A lot of folks have pondered the buy now or buy later question when it comes to a home purchase.

The waiters are waiting for home prices to fall, knowing affordability is historically low.

The non-waiters either can’t wait or don’t want to wait because they expect competition to heat up once things turn around. Or they simply bought not knowing prices had peaked.

But is it possible to get the best of both worlds? Can you buy a home for less and refinance to a lower rate later?

Let’s look at the math to see how this would pan out.

Those Who Didn’t Wait to Buy a Home

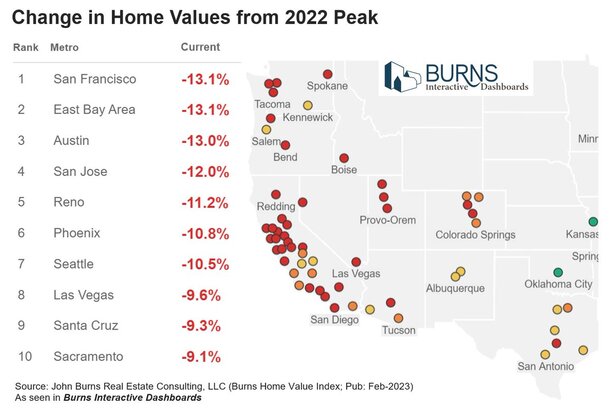

I’m going to use the Austin, Texas metro for this exercise. Prices there are apparently down about 13% from their 2022 peak.

Let’s assume someone bought a home there during the “peak” for $600,000 and put down 20%.

That’s a down payment of $120,000 and a loan amount of $480,000. We’ll assume they got a 30-year fixed set at 3.75%.

The monthly principal and interest payment is $2,222.95. Pretty low payment, but they visit Redfin/Zillow and find that their property is now valued at around $525,000. Ouch.

Thanks to their 20% down payment they aren’t in a negative equity position. But their LTV is now over 90%, at least on paper.

They’re basically not going anywhere, but they’ve got that awesome 3.75% fixed-rate mortgage for the next three decades.

Those Who Waited to Buy but Missed the Mortgage Rate Bottom

Now let’s consider a buyer entering the market in February 2023 with home prices down about 13%.

That $600,000 home is now priced to sell for around $525,000. This means a 20% down payment sets them back $105,000. And the loan amount at 80% LTV is $420,000.

Good news on the lower down payment and the smaller loan amount. However, the 30-year fixed climbed to a much higher 6.5%.

That results in a P&I payment of $2,654.69 per month, a full $431 more than the individual who paid $75,000 more for the same basic home.

If the loan is held to maturity, we’re talking about $536,000 in total interest paid.

The 3.75% loan would result in total interest of just $320,000.

This doesn’t look good for the home buyer who waited for prices to come down, given the massive increase in mortgage rates.

But what if rates settle down again by the end of 2023?

The Recent Home Buyer Who Refinances Their Mortgage

| $600,000 Purchase | $525,000 Purchase | $525,000 Refinance | |

| Down payment (20%) | $120,000 | $105,000 | n/a |

| Loan amount | $480,000 | $420,000 | $420,000 |

| Mortgage rate | 3.75% | 6.5% | 4.5% |

| Monthly P&I | $2,222.95 | $2,654.69 | $2,128.08 |

| Interest paid | $320,262.00 | $535,688.40 | $346,108.80 |

| Total paid | $800,262.00 | $955,688.40 | $766,108.80 |

Let’s imagine a scenario where inflation gets under control, the Fed stops raising rates, and long-term mortgage rates ease.

No, not back to 3%, but call it 4.5%. The buyer takes advantage of this and gets their rate down to 4.5% via a rate and term refinance.

The monthly payment drops to $2,128.08, about $100 less than the person who bought at the “peak.”

And the total amount paid over the life of the loan is about $766,000 versus roughly $800,000 on the loan taken out at the peak.

The recent buyer stills pay a bit more interest, but less overall due to a smaller amount borrowed.

Of course, this only works if mortgage rates fall rather substantially, from the 6% range to the 4% range. It’s certainly possible, but not a guarantee.

And in the meantime the monthly payment is $400+ extra. Tick tock.

Still, the buyer with the higher mortgage rate has options, whereas the buyer with the below-market rate can’t really improve upon their situation.

Another perk to the lower sales price is a better tax basis, and potentially less competition from other buyers if higher rates dampen demand.

The downside is you’d have to go through the stress and aggravation of the home loan process twice.

And as noted, there’s no guarantee mortgage rates actually come down.

But this is the basic premise of the marry the house, date the rate line you may have come across.