual fund space in 2021 was mainly braced by a rally in the stock markets. The increase in asset base in 2022 is mostly the result of advanced SIP flows, which touched more than Rs.13,000-crore for the third time in a row in December. During the calendar year, SIP inflows averaged more than Rs.12,500 crore per month. The steady inflow suggests resilience in domestic inflows, which have been strong counterbalance to FPIs (Foreign Portfolio Investors) selling. Further, the current run rate of inflows is expected to continue in 2023 with monthly SIPs touching around Rs.14,000 crore on an average.

Growth Drivers:

- The India has more than 50 crore income tax permanent account numbers, but only ~3.6 crore mutual fund investors as of Dec, 2022.

- Despite the high growth, India’s mutual fund AUM to GDP ratio remains significantly low at 16%, as compared to a global average of 74% which shows a huge headroom.

- As per the latest RBI data, only up to 27% of Indian adults meet the minimum level of financial literacy. With the largest youngest population pool in the world, the increase in the financial literacy among the youngsters will result in huge growth.

Competitors: UTI AMC, Nippon India AMC, Aditya Birla Sun Life, etc.

Peer Analysis:

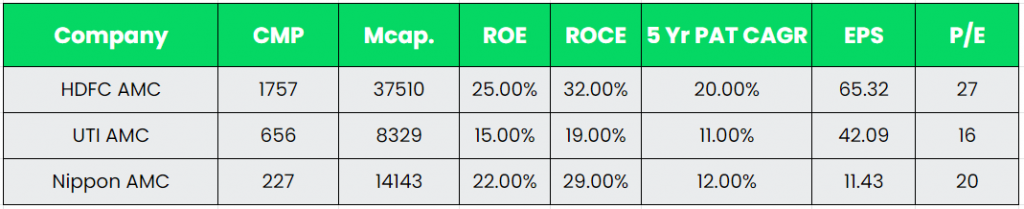

For comparison, we have taken UTI and Nippon India. In that, HDFC is strong and consistent in terms of PAT growth over the years. The 5-year PAT CAGR of HDFC is way better than the others and return ratios also indicates the same argument.

Outlook:

AUM growth continued to see decent improvement on YoY and sequential basis, with strong growth in systematic transactions. 4.13 million Systematic transactions with a value of Rs.15.7 billion processed during the month of December 2022. SIP book AUM was at Rs.84800 crore, out of which ~77% is over 10 years tenure. With 55% of the overall AUM is contributed by the equity segment, the company has outperformed the industry (50:50) in terms of AUM mix. As of December 31, 2022, 66% of the company’s total monthly average AUM is contributed by individual investors compared to 58% for the industry. 40.9% of the total AUM is sourced from the investors through Direct channels. The high equity mix, high retail contribution and more direct channel sourcing of the HDFC AMC is well set to maximize its AUM yield. Unique investors grew to 63 lakhs (3% QoQ), with HDFC AMC’s market share at 17% within the domestic 3.67 crore MF industry. The company also took initiatives to gradually increase its market share in AIF segment over the next three to five years.

Valuation:

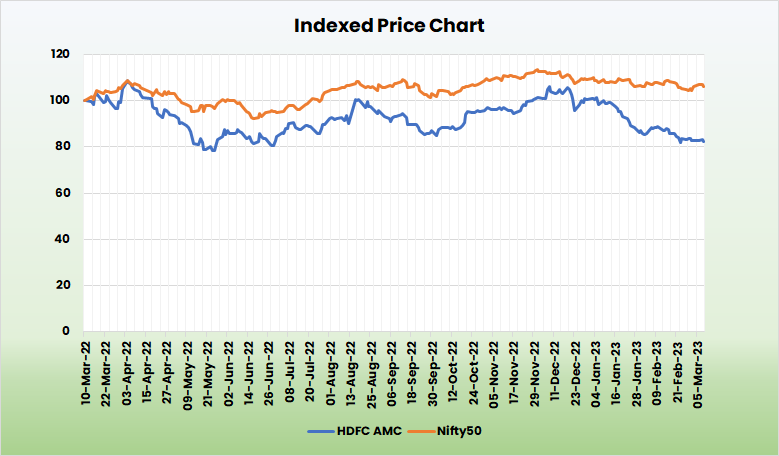

We remain positive on the strong brand franchise, Steady SIP inflows, new product launch pipeline and efficient operational strength but have near term concerns over increasing competitive pricing pressure. However, expansion of AUM and gaining additional market share across all segments are expected to boost overall growth in the near term. Hence, we recommend an ‘ACCUMULATE’ rating in the stock with the target price (TP) of Rs.2225, 30x FY25E EPS.

Risks:

- Volatility Risk – Market volatility (especially downward) has high correlation with fund flows into AMCs. So, any prolonged period of negative returns from equity market can hurt company’s revenues hard.

- Regulatory Risk – Any adverse change of regulations can also impact the business of the company.

- Competitive Risk – Mutual Fund industry is highly competitive business. Apart from having a strong brand recall and vast distribution franchise, consistent fund manager reputation and performance is the key imperative for AUM growth. Continuous under performance of the schemes could lead to high level of redemption.

Other articles you may like