Jump to winners | Jump to methodology

The future of home buying

One of the key ways the Australian mortgage sector is fostering mortgage innovations is by creating broad digital ecosystems, according to Doug Nixon, EY banking and capital markets leader – Oceania.

“This is not only covering the end-to-end credit process, but also extending to a wide range of adjacent services supporting consumers through the end-to-end home buying process – from deposit saving right through to conveyancing and settlement technologies,” he explains. “These investments help financial institutions offer a more valuable, and therefore stickier, experience for the customer, thereby reducing the need to differentiate on price alone.”

Australian Broker’s 5-Star Mortgage Innovators are at the vanguard of this trend.

Nixon further explained that ongoing investment in mortgage innovations helps financial institutions:

• seek new ways to increase the speed of products across distribution channels

• reduce their cost to serve

He also makes the case that Australian mortgage innovators, like AB’s 5-Star winners, are crucial at this juncture.

“Australian households are more exposed to interest rate risks than those in many other economies, particularly when you consider our comparatively high levels of household debt,” Nixon says. “This means we have a deep mortgage market, but one that will require rapid innovation if it is to continue to effectively serve both commercial imperatives and the needs of the broader economy in a high interest rate environment.”

“[Australian] products that can help reduce exposure to high interest rates and keep the hearts of households beating steadily will be in high demand in the coming years”

Doug Nixon, EY

Three mortgage innovators reveal their blueprint for success

In keeping with Nixon’s assessment, this year’s 5-Star Mortgage Innovators have leveraged fast-evolving technologies to push the boundaries of what’s possible.

Finding tomorrow’s clients today

Kristy Bartlett, co-director and head of partnerships of winner Mynt Financial, exemplifies that. With their Mynt Savers app, the firm transformed their lead pipeline.

“We generate around 150 leads per month, and around 100 are not ready to do anything for at least six months to two years,” explains Bartlett. “Now many may consider these cold leads and tell them to come back when they are ready to go, but we were determined to build a relationship with them to ensure we were along for the journey and could hold their hands and be ready to be their broker when they were three months out from being ready.”

As a result, leads don’t fall through the cracks. Two new customer service reps, Mynt Savers Coaches and an automated system encourage prospects to save for their first home.

“Many people go away to save, but if there is no coach or anyone cheering from the sidelines, it’s easy to give up and go on holiday or buy a car with your house-saving money,” Bartlett adds.

Things are going well. On average, Mynt Financial onboards 14 people to their savers program each month. The average person takes about nine months to reach their savings deposit goal. What’s more, the company is determined to get 200 people on the program, with 10 people qualifying for a home loan each month, and anticipates it will take 18 months to reach this objective.

“Many people inquired about this program and, in fact, were ready to go, just didn’t have enough knowledge of the home buying process,” says Bartlett. “So, it’s been great to find people who are ready along the way.”

“Brokers will continue to play a pivotal role in guiding home buyers, especially first home buyers, through the overwhelming information and options available”

Strachan Taylor, Helia Group

Building out internal capabilities

Brighten Home Loans is determined to reshape non-bank lending.

“Brighten took the decision to build rather than buy its new lending platform,” says chief technology officer Craig Thompson. “It is tailored to its business needs, is able to process large application volumes, is integrated with key third-party services – removing any manual off-platform processing – and is increasing processing speeds and turnaround times for brokers.”

Furthermore, the architecture is more composable. As a result, Brighten can hook into other third-party service providers – it has approximately six or seven integrations with companies such as CoreLogic and Equifax.

“When we hit headwinds, do we need to introduce new products? Do we need to think about asset classes? No, we can actually pivot very quickly, and we’ll be doing so. Everything flows through the nervous system, sort of like our integration layer and our data lake. So, we have all the data and analytics starting to be merged and/or at least bubble up to the surface,” Thompson adds.

With this mortgage innovation, Brighten was able to increase scalability, market responsiveness (ability to launch new products), develop new insights through its analytics platform, and drive business efficiencies with new automation tools. In 2022, these improvements helped the company boost loan origination volume by over 91% year over year and increase personnel counts by 42% to over 100 full-time employees.

“At Brighten, we are excited about our technology advancement journey and how it sets us apart in the marketplace,” says Thompson. “Unlike some of our competitors with legacy systems and processes, we are able to develop and enhance our digital initiatives for our broker and aggregator network quickly and effectively.”

