Higher mortgage rates and home prices, as well as increased construction costs contributed to lackluster new home sales in February, but signs point to improvement later in the year.

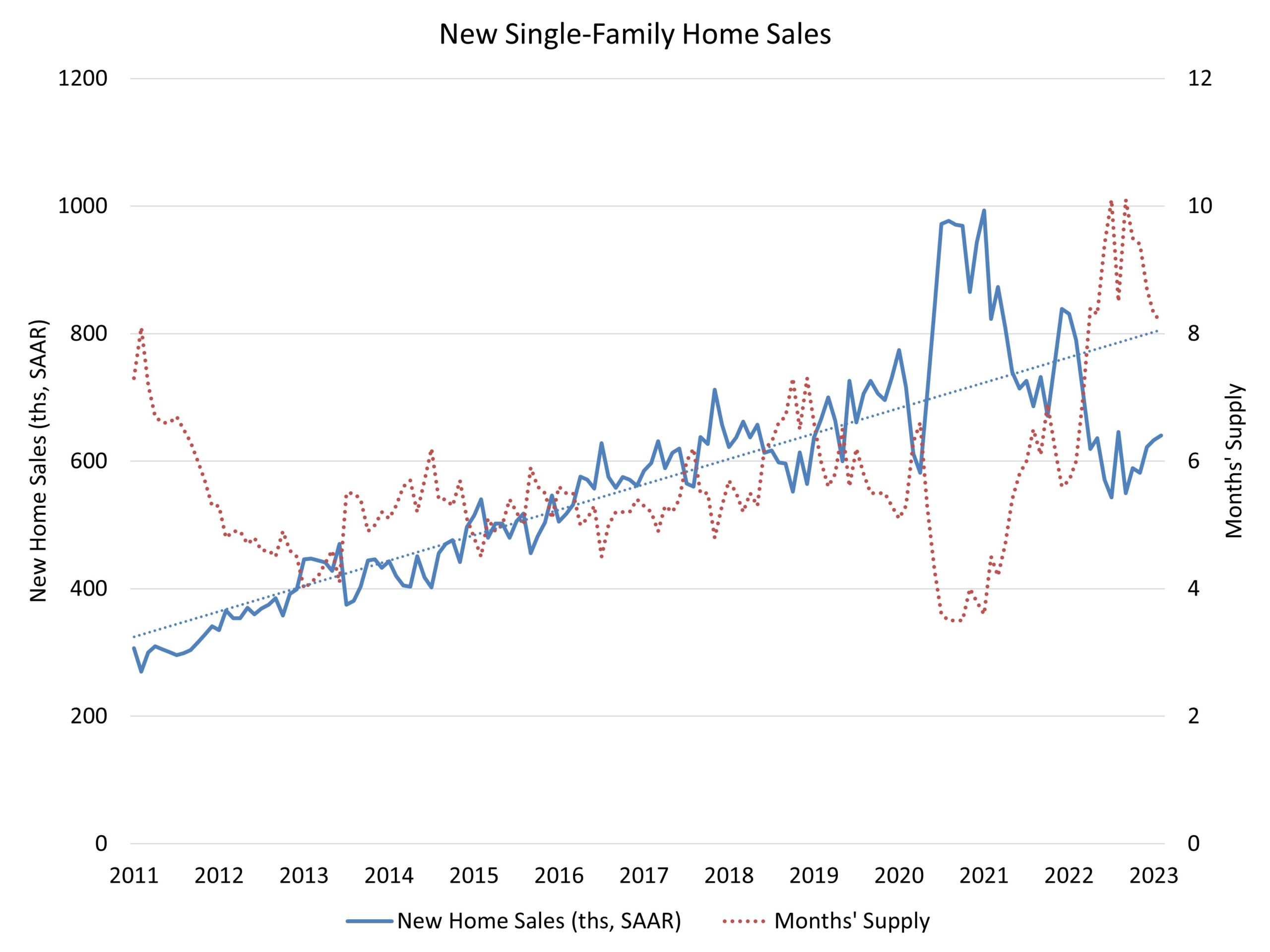

Sales of newly built, single-family homes in February increased 1.1% to a 640,000 seasonally adjusted annual rate from a downwardly revised reading in January, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. However, new home sales are down 19% compared to a year ago.

Builders continue to face challenges in terms of higher interest rates, elevated construction costs, and access to critical materials like electrical transformers. Access to AD&C financing will also be a challenge for builders in the coming months due to recent banking system stress. Nonetheless, the lack of existing home inventory means demand for new homes will rise as interest rates decline over the coming quarters.

Indeed, there was an increase for sales of homes not yet started construction in February. There were 15,000 such sales in February (non seasonally adjusted). This is the highest monthly total since March 2022.

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the February reading of 640,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory fell for the fifth straight month. The February reading indicated an 8.2 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. However, single-family resale home inventory stands at a reduced level of 2.5 months per NAR.

The median new home sale price rose in February to $438,200, up 2.5% compared to a year ago. Elevated costs of construction have contributed to a rise in home prices. A year ago, roughly 15% of new home sales were priced below $300,000, while that share is now just 10% of homes sold.

Regionally, on a year-to-date basis, new home sales fell in all regions, down 29.2% in the Northeast, 21.3% in the Midwest, 7.3% in the South and 40.6% in the West.

Related