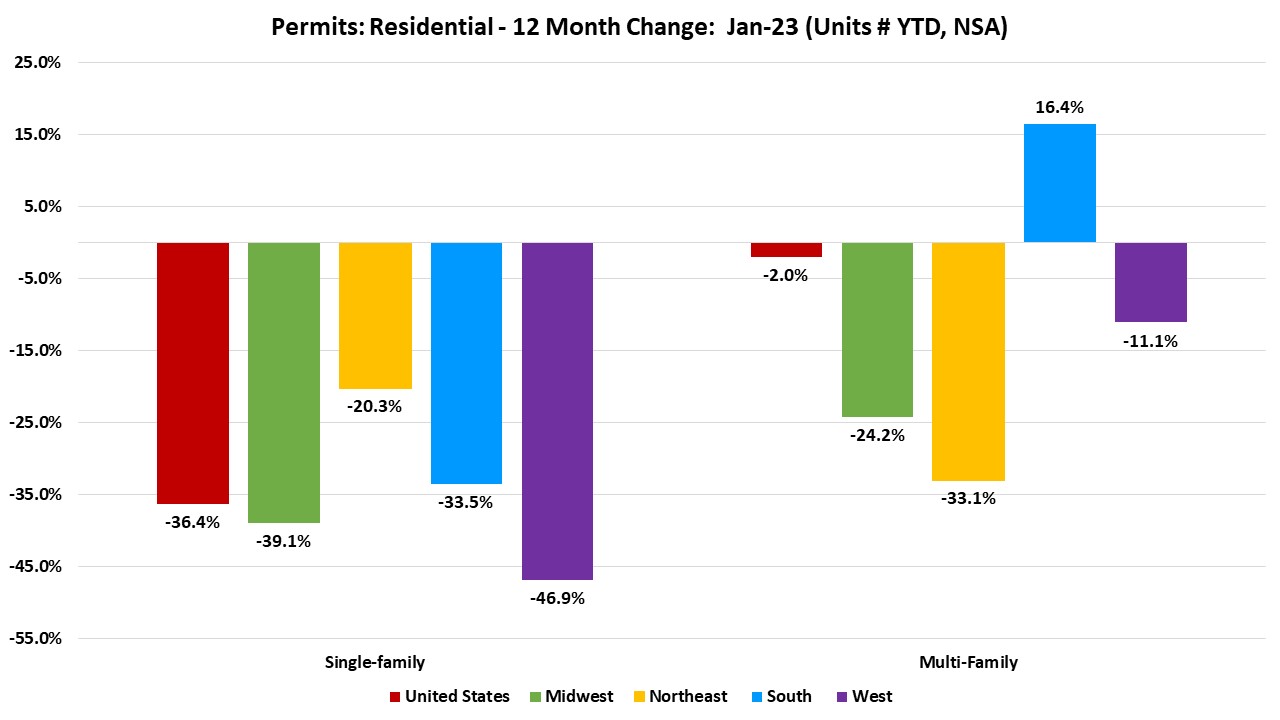

Over the first month of 2023, the total number of single-family permits issued year-to-date (YTD) nationwide reached 53,062. On a year-over-year (YoY) basis, this is 36.4% below the January 2022 level of 83,404.

Year-to-date ending in January, single-family permits declined in all four regions. The Northeast posted a decline of 20.3%, while the West region reported the steepest decline of 46.9%. The Midwest declined by 39.1% and the South declined by 33.5% in single-family permits during this time. The South posted an increase of 16.4% in multifamily permits while the other three regions posted declines. Multifamily permits were down 33.1% in the Northeast, down 24.2% in the Midwest, and down 11.1% in the West.

Between January 2022 YTD and January 2023 YTD, the District of Columbia, North Dakota, and New Mexico saw growth in single-family permits issued. The District of Columbia recorded the highest growth rate during this time at 20.0% going from 10 permits to 12. Forty-eight states reported a decline in single-family permits during this time ranging from 2.9% decline in New Jersey to 60.7% decline in Arizona. The ten states issuing the highest number of single-family permits combined accounted for 65.6% of the total single-family permits issued.

Year-to-date, ending in January, the total number of multifamily permits issued nationwide reached 47,936. This is 2.0% below the January 2022 level of 48,912.

Between January 2022 YTD and January 2023 YTD, 23 states and the District of Columbia recorded growth, while 26 states recorded a decline in multifamily permits. Rhode Island reported no change. The District of Columbia led the way with a sharp rise in multifamily permits from four to 788 while Maine had the largest decline of 83.0% from 147 to 25. The ten states issuing the highest number of multifamily permits combined accounted for 69.1% of the multifamily permits issued.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

| Top 10 Largest SF Markets | January 2023 (# of units YTD, NSA) | YTD % Change (compared to Dec 2021) |

| Houston-The Woodlands-Sugar Land, TX | 2,692 | -40% |

| Dallas-Fort Worth-Arlington, TX | 2,244 | -44% |

| Atlanta-Sandy Springs-Roswell, GA | 1,348 | -41% |

| Charlotte-Concord-Gastonia, NC-SC | 1,324 | -19% |

| Phoenix-Mesa-Scottsdale, AZ | 1,102 | -63% |

| Orlando-Kissimmee-Sanford, FL | 1,077 | -32% |

| Tampa-St. Petersburg-Clearwater, FL | 954 | -35% |

| New York-Newark-Jersey City, NY-NJ-PA | 945 | -4% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 900 | -34% |

| Austin-Round Rock, TX | 892 | -59% |

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

| Top 10 Largest MF Markets | January 2023 (# of units YTD, NSA) | YTD % Change (compared to Dec 2021) |

| Houston-The Woodlands-Sugar Land, TX | 3,574 | 147% |

| Atlanta-Sandy Springs-Roswell, GA | 2,359 | 318% |

| Dallas-Fort Worth-Arlington, TX | 2,336 | -18% |

| New York-Newark-Jersey City, NY-NJ-PA | 1,638 | -55% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 1,430 | 2% |

| Miami-Fort Lauderdale-West Palm Beach, FL | 1,384 | 21% |

| Denver-Aurora-Lakewood, CO | 1,367 | 162% |

| Raleigh, NC | 1,223 | 112% |

| Tampa-St. Petersburg-Clearwater, FL | 1,156 | 1462% |

| San Antonio-New Braunfels, TX | 983 | -38% |

Related