A year of transformation

Helia Group implemented unique mortgage innovations in 2022. As Strachan Taylor, acting chief commercial officer and strategic partnership leader, explains, “The last 12 months have been a transformation year. With the completion of the operational separation from our former majority shareholder and the launch of our new bank, Helia Group, our business has evolved to harness the new independence in the Australian property market.

“We undertook first-home buyer research and human-centered design work and found that borrowers and brokers were seeking easy and accessible tools to understand the many market entry options, including lenders mortgage insurance (LMI).

“We reimagined and innovated our ‘buy and rent calculator’ to reflect contemporary deposit options that are used by home buyers, including our various evolving LMI payment features,” Taylor adds.

Among the problems solved were better educating brokers, lenders and aspiring home buyers on the options available to them through a deposit comparison estimator tool. The tool also provides an estimate of cost across six scenarios:

1. Wait and save for a 20% deposit.

2. Buy now with the support of a third-party guarantor.

3. Buy with government schemes, such as the First Home Guarantee.

4. Buy now with the upfront cost of LMI capitalised into the loan amount.

5. Buy now with an LMI monthly fee.

6. Buy now with LMI family assistance.

Each deposit option displays the key considerations based on the data provided and the pros and cons for each option. It is written in simple language and focuses on what is important for a home buyer.

The tool also helps brokers and lenders talk through the best use of their customers’ deposits, demonstrating in one tool the options available in a clear format. It provides a convenient method to discuss items like LMI with a prospective home buyer and helps a broker cover key facts to assist the broker in complying with their obligation to act in the best interest of the home buyer.

What’s more, the estimator also provides the user with a snapshot of future value: it projects assumptions out 10, 20 and 30 years, which assists home buyers in considering their financial situation and enables them to make decisions with more confidence.

“Many people go away to save, but if there is no coach or anyone cheering from the sidelines, it’s easy to give up and go on holiday or buy a car with your house-saving money”

Kristy Bartlett, Mynt Financial

5-Star Mortgage Innovators reflect on market conditions

For Helia Group, that meant learning how to navigate market conditions where it is important to balance abundant resources with human services.

“Access to information has never been easier, which is good and bad for borrowers,” says Taylor. “Brokers will continue to play a pivotal role in guiding home buyers, especially first home buyers, through the overwhelming information and options available. The pros and cons of automation and consolidations are other factors,” he adds.

The sentiments resonate with Bartlett.

“There is so much choice in technology for business owners; it’s almost daunting,” she explains. “No aggregator seems to have the solution that ticks everyone’s boxes, so it’s interesting to see everyone integrate different systems from Trello, QUICKI, DocuSign, Pipedrive, BrokerEngine, Slack, Sherlock, Salesforce/Salestrekker plus so many more options.”

Bartlett highlights the three areas that mortgage users want technology to manage:

• “ingest and manage lead flow, and qualify quickly”

• “manage the application or workflow to keep you compliant”

• “manage and stay in touch with the loan book and client retention”

Meanwhile, Nixon adds, “[Australian] products that can help reduce exposure to high interest rates and keep the hearts of households beating steadily will be in high demand in the coming years. Successful innovators will be looking for new opportunities and solutions in this space.”

“At Brighten, we are excited about our technology advancement journey and how it sets us apart in the marketplace”

Craig Thompson, Brighten Home Loans

500+ employees

101–200 employees

- Loan Market

- Loan Market Group Asset Finance (LMGAF)

26–100 employees

- Bridgit

- Finsure

- Funding

- Shore Financial

- Uptick Marketing

- Yellow Brick Road

10–25 employees

- Deposit Assure

- My Mortgage Freedom/RateTracker

- Ramsey Property Wealth

- Sherlok

<10 employees

- Broker Essentials

- Loans Australia

- Purple Circle Financial Services

- Virtus Mortgage Broking Services

Australian Broker’s 5-Star Mortgage Innovators report recognises the companies that are moving the mortgage industry forward, whether by introducing new technology, rolling out a groundbreaking product, or implementing a groundbreaking distribution channel strategy.

