Mahila Samman Savings Certificate 2023 is available from 31st March 2023 to 31st March 2025. This offers an interest rate of 7.5%. Should you invest?

Finally, the government notified Mahila Samman Savings Certificate 2023 scheme details. Let us see the features, eligibility, and applicable interest rate.

As you may be aware, during the Budget 2023 speech, the finance minister announced the special savings scheme for women. In this regard, the government issued the gazette notification issued on March 31, 2023.

All about Mahila Samman Savings Certificate 2023 – Features and Eligibility

Let us now look into the features of Mahila Samman Savings Certificate 2023 features and eligibility.

# Who can open Mahila Samman Savings Certificate?

Mahila Samman Savings account can be opened by a woman or girl for herself, or by the guardian on behalf of a minor girl. Investors have to fill the Form – I, on or before the 31st of March, 2025.

Hence, this scheme is available for investment from 31st March 2023 to 31st March 2025 (for two years ONLY) as of now.

An account opened under this Scheme shall be a single-holder type account. Hence, you can’t open this in a joint account format.

# How much is the minimum and maximum investment in Mahila Samman Savings Certificate 2023?

You can open as many accounts as you wish. There is no such limit in numbers. However, the limit is concerning the minimum amount and maximum amount to be invested.

There should be at least 3 months of gap between the existing account and the new opening date.

The minimum amount to be invested is Rs.1,000 and any sum in multiples of Rs.100. The maximum investment limit is Rs.2,00,000.

Hence, one can have as many as investments without breaching the maximum limit set under this scheme.

# How much is the interest rate under Mahila Samman Savings Certificate 2023?

The deposits made under this Scheme shall bear interest at the rate of 7.5% per annum. However, as the interest rate is compounding quarterly basis, the effective rate will be 7.71%.

However, if you deposited by breaking the rules and eligibility set under this scheme, then the interest payable on such deposits is equal to the rate of the Post Office Saving Account rate (which is currently at 4%. You can refer to my latest post on the post office savings scheme interest rates “Latest Post Office Interest Rates April – June 2023“).

# Term or tenure of Mahila Samman Savings Certificate 2023

The effective date of the start of this scheme is 31st March 2023. The tenure of the deposit is two years.

The deposit will mature on completion of two years from the date of the deposit and the Eligible Balance may be paid to the account holder on an application in Form-2 submitted to the accounts office on maturity.

In calculating the maturity value, any amount in fraction of a rupee shall be rounded off to the nearest rupee and for this purpose, any amount of fifty paise or more shall be treated as one rupee, and any amount less than fifty paise shall be ignored.

# Premature withdrawal rules for Mahila Samman Savings Certificate 2023

You are eligible to withdraw a maximum of up to 40% of the Eligible Balance once after the expiry of one year from the date of opening of the account but before the maturity of the account by submitting an application Form-3.

In case of an account opened on behalf of a minor girl, the guardian may apply for the withdrawal for the benefit of the minor girl by submitting the following certificate to the accounts office, namely:- “Certified that the amount sought to be withdrawn is required for the use and welfare of Miss/ Kumari…………………………………………… who is a minor girl and is alive on this………………. the day of…………………. (month), …………. (year).”.

In calculating the withdrawal from the account, any amount in fraction of a rupee shall be rounded off to the nearest rupee and for this purpose, any amount of fifty paise or more shall be treated as one rupee, and any amount less than fifty paise shall be ignored.

# Premature withdrawal rules for Mahila Samman Savings Certificate 2023

The account shall not be closed before maturity except in the following cases, namely

- On the death of the account holder.

- When the post office or the bank in question determines that the operation of the account is putting the account holder through undue hardship due to extreme compassionate circumstances, such as medical support for the account holder’s life-threatening illnesses or the death of the guardian, it may, after thorough documentation, by order and for reasons that will be documented in writing, permit the account to be prematurely closed.

- Where an account is prematurely closed, interest on the principal amount shall be payable at the rate applicable to the Scheme for which the account has been held.

- Premature closure of an account will be allowed at any time following after six months from the date of account opening for any reason other than those listed, in which case the balance that was previously in the account would only be eligible for interest at a rate that was 2% lower than the rate specified in this Scheme.

# Charges under Mahila Samman Savings Certificate 2023

You have to bear the below charges.

