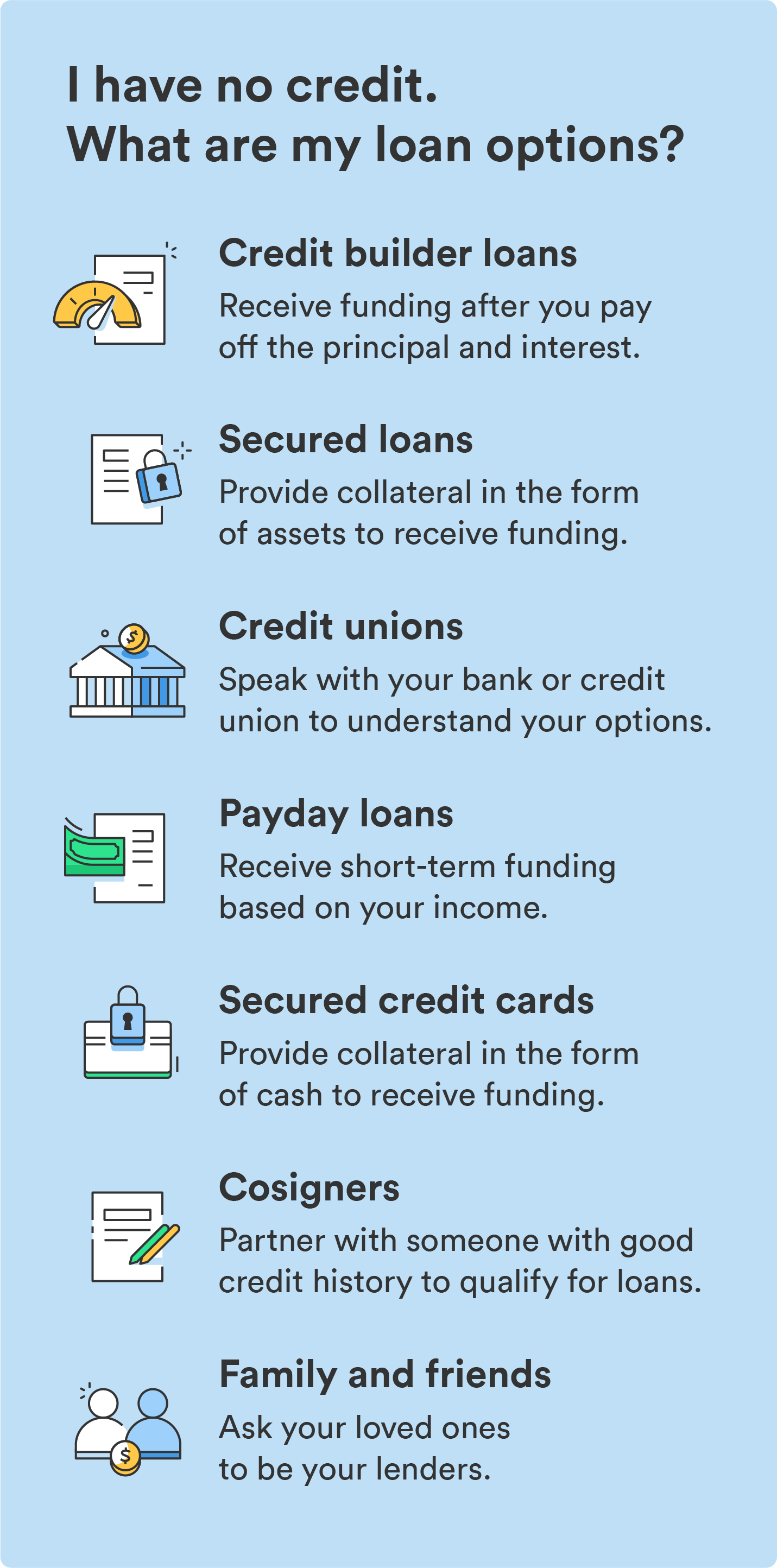

The right loan strategy will depend on your financial health and the reasoning behind getting a loan in the first place. Not only can you get a loan with no credit, but you also have several options. Check out these loans to see which one works best for you.

Credit builder loans

A credit builder loan is an excellent option if you aren’t rushing to secure financing. This type of loan helps people with no credit get access to funding. You match with a lender and can only access the funds after paying off the principal and interest. The lender will hold your funds in an account and report your payments to credit bureaus.

Secured loans

Instead of a credit score, a secured loan requires collateral to provide funding. Collateral can be real estate, vehicles, and stocks. Lenders get to keep your collateral if you can’t make loan payments. Secured loans are popular funding options for individuals with bad or no credit but have access to other assets.

Credit unions

Financial institutions like credit unions and banks can offer tailored services to meet your funding needs. Even with no credit, a credit union can help you explore options and show you which loans you qualify for. They also have financial advisors ready to show you how to build credit to qualify for larger loans.

Payday loans

Payday loans are short-term loans that you can qualify for based on your income rather than your credit. These loans exist to help with emergency expenses, which you have to pay back by your next pay period. The big catch is that the interest is usually 300% to 400%. For every $100 you borrow, you’ll pay an extra $15 to $30 in fees.

Payday loans are a last resort; even the ‘best’ options are expensive. Because of the cost, payday loans could lead to additional debt and financial strain if you can’t afford to pay back your loan.

According to the Consumer Financial Protection Bureau, some states have outlawed payday loans, which tells you they’re not the best financial option.

Secured credit cards

Secured credit cards work similarly to secured loans. Instead of putting up assets as collateral, a secured credit card requires cash upfront as insurance against you defaulting on your loan payments. A secured credit card can also help you build credit while accessing an alternate funding source.

Start building credit with everyday purchases¹ — apply for a Chime Credit Builder Secured Visa® Credit Card in two minutes without a credit check.

Co-signers

Partnering with a co-signer can potentially increase your approval odds when applying for a personal loan. The co-signer’s credit score can help you access loans that require a credit history. Whoever you apply with should understand that their credit score can be affected if you make late payments or default on the loan.

Family and friends

If you have a trustworthy relationship with family members and close friends, consider asking them to be your lender.

Out of respect for the lender, draft a loan proposal that includes the following:

- Funding range: Share a minimum and maximum amount of possible funding

- Collateral options: Provide asset options for collateral

- Payback time: Share how long it will take you to pay them back

- Interest amount: Calculate how much interest you will pay them

Although you do not have to sign a contract, doing so protects you and your loved one.