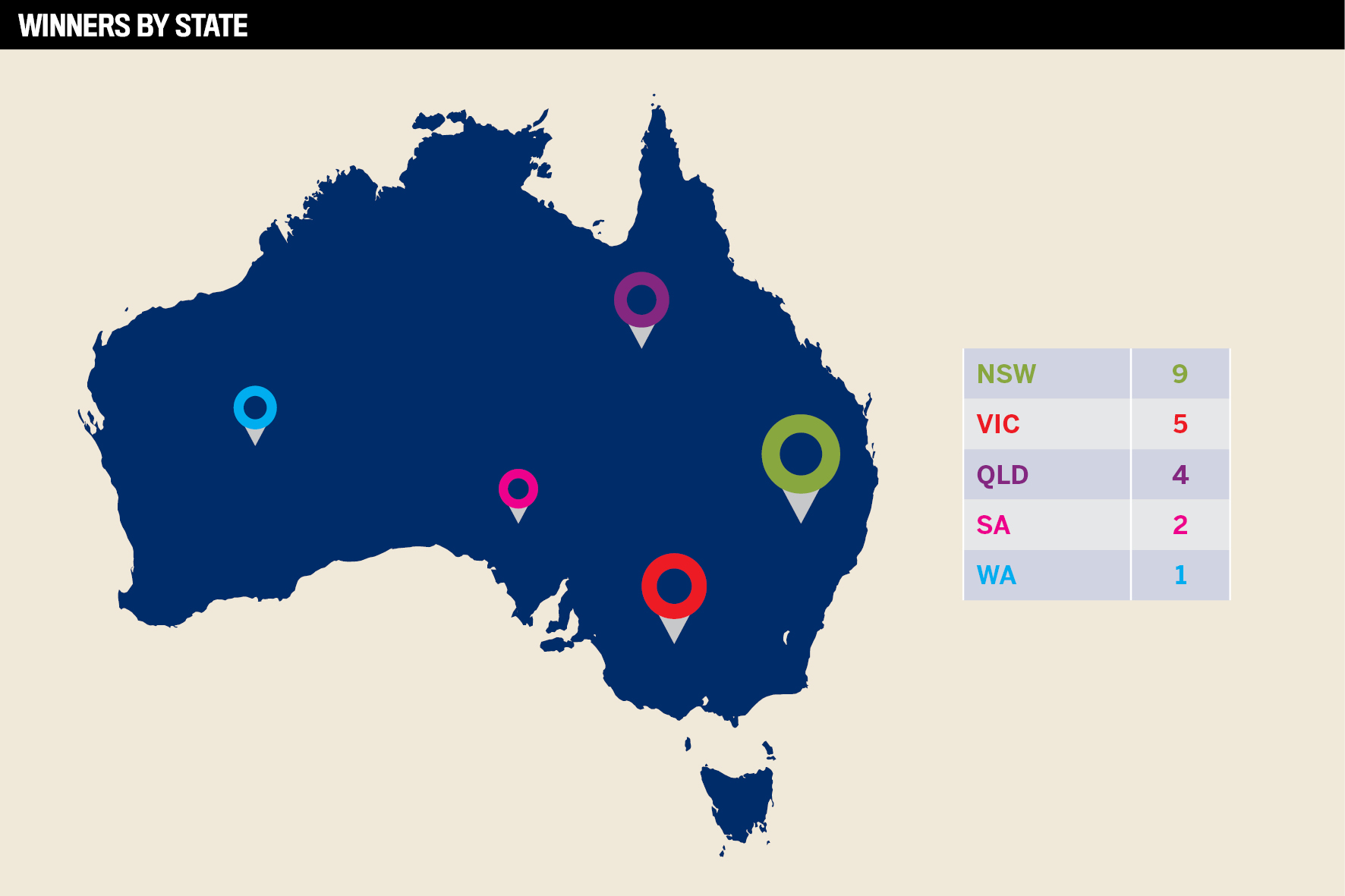

In December 2022, the research team invited lenders, aggregators, brokerages and service providers from around Australia to submit a nomination, including details of the steps they had taken to introduce innovations in the mortgage industry. Companies were encouraged to focus on their new initiatives and results achieved in the calendar year 2022.

The team objectively assessed each entry for detailed information, true innovation and proven success while also benchmarking it against the other entries to determine the 5-Star Mortgage Innovators of 2023.