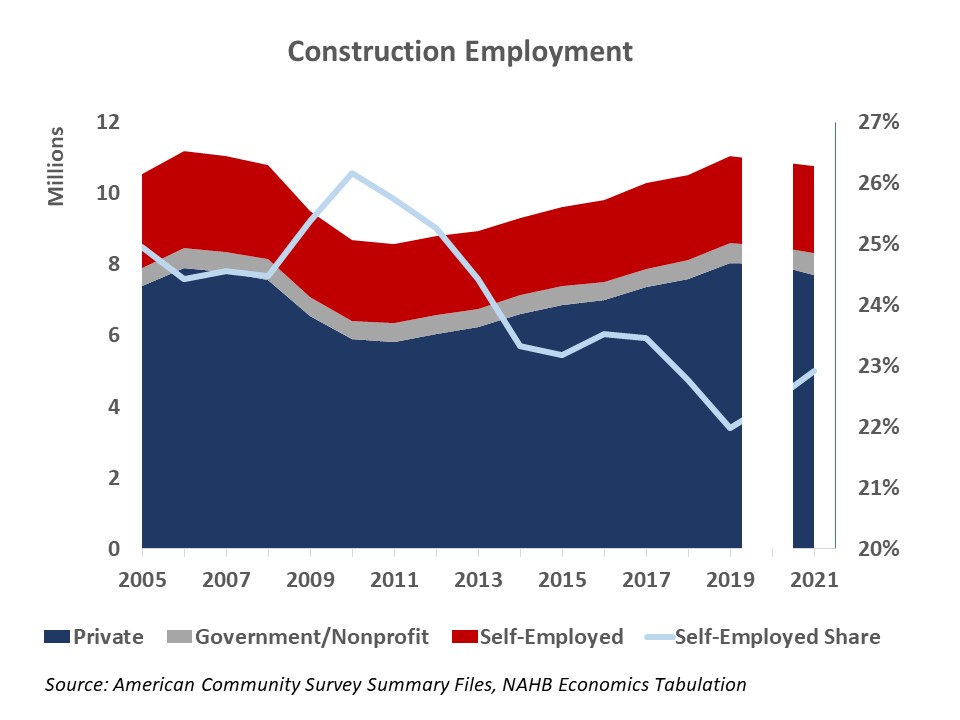

According to the 2021 American Community Survey (ACS), 23% (or close to 2.5 million) of workers employed in construction are self-employed. This is a whole percentage point higher than the share of self employed in construction in 2019, before the pandemic rattled the labor market. Even though the Covid-19 pandemic boosted self-employment across all industries, construction self-employment rates remain significantly higher than an economy-wide average of 10% of the employed labor force.

Under normal circumstances, self-employment rates in construction are counter-cyclical, rising during the economic downturn and falling during the expansion. This presumably reflects a common practice among builders to downsize payrolls when construction activity is declining. Contrariwise, builders and trade contractors would offer better terms for employment and attract a larger share of pool of laborers to be employees rather than self-employed when workflow is steady and rising.

The Covid-19 pandemic disrupted this natural cycle with self-employment rates rising during the post-pandemic housing boom. The number of self-employed in construction approached 2.5 million in 2021, slightly exceeding the pre-pandemic levels, while the number of private payroll workers in construction remained slightly below the 2019 levels. As a result, the share of self-employed increased by a whole percentage point from 22% to 23%.

It is likely that rising self-employment in construction reflects divergent trends within the industry – a faster V-shape recovery for home building and a slower delayed improvement for commercial construction that is less dependent on self-employed. It is also possible that some construction employees laid off during the Covid-19 recession of early 2020 were pushed into self-employment. Similarly, and consistent with economy-wide “Great Resignation” trends, some workers might have chosen self-employment because it offers more independence and flexibility in hours, pay, type and location of work. Given the widespread labor shortages in construction, securing a steady workflow was less of a concern for construction self-employed in post-pandemic times.

Since the 2020 ACS data are not reliable due to the data collection issues experienced during the early lockdown stages of the pandemic, we can only compare the pre-pandemic 2019 and 2021 data (hence the omitted 2020 data in the chart above). As a result, it is not clear whether self-employed in construction managed to remain employed during the short Covid-19 recession or able to recover jobs faster afterwards, compared to private payroll workers. It is also unclear whether the booming residential construction sector attracted self-employed from other more vulnerable or slow recovering industries, including commercial construction.

The Quarterly Census of Employment and Wages (QCEW), that relies on the unemployment insurance accounting system in each state, provides data on employment and establishment counts throughout the pandemic. Even though self-employed are not covered by the QCEW, the survey reveals a shift in construction employment towards smaller size establishments. As of January 2022, construction establishments with fewer than 50 employees were able to recover all jobs lost early in the pandemic and currently have larger payrolls than in January 2020 before the pandemic wreaked havoc on labor markets. At the same time, construction establishments with 500 or more employees have not reached their pre-pandemic employment levels, with payroll employment being 10% lower for establishments with 500-999 employees and 19% lower for the largest companies with 1,000 or more workers.

Given the current record high top builder market share, a shift in construction employment towards smaller size establishments may seem puzzling but likely reflects substantial employment gains by residential construction firms and slower recovery in commercial construction. It also reflects strength in remodeling.

Additional insights into construction self-employment rates can be gained by examining cross-state variation. Maine and Nevada constitute two opposites, with Maine registering the highest (38%) and Nevada showing lowest (10%) self-employment rates in construction. The substantial differences likely reflect a predominance of home building in Maine and a higher prevalence of commercial construction in Nevada.

The New England states are where it takes longer to build a house. Because of the short construction season and longer times to complete a project, specialty trade contractors in these states have fewer workers on their payrolls. The 2012 Economic Census data show that specialty trade contractors in Montana, Maine, Rhode Island, Vermont, Idaho, New Hampshire have the smallest payrolls in the nation with 5 to 6 workers, on average. The national average is close to 9 workers. As a result, a greater share of work is done by independent entrepreneurs, thus explaining high self-employment shares in these states, which matches the elevated shares of residential construction workers in these local labor forces.

Related