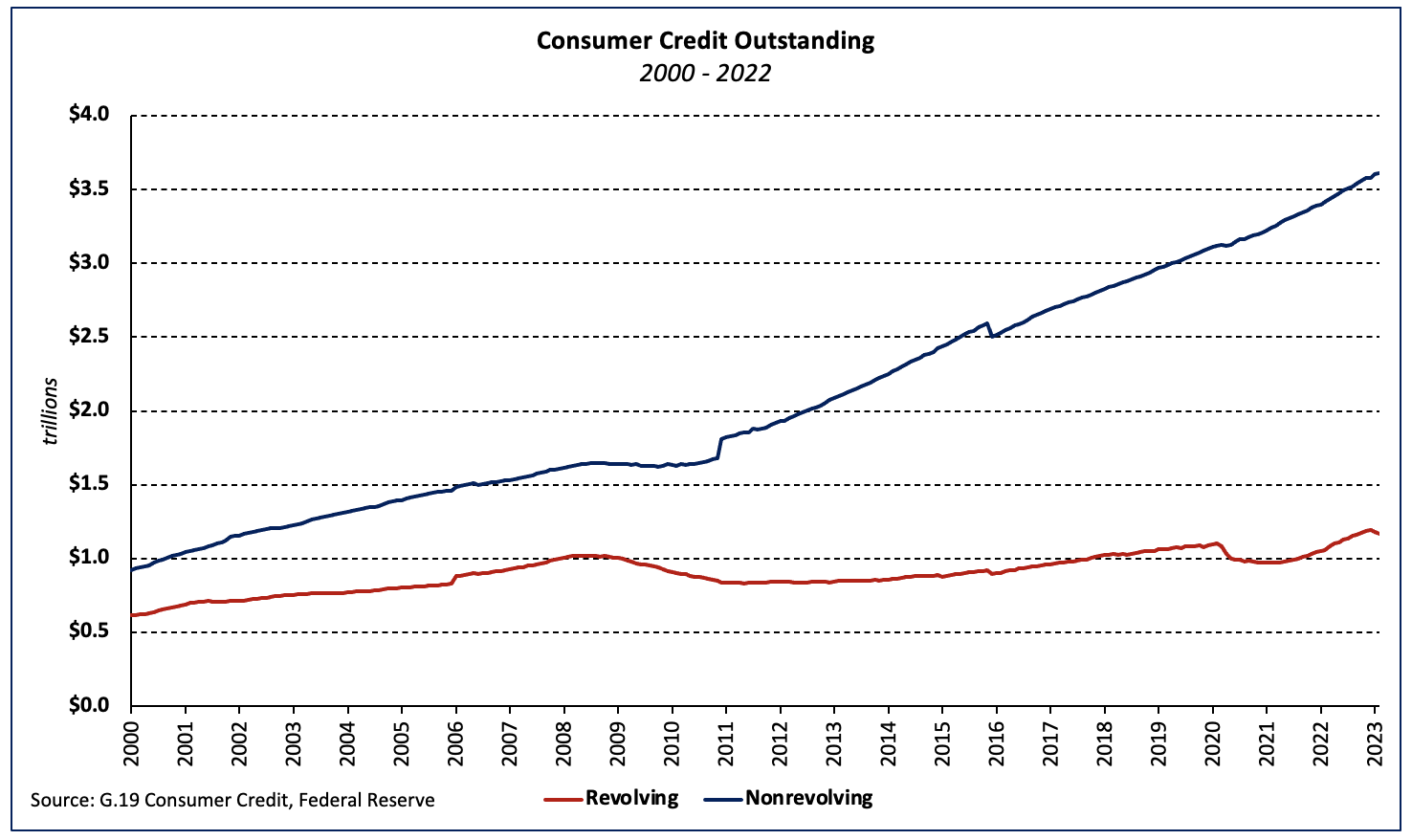

According to the Federal Reserve’s latest G.19 Consumer Credit report, total consumer credit outstanding totaled $4.78 trillion in February, a decrease of $12 billion over the month but $300 billion higher than February 2022. Nonevolving credit outstanding increased $1.0 billion while the level of revolving debt—primarily credit card debt—fell $13.0 billion over the month. Revolving debt outstanding has declined two consecutive quarters for the first time since late 2020.

The balance of consumer credit outstanding grew 3.8% in February 2023 (seasonal adjusted annual rate) after climbing 4.9% (SAAR) in January. Revolving debt——increased at a 5.0% rate while nonrevolving debt (excluding real estate) grew 3.4% (SAAR).

Revolving and nonrevolving debt accounted for 24.5% and 75.5% of total consumer debt, respectively. Between February 2021 and February 2022, revolving consumer credit outstanding as a share of the total increased 0.8 percentage point.

Interest rates for 60-month auto loans issued by commercial banks climbed 93 basis points—from 6.55% to 7.48%–in Q1 2023, following a 105 basis point increase in Q4 2022. Over the last year, auto loan rates have surged 65.5%.

Related