There are numerous stock research tools available on the web, and they aren’t all created equal. Every research tool has its own strengths, weaknesses, price points, and target audiences. It can be a daunting and tedious task to sort through all the available options and compare them.

The good news is that you don’t have to spend your time sifting through the best tools out there because we’ve done it for you.

Best Stock Research Tools

BEST FOR BEGINNERS

Yahoo! Finance

Research: News, Basic Analysis, Fundamentals

Charting: Basic Charting, Some Customization

Screening: Simple Equity, ETF, Mutual Funds, and Futures Screeners

Portfolio Analysis: General Composition and Performance Analysis

Yahoo! Finance gives you a nice (free) introduction to the investing world. It has a ton of information available without going too deeply into anything, making it a great first step on the way to mastering the markets. Learn more

BEST FOR INTERMEDIATE INVESTORS

Seeking Alpha

Research: Quant Ratings, Author Articles, and Analysis, In-Depth Ratings

Charting: Customizable Charts with Technical Indicators and 10 Years of Financial Data

Screening: Smart Screening Tools with Dozens of Prebuilt Screeners

Portfolio Analysis: Analysis with Factor Grades, Quant Ratings, Custom Watch Lists

Seeking Alpha is a reservoir full of community-driven research and analysis. There’s a huge quantity of information and research available, but it’s also a great place for intermediate investors to learn by example and watch how more experienced investors play the game. Learn more

BEST FOR FUNDAMENTAL ANALYSIS

Morningstar

Research: Analysis from Skilled Professionals, Detailed Stock Ratings, In-Depth Research Reports

Charting: Basic Charting Tools

Screening: Screener Tool with Custom and Premade Screeners

Portfolio Analysis: Portfolio X-Ray Tool for Analyzing Allocation, Weightings, Stats, and Personalized Insights

Morningstar is the source for some of the most in-depth and respected analyses on the market. Their value-focused analysts cut through the noise and deliver the kind of insights that help you understand all there is to know about a stock and its prospects. Learn more

BEST FOR TECHNICAL ANALYSIS

Stock Rover

Research: News, Stock Ratings, Linked Research Reports

Charting: Advanced and Customizable Charts with Hundreds of Metrics and Indicators

Screening: Powerful Screening Tools with Prebuilt and Custom Equation-Based Screeners

Portfolio Analysis: Robust Portfolio Analysis Tools

Stock Rover’s dizzying array of metrics and technical indicators, its unique and innovative interface, and powerful portfolio management tools make it the perfect choice for anyone who’s looking to read the charts. You can spend days at a time creating and customizing charts and not even come close to reaching the bottom of its indicators list. It’s also a powerful fundamental analysis tool, making it a great choice for investors interested in both the fundamental and the technical approaches. Learn more

