A new survey from John Burns Research & Consulting found that 5.5% is the “magic mortgage rate.”

By magic, they mean the threshold for a home buyer before they balk at a purchase.

Looked at another way, if mortgage rates were 5.5% or lower, most prospective home buyers would proceed with the transaction.

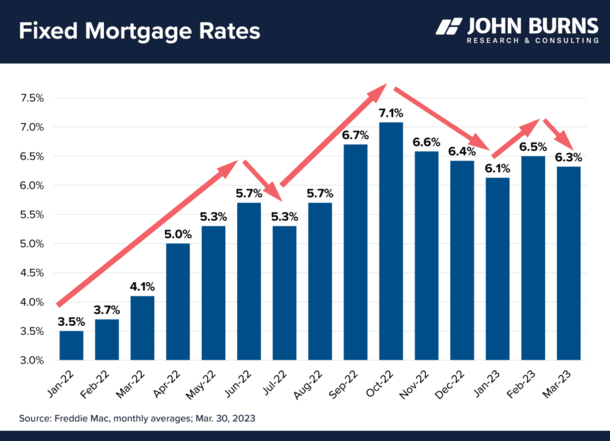

At last glance, the average rate on a 30-year fixed was 6.27%, according to Freddie Mac.

This means we’re pretty close to mortgage rates no longer being a roadblock for new home buyers.

5.5% Mortgage Rates Are Within Reach

As noted, the 30-year fixed is averaging around 6.25% at present. While this might sound high, rates have fallen for five consecutive weeks, per Freddie Mac.

You can thank the short-lived banking crisis and some favorable economic reports (with regard to inflation) for that.

Still, they’re a far cry from the 2-3% rates on offer back in 2020 and 2021. But because it’s been a while now, rates are only up about 1% from a year ago.

The 30-year fixed averaged 5.00% at this time in 2022, not a huge jump. And rates exceeded 7% back in October.

So as it stands, mortgage rates aren’t terrible. And older generations will argue that they’re historically low. Or point you to mortgage rates in the 1980s.

Regardless of all that, it appears today’s home buyer is OK with a 5.5% mortgage rate. But anything beyond that might be a deal breaker.

71% Won’t Buy a Home If the Mortgage Rate Is Above 5.5%.

Now to that survey. The New Home Trends Institute team at John Burns Research & Consulting surveyed more than 1,300 homeowners and renters in late February and early March.

They found that a whopping 71% of prospective home buyers who plan to utilize a mortgage “say they are not willing to accept a mortgage rate above 5.5%.”

In other words, 5.5% is the limit. Anything beyond that and they won’t budge.

This might be because 62% of these same consumers indicated that “a historically normal mortgage rate is below 5.5%.”

They’d be right if you only consider mortgage rates since 2010, as seen in the chart above retrieved from FRED. Prior to that, rates between 6-8% were the norm.

Some 55% of these respondents also believe it is a bad time to buy a home, while only 22% think it’s a good time to buy.

So if the mortgage rate piece of the equation isn’t favorable, they’re probably not going to proceed.

This speaks to home prices being quite elevated, despite some pullbacks over the past year or so.

And the continued lack of quality existing inventory, which is proving to be a boon for home builders.

Home Builders Are Buying Down Mortgage Rates Below 5% to Make Deals Works

The good news is many of the largest home builders are buying down mortgage rates to make deals pencil.

And they’re going beyond 5.5%, often pushing rates below 5% for their customers.

They’re able to pull this off for a number of reasons. There’s that lack of competition from the resale market (due to the mortgage rate lock-in effect).

Simply put, most existing homeowners aren’t selling because they want to retain their 2-3% interest rate.

This has allowed new home builders to raise their prices, or at least not lower them.

Additionally, construction costs have fallen, and lumber prices are way down.

As a result, builders are “paying as much as 6.0% of the mortgage amount” to buy down the mortgage rate.

For the record, existing homeowners can accomplish this too via seller concessions that can be used for discount points.

This allows home buyers to qualify at a lower interest rate and reduce their monthly housing payment. It could also make deals look more favorable.

And mortgage lenders can also offer temporary buydowns that reduce mortgage rates for the first 1-2 years.

But none of this changes the fact that home prices remain lofty.