The older you get, the more you will value life because you have less of it. If you want to live longer, you should aim to grow richer and live in a more hospitable place. As you will see in this article, the correlation with life expectancy, wealth, and location is strong.

Sadly, life expectancy at birth fell in 2021 to its lowest level since 1996 according to the Centers for Disease Control and Prevention. This almost one-year decline in life expectancy in 2021 followed a 1.8-year life expectancy decline from 2019 to 2020.

The CDC attributes roughly half of the life expectancy decline to COVID-19. Because of the virus, roughly 20 years of life expectancy progress was wiped out.

Other reasons for the dramatic life expectancy declines include: Unintentional injuries (16%), which include drug overdoses, heart disease (4.1%), chronic liver disease and cirrhosis (3%), and suicide (2.1%).

Given the pandemic has waned, we can expect life expectancy to stabilize or even rebound back to an upward trend. However, as someone who values life too much to leave living to chance, let’s explore direct solutions to improving our own life expectancy.

Straightforward Ways To Increase Life Expectancy

Based on the above causes for shorter life expectancies, if we want to live longer, we should do the following:

- Improve our mental health to reduce our chances of suicide

- Eat healthier and exercise more to reduce our risk of heart disease

- Drink less alcohol to reduce our risk of liver disease

- Stop taking illegal drugs and consume legal drugs in moderation

- Drive less, drive more carefully, participate in lower-risk activities

Pretty straightforward right? The other clear solution to increasing life expectancy is to get richer. You can do so by signing up for my weekly newsletter and reading my book on building more wealth.

Now let’s look at life expectancy differentials by state. The differences are shocking.

Improve Your Life Expectancy By Living In The Right State

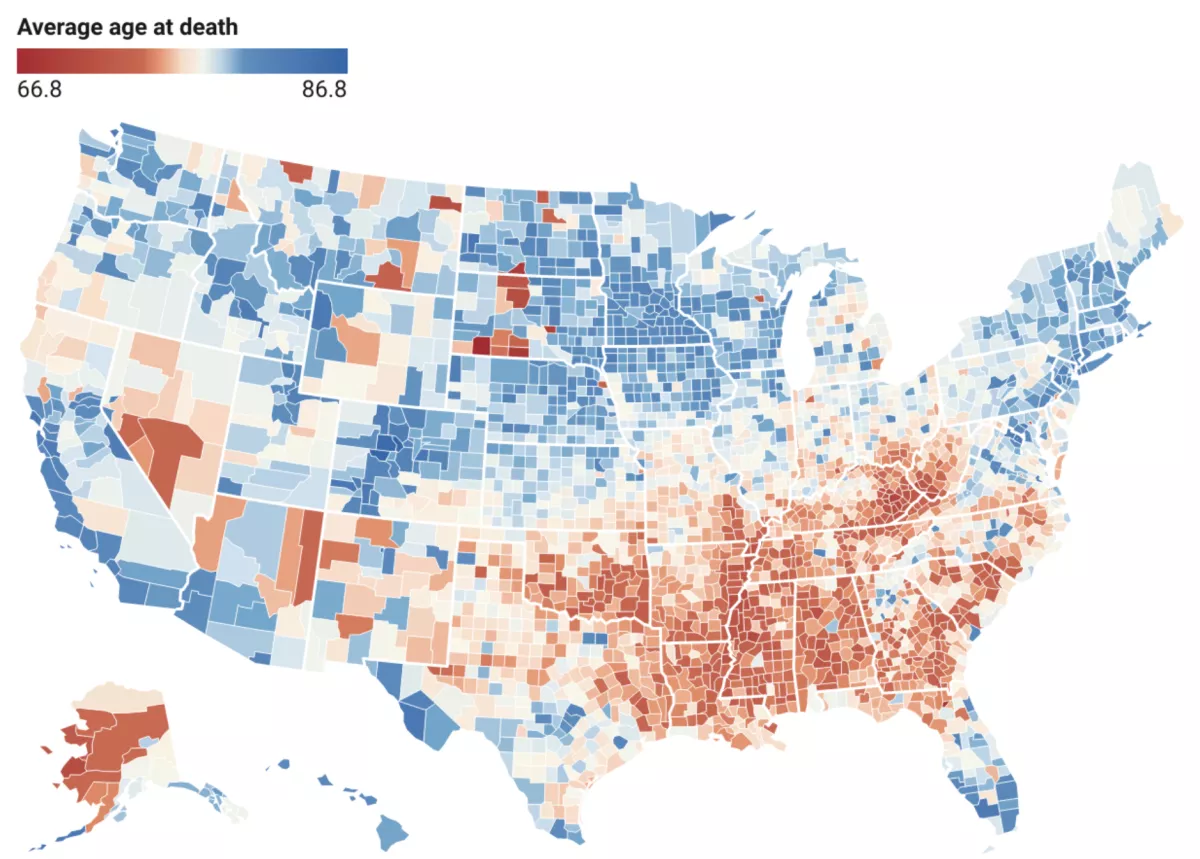

According to this life expectancy chart by the Global Health Data Exchange and Jeremy Ney, it’s clear some residents in certain states live longer.

We’re talking about a 20-year life expectancy gap between states with the shortest life expectancies and states with the longest life expectancies! Therefore, if you want to increase your life expectancy, consider relocating to states with the highest average age at death.

Sure, it may be more expensive to live in California than Mississippi, but how much is life worth to you? Where you want to live is up to you. This is not an article about where you should live. Instead, this is an article about where you might want to live to extend your life. Every state has its pros and cons.

It may be too difficult to relocate during your working years, unless you’re able to work remotely. However, relocating to a high-life-expectancy state for retirement may be more feasible. When you’re older, you’ll likely be more motivated to extend your life as well.

States With The Highest Life Expectancies

To live longer, you may want to live in Hawaii, California, Washington, Colorado, Minnesota, Southern Florida, and the Northeastern States. Residents in Utah, Iowa, and Wisconsin also have relatively long life expectancies.

My favorite state is Hawaii. As soon as I step off the plane at Honolulu International Airport, my stress level drops by another three points out of ten. There’s something magical about the scent of plumeria flowers and feeling the sea breeze that makes living in Hawaii so wonderful.

As a resident of San Francisco, California since 2001, I’m happy living here as well. San Francisco is one of the cheapest international cities in the world with a torrent of fortune-making opportunities.

Although every big city has its problems, I enjoy the nature, scenic beauty, diversity, activities, and cuisine of San Francisco. Having two young children has also increased my appreciation of living in San Francisco given we don’t have to fly anywhere to have a great vacation.

States With The Lowest Life Expectancies

If you are OK with living a potentially shorter life, you may want to live in Alaska, Nevada, Northern Arizona, New Mexico, Northern and Eastern Texas, Oklahoma, Arkansas, Louisiana, Mississippi, Alabama, Georgia, Northern Florida, Tennessee, Kentucky, South Carolina, North Carolina, and West Virginia.

My favorite states in this group are Alaska and Louisiana. Hiking and fishing in Alaska are amazing experiences. I highly recommend visiting Mt. Denali National Park for the wildlife. I’ll never forget taking a boat plane to some remote lake and camping with nobody around for hundreds of miles.

I also love Louisiana because of New Orleans. The food is incredible, the culture is wonderful, and so are the people. I’m sure if I lived in New Orleans, I’d gain at least ten pounds and still be happy. Sugar-coated beignets filled with jam or chocolate for the win!

If you live in a state with a low life expectancy, at least get an affordable term life insurance policy to protect your family. It’s the responsible thing to do if you have dependents.

Why Are Life Expectancies So Different By State?

According to Robert H. Shmerling of Harvard Medical School, “Americans with the shortest life expectancies tend to have the most poverty, face the most food insecurity, and have less or no access to healthcare. Additionally, groups with lower life expectancy tend to have higher-risk jobs that can’t be performed virtually, live in more crowded settings, and have less access to vaccination, which increases the risk of becoming sick with or dying of COVID-19.”

Whatever your views on vaccinations are, there does clearly seem to be a correlation with higher vaccination rates and longer life expectancies.

Policy decisions at the state level matter.

Social Determinants Of Health

Where you live may affect what the CDC calls “the social determinants of health” — “economic policies and systems, development agendas, social norms, social policies, racism, climate change and political systems.”

For example, here in San Francisco, almost nobody smokes. Therefore, there is greater pressure on you to not smoke as well. In Los Angeles, there are super-fit people everywhere given the constant sunshine and entertainment scene. As a result, you feel more motivated to stay in shape.

Given this is a personal finance site, what I’m most interested in is the correlation between wealth and life expectancy. I want to know whether it’s worth grinding hard to make and save as much money as possible. Or whether the intense pursuit of money will ultimately lead to a poorer lifestyle.

I believe in the simple hypothesis that the wealthier you are, the longer your life expectancy due to greater education and better medical services. Let’s take a look at income and wealth by state and compare the data to life expectancies by state.

Average Household Income By State

Below is a map of the average household income by state. As you can see below, there is a high correlation between longer life expectancies and higher average household income. The average household income ranges from $60,923 to $127,264 as of 2019. For 2023, we can assume 10% higher income ranges.

The southeastern states all have the lowest average household incomes in America. Montana is also one of the lowest household income states, however its life expectancy is average. Hence, good on Montana for providing life extending policies and social customs.

Virginia As Proof Of Correlation Between Income And Life Expectancy

The state that fascinates me the most is Virginia, the state where I went to high school and college. I attended to McLean High School in Northern Virginia and graduated from William & Mary in Williamsburg, southeastern Virginia.

Virginia has one of the highest average household incomes in America, yet is a mixed bag in terms of life expectancy. Wealth is concentrated in Northern Virginia, near Washington D.C, where life expectancy is high. However, the closer you get to southwestern Virginia, the poorer its residents and the lower the life expectancy.

Hence, I see Virginia as a great example to demonstrate the strong correlation between life expectancy and income. I visited all corners of Virginia during my high school and college years, and could clearly see the differences in wealth and health across the state.

The greater your income, the easier it is to afford healthcare, live in a nice house, eat healthier food, and pay for education.

Using an extreme example, some families I know pay more than $75,000 a year for private concierge health service. Talk about an unaffordable luxury for most families.

Average Net Worth By State

In addition to looking at household income by state, let’s look at the average net worth by state according to Empower. I’ve used Empower’s (formerly known as Personal Capital) free financial tools to track my net worth since 2012 and was a shareholder.

Once again, you will see a high correlation between life expectancy and net worth. The states with higher average net worths have higher life expectancies and vice versa.

At the end of the day, you want to build as large a net worth as possible in order to generate as much passive income as possible. Because eventually, we will all tire or be unable to work. If you are out of work or unable to work, your life expectancy may suffer.

| Rank | State | Amount |

| 1 | California | $884,003 |

| 2 | Connecticut | $873,746 |

| 3 | Washington | $865,309 |

| 4 | New Jersey | $810,106 |

| 5 | Massachusetts | $787,154 |

| 6 | New Hampshire | $735,968 |

| 7 | Vermont | $730,730 |

| 8 | Virginia | $716,643 |

| 9 | Colorado | $711,968 |

| 10 | Illinois | $690,464 |

| 11 | New York | $690,037 |

| 12 | Oregon | $666,247 |

| 13 | North Carolina | $653,513 |

| 14 | Alaska | $652,999 |

| 15 | Maryland | $650,616 |

| 16 | Minnesota | $648,178 |

| 17 | Pennsylvania | $636,880 |

| 18 | Nevada | $636,385 |

| 19 | Texas | $634,048 |

| 20 | Idaho | $626,599 |

| 21 | Florida | $619,275 |

| 22 | South Dakota | $614,059 |

| 23 | Washington, D.C. | $611,898 |

| 24 | Arizona | $605,953 |

| 25 | Iowa | $600,063 |

| 26 | South Carolina | $587,075 |

| 27 | Georgia | $568,001 |

| 28 | New Mexico | $553,107 |

| 29 | Wisconsin | $553,086 |

| 30 | Michigan | $550,298 |

| 31 | Ohio | $545,090 |

| 32 | Kentucky | $544,334 |

| 33 | Delaware | $542,743 |

| 34 | Tennessee | $530,092 |

| 35 | Kansas | $523,916 |

| 36 | Rhode Island | $523,710 |

| 37 | Hawaii | $518,417 |

| 38 | Wyoming | $516,292 |

| 39 | Nebraska | $504,347 |

| 40 | Missouri | $504,319 |

| 41 | Indiana | $497,440 |

| 42 | Maine | $494,845 |

| 43 | Montana | $490,433 |

| 44 | Alabama | $481,228 |

| 45 | Utah | $474,093 |

| 46 | Louisiana | $459,770 |

| 47 | Oklahoma | $448,494 |

| 48 | Arkansas | $439,790 |

| 49 | Mississippi | $407,691 |

| 50 | West Virginia | $376,690 |

| 51 | North Dakota | $339,955 |

Outlier States With Weak Correlation With Net Worth And Life Expectancy

North Carolina, Alaska, Nevada, Texas Underperforming

The biggest outliers above are North Carolina (#13 rank, $653,513 net worth), Alaska (#14 rank, $652,999 net worth), Nevada (#18 rank, $636,385 net worth), and Texas (#19 rank, $634,048 net worth). Despite relatively high average net worths, the life expectancies in these states are below average.

We can make the assumption that after a certain level of net worth, money doesn’t matter as much if state policies and social influences are not conducive to healthier lifestyles.

For example, of the 20 states with the worst life expectancies, eight are among the 12 states that have not implemented Medicaid expansion under the Affordable Care Act.

Related: The Unhappiest Cities In America Based On A Wealth Realty Ratio

Hawaii and North Dakota Outperforming

On the flip side, the average net worth in Hawaii is only $518,417 (#17 rank), however, Hawaii residents live the longest. One could argue the slower lifestyle, better year-around weather, state policies, and healthier social influences are the reasons for the life expectancy outperformance.

During the pandemic, for example, Hawaii barred tourists and other non-essential travelers from coming to their islands. No other state took such drastic measures to protect its citizens from the virus.

North Dakota ($339,955 net worth) is also outperforming on the life expectancy front. Despite being the state with the lowest net worth in the country, its overall life expectancy is about average.

Finally, one of the greatest determinants of a higher net worth is owning your primary residence. It is no coincidence the states with the highest net worths also have the highest median home prices. Hence, if you want to build more wealth, own real estate.

How Much Would You Pay To Live Longer?

The life expectancy spread between states with the highest and lowest life expectancies is between 10 to 20 years. You’ve got to ask yourself how much you’d be willing to pay to have 10 to 20 years more of life?

At age 45, I’d be willing to give up 70% of my net worth for 10 more years of life and 90% of my net worth for 20 more years of life. I’ve considered giving up all my net worth to live an extra 20 healthy years, however, then I wouldn’t be able to take care of my family.

If life is priceless, paying more to live in an expensive city and state is worth it. For those who cannot afford to live in the most expensive cities and states, good thing there’s a plethora of lower-cost options such as Colorado, Minnesota, Iowa, and Southern Florida.

Below is a sad chart that shows the United States spending the most per capita on health while having the lowest life expectancy amongst countries with similar GDP per capita.

Invest In Low Cost, High Life Expectancy States

As the average age of Americans gets older due to declining birth rates, the investor in me thinks there will be a greater flow of capital to states with higher life expectancies. As a result, you may want to invest in real estate and companies based in states with the highest life expectancies.

Specifically, you want to focus on investing in lower-cost states with high life expectancies. These states are: Colorado, Nebraska, Minnesota, Wisconsin, Iowa, and Idea.

Higher life expectancies also create the need for more service-related businesses that cater to the elderly. Hence, investments in retirement homes, community living homes, low-impact sporting facilities, wellness centers, and entertainment should boom.

Living Longer In Hawaii Is My Goal

We plan to retire to Hawaii where half my family is from.

The problem is making the move since we’ve grown roots in California since 2001. Our window of opportunity may be in 2025, when our daughter is eligible for kindergarten. If 2025 doesn’t work, we will consider 2031, when our son is eligible for high school.

Given the strong correlation between wealth and life expectancy, I now have an additional motivation to write more books and articles about how to build more wealth. Longer life expectancies lead to greater happiness and more contributions to society.

Now these are things worth living for!

Reader Questions and Suggestions

Do you believe there is a strong correlation with wealth, location, social influences and life expectancy? What do you think are the biggest reasons for such huge life expectancy discrepancies among states? What are some things you plan to do to increase your life expectancy?

Compare life insurance quotes in one place at PolicyGenius. Both my wife and I got new 20-year term policies with PolicyGenius during the pandemic and we feel more at peace. No matter where you live or how rich you are, life is not guaranteed.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.