BEST AI-DRIVEN TOOL

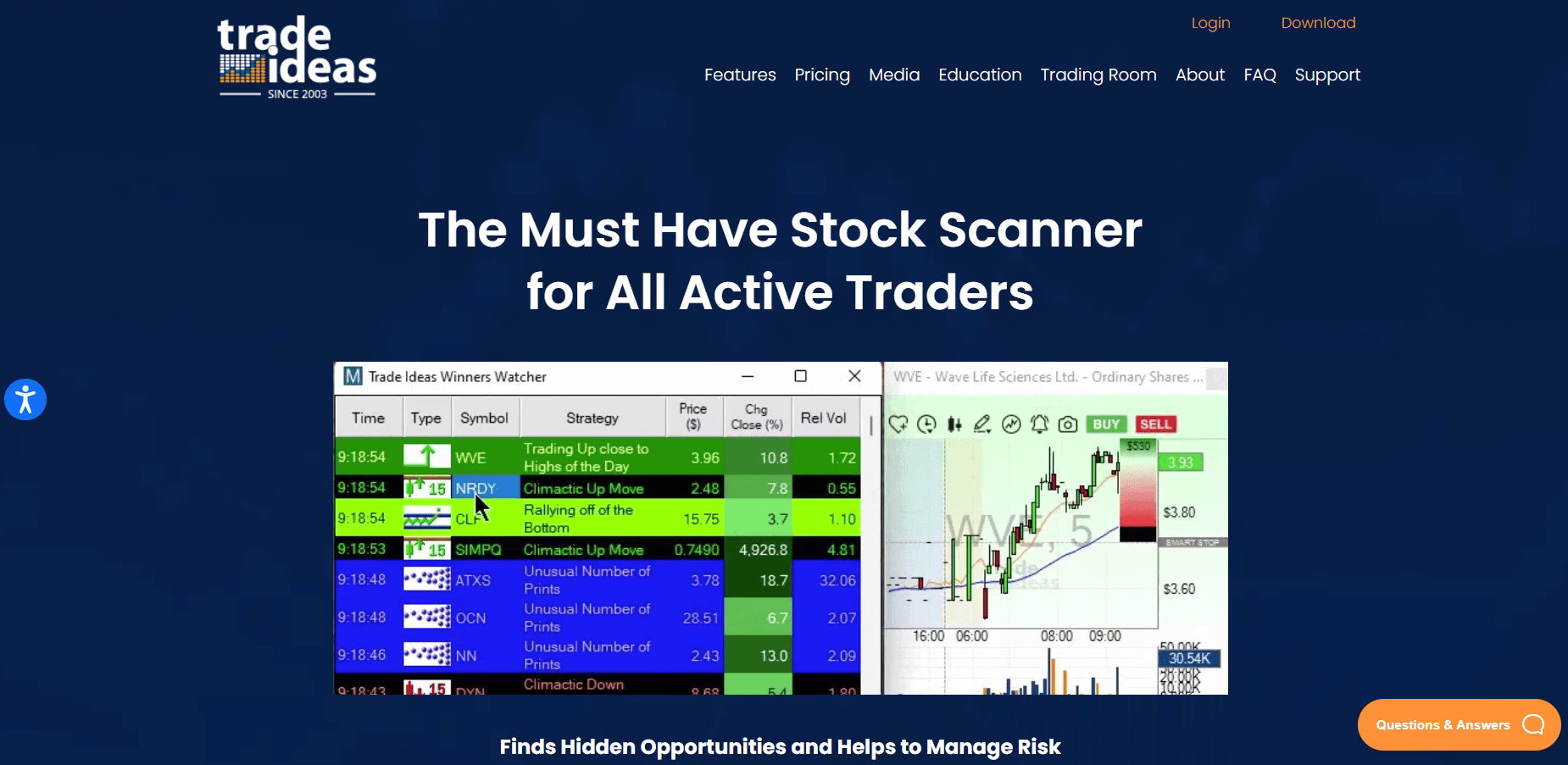

Trade Ideas

Research: Real-Time AI-Driven Trade Ideas, Entry and Exit Signals, Stock Simulations

Charting: Chart-Based AI and Visual Trade Assistants

Screening: PAI-Enhanced Screening with Automated Optimization and Strategies

Portfolio Analysis: AI-Powered Risk Assessment, Portfolio Analysis, Auto Trading

Trade Ideas uses an advanced AI named Holly to give you recommendations, optimize your portfolio, automate trades, and run detailed stock simulations. It’s a bit expensive, but there’s no question that this is a glimpse of the future of investing: using AI to improve decision-making and get statistics and algorithm-driven insights you won’t find anywhere else. Learn more

1. Yahoo! Finance

Yahoo! Finance is a great starting point for anyone who’s interested in investing but isn’t quite ready to commit to the pricier services out there. The free version has all kinds of useful information on stocks, bonds, ETFs, cryptocurrencies, and other assets.

The service has your standard set of relevant news stories, adjustable charts, financial metrics, share performance, and analyst recommendations, but that’s not all. Yahoo! Finance also lets you put together your own portfolios, monitor their performance, and conduct basic analysis.

If you want more, you can subscribe to one of the two paid tiers: Yahoo! Finance Plus Lite or Plus Essential. They come with a few pretty significant upgrades like advanced portfolio analysis tools, daily trade ideas, enhanced screeners, and research from Morningstar and Argus.

Yahoo! Finance stands out as a good choice for beginners for one simple reason: it’s reasonably simple. Newer investors won’t know how to use the kinds of technical indicators, screening features, and analytical metrics that you’ll get in many of the more sophisticated services. It has a nice range of features, covers a wide swath of assets, and has the option of upgrading to a paid tier once you’ve gotten the hang of the basics.

| Basic | Plus Lite | Plus Essential | |

|---|---|---|---|

| Markets | US, Some Int’l | US, Some Int’l | US, Some Int’l |

| Research | News, Basic Analysis | +Fair Value Analysis, Community Insights | +Research from Morningstar and Argus |

| Charting | Basic Charting | Basic Charting | +Enhanced Charting with Auto Pattern Recognition |

| Screening | Equity, ETF, Mutual Funds, Futures Screeners | +Analyst Rating Screeners, Added Metrics | +Same as Above |

| Portfolio Analytics | General Composition and Performance Analysis | +Advanced Portfolio Analysis Tools | +Same as Above |

| Pricing | Free | $20.83/month | $29.16/month |

Pros & Cons

- Feature-rich platform

- A surprisingly large amount of information and analysis is available for free.

