Closing a credit card is a pretty straightforward process – but before you do, it’s important to know how it could impact your credit score. The effects of closing a credit card account on your credit score mainly depend on any other accounts you have open. Still, your credit utilization ratio will likely be the most immediate impact.

When you cancel a credit card, that line of credit can no longer contribute to your credit profile. As a result, any existing balances from other accounts will take up a larger portion of your total available credit, causing your credit utilization to jump and potentially lowering your score.

If you’re not new to building credit and have had one or more accounts open for a while, it’s possible that closing your credit card won’t impact your credit significantly. But check if that’s the case before you do.

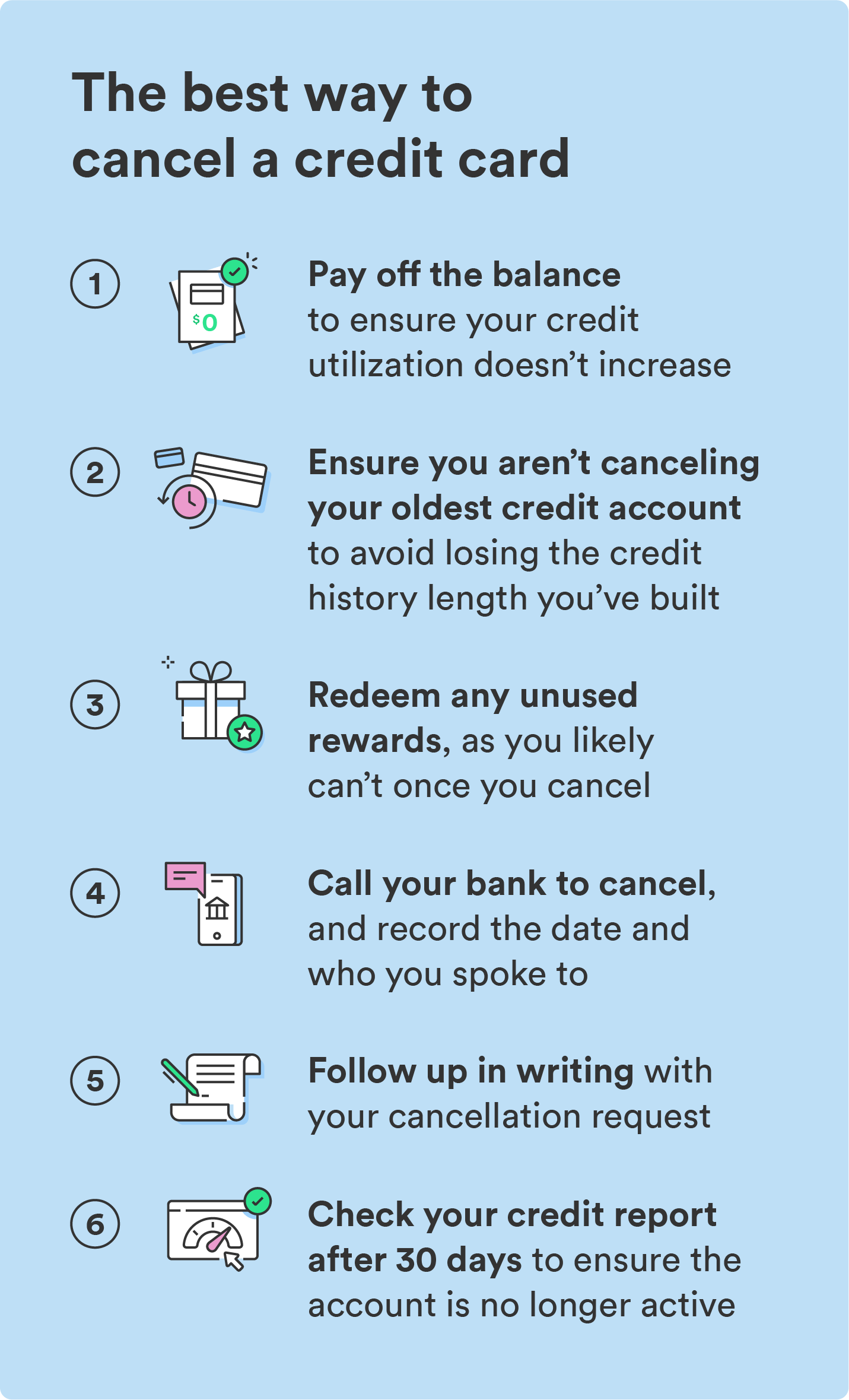

Below, we cover the best way to cancel a credit card and shed some light on the question, “is it bad to close a credit card?”