- Receipt – Physical Mode – Rs.40

- Receipt – e mode – Rs.9

- Payments – 6.5 paise per Rs.100 turnover

# Where to open Mahila Samman Savings Certificate 2023?

You can invest either through Post Offices or with any authorized banks (the list is not shared in the notification).

# Taxation of Mahila Samman Savings Certificate 2023

As of now, the government has not mentioned any tax benefits. Hence, when you invest in this scheme, then you will not get any special tax benefits. Also, as per the current information, there is no tax benefit at maturity. The interest is taxable as per your tax slab.

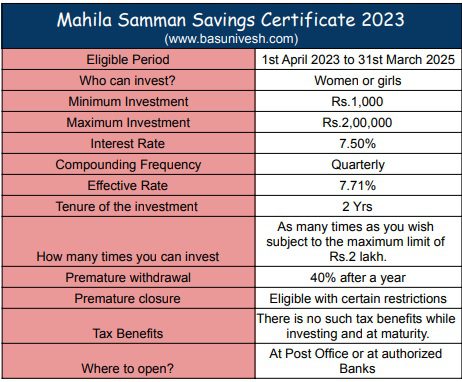

I have tried to explain all the above features in the below table.

Should you invest in Mahila Samman Savings Certificate 2023?

# 7.5% interest with an effective interest rate of 7.71% for two years is a little bit more attractive than any other available safe options.

Take for example, the two-year Government Of India Bond showing a YTM of 7.13% and if you look at the Post Office Term Deposit rate of two years is currently at 6.8% (effective rate 6.9%). Hence, those who are looking for the better option to generate the highest return, in a short period of two years and with the highest safety can obliviously look for such an opportunity.

However, don’t break your existing investments for the sake of investing in this scheme. Because we don’t know the rate of interest of this scheme after 31st March 2025. Hence, reinvestment risk is always there. Use the corpus which you need after two years rather than BLIND investing to earn a higher rate.

# Rs.2 lakh limit seems to be too low. If one opts for this scheme and compares the return difference with Post Office Term Deposits to this scheme, then one will earn Rs.2,28,874 from Post Office deposit (considering 6.8% with compounding quarterly benefit) and from Mahila Samman Savings Certificate 2023 it is Rs.2,32,044. The difference of Rs.3,170. This looks too small.

To make it attractive, the government should have increased the maximum limit from Rs.2 lakh to around Rs.5 lakh or Rs.10 lakh. However, it is very clear that by offering this product for a shorter period with a small amount, the government does not want to take a huge and long-term commitment.

# Liquidity is a concern. When you book two years of FD, then you are eligible to withdraw at any point in time (of course with a premature penalty of around 0.25% to the offered rate). However, in this scheme, premature closure or withdrawal rules seem to be a bit strict than the normal FDs. This makes people stay away from this scheme.

# No tax benefit in investing in this scheme means one more hindrance for investors. Of course, those who are in lower income groups can opt for this scheme. However, for those who are under the tax bracket or at a higher tax bracket, this scheme in my view is of no use.

Hence, apart from the scheme being meant for women and girls with a bit of a higher interest rate, I don’t think this scheme is worth it in any other manner to be attractive to investors.

Therefore, take a call based on your requirements. As I mentioned above, the difference between putting money in Post Office for 2 years term deposit to this scheme is a matter of Rs.3,170 with a bit of liquidity concerns.

I am comparing Post Office Scheme to this scheme mainly because both offer a sovereign guarantee of the government. Of course, you can cross-check the rates with banks also as the investable amount is just Rs.2 lakh and banks also offer you up to Rs.5 lakh of insurance under the DICGC. You can refer to the details in my earliest post “Bank FDs-Is your Bank have Deposit Insurance and Credit Guarantee (DICGC)?“. Even you can compare the Target Maturity Funds also. The taxation is the same. For example, Bharat Bond ETF which will mature in April 2025 is showing the yield to maturity as 7.59% (as of today). This I think far superior to Mahila Samman Savings Certificate 2023 in terms of liquidity and returns. But do remember that the YTM of debt funds changes on daily basis. Hence, you have to cross-check before you invest. Also, if you wish to liquidate in between, then the YTM may differ for you. Investing in the bond market either directly or through debt mutual funds is entirely different than Bank FDs or Mahila Samman Savings Certificate 2023 kind of schemes. The idea of comparison is just to give you a hint. In the end, check your requirement and accordingly you can choose the best suitable product.