- Easy-to-use interface.

- Fee-free introduction to functions like charts, portfolio analysis, screeners, watchlists, fundamental financial information, research, and analyst opinions.

- Paid versions may not provide the same value as other services.

- Not much original reporting or analysis.

2. Seeking Alpha

Seeking Alpha is the perfect service for those investors who love sifting through reams of reports, transcripts, analysis articles, and years of financial data in pursuit of the best stocks on the market.

Its free version is great, but Seeking Alpha Premium is where the real magic happens. Seeking Alpha Premium is partly a research platform, partly an investing community, and partly a centralized repository for all the research and analysis you could ever want.

What makes Seeking Alpha Premium perfect for intermediate investors is the sheer volume of writings, actionable investment ideas, ratings, and other information from some of the best traders and fund managers on the net. It’s not enough to know the basics that something like Yahoo! Finance can teach.

Most people learn by example, so having access to Seeking Alpha Premium’s collective of accomplished investors allows you to see how the best in the game operate. And when you throw in all the advanced screeners, quant ratings, portfolio analysis, and all the other stuff it has to offer, it’s easy to see why so many people are part of the Seeking Alpha community.

| Free | Premium | PRO | |

|---|---|---|---|

| Markets | US, Some Int’l | US, Some Int’l | US, Some Int’l |

| Research | News, Some Analysis | +Quant Ratings, Author Articles, Analysis Articles, Transcripts, Ratings | +Filtered Analysis, Top Ideas, Weekly Digest, Actionable Ideas |

| Charting | Customizable Charts with Technical Indicators | +10 Years of Financial Data | Same as Above |

| Screening | +Dozens of Screeners Designed by Seeking Alpha | +Smart Screening and Filtering Tools | |

| Portfolio Analytics | Basic Portfolio Management | +Analysis with Factor Grades, Quant Ratings, Custom Watch Lists, Link to Brokerage | +Same as Above |

| Pricing | Free | $4.95 for the first month, then $239/per year | $41.99/month |

Pros & Cons

- Massive amount of research and analysis is available.

- Community of investors and fund managers sharing advice and strategies.

- Quant Ratings give unique quantitative insights on holdings and potential investments.

- An advanced, customizable news dashboard makes keeping up with relevant news easy.

- Not as much emphasis on charting and technical analysis as some other services.

- It can be hard to keep up with all the information available.

- Seeking Alpha PRO is pretty expensive.

3. Morningstar

A lot of paid services advertise research from Morningstar as one of the benefits. There’s a reason for that. Morningstar’s been around for almost 40 years, and in that time, they’ve developed a well-deserved reputation for providing some of the best, most thorough stock research out there.

Morningstar’s free version looks very similar to Yahoo! Finance and a dozen other services, but if you take a closer look, you’ll notice something interesting. Instead of aggregating news from around the web, Morningstar actually produces the stories on its front page. That’s the difference.

Morningstar’s main value proposition comes from its network of over 150 skilled analysts who are constantly pumping out excellent research and analysis on stocks worldwide. Their analysis always focuses on fundamentals and goes against the Wall Street hype machine in a way that most services just don’t.

You won’t find that many technical indicators or advanced charting on Morningstar, but you will find deep research, meticulous ratings on everything from performance to ESG stats, and some pretty impressive portfolio analysis tools. There aren’t many better options for the fundamental-focused investor out there.

| Free | Investor | |

|---|---|---|

| Markets | Global | Global |

| Research | Original News and Analysis | +Analysis From Independent Analysts, Detailed Stock Ratings |

| Charting | Basic Charting | Basic Charting |

| Screening | +Screener Tool With Custom and Premade Screeners | |

| Portfolio Analytics | Basic Portfolio Management | +Portfolio X-Ray Tool Analyzes Allocation, Weightings, Fees, Stock Stats, Etc. Personalized Insights |

| Pricing | Free | $34.95/month or $249/year |

Pros & Cons

- Network of analysts constantly delivering new, in-depth research and analysis.

- Comprehensive stock ratings from several angles.

- The Portfolio X-Ray tool is easy to use and incredibly effective.

- Advanced screening tool with custom and premade screeners.

- Not much charting or technical analysis.

- The amount of information can be overwhelming.

4. Stock Rover

Stock Rover is a collection of powerful, interlocking tools that work together like a well-oiled machine. It’s mainly limited to US stocks and ETFs, but its array of analytical features more than makes up for it.

In addition to interesting tweaks on the form, like an interactive, color-coded dashboard and the ability to create your own equations/specific factors in stock screeners, Stock Rover has some serious firepower in its analytical arsenal. Its portfolio management and analysis features are robust and comprehensive, to say the least, but that’s not all.

Where Stock Rover really shines is in its charting and technical analysis features. There are hundreds of factors and metrics you can screen for, apply to stock charts, customize, and adapt—and that’s barely scratching the surface. If you’re into technical analysis at all, you should do yourself a favor and check out the dizzying array of indicators you can chart and tweak for any stock in the US markets.

Stock Rover offers a robust suite of fundamental analysis features to accompany its technical mastery, making it a solid choice for investors who combine these methods.

Pricing

Pricing

- Stock Rover Free: Free

- Stock Rover Essentials: $7.99/month, $79.99/year, $139.99/2 years

- Stock Rover Premium: $17.99/month, $179.99/year, $319.99/2 years

- Stock Rover Premium Plus: $27.99/month, $279.99/year, $479.99/2 years

| Free | Essentials | Premium | Premium Plus | |

|---|---|---|---|---|

| Markets | US, Some Int’l | US, Some Int’l | US, Some Int’l | US, Some Int’l |

| Research | Ratings, News, Market Dashboard, Screeners, | +Real Time Alerts, Stock Rover Library, Dynamic Table for Stock Comparisons | Advanced stock Ratings, Investor Warnings, Stock Scoring | |

| Charting | Powerful Charting Tool with Tech Indicators and Extensive Customization | +Over 260 Metrics, 5 Years of Detailed Historical Data | +More than 90 Additional Metrics, 10 Years of Historical Data | +Over 300 More Metrics, Custom Metrics, Valuation Charts, Ratio Charts, Multiple Metric Charting |

| Screening | Advanced Screening Tool | +Extensive Library of Premade Screeners | +Ranked Screening, Additional Screening Metrics | +Equation Screening, 180+ ETF Screening Metrics, |

| Portfolio Analytics | Portfolio Management, Performance Information and Analysis | +Brokerage Integration, Watchlist Tracking, Added Analysis Features | +Detailed Portfolio Analytics, Monte Carlo Simulation, Correlation Analysis, Trade Planning and Rebalancing Tools | |

| Pricing | Free | $7.99/month, $79.99/year, $139.99/2 years | $17.99/month, $179.99/year, $319.99/2 years | $27.99/month, $279.99/year, $479.99/2 years |

Pros & Cons

- Amazing technical analysis features.

- Strong, comprehensive portfolio management and analysis tools.

- Powerful screener feature with customizable criteria/equations.

- An innovative interface that really opens up once you get the hang of it.

- Limited to US markets.

- Takes a while to figure out how to use it.

5. Trade Ideas

Artificial intelligence may end up destroying the world one day, but in the meantime, it can help you make some money. Trade Ideas’ AI is named Holly. She uses several dozen different investment algorithms to analyze the markets—over a million trading scenarios every night—and delivers a set of recommendations for when to enter and exit your positions.

It would take someone with an advanced computer science degree to even begin to explain how Trade Ideas’ technology works, so please accept a quick overview of what it can do instead. In addition to recommending entries and exits, the platform also lets you create scans to identify trading opportunities, build trading strategies, and automate those strategies for hands-off trading.

The Simulated Trading feature combines the power of AI with the ability to project different scenarios that may arise given any number of different factors, which means you can watch investments play out and tweak your strategy until you find a winning approach. And that’s not all—the platform will also let you score scans, signals, and trading plans and will actually optimize your strategies for you based on Holly’s statistical analysis. The technology is promising, to say the least.

| Standard | Premium | |

|---|---|---|

| Markets | Global | Global |

| Research | Real-Time Trade Ideas, Price Alerts | +AI-Driven Entry and Exit Signals, Trade Simulations, Virtual Trading Analyst |

| Charting | 10 Simultaneous Charts with Visual Trade Assistant | +20 Simultaneous Charts, Chart-Based AI Trade Assistant |

| Screening | Advanced Scanners, Automated Strategies | +AI-Enhanced Screening and Automated Optimization |

| Portfolio Analytics | +Risk Assessment, AI-Based Portfolio Analysis, Autotrading | |

| Pricing | $84/month, $999/year | $167/month, $1,999/year |

Pros & Cons

- Powerful AI-driven analysis, recommendations, and functionality.

- Stock trading simulations allow risk-free speculation and strategy optimization.

- Ability to trade inside the program.

- Ability to set up automated trading strategies.

- Newish technology.

- High level of complexity.

- Relatively expensive.

How to Choose a Stock Research Service

There are many stock research services available, and almost all of them offer more information than any human being could possibly process. When you select a research platform, you will likely be using it for some time, so making the right choice from the start will help you.

So how do you choose the service that will work best for you?

Here are some key steps.

Assess Your Needs

This is critical, so take some time with it. You can’t find a stock research service that meets your needs if you don’t understand what your needs are!

Start with an assessment of your investment style. How do you choose stocks? What information do you use, and how do you prioritize it? Do you use different systems to choose investments and time exit and entry points? What information do you need for those systems?

It will help to make a list of the information or types of information that you want from a stock research service, in order of priority.

Evaluate Your Options

There will usually be several services available that can provide the information you need. That doesn’t make them equally good choices. You will want to select the service that’s easiest for you to use and has the most comfortable interface.

If you’re trying to decide between two or more candidates, consider using the free version of each for some time to get a sense of how they work and which is most comfortable for you. You’ll also want to compare the different service tiers and choose the most appropriate tier for each service you’re comparing.

Compare Costs

Costs matter. Once you select a stock research platform, it’s likely that you’ll be using it for years. The monthly fee may sound small – and for some more sophisticated systems, it may sound large – but over time, it adds up to a substantial amount.

It may be worth paying more if you’re getting something you want, but you should know what you’re getting and know what it’s worth to you. There’s no point in paying more for features or information that you won’t use!

If you’ve narrowed your options down to a few candidates that seem equally attractive – be sure that you are comparing equivalent service tiers, as many platforms have several – it makes sense to choose the one that offers the best price.

Our Methodology

Stock research tools included in this list all met the necessary standards of:

- Functionality

- Accessibility

- Usability

Functionality

A good stock research tool needs to let you research stocks. It must include most or all of these features:

- Relevant news

- Fundamental data

- Professional research and/or analytics

- Charting tools

- Technical analysis features

- Screening tools

- Portfolio management/analysis tools

Every service has its own set of strengths and weaknesses, and not all of the services have the same functionality. The tools included in this list all combine these features and specialize in at least one.

Accessibility

There are several powerful and highly reputable stock research tools that are only available to businesses in the finance industry, or only used by such businesses due to their high price points. To qualify for this roundup, the services had to be available to the public, i.e. individual investors, not just to enterprise clients. They also had to be priced at a rate that would be reasonable for individual traders.

Usability

Services that qualified for this list are all usable by people who don’t have specialized equipment (like Bloomberg terminals and/or incredibly powerful computers) and aren’t completely code-based. In other words, a person would have to be able to use the services on a normal computer with a graphical user interface that wasn’t so complicated it would require an advanced degree to operate.

Once qualified, we compared the services based on a few different factors.

Markets

This wasn’t a qualifying or disqualifying factor; it’s just important to know what any given service’s reach was in terms of stock markets.

Research

A good stock research tool needs to offer a significant amount of information about stocks. Relevant news stories from public sources is the minimum, while in-depth private research and/or proprietary analysis like you find on Morningstar is the best you can hope for.

Charting

Charting is a key visual component for researching stocks. Static charts with a few different time frames are okay but very basic. What we really want is something like Stock Rover’s customizable charts with overlaid technical analysis indicators and custom metrics.

Screening

Before researching stocks, you need to identify the stocks you want to research. That’s where screeners come in. A good screening tool will let you filter the markets based on any number of criteria and even let you create your own bespoke screeners and get incredibly specific with them.

Portfolio Analytics

In addition to helping you find and research stocks, it’s nice for a stock research tool to include some way for you to keep track of what you’ve bought or what you’re keeping your eye on. At its most basic level, a portfolio analysis tool will just show you a list of your positions and how their prices have changed in the most recent session. A good portfolio analysis tool, on the other hand, will let you run simulations, give you breakdowns on risk and sector composition, help you plan trades, and even help you devise strategies to make up for any weak spots in your